Table of Contents

The Sati Poly Plast IPO marks a significant milestone for Sati Poly Plast Limited, a company founded in July 1999 and renowned for manufacturing multifunctional flexible packaging material. Catering to diverse industries, Sati Poly Plast provides comprehensive end-to-end packaging solutions, particularly excelling in the food and beverage sector with products like savoury snacks, snack bars, dried fruit, confectionery, and dry foods. The company has consistently expanded its operations, boosting its installed capacity from 250 tonnes per month to 500 tonnes per month by 2019. With two state-of-the-art manufacturing units in Noida, boasting an installed capacity of 540 tonnes per month each.

Sati Poly Plast IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

12th July 2024 | 16th July 2024 | 18th July 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 19th July 2024 | 19th July 2024 | 22nd July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹17.36 Cr | ₹ 123.00 – ₹ 130.00 | 1000 Shares | 13,35,000 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 1000 | ₹ 1,30,000 |

| Retail(Max) | 1 | 1000 | ₹ 1,30,000 |

| Small-HNI (Min) | 2 | 2000 | ₹ 2,60,000 |

| Small-HNI (Max) | 7 | 7000 | ₹ 9,10,000 |

| Big-HNI (Min) | 8 | 8000 | ₹ 10,40,000 |

| RII (Retail) | NII | QIB |

| 35.00% | 15.00% | 50.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 86.30% | 63.00% | NSE SME |

| No | Objectives |

| 1 | Working Capital Requirements |

| 2 | General Corporate Purposes |

| LEAD | REGISTRAR |

| BEELINE CAPITAL ADVISORS PRIVATE LIMITED | LINK INTIME INDIA PRIVATE LIMITED |

| Telephone | |

| satipolyplast1@gmail.com | +91 98181 04164 |

Sati Poly Plast IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Financial of Sati Poly Plast IPO

