Table of Contents

“Vraj Iron and Steel IPO” presents a lucrative opportunity to invest in the thriving steel industry, with a company boasting a strong legacy and a prominent presence in central India’s manufacturing sector. Established in June 2004, Vraj Iron and Steel Limited, formerly known as Phil Ispat Pvt. Ltd., operates as a subsidiary of Gopal Sponge and Power Private Limited (GSPPL) Raipur. Renowned for its production of premium-quality sponge iron, M.S. billets, and TMT bars under the trusted brand name Vraj, the company operates two cutting-edge manufacturing units situated in Raipur and Bilaspur, Chhattisgarh. Committed to innovation and growth, Vraj Iron and Steel is expanding its production capacities and venturing into related segments.

Vraj Iron and Steel IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

26th Jun 2024 | 28th Jun 2024 | 01st July 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 02nd July 2024 | 02nd July 2024 | 03rd July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹ 171.00 Cr | ₹ 195.00 – ₹ 207.00 | 72 Shares | 82.60,870 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 207 | ₹ 14,904 |

| Retail(Max) | 13 | 2691 | ₹ 1,93,752 |

| Small-HNI (Min) | 14 | 2898 | ₹ 2,08,656 |

| Small-HNI (Max) | 67 | 13869 | ₹ 9,98,568 |

| Big-HNI (Min) | 68 | 14076 | ₹ 10,13,472 |

| RII (Retail) | NII | QIB |

| 35.00% | 15.00% | 50.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 99.99% | – | BSE & NSE |

| No | Objectives |

| 1 | Funding for Capital Expenditure towards the “Expansion Project” at Bilaspur Plant |

| 2 | Repayment or prepayment of borrowings from HDFC Bank obtained by the company for the capital expenditure towards the “Expansion Project” at Bilaspur Plant |

| 3 | Capital expenditure towards the “Expansion Project” at Bilaspur Plant |

| 4 | General Corporate Purposes |

| LEAD | REGISTRAR |

| Aryaman Financial Services Limited | Bigshare Services Private Limited |

| Telephone | |

| info@vrajtmt.in | +91-771-4059002 |

Vraj Iron and Steel IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Financial of Vraj Iron and Steel IPO

