Table of Contents

The Tunwal E-Motors IPO showcases the rise of Tunwal E-Motors Limited, an innovative force in the EV-2-Wheeler industry since its establishment in December 2018. Dedicated to manufacturing excellence, the company has achieved a remarkable 346% sales increase and launched over 23 models, including 7 variants of 2-wheelers. With a robust dealer base of more than 225 across 19 states in India, Tunwal E-Motors, founded by Jhumarmal Pannaram Tunwal, stands out for its state-of-the-art manufacturing facility in Palsana, Rajasthan.

The company’s tight organizational hierarchy, led by its sales, marketing, and accounting departments, ensures effective strategies and financial stability. Registered with the Bureau of Indian Standards and recognized by SAE International.

Tunwal E-Motors IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

15th July 2024 | 18th July 2024 | 19th July 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 22nd July 2024 | 22nd July 2024 | 23rd July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹115.64 Cr | ₹ 59.00 | 2000 Shares | 1,96,00,000 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 2000 | ₹ 1,18,000 |

| Retail(Max) | 1 | 2000 | ₹ 1,18,000 |

| Small-HNI (Min) | 2 | 4000 | ₹ 2,36,000 |

| Small-HNI (Max) | 8 | 16000 | ₹ 9,44,000 |

| Big-HNI (Min) | 9 | 18000 | ₹ 10,62,000 |

| RII (Retail) | NII | QIB |

| 50.00% | 50.00% | – |

| Pre-Promoter | Post Promoter | Listing IN |

| 97.04% | 62.34% | NSE SME |

| No | Objectives |

| 1 | Funding of working capital requirements of the Company |

| 2 | Research & Development |

| 3 | Pursuing Inorganic Growth |

| 4 | General corporate purposes |

| LEAD | REGISTRAR |

| Horizon Management Private Limited | SKYLINE FINANCIAL SERVICES PRIVATE LIMITED |

| Telephone | |

| cs@tunwal.com | +91-20-24336001 |

Tunwal E-Motors IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Financial of Tunwal E-Motors IPO

| Amounts in Lakhs ₹ | |||

| Particulars | FY-2024 | FY-2023 | FY-2022 |

| Assets | 7,583 | 5,694 | 5,037 |

| Revenue | 10,554 | 7,656 | 7,566 |

| Expense | 8,977 | 7,163 | 7,242 |

| Net Worth | 2,053 | 822 | 424 |

| RoNW (%) | 57.53 | 45.32 | 55.12 |

| EBITDA(%) | 17.05 | 8.64 | 5.74 |

| Reserves | 1,224.06 | 409.40 | 321.55 |

| PAT | 1,181.17 | 372.48 | 233.94 |

| EPS | 2.85 | 1.81 | 1.21 |

| Debt/Equity | 1.00 | 2.30 | 3.20 |

| Established | Website | Industry |

| 2018 | tunwal.com | 2&3 wheelers |

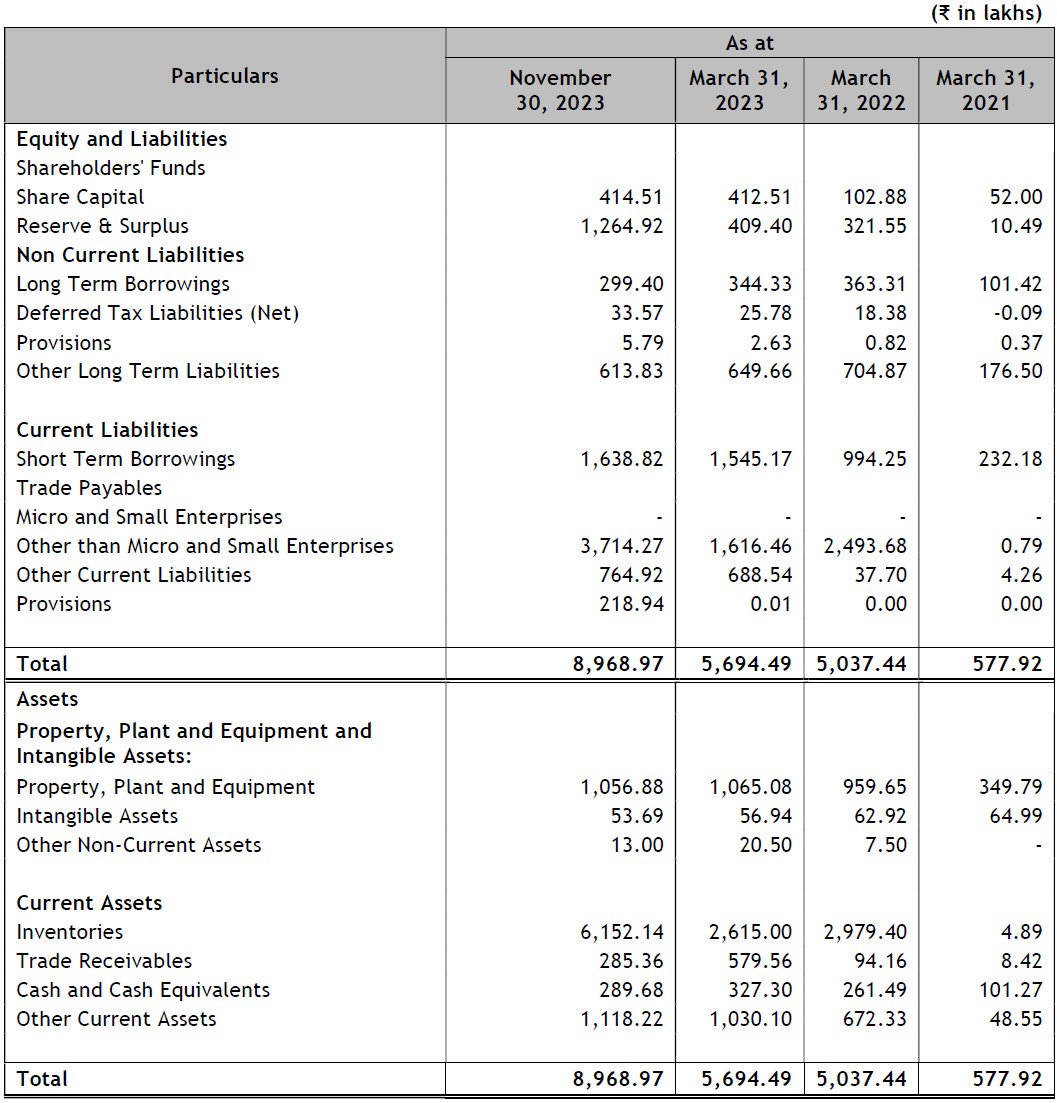

Statement of Assets and Liabilities

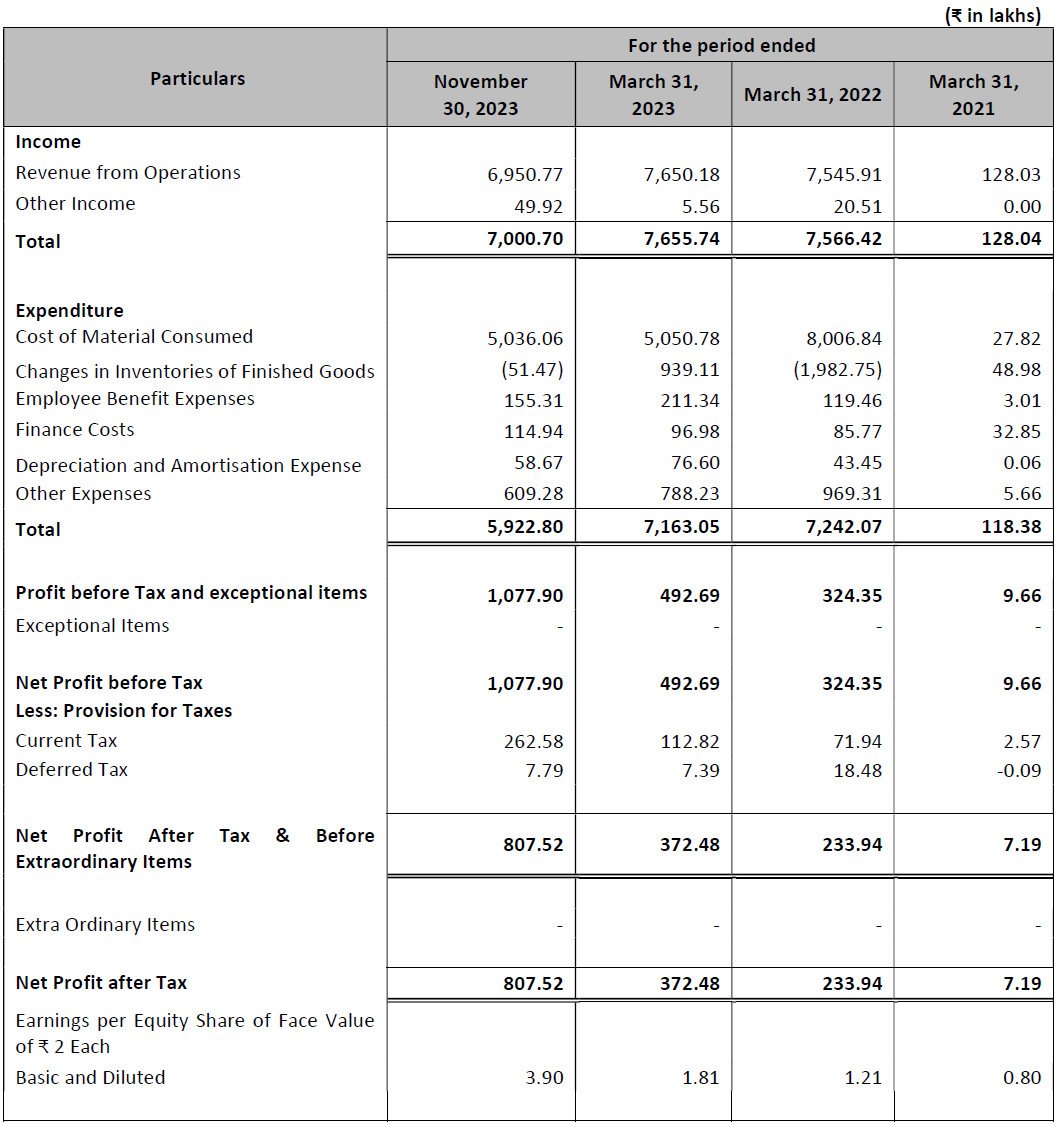

Statement of Profit and Loss

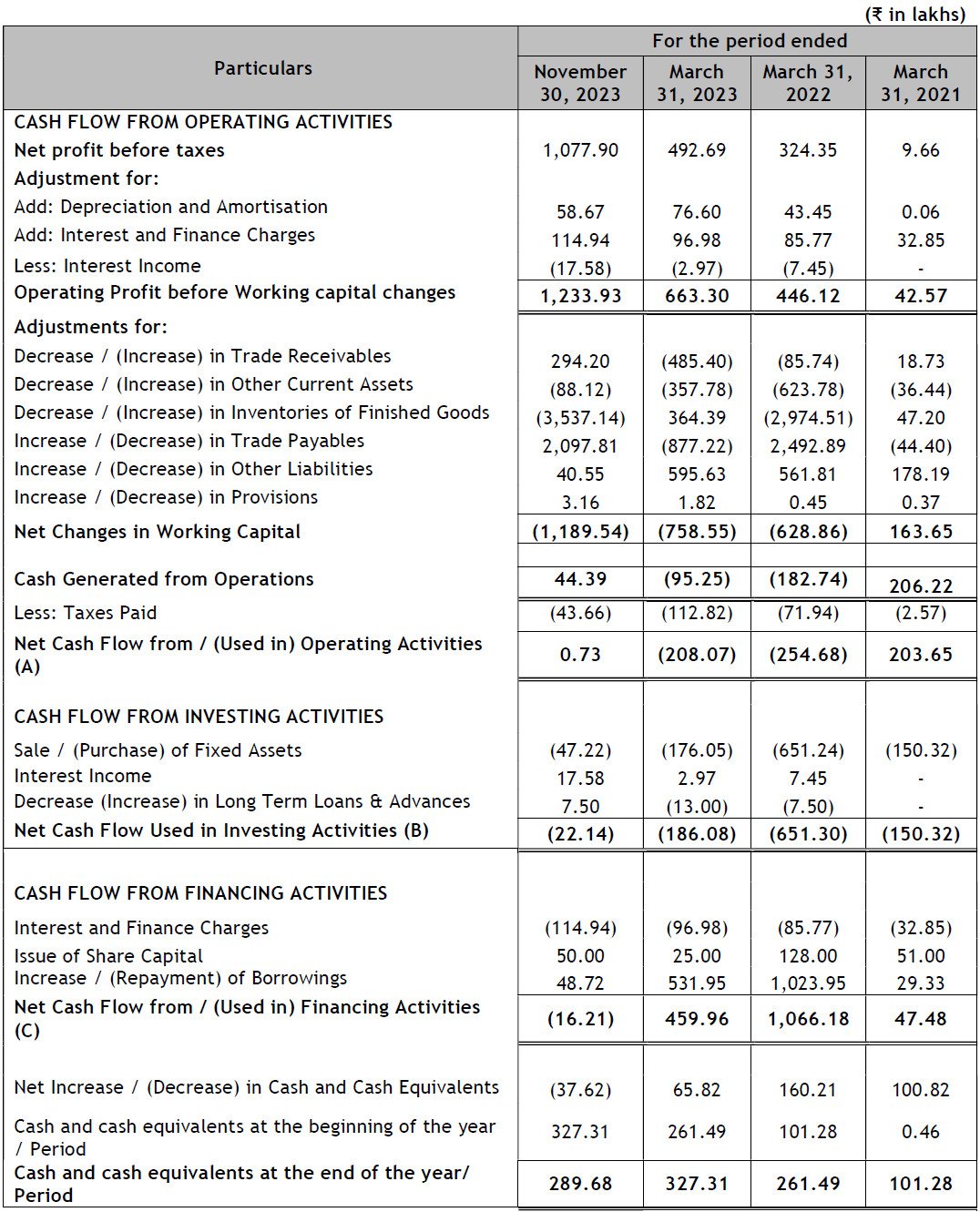

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Tunwal E-Motors IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Tunwal E-Motors IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Tunwal E-Motors IPO and other offerings a more informed and confident endeavor.

1. Tunwal E-Motors IPO key dates & Issue Details

The Tunwal E-Motors SME IPO is set to open for subscription on the 15th of July, 2024, and will close on the 18th of July, 2024. This fixed price issue is priced at ₹59.00 per share, providing an opportunity for investors to partake in the growth of Tunwal E-Motors. The IPO is listed on the NSE SME platform, with a total issue size of ₹115.64 crore. The offer comprises a fresh issue of ₹81.72 crore and an offer for sale amounting to ₹33.93 crore. With a face value of ₹2 per equity share, the IPO promises significant potential for investors.

Retail investors will have the advantage of a 50% quota of the net issue, making it a highly accessible investment opportunity. Before the IPO, the promoter holding stands at 97.04%, which will reduce to 62.34% post-IPO. The listing is eagerly anticipated, and the Tunwal e motors IPO is generating considerable interest in the market.

Important Dates for Tunwal E-Motors SME IPO

Investors should mark their calendars for the following key dates regarding the Tunwal E-Motors SME IPO. The basis of allotment is scheduled for the 19th of July, 2024, followed by the initiation of refunds on the 22nd of July, 2024. The shares will be credited to Demat accounts on the same day, and the IPO will be listed on the 23rd of July, 2024. These dates, while tentative, provide a clear timeline for investors to follow and plan their investments accordingly.

Tunwal E-Motors SME IPO Lots

For those looking to invest in the Tunwal E-Motors IPO, the issue price is set at ₹59.00 per share. The market lot size is 2000 shares, with a minimum amount of ₹118,000 for one lot. High Net-worth Individuals (HNIs) are required to invest in a minimum of two lots, totaling 4000 shares, amounting to ₹236,000. This structured lot system ensures a clear and straightforward investment process for all types of investors.

The Tunwal e motors IPO offers a unique opportunity to invest in a promising company within the electric vehicle sector. With an attractive issue price, significant promoter holding, and a clear timeline of important dates, this IPO is positioned to attract substantial interest from both retail and institutional investors. Stay updated with the Tunwal E-Motors SME IPO to make the most of this investment opportunity.

2. Tunwal E-Motors IPO Allotment Status

Dive into the excitement surrounding the Tunwal E-Motors IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Tunwal E-Motors IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Tunwal E-Motors IPO journey.

3. Introduction to Tunwal E-Motors IPO: A Comprehensive Business Overview

Tunwal E-Motors Limited, originally incorporated as “Tunwal E-Motors Private Limited” on December 21, 2018, has quickly ascended to become a significant player in India’s electric vehicle (EV) market. The company transitioned to a public limited company on December 1, 2023, reinforcing its commitment to growth and innovation. Tunwal E-Motors Ltd.

Focuses on the manufacturing and distribution of high-quality electric two-wheelers, achieving a remarkable 346% CAGR on revenue. With over 23 models, a dealer base exceeding 225 across India, and a presence in 19 states, the company stands at the forefront of India’s shift towards sustainable mobility solutions.

Strategic Production Facilities and Certifications

The state-of-the-art production facility in Palsana, Rajasthan, enables Tunwal E-Motors to meet the rising demand for electric scooters efficiently. The company is registered under the Bureau of Indian Standards, and SAE International, USA, has confirmed its World Manufacturer Identifier (WMI) code. Tunwal E-Motors’ commitment to quality and innovation in electric two-wheeler manufacturing positions it as a leader in the EV sector.

Revenue Model

Tunwal E-Motors’ robust revenue model is designed to sustain financial health and foster growth. The primary revenue stream comes from sales of various models through an extensive dealer network, enhancing market penetration. Additionally, the sale of spare parts ensures continuous revenue. This comprehensive approach positions Tunwal E-Motors as a dynamic player in the electric vehicle market, capitalizing on direct sales, dealer network reach, and maintenance services.

Diverse Product Portfolio

Tunwal E-Motors offers over 23 different models catering to various needs and segments. Key models include Mini Sports 63 – 48V, Mini Lithino, Storm Zx, Lithino Li, TZ, ROMA, and ALFA PRO. These models, available in myriad colors, feature options for different battery types and distances covered. Notably, low-speed bikes, which do not require registration, constitute over 75% of sales, while high-speed products contribute to around 25% of sales.