| Amounts in Lakhs ₹ | |||

| Particulars | FY-2024 | FY-2023 | FY-2022 |

| Assets | 5,638 | 4,194 | 3,579 |

| Revenue | 17,941 | 19,097 | 17,522 |

| Expense | 17,523 | 18,703 | 17,507 |

| Net Worth | 1,230 | 398 | 89 |

| Borrowing | 2,520 | 2,631 | 2,359 |

| EBITDA(%) | 5.17 | 4.59 | 2.92 |

| Reserves | 869.08 | 291.24 | -17.65 |

| PAT | 328.64 | 308.89 | 28.23 |

| EPS | 9.70 | 9.68 | 0.88 |

| Debt/Equity | 1.82 | 6.62 | 26.58 |

| Established | Website | Industry |

| 1999 | satipolyplast.in | Packaging |

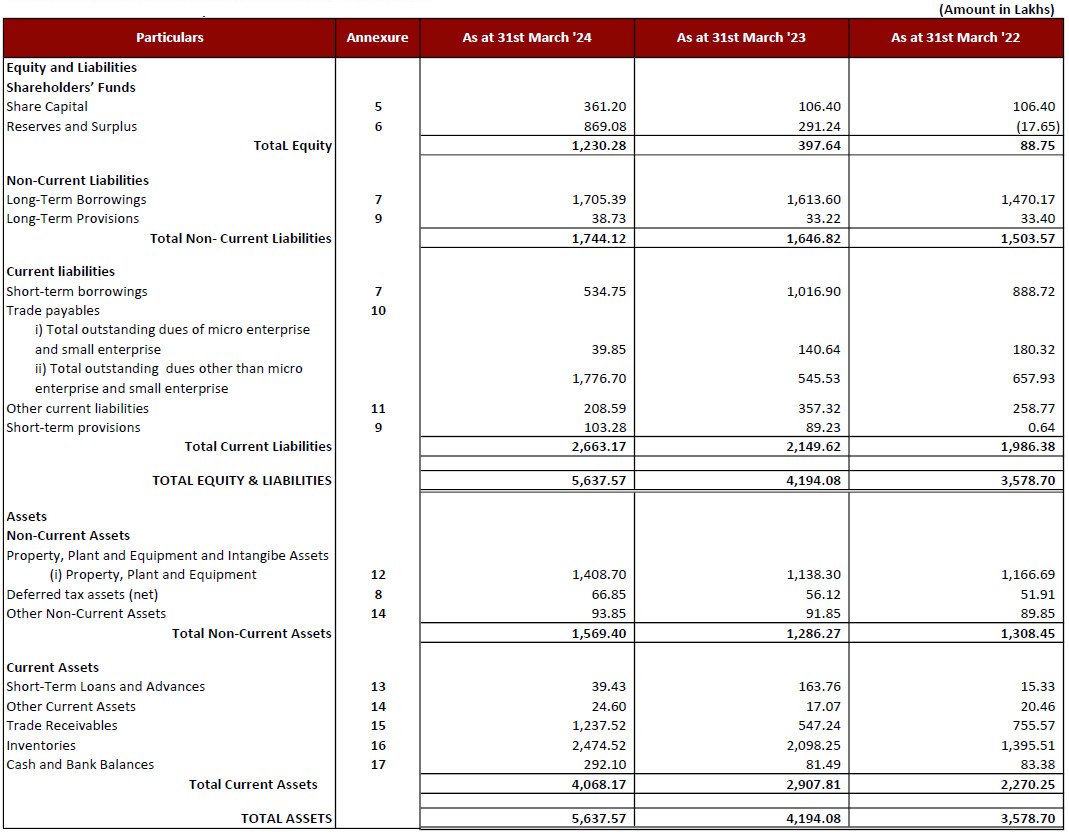

Statement of Assets and Liabilities

Statement of Profit and Loss

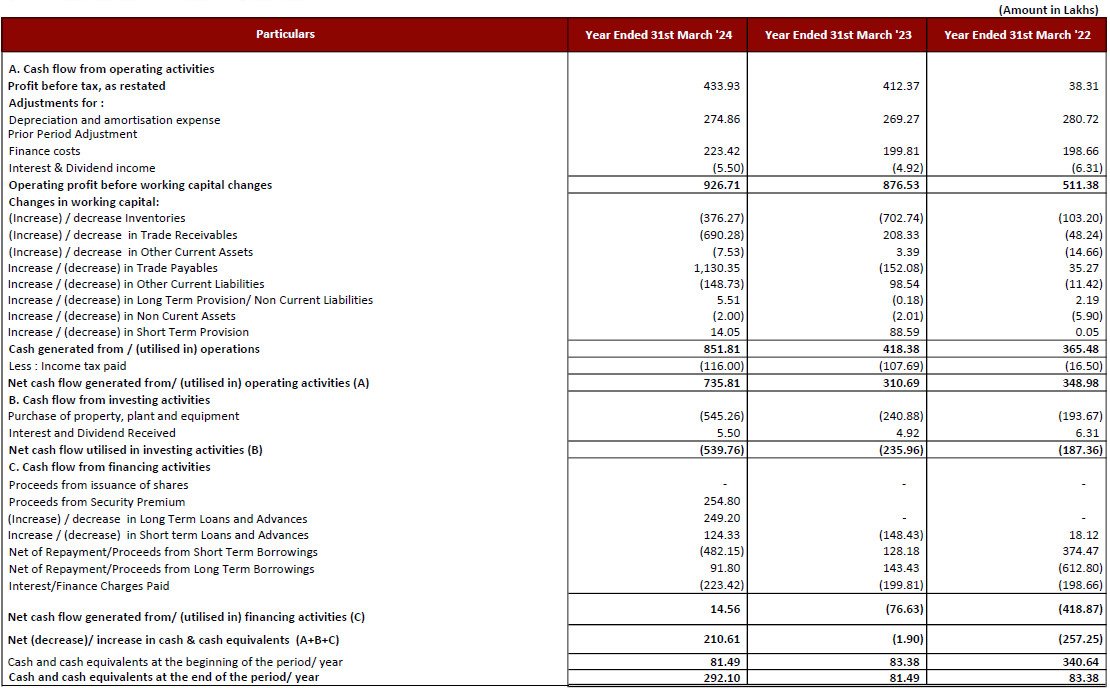

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Sati Poly Plast IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Sati Poly Plast IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Sati Poly Plast IPO and other offerings a more informed and confident endeavor.

1. Sati Poly Plast IPO key dates & Issue Details

The Sati Poly Plast IPO is set to open for subscription on 12th July 2024 and will close on 16th July 2024. This SME IPO is priced between ₹123.00 and ₹130.00 per share, with an overall issue size of ₹17.36 Crores. The IPO is a Book Build Issue and will be listed on the NSE SME platform. The face value of each equity share is ₹10. Notably, the retail quota for the Sati Poly Plast IPO is set at no less than 35% of the net issue.

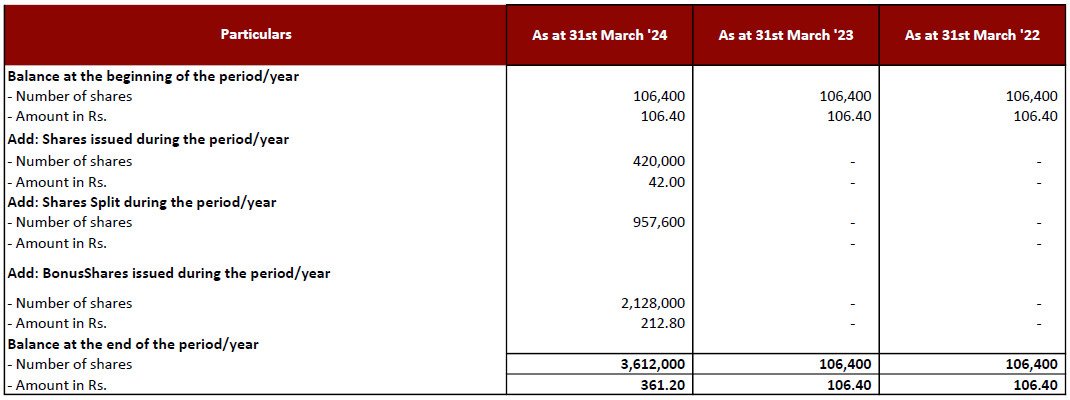

Investors should note that the Sati Poly Plast IPO involves a fresh issue of ₹17.36 Crores. Pre-IPO, the promoter holding is 86.30%, which will reduce to 63.00% post-IPO. The SME IPO discount is yet to be determined.

Sati Poly Plast IPO Important Dates

Mark your calendars for the important dates associated with the Sati Poly Plast IPO. The basis of allotment date is tentatively scheduled for 18th July 2024. Refunds will be initiated on 19th July 2024, and the shares will be credited to Demat accounts on the same day. Finally, the listing date on the NSE SME is anticipated to be 22nd July 2024.

Sati Poly Plast IPO Lots

The Sati Poly Plast IPO is priced between ₹123.00 and ₹130.00, with a market lot of 1000 shares. The minimum lot amount for retail investors is ₹130,000, while High Net-worth Individuals (HNIs) need to purchase a minimum of 2000 shares (2 lots), amounting to ₹260,000.

For investors looking to capitalize on the Sati Poly Plast IPO, it is crucial to stay updated on these dates and details to make informed investment decisions.

2. Sati Poly Plast IPO Allotment Status

Dive into the excitement surrounding the Sati Poly Plast IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Sati Poly Plast IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Sati Poly Plast IPO journey.

3. Introduction to Sati Poly Plast Limited - Leading the Way in Flexible Packaging Solutions

Company Background

Incorporation and Evolution:

– Incorporation: The company was initially incorporated as ‘Sati Poly Plast Private Limited’ on July 14, 1999, as a Private Limited Company under the Companies Act, 1956, by the Registrar of Companies, Bihar.

– Conversion to Public Limited Company: On November 1, 2023, the company was converted from a private limited company to a public limited company, changing its name to ‘Sati Poly Plast Limited.’ The fresh certificate of incorporation was issued on December 26, 2023.

– Corporate Identification Number: U82920BR1999PLC008904.

Promoters: The company is promoted by Mr. Balmukund Jhunjhunwala, Mrs. Anita Jhunjhunwala, Mr. Aditya Jhunjhunwala, Mr. Keshav Jhunjhunwala, and Balmukund Jhunjhunwala HUF. Collectively, they have over ten years of experience in the flexible packaging industry.

Business Activities

ISO Certification:

The company is ISO certified and specializes in manufacturing flexible packaging materials that cater to various industries’ packaging requirements.

Transition from Trading to Manufacturing:

– Until 2015: Engaged in trading flexible packaging materials.

– From 2017: Commenced manufacturing flexible packaging materials.

Manufacturing Facilities

Plant Locations:

– Plant 1: C44, Phase II, Gautam Budh Nagar – Noida-201305 with a capacity of 540 tonnes per month.

– Plant 2: Plot No. 85 Udhyog Kendra, Noida -201306 with a capacity of 540 tonnes per month.

Product Range and Materials

Product Portfolio:

– Flexible Packaging Solutions: Catering to food and beverage industries, including snacks, dry fruits, confectionery, and dry foods.

– Materials Used: Polyethylene terephthalate, biaxially-oriented polypropylene, polythene, cast polypropylene, foil, paper, bio-degradable films, etc.

Sustainability Efforts:

– Recycling Initiative: The company recycles waste generated during production, transforming it into recycled plastic material for sale, contributing to waste reduction and the circular economy.

Product Portfolio Details

1. Roll Form Packaging:

– Description: Packaging materials supplied in continuous rolls made from materials like polyethylene, polypropylene, aluminum foil, laminates, kraft or coated papers.

– Applications: Widely used in food and beverage, personal care and cosmetics, agriculture, and pharmaceutical industries.

2. Pouch Form Packaging:

– Description: Packaging that uses flexible materials like plastic or foil to create pouches, customizable with resealable zippers, spouts, and tear notches.

– Applications: Extensively used in food and beverage, pharmaceutical, personal care, household cleaning products, automotive, and industrial applications.

3. Coextruded Films:

– Description: Multiple layers of different materials are extruded together to create films with unique properties tailored for specific packaging requirements.

– Applications: Applied in food packaging, pharmaceutical industry, flexible packaging industry, and agriculture and horticulture industry.

Manufacturing Process

1. Extrusion Process:

– Description: Involves melting and forcing raw material through a die to form a continuous shape, followed by rapid cooling to solidify the material.

– Importance: Key for producing consistent and high-quality flexible packaging materials.

2. Printing:

– Description: