Table of Contents

Introducing Diensten Tech IPO, a pioneering force in the realm of Information Technology (IT), poised to redefine industry standards. Established in March 2007, Diensten Tech specializes in IT Consulting, Training, and Software Asset Management (AMC), offering tailored solutions to meet clients’ diverse needs. From providing specific IT skill sets to managing team capacity and delivering in-house technology experts, Diensten Tech ensures seamless project execution. With a strong emphasis on IT Professional Solution Services and Corporate Training, Diensten Tech caters to a wide spectrum of clients, ranging from large enterprises to small and medium businesses. Originally known as JKT Consulting Limited, Diensten Tech has evolved into a powerhouse, offering technical consulting, training, and software services across various industries.

Diensten Tech IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

26th Jun 2024 | 28th Jun 2024 | 01st July 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 02nd July 2024 | 02nd July 2024 | 03rd July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹22.08 Cr | ₹ 95.00 – ₹ 100.00 | 1200 Shares | 22.08,000 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 1200 | ₹ 1,20,000 |

| Retail(Max) | 1 | 1200 | ₹ 1,20,000 |

| Small-HNI (Min) | 2 | 2400 | ₹ 2,40,000 |

| Small-HNI (Max) | 8 | 9600 | ₹ 9,60,000 |

| Big-HNI (Min) | 9 | 10800 | ₹ 10,80,000 |

| RII (Retail) | NII | QIB |

| 35.00% | 15.00% | 50.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 95.50% | 69.97% | NSE SME |

| No | Objectives |

| 1 | Payment of liability raised against outstanding payment of consideration for “Professional Services and Training Division” business acquired from J K Technosoft Limited, vide Business Transfer Agreement Dated April 30, 2022. |

| 2 | To meet the Working Capital requirements of the Company |

| 3 | To meet out the General Corporate Purposes |

| 4 | To meet out the Issue Expenses |

| LEAD | REGISTRAR |

| Corporate Professionals Capital Private Limited | KFin Technologies Limited |

| Telephone | |

| cs@jkdtl.com | 011-40562187 |

Diensten Tech IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Financial of Diensten Tech IPO