| Amounts in Crores ₹ | |||

| Particulars | FY-2023 | FY-2022 | FY-2021 |

| Assets | 192 | 151 | 126 |

| Revenue | 517 | 414 | 291 |

| Expense | 448 | 377 | 277 |

| Net Worth | 141 | 87 | 58 |

| Borrowing | 23 | 43 | 46 |

| EBITDA(%) | 15.77 | 11.99 | 10.01 |

| ROCE (%) | 136 | 82 | 53 |

| PAT | 54 | 29 | 11 |

| EPS | 21.86 | 11.62 | 4.45 |

| Debt/Equity | 0.17 | 0.51 | 0.82 |

| Established | Website | Industry |

| 2004 | vrajtmt.in | Steel & Iron |

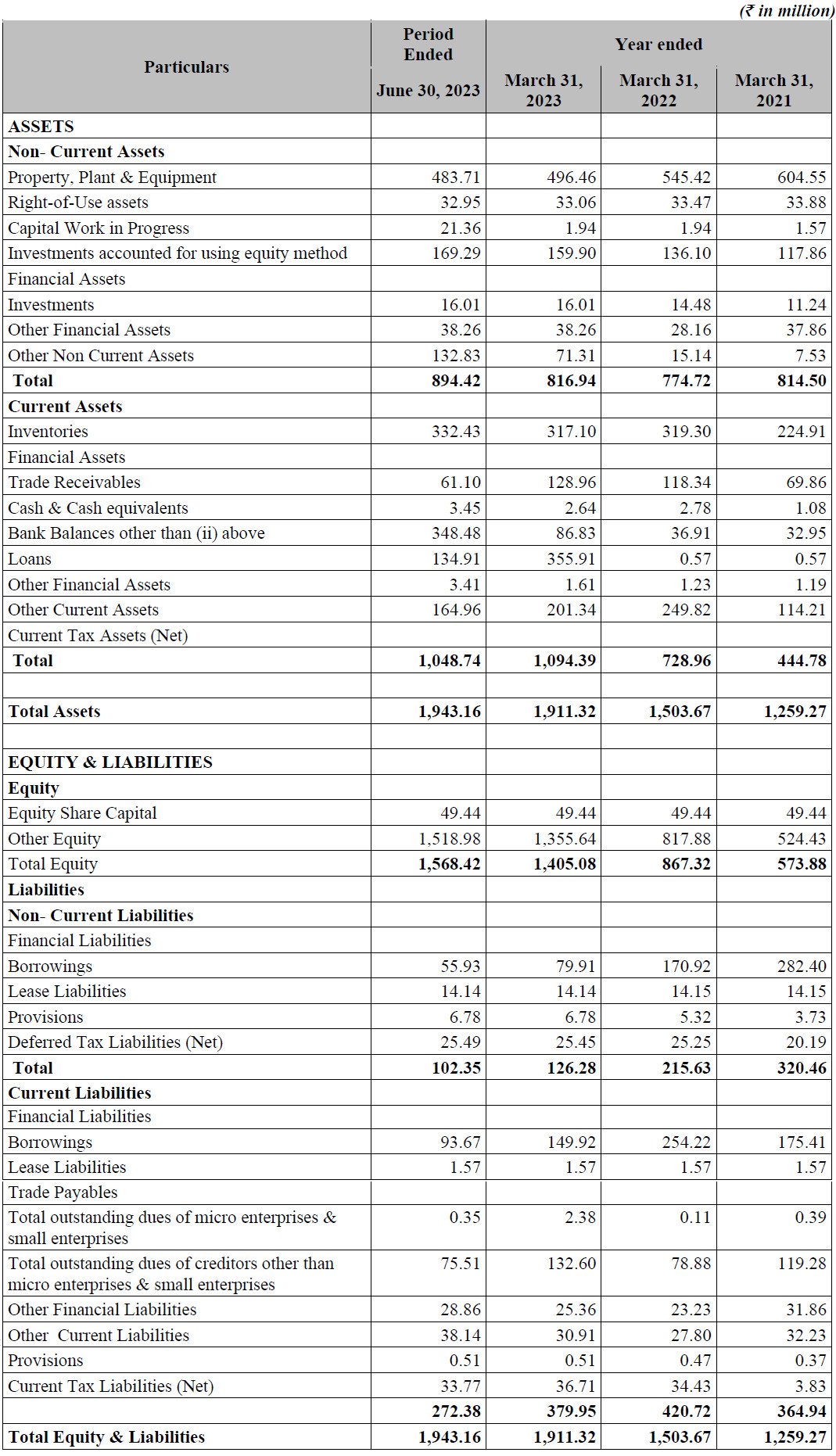

Statement of Assets and Liabilities

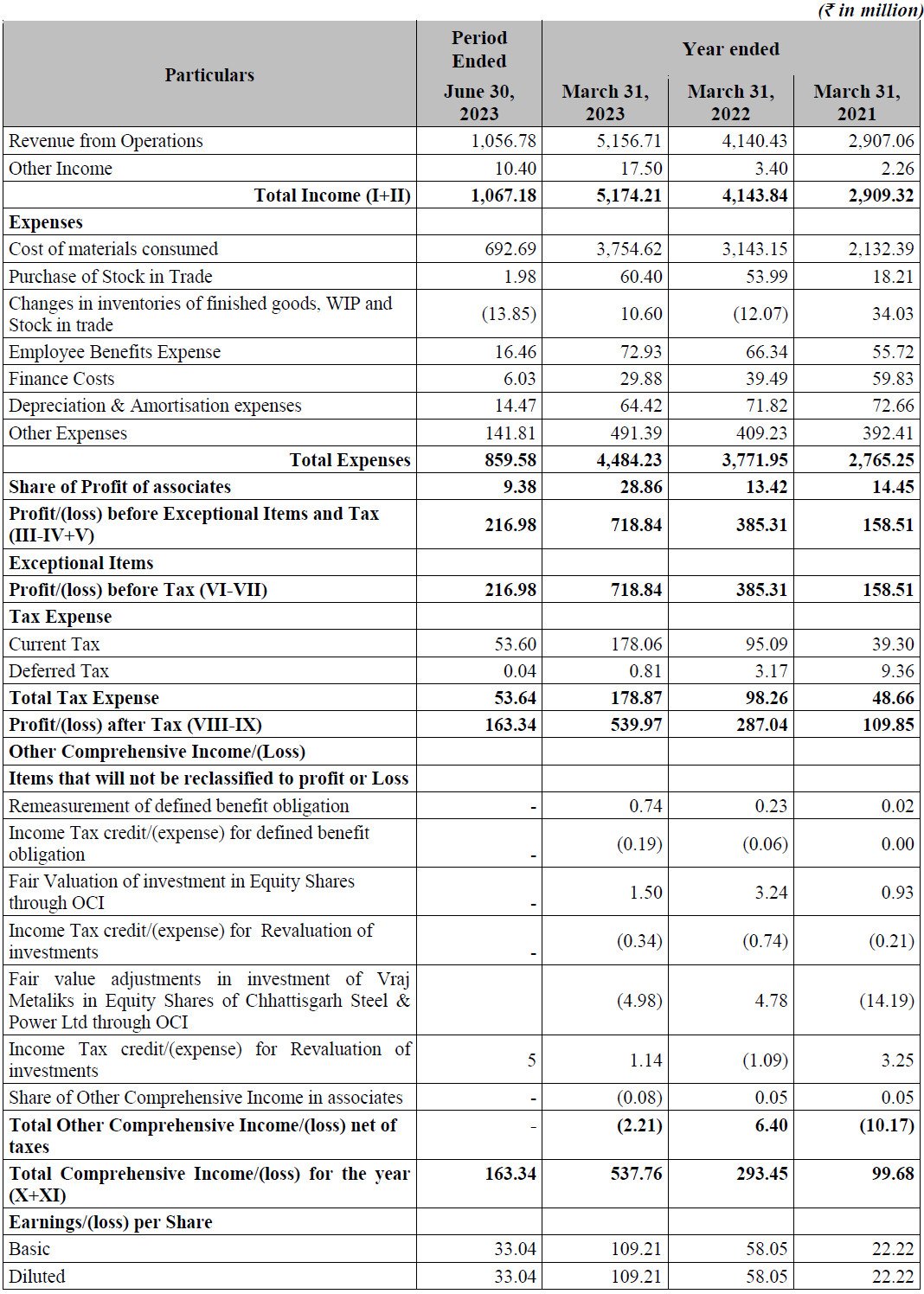

Statement of Profit and Loss

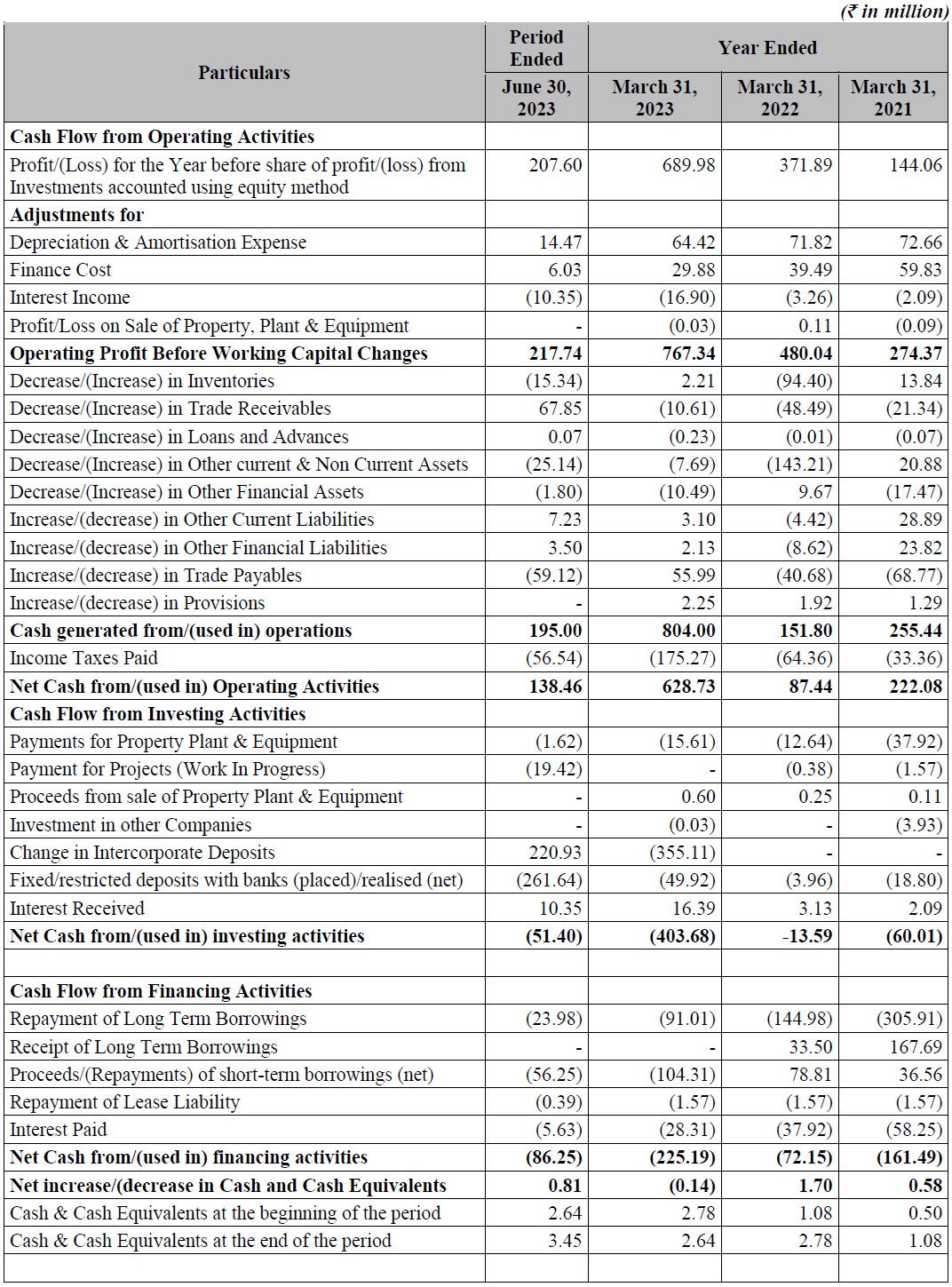

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Vraj Iron and Steel IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Vraj Iron and Steel IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Vraj Iron and Steel IPO and other offerings a more informed and confident endeavor.

1. Vraj Iron and Steel IPO key dates & Issue Details

The Vraj Iron and Steel IPO is set to open for subscription on 26th June 2024 and will close on 28th June 2024. This highly anticipated IPO offers shares at a price range of ₹195.00 to ₹207.00 per share. With its listing planned on both the BSE and NSE, the Vraj Iron and Steel IPO is expected to attract significant interest from investors. The issue type for this IPO is a Book Build Issue, aiming to raise ₹171.00 Cr through a fresh issue.

Investors keen on participating in the Vraj Iron and Steel IPO should note the important dates. The basis of allotment is tentatively scheduled for 1st July 2024, followed by the initiation of refunds on 2nd July 2024. The shares are expected to be credited to demat accounts on the same day, 2nd July 2024. The Vraj Iron and Steel IPO listing date is set for 3rd July 2024, making it a crucial date for investors looking forward to the stock’s market performance.

Retail investors will have ample opportunity to participate, with a retail quota set at not less than 35% of the net issue. The market lot for the Vraj Iron and Steel IPO is 72 shares, requiring a minimum investment of ₹14,904 for one lot. For high net-worth individuals (HNIs), the minimum lot size varies, with small HNIs needing to purchase at least 1008 shares (14 lots) and big HNIs requiring 4896 shares (68 lots).

Pre-IPO, the promoter holding stands at a dominant 99.99%. Details on the promoter holding post-IPO will be updated as they become available. The face value of each equity share in the Vraj Iron and Steel IPO is ₹10. Although the IPO discount is yet to be determined, prospective investors should stay tuned for further updates.

For investors seeking to capitalize on the Vraj Iron and Steel IPO, understanding the timeline and investment requirements is crucial. This IPO not only offers a chance to invest in a growing company but also promises significant participation opportunities through its well-structured issue plan. Keep an eye on the important dates and details to make the most out of the Vraj Iron and Steel IPO investment.

2. Vraj Iron and Steel IPO Allotment Status

Dive into the excitement surrounding the Vraj Iron and Steel IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Vraj Iron and Steel IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Vraj Iron and Steel IPO journey.

3. Introduction to Vraj Iron and Steel IPO: Comprehensive Business Model Overview

Vraj Iron and Steel, a prominent name in the manufacturing of Sponge Iron, M.S. Billets, and TMT bars, is now making waves with its upcoming IPO. Operating under the brand name Vraj, the company boasts two expansive manufacturing plants situated in Raipur and Bilaspur, Chhattisgarh, covering a total area of 52.93 acres. As of March 31, 2023, these plants had a combined installed capacity of 2,31,600 tons per annum (TPA) for both intermediate and final products. Notably, the Raipur plant also features a captive power plant with an installed capacity of 5 MW, which is set to expand significantly by FY 2024-25.

The company’s strategic growth plans include increasing the aggregate installed capacity to 5,00,100 TPA and boosting the captive power plant’s capacity to 20 MW. The expansion details include ramping up TMT Bars to 54,000 TPA, Sponge Iron to 235,500 TPA, and M.S. Billets to 210,600 TPA. This robust growth trajectory positions Vraj Iron and Steel IPO as a highly anticipated event for investors looking to tap into the thriving steel industry.

Vraj Iron and Steel caters to a diverse customer base, including both industrial clients and end-users, with product offerings such as Sponge Iron, TMT Bars, M.S. Billets, and by-products like Dolochar, Pellet, and Pig Iron. The company’s distribution channels include direct sales and broker/dealer networks, ensuring broad market penetration. The Raipur plant’s ISO 14001: 2015 certification underscores the company’s commitment to environmental management standards.

As of June 30, 2023, Vraj Iron and Steel employed a dedicated workforce of 533, including 298 permanent employees and 235 contract workers, distributed across its registered office and manufacturing plants. The company’s integrated manufacturing setup ensures control over operational aspects, enhancing quality and operational margins. With an existing production capacity of 1,20,000 TPA for Sponge Iron and 57,600 TPA for M.S. Billets, Vraj Iron and Steel is well-positioned to capitalize on market opportunities and drive growth.

Vraj Iron and Steel IPO’s strategic location in Chhattisgarh, close to the mineral-rich belt of eastern India, offers significant logistical advantages. Proximity to key raw materials like iron ore and coal reduces transportation costs, enhancing operational efficiency and margins. The company’s experienced board and management team, led by industry veterans like Promoter and Chairman Vijay Anand Jhanwar, further strengthen its market position. The leadership team’s deep industry expertise and strategic vision are pivotal to the company’s growth and expansion plans.

The upcoming Vraj Iron and Steel IPO aims to leverage the company’s robust operational framework and strategic advantages to reduce debt levels and improve the debt-to-equity ratio. As of December 22, 2023, the company’s total debt stood at ₹328.50 million, primarily from term loans for the ongoing expansion project at the Bilaspur plant. The IPO proceeds will be used to repay these loans, bolstering the company’s financial health and ensuring long-term profitability.

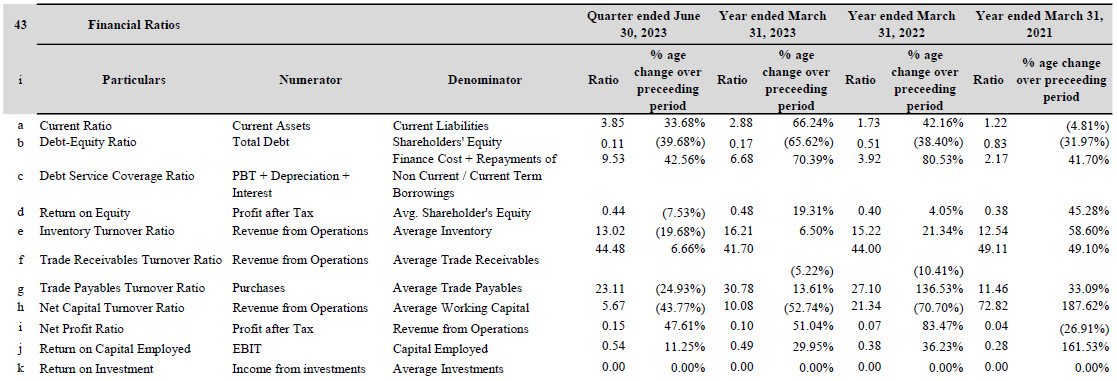

Vraj Iron and Steel’s commitment to operational efficiency is evident from its impressive financial performance, with a RoCE of 13.62% and RoE of 10.41% for the three months ending June 2023. The company’s ability to integrate manufacturing processes in-house, coupled with strategic initiatives to improve productivity and optimize costs, positions it as a formidable player in the steel industry.

In conclusion, the Vraj Iron and Steel IPO represents a strategic investment opportunity in a company with a solid growth trajectory, operational excellence, and a strong market presence. With its integrated manufacturing setup, strategic location, and experienced leadership, Vraj Iron and Steel is well-equipped to capitalize on the burgeoning demand in the steel sector and deliver sustained value to its shareholders.

4. Financial Details of Vraj Iron and Steel

The Vraj Iron and Steel IPO presents a compelling financial narrative, highlighting significant growth and strong financial health. The company’s revenue saw a notable increase of 24.87% between the financial years ending March 31, 2023, and March 31, 2022, while the profit after tax (PAT) surged by an impressive 88.12% during the same period. This remarkable financial performance underscores the robust growth trajectory and profitability of Vraj Iron and Steel.

Key Financial Figures (Restated Consolidated)

As of December 31, 2023, Vraj Iron and Steel reported total assets of ₹253.05 crore, up from ₹191.54 crore on March 31, 2023. The company’s revenue for the year ending March 31, 2023, was ₹517.42 crore, a substantial rise from ₹414.38 crore in the previous year. The PAT for the same period was ₹54.00 crore, compared to ₹28.70 crore the prior year. The company’s net worth increased to ₹187.50 crore, and reserves and surplus stood at ₹162.78 crore as of March 31, 2023. Total borrowing decreased to ₹22.98 crore from ₹42.51 crore the previous year, highlighting improved financial management and reduced debt levels.

Detailed Financial Performance (₹ in million)

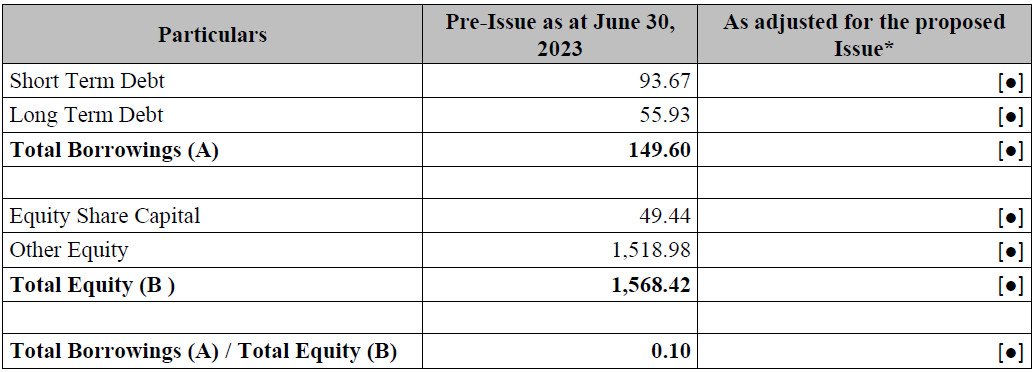

For the period ending June 30, 2023, Vraj Iron and Steel reported total income of ₹1,067.18 million, with an EBITDA of ₹237.47 million, reflecting an EBITDA margin of 22.47%. The PAT for this period was ₹163.34 million, with a PAT margin of 15.46%. As of June 30, 2023, the company’s net worth was ₹1,568.42 million. The Return on Equity (ROE) for the same period was 10.41% (annualized), while the Return on Capital Employed (ROCE) was 13.62% (annualized).

Vraj Iron and Steel IPO Valuations and Margins

The Vraj Iron and Steel IPO valuations highlight the company’s financial robustness. The Earnings Per Share (EPS) for FY 2021 was 4.45, which increased to 11.62 in FY 2022 and further to 21.86 in FY 2023. The Price to Earnings (PE) ratio post-issue for FY 2024 is expected to range between 10.83 and 11.49. The Return on Net Worth (RONW) improved from 19.01% in FY 2021 to 32.94% in FY 2022 and 38.32% in FY 2023.

The Net Asset Value (NAV) increased from 23.40 in FY 2021 to 35.28 in FY 2022 and further to 57.05 in FY 2023. The EBITDA margin rose from 10.01% in FY 2021 to 15.77% in FY 2023, while the ROCE improved significantly from 20.68% in FY 2021 to 44.98% in FY 2023. The company’s Debt to Equity ratio decreased from 0.82 in FY 2021 to 0.17 in FY 2023, showcasing a substantial reduction in debt and a stronger financial position.

The Vraj Iron and Steel IPO offers a robust financial proposition, reflecting strong revenue growth, improved profitability, and effective debt management. These financial highlights underscore the potential for substantial returns for investors, making the Vraj Iron and Steel IPO a noteworthy opportunity in the steel industry.

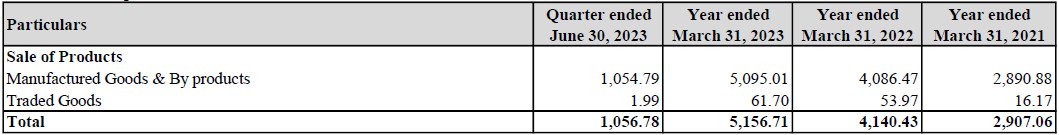

Statement Of Revenue From Operations

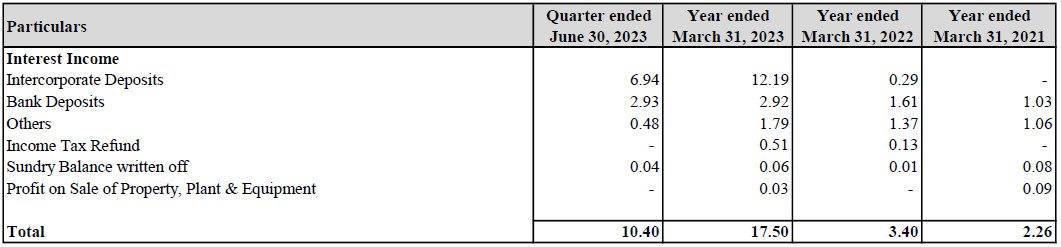

Statement of Other Income

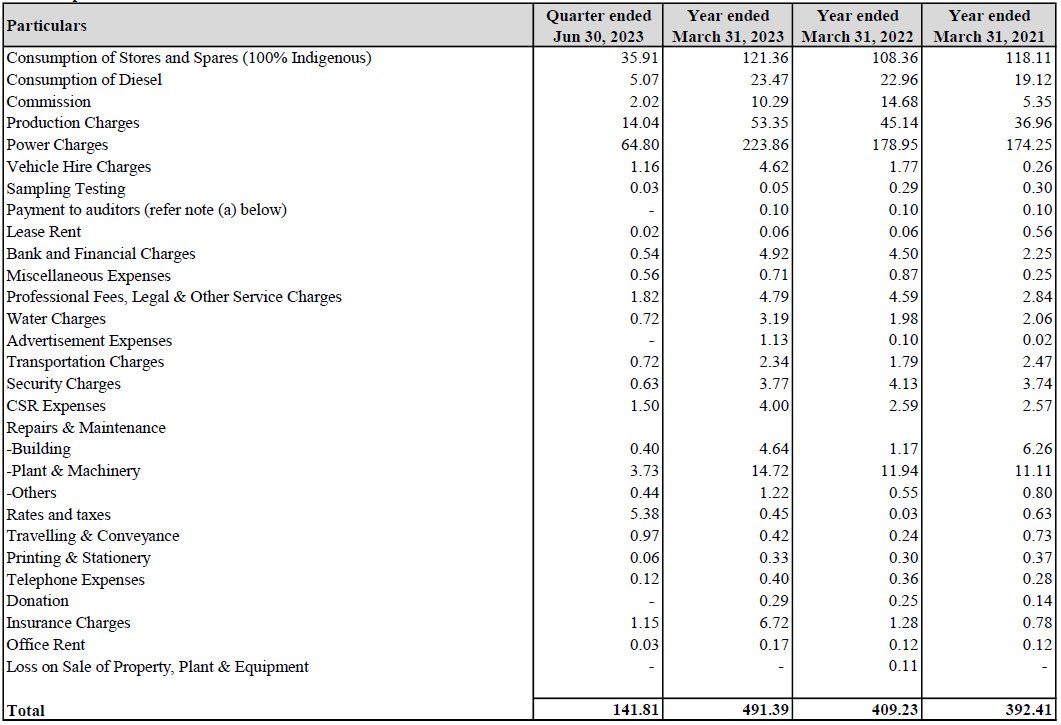

Statement of Other Expenses

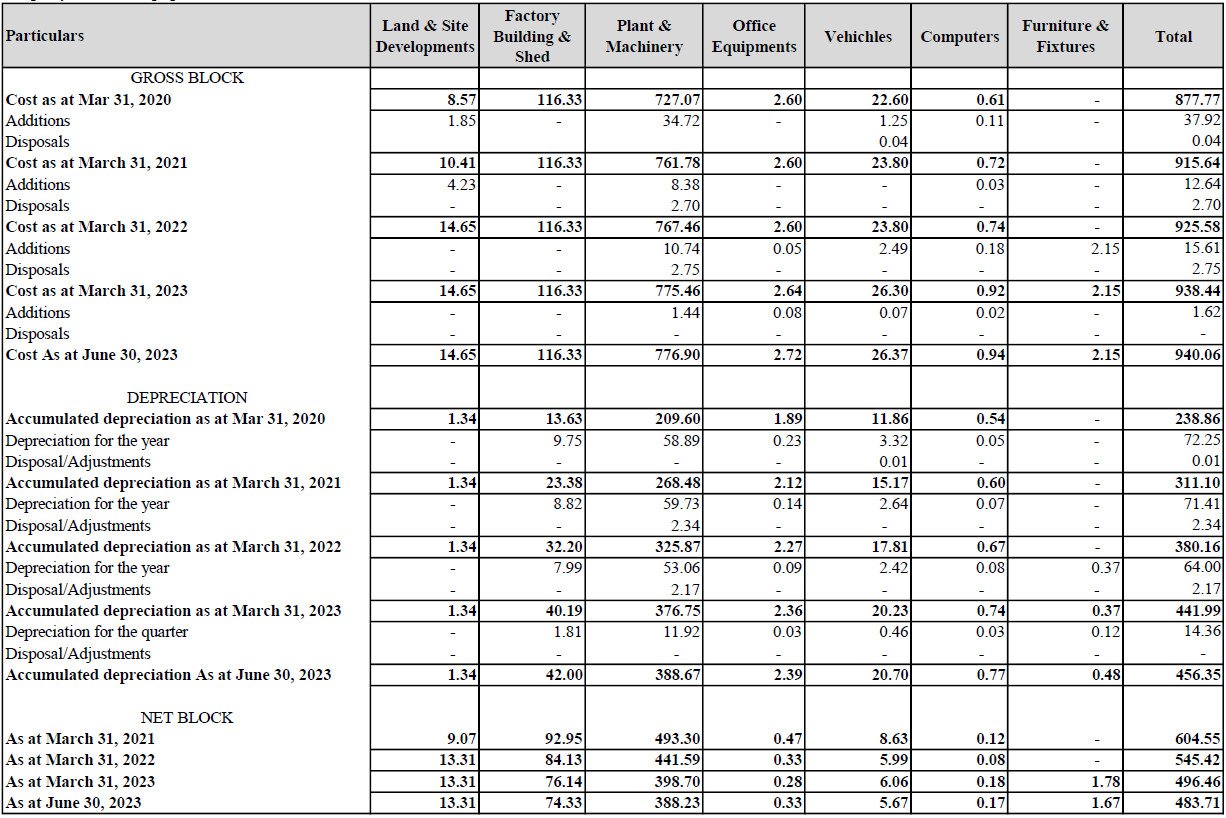

Statement of Property, Plant and Equipment

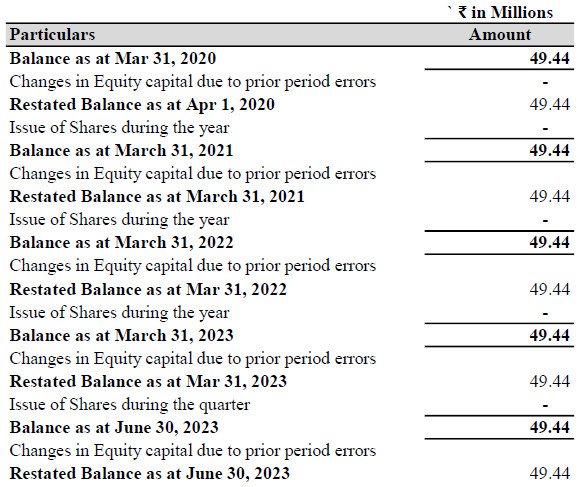

Statement of Equity Share Capital

Statement of Capitalisation

Financial Ratios

5.Vraj Iron and Steel IPO FAQs

Vraj Iron and Steel IPO Details

The price range for the Vraj Iron and Steel IPO is ₹195.00 to ₹207.00 per share.

The total issue size of the Vraj Iron and Steel IPO is ₹171.00 crore.

The Vraj Iron and Steel IPO is a Book Build Issue.

The face value of the equity shares in the Vraj Iron and Steel IPO is ₹10 per share.

The Vraj Iron and Steel IPO will be listed on both the BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

Vraj Iron and Steel IPO Dates

The Vraj Iron and Steel IPO opens for subscription on June 26, 2024.

The closing date for the Vraj Iron and Steel IPO is June 28, 2024.

The basis of allotment for the Vraj Iron and Steel IPO will be finalized on July 1, 2024.

Refunds for the Vraj Iron and Steel IPO will be initiated on July 2, 2024.

The shares will be credited to Demat accounts on July 2, 2024.

The listing date for the Vraj Iron and Steel IPO is July 3, 2024.

Vraj Iron and Steel IPO Issue Details

The minimum lot size for retail investors is 72 shares.

The minimum investment amount for one lot is ₹14,904.

The minimum lot size for Small HNI investors is 14 lots (1008 shares), and the maximum lot size is 10 lakhs.

The minimum lot size for Big HNI investors is 68 lots (4896 shares), and the maximum lot size exceeds 10 lakhs.

Vraj Iron and Steel Business Model

Vraj Iron and Steel manufactures sponge iron, M.S. billets, and TMT bars.

The manufacturing units of Vraj Iron and Steel are located in Raipur and Bilaspur, Chhattisgarh.

Vraj Iron and Steel holds the ISO 14001: 2015 certification for its environmental management system.

As of March 31, 2023, the installed capacity of the manufacturing plants was 2,31,600 tons per annum (TPA), which is expected to increase to 5,00,100 TPA.

Vraj Iron and Steel Financial Data

For the fiscal year ending March 31, 2023, Vraj Iron and Steel reported revenue of ₹517.42 crore and a profit after tax (PAT) of ₹54.00 crore.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Vraj iron and steel IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Vraj iron and steel IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Vraj iron and steel IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Vraj iron and steel IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.