Competitive Strengths

Tunwal E-Motors’ growth is driven by experienced leadership, a professional team, and consistent financial performance. The management’s extensive industry knowledge has been instrumental in shaping and executing successful business strategies. The company has demonstrated financial resilience, maintaining profitability even during the COVID-19 pandemic. With a wide product portfolio and a well-developed and expanding dealer network, Tunwal E-Motors ensures increased customer accessibility and efficient service delivery.

Commitment to Environmental Sustainability

Tunwal E-Motors is dedicated to sustainability, aligning with the global focus on eco-friendly transportation. The company’s electric two-wheelers contribute to a cleaner and greener future, resonating with environmentally conscious consumers. This commitment to sustainability distinguishes Tunwal E-Motors in the competitive electric vehicle market.

Business Strategies

Tunwal E-Motors aims to enhance its nationwide presence by expanding its geographic footprint and bolstering network capabilities. The company plans to introduce new and improved EV models, ensuring a diverse and cutting-edge product portfolio. Investing in R&D to advance technological capabilities and optimize costs is a key focus. Additionally, Tunwal E-Motors is exploring export opportunities to tap into international markets, aiming to become a global player in the electric vehicle sector.

State-of-the-Art Manufacturing Plant

The manufacturing plant, located at E 123-124 RIICO Industrial Area, Palsana, Shikar, spans 8000 sq. meters with over 60,000 sq. feet of built-up space. The facility has the capacity to produce 41,000 units of electric two-wheelers annually, with space for further expansion. The plant infrastructure supports efficient production and maintenance of finished inventory.

Advanced Machinery

The production process at Tunwal E-Motors utilizes advanced machinery, including assembly lines, forklifts, laser marking machines, frame coding machines, laser printing machines, stamping machines, CNC lathe machines, MIG automatic welding machines, wheel rim manufacturing machines, and motor manufacturing assembly lines. This advanced machinery ensures high-quality manufacturing and assembly processes, supporting the company’s commitment to excellence.

Tunwal E-Motors IPO presents a unique investment opportunity in a leading company within the electric vehicle sector. With a strong business model, diverse product portfolio, and commitment to sustainability, Tunwal E-Motors is poised for significant growth. The company’s strategic expansion plans and focus on innovation further enhance its position in the market, making the Tunwal e motors IPO a compelling investment prospect.

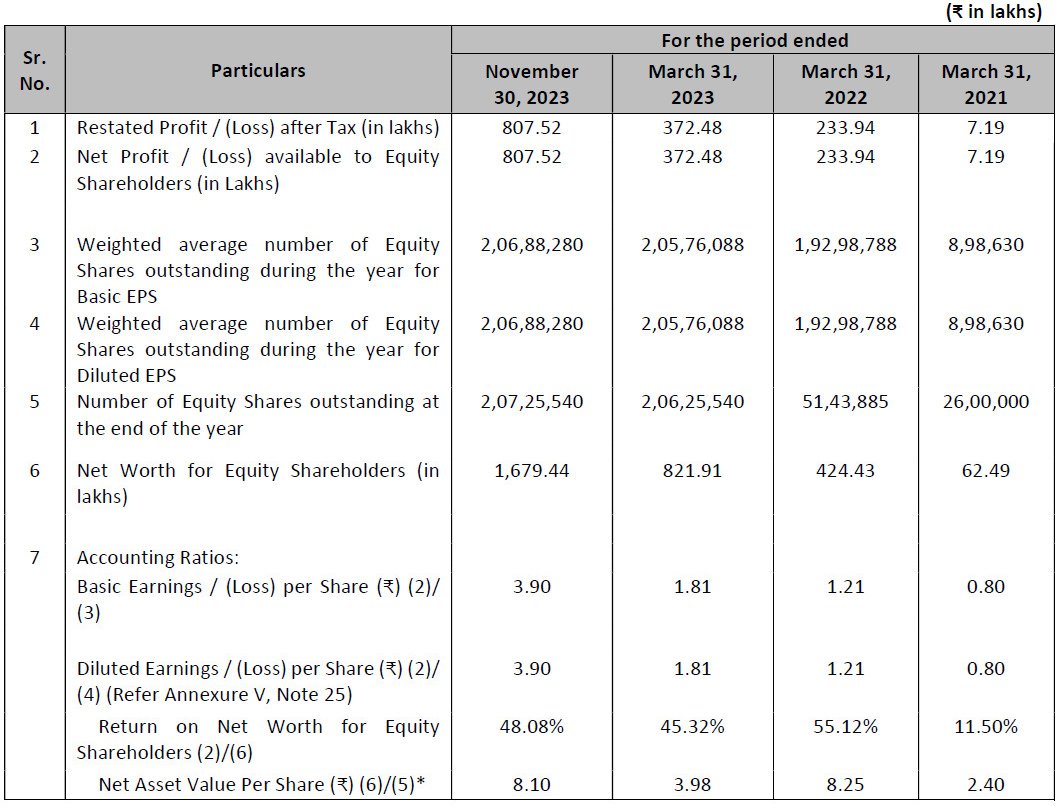

4. Financial Details of Tunwal E-Motors

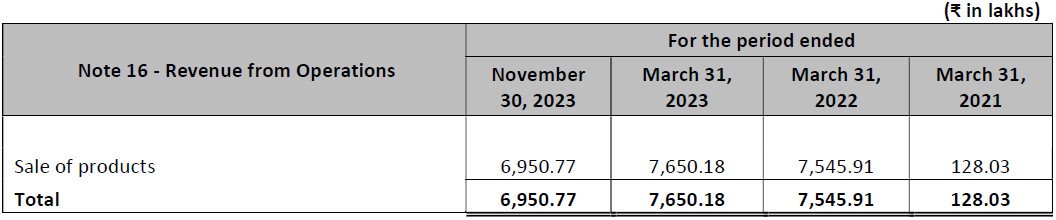

Tunwal E-Motors Limited has demonstrated robust financial growth in recent years. For the financial year ending March 31, 2024, the company reported a significant increase in revenue and profit after tax (PAT). Revenue surged by 37.85%, reaching ₹10,553.69 lakhs, up from ₹7,655.74 lakhs in the previous year. Meanwhile, PAT saw an impressive rise of 217.11%, climbing to ₹1,181.17 lakhs from ₹372.48 lakhs. This remarkable financial performance highlights the company’s strong market presence and growth potential.

In terms of assets, Tunwal E-Motors’ total assets increased to ₹7,582.97 lakhs as of March 31, 2024, compared to ₹5,694.49 lakhs the previous year. The company’s net worth also grew substantially, reaching ₹2,053.08 lakhs from ₹821.91 lakhs. Additionally, reserves and surplus rose to ₹1,224.06 lakhs, indicating a solid financial foundation for future expansion.

Key Financial Metrics

The Tunwal e motors IPO provides insight into the company’s financial health and valuation metrics. For the financial year 2024, the Earnings Per Share (EPS) stood at ₹2.85, reflecting the company’s profitability and shareholder value. The Price-to-Earnings (PE) ratio for the same period was 20.70, indicating a favorable valuation in the market.

The Return on Net Worth (RONW) for FY 2024 was 57.53%, up from 45.32% in FY 2023 and 55.12% in FY 2022. This increase underscores Tunwal E-Motors’ efficient use of equity capital to generate profits. The Net Asset Value (NAV) also improved, reaching ₹4.95 in FY 2024, compared to ₹3.98 in FY 2023 and ₹8.25 in FY 2022.

Operational Efficiency and Profitability

Tunwal E-Motors has shown significant improvement in operational efficiency and profitability. The Return on Capital Employed (ROCE) was 59.38% in FY 2024, up from 31.97% in FY 2023 and 27.13% in FY 2022. This indicates the company’s effective use of capital in generating returns.

The Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) margin for FY 2024 was 17.05%, a substantial increase from 8.64% in FY 2023 and 5.74% in FY 2022. This growth in EBITDA margin reflects Tunwal E-Motors’ ability to manage its operating costs efficiently while increasing revenue.

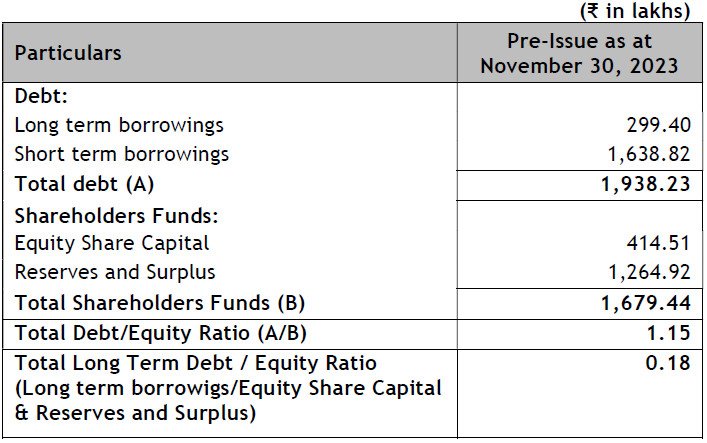

Debt Management

Tunwal E-Motors has also made significant strides in managing its debt. The debt-to-equity ratio improved to 1.00 in FY 2024, down from 2.30 in FY 2023 and 3.20 in FY 2022. This reduction in debt highlights the company’s focus on maintaining a healthy balance sheet and reducing financial risk.

The financial data of Tunwal E-Motors IPO showcases the company’s strong growth trajectory, efficient operations, and robust financial health. With significant improvements in revenue, profitability, and asset base, Tunwal E-Motors is well-positioned for future success in the competitive electric vehicle market. The company’s favorable valuation metrics and improved debt management further enhance its attractiveness to investors. The Tunwal e motors IPO is a compelling opportunity for those looking to invest in a promising player in the EV sector.

Statement Of Revenue From Operations

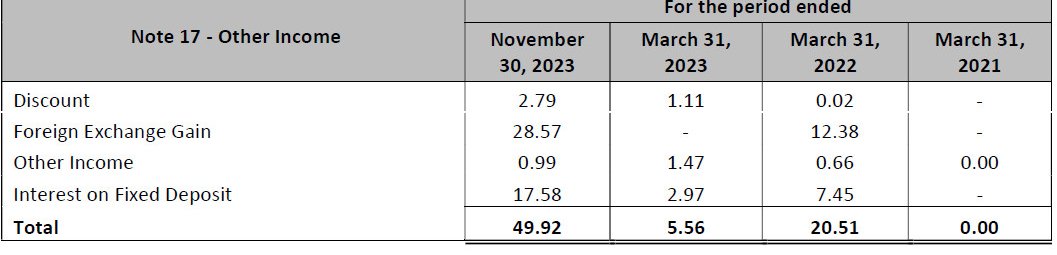

Statement of Other Income

Statement of Other Expenses

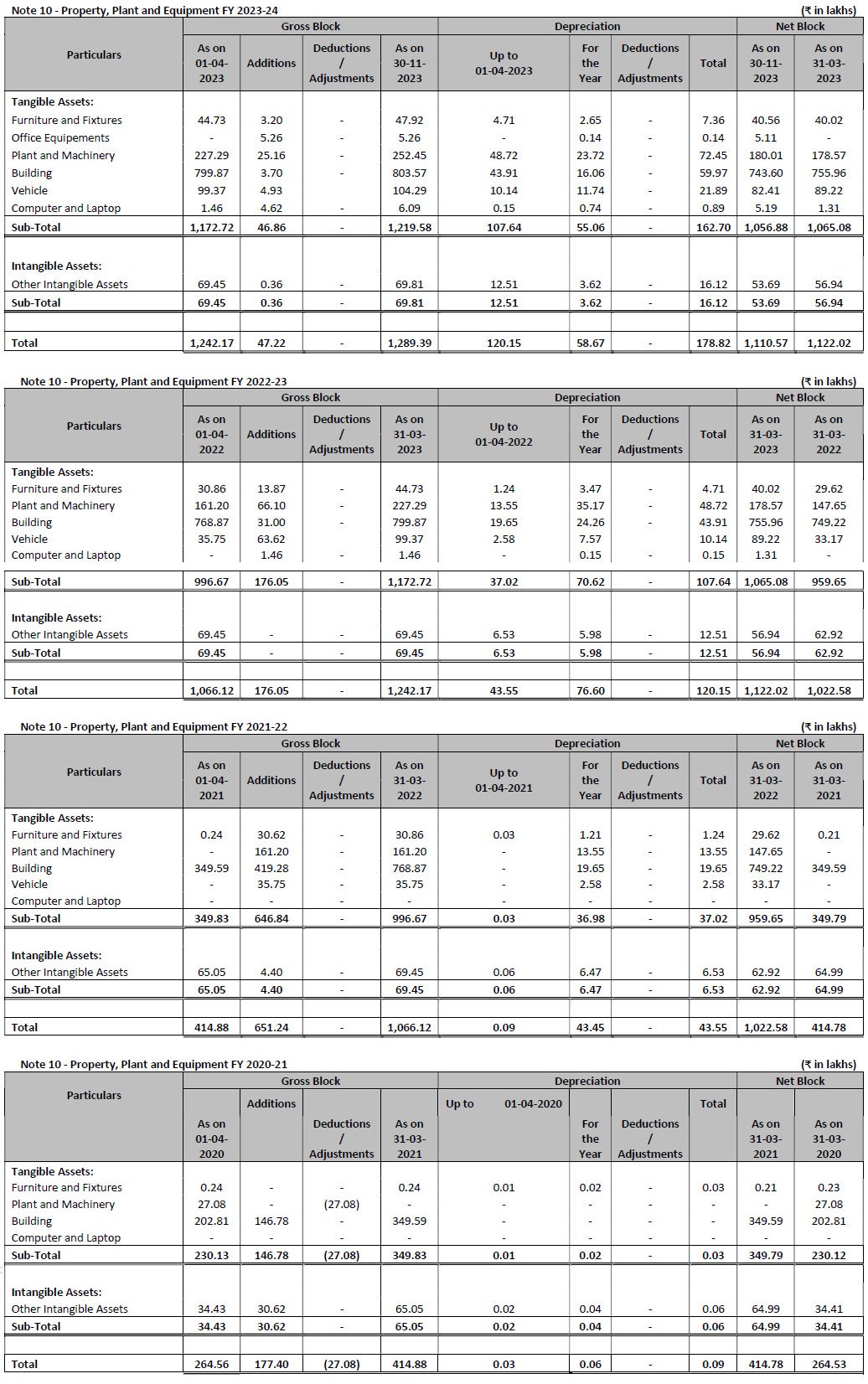

Statement of Property, Plant and Equipment

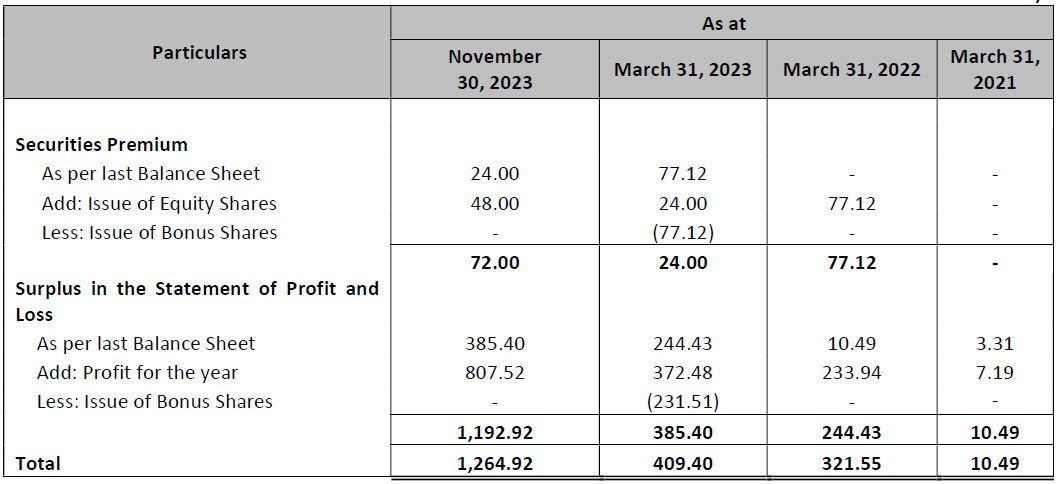

Statement of Reserves & Surplus

Statement of Capitalisation

Financial Ratios

5. Tunwal E-Motors IPO FAQs

The Tunwal E-Motors IPO opens on July 15, 2024.

The IPO closes on July 18, 2024.

The issue price is ₹59.00 per share.

The total issue size is ₹115.64 crores.

The offer for sale is ₹33.93 crores.

The fresh issue is ₹81.72 crores.

The face value is ₹2 per equity share.

The IPO will be listed on the NSE SME.

The retail quota is 50% of the net issue.

It is a fixed price issue.

The basis of allotment is expected on July 19, 2024.

Refunds will be initiated on July 22, 2024.

Shares will be credited to demat accounts on July 22, 2024.

The expected listing date is July 23, 2024.

The market lot is 2000 shares.

The minimum amount for one lot (2000 shares) is ₹118,000.

The EPS for FY 2024 is ₹2.85.

The RONW for FY 2024 is 57.53%.

The EBITDA margin for FY 2024 is 17.05%.

The debt-to-equity ratio for FY 2024 is 1.00.

Business Model and Financial Data

Tunwal E-Motors focuses on the design, development, manufacturing, and distribution of electric two-wheelers.

Tunwal E-Motors offers over 23 different models of electric two-wheelers.

Tunwal E-Motors has a dealer base of over 225 dealers across India.

The revenue for FY 2024 was ₹10,553.69 lakhs.

The PAT for FY 2024 was ₹1,181.17 lakhs.

Key strengths include a wide product portfolio, extensive dealer network, experienced leadership, and a strong commitment to sustainability.

The ROCE for FY 2024 is 59.38%.

Tunwal E-Motors’ net worth increased to ₹2,053.08 lakhs in FY 2024 from ₹821.91 lakhs in FY 2023.

Tunwal E-Motors invests in R&D to advance technological capabilities, improve product offerings, and enhance cost and operational efficiency.

The manufacturing plant is located in the RIICO Industrial Area, Palsana, Shikar, Rajasthan.

Investment Insights

Investors should consider the IPO due to the company’s strong financial performance, robust growth trajectory, and significant market presence in the EV sector.

Tunwal E-Motors contributes to sustainability by focusing on eco-friendly electric two-wheelers, promoting cleaner and greener transportation solutions.

The potential for future growth is high, driven by expanding the dealer network, introducing new models, investing in R&D, and exploring global market opportunities through exports.

The company plans to enhance its presence by expanding its geographic footprint, strengthening its existing network, and establishing new networks in key states.

Tunwal E-Motors stands out due to its extensive product portfolio, commitment to innovation, strong dealer network, and focus on sustainability.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Tunwal E-Motors IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Tunwal E-Motors IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Tunwal E-Motors IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Tunwal E-Motors IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.