| Amounts in Lakhs ₹ | |||

| Particulars | FY-2023 | FY-2022 | FY-2021 |

| Assets | 1,505 | 204 | 370 |

| Revenue | 3,760 | 77 | 525 |

| Expense | 3,738 | 70 | 361 |

| Net Worth | 425 | 140 | -112 |

| Reserves | -180 | -196 | -198 |

| PAT | 16 | 1 | 117 |

| EPS | 0.29 | 0.16 | 13.61 |

| RoCE (%) | 9.47 | 16.12 | -180.75 |

| EBITDA (%) | 3.98 | 25.59 | 38.29 |

| RoNW(%) | 3.78 | 1.04 | -104.79 |

| Established | Website | Industry |

| 2007 | dienstentech.com | IT |

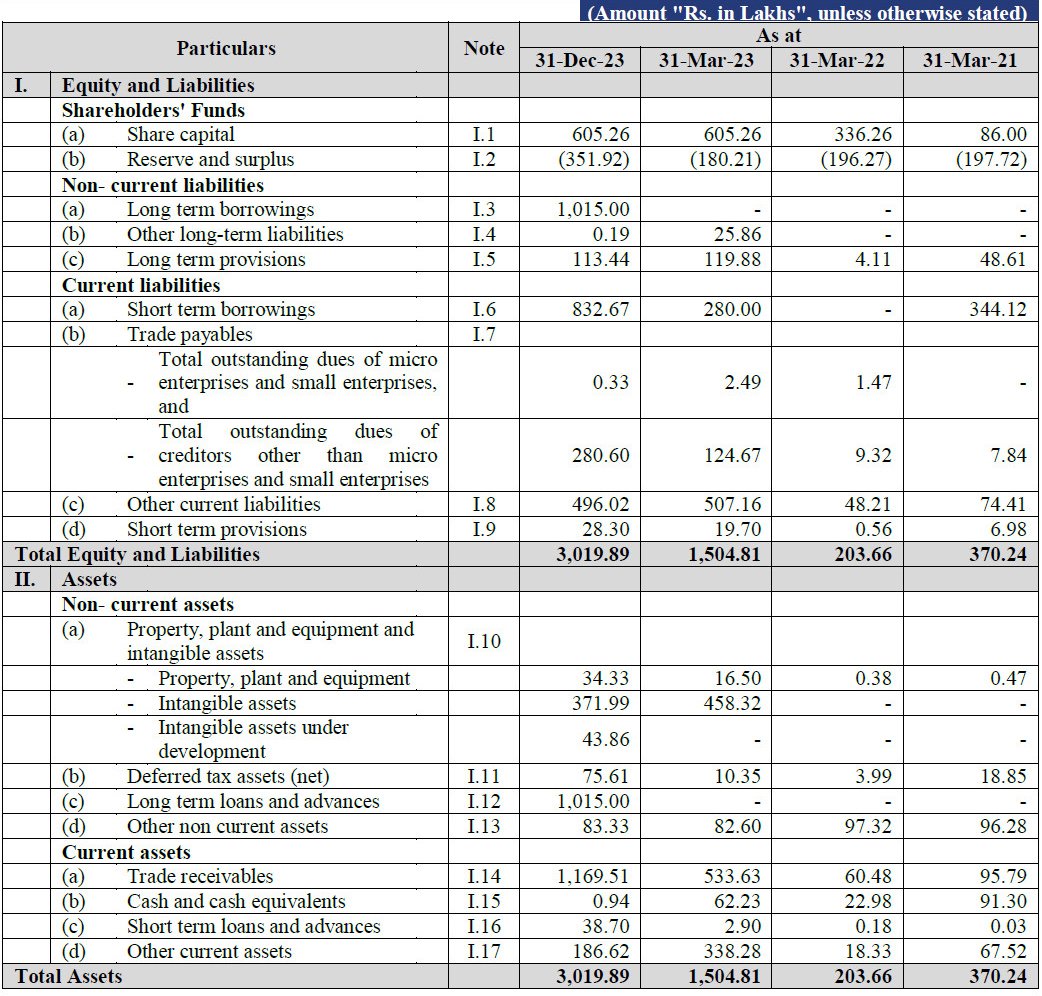

Statement of Assets and Liabilities

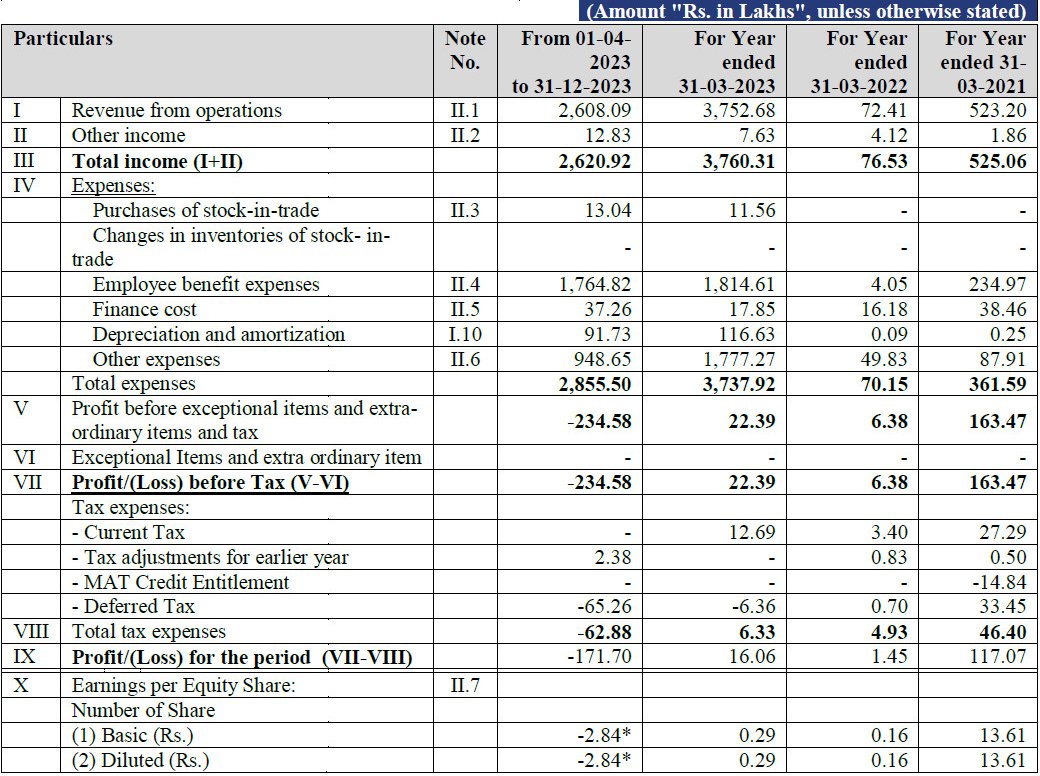

Statement of Profit and Loss

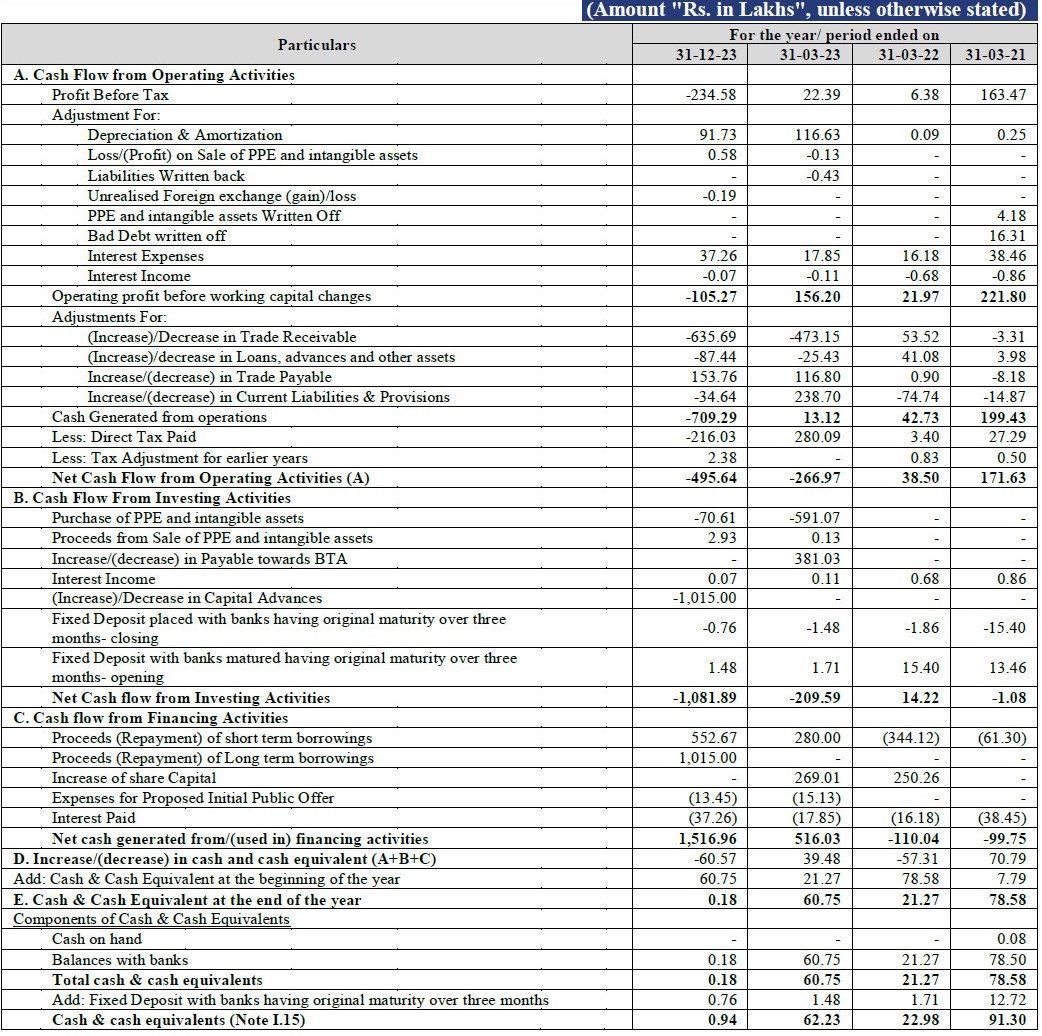

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Diensten Tech IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Diensten Tech IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Diensten Tech IPO and other offerings a more informed and confident endeavor.

1. Diensten Tech IPO key dates & Issue Details

Get ready to dive into the world of opportunities with the Diensten Tech IPO, slated to open its doors to investors on June 26th, 2024, and concluding on June 28th, 2024. This eagerly awaited IPO offers an enticing price range of ₹95.00-100.00 per share, making it an appealing investment prospect for both seasoned investors and newcomers alike. With a substantial issue size of ₹22.08 Cr, exclusively comprising fresh issues, Diensten Tech aims to fuel its growth trajectory and expand its market presence in the ever-evolving tech sector.

Investors can seize this chance to partake in the IPO with a market lot of 1200 shares, equating to an initial investment of ₹120,000 per lot. Notably, high net-worth individuals (HNIs) have the opportunity to participate with a minimum of 2400 shares (2 lots), ensuring inclusivity across investor segments. Furthermore, the retail quota, set at a minimum of 35.00% of the offer, underscores Diensten Tech’s commitment to democratizing access to its IPO, allowing retail investors to capitalize on this promising venture.

As the IPO journey unfolds, key milestones mark the path to the much-anticipated listing on the NSE SME platform. On July 1st, 2024, investors can eagerly await the basis of allotment, offering insights into the allocation process. Subsequently, on July 2nd, 2024, refunds initiation and the credit of shares to Demat accounts signify a crucial step towards realizing investors’ participation in Diensten Tech’s growth story. Finally, on July 3rd, 2024, the IPO culminates with its listing, ushering in a new chapter for Diensten Tech and its stakeholders.

With a pre-IPO promoter holding of 95.50%, Diensten Tech’s IPO marks a strategic shift, with the promoter holding post IPO expected to decrease to 69.97%. This transition not only diversifies the shareholder base but also signifies Diensten Tech’s confidence in its ability to attract external investments and foster sustained growth in the competitive tech landscape.

In conclusion, the Diensten Tech IPO presents investors with a compelling opportunity to be part of a dynamic tech company poised for expansion. With a clear roadmap outlined by key dates and issue details, investors can navigate the IPO journey with confidence, keeping their sights set on the destiny of Diensten Tech.

2. Diensten Tech IPO Allotment Status

Dive into the excitement surrounding the Diensten Tech IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Diensten Tech IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Diensten Tech IPO journey.

3. Introduction to Diensten Tech IPO: Revolutionizing the IT Landscape

In the realm of technological innovation, Diensten Tech IPO emerges as a beacon of transformation, poised to redefine the IT landscape. Originally established as “JKT Consulting Limited” in 2007, the company underwent a significant evolution, culminating in its rechristening as “Diensten Tech Limited” in May 2021. Since then, Diensten Tech has emerged as a frontrunner in Information Technology (IT) professional resourcing, consultancy, training, and software asset management (AMC).

At the heart of Diensten Tech’s business model lies a commitment to empowering enterprises for the digital age. By providing end-to-end professional solutions, Diensten Tech facilitates large companies and organizations in enhancing their competitiveness. Through a collaborative approach and a deep understanding of diverse business sectors, Diensten Tech leverages innovative technologies to drive sustainable growth.

The journey of Diensten Tech reflects a strategic shift towards Information Technology consultancy, training, and software services. With the acquisition of Professional Services & Training (PS & T) business from JK Technosoft Limited, Diensten Tech has solidified its position in the market, expanding its client base and revenue streams. Moreover, strategic partnerships with Klaus IT Solutions Private Limited and Skandha IT Services Private Limited have further bolstered Diensten Tech’s growth trajectory, enabling it to cater to a broader clientele.

Operating from its registered office in Delhi and branch offices across Uttar Pradesh, Haryana, Karnataka, and Maharashtra, Diensten Tech ensures a nationwide presence to deliver seamless IT solutions and services. The company’s diverse portfolio encompasses IT professional solution services and corporate training, catering to the evolving needs of clients across various industries.

Under the umbrella of IT professional solution services, Diensten Tech offers comprehensive resourcing, consultancy, and software AMC, catering to diverse sectors such as banking, healthcare, retail, and entertainment. Meanwhile, its corporate training services focus on imparting technical and soft skills training, aligning with clients’ business objectives.

As Diensten Tech embarks on its IPO journey, it remains committed to further widening its customer base, enhancing cost management practices, and fostering cordial relationships with customers and employees alike. With a vision to revolutionize the IT landscape, Diensten Tech IPO signifies a new era of innovation and growth in the realm of Information Technology.

Stay tuned as Diensten Tech IPO paves the way for a destiny shaped by technological prowess and visionary leadership.

4. Financial Details of Diensten Tech Limited

Embarking on its IPO journey, Diensten Tech Limited unveils a compelling narrative of financial growth and resilience. The company’s financial performance showcases a remarkable trajectory, with revenue witnessing a staggering surge of 4813.51% and profit after tax (PAT) soaring by 1007.59% between the fiscal years ending on March 31, 2023, and March 31, 2022. This exponential growth underscores Diensten Tech’s strategic positioning and robust business model, poised to capitalize on emerging opportunities in the dynamic IT landscape.

Diving deeper into key performance indicators, Diensten Tech’s financial prowess shines through. Despite challenges, the company demonstrates resilience, as evidenced by its revenue from operations reaching ₹2,608.08 lakhs for the period ended December 31, 2023. Notably, while navigating fluctuations in profitability, Diensten Tech maintains a steadfast focus on operational efficiency, as reflected by its EBITDA margin of 4.18% for the fiscal year ending March 31, 2023.

Moreover, Diensten Tech’s valuations and margins paint a compelling picture of growth potential and stability. Despite initial volatility, the company’s earnings per share (EPS) surged from ₹0.16 in FY 2022 to ₹0.29 in FY 2023, indicative of a positive momentum in earnings growth. With a PE ratio ranging from 327.59 to 344.83, Diensten Tech positions itself as an attractive investment opportunity in the competitive market landscape.

Furthermore, Diensten Tech’s return on net worth (RONW) showcases a notable improvement from negative territory to 3.78% in FY 2023, underscoring the company’s enhanced efficiency in utilizing shareholders’ funds. Additionally, Diensten Tech demonstrates a prudent approach to capital structure management, as evidenced by its debt/equity ratio of 0.66 in FY 2023, reflecting a balanced blend of debt and equity financing.

As Diensten Tech IPO unfolds, investors are presented with a unique opportunity to partake in the destiny of a company poised for exponential growth and value creation. With a robust financial foundation, strategic vision, and commitment to operational excellence, Diensten Tech paves the way for a future defined by innovation, resilience, and sustained profitability. Stay tuned as Diensten Tech IPO sets sail towards a destiny shaped by financial fortitude and market leadership.

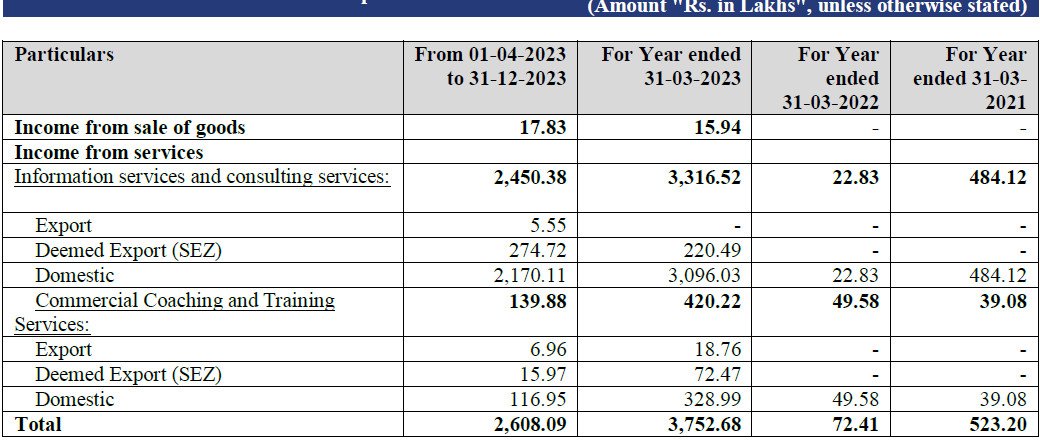

Statement Of Revenue From Operations

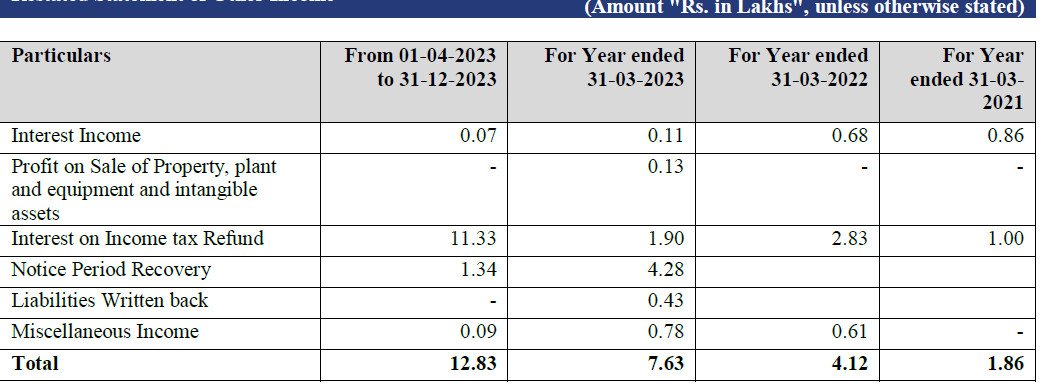

Statement of Other Income

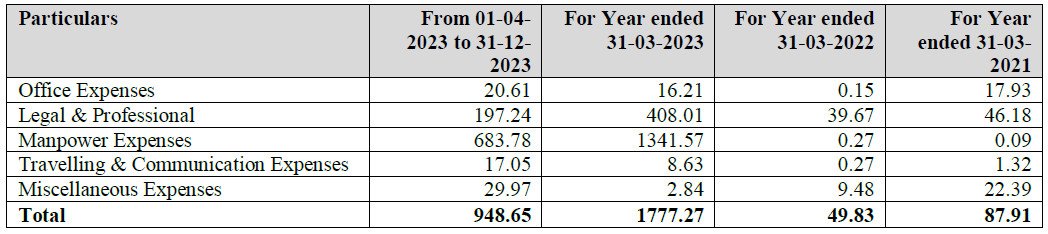

Statement of Other Expenses

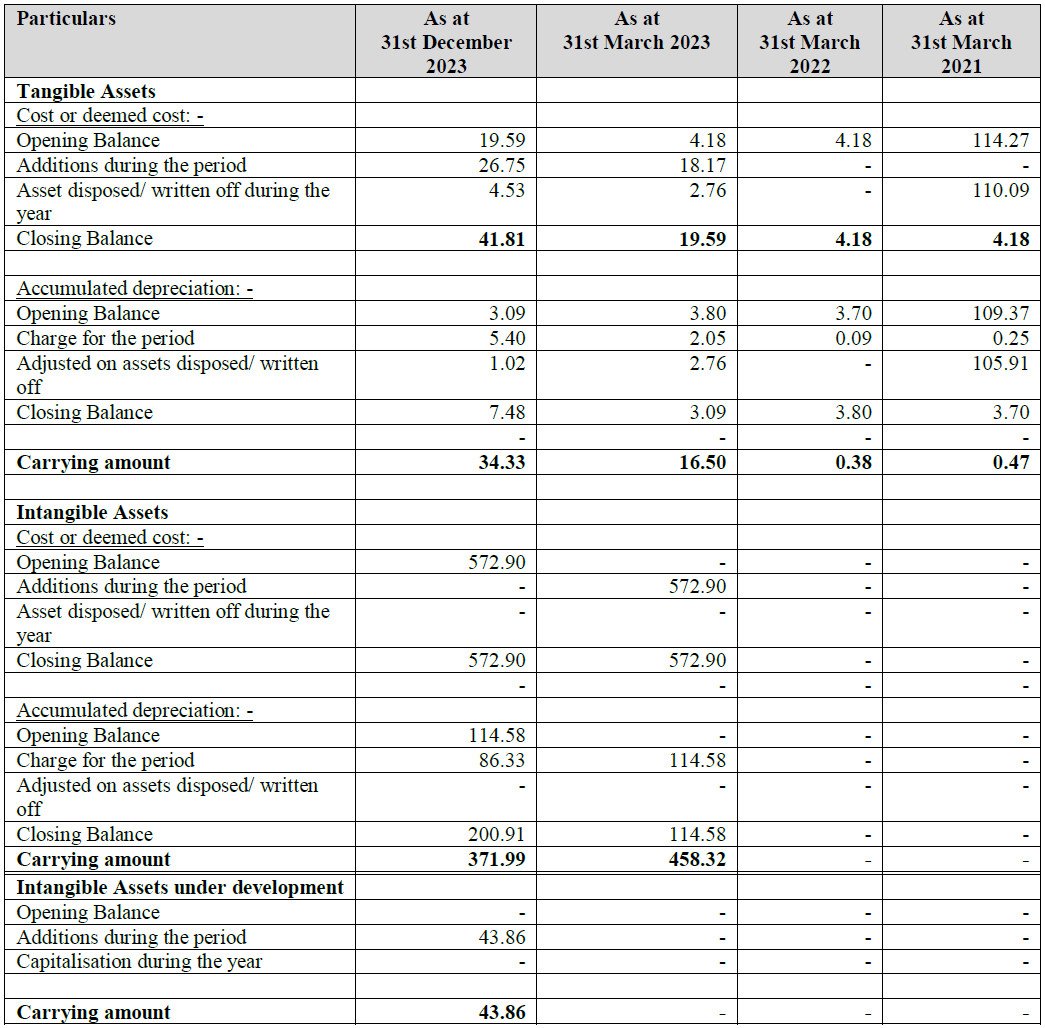

Statement of Property, Plant and Equipment

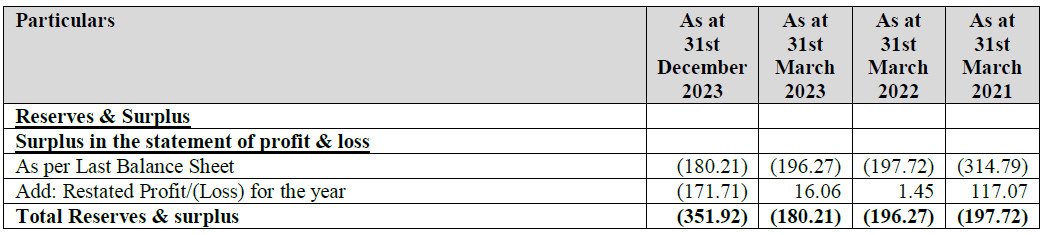

Statement of Reserves & Surplus

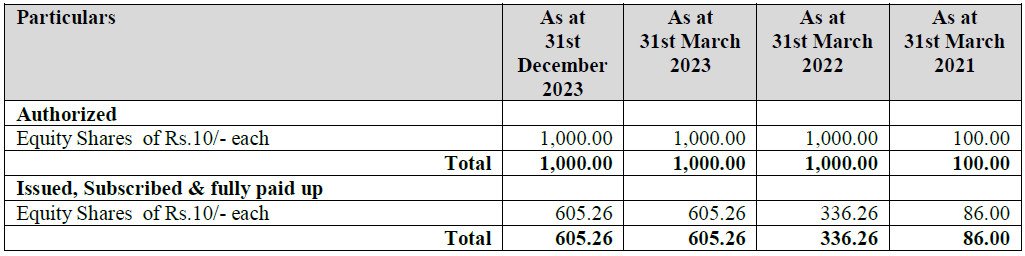

Statement of Equity Share Capital

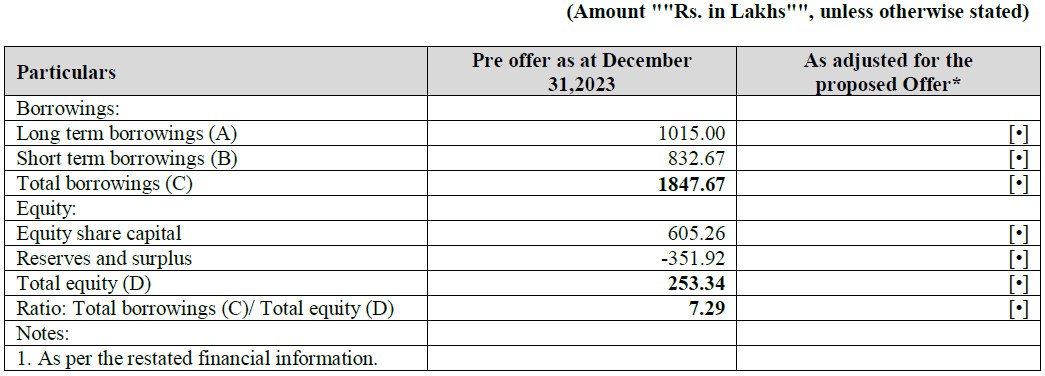

Statement of Capitalisation

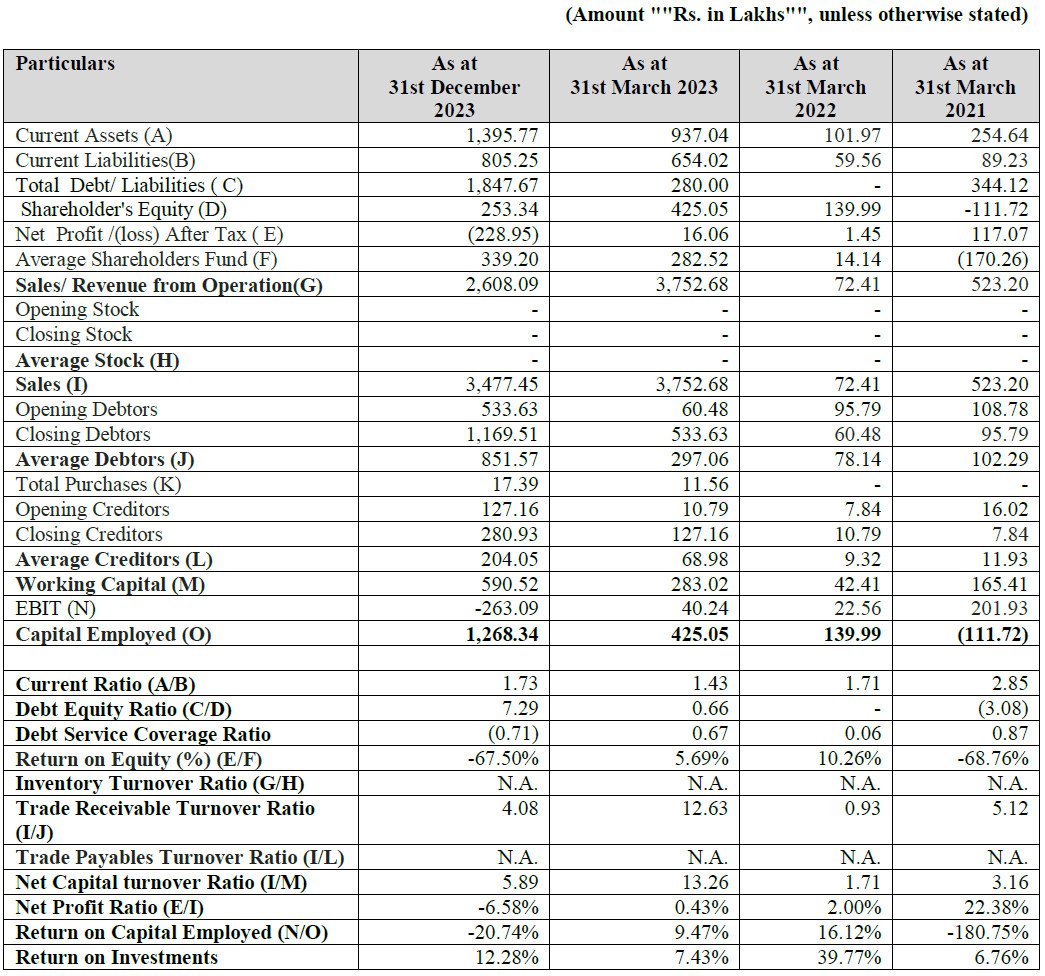

Financial Ratios

5.Diensten Tech IPO FAQs

Diensten Tech IPO is the initial public offering of shares by Diensten Tech Limited, a company specializing in Information Technology (IT) professional resourcing, consultancy, training, and software asset management.

Diensten Tech IPO is scheduled to open on June 26th, 2024.

The closing date for Diensten Tech IPO is June 28th, 2024.

The price range for Diensten Tech IPO shares is ₹95.00-100.00 per share.

Diensten Tech IPO will be listed at NSE SME (National Stock Exchange – Small and Medium Enterprises).

The issue size for Diensten Tech SME IPO is ₹22.08 Cr.

Not less than 35.00% of the Diensten Tech IPO offer is allocated to retail investors.

Diensten Tech IPO is a Book Build Issue.

The face value of Diensten Tech IPO shares is ₹10 per equity share.

The tentative basis of allotment date for Diensten Tech IPO is July 1st, 2024.

The refunds for Diensten Tech IPO will be initiated on July 2nd, 2024.

The shares will be credited to Demat accounts for Diensten Tech IPO on July 2nd, 2024.

The tentative listing date for Diensten Tech IPO is July 3rd, 2024.

Diensten Tech Limited specializes in IT professional resourcing, consultancy, training, and software asset management.

Diensten Tech’s revenue witnessed a remarkable growth of 4813.51% between the fiscal years ending March 31, 2023, and March 31, 2022.

Diensten Tech offers IT professional solution services and corporate training services, catering to various industries.

Key financial performance indicators for Diensten Tech include revenue from operations, EBITDA margin, profit after tax (PAT), and PAT margin.

Diensten Tech’s EPS surged from ₹0.16 in FY 2022 to ₹0.29 in FY 2023.

Diensten Tech’s debt/equity ratio for FY 2023 stands at 0.66, reflecting a balanced capital structure.

The PE ratio range for Diensten Tech in FY 2023 is between 327.59 and 344.83.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Diensten Tech IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Diensten Tech IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Diensten Tech IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Diensten Tech IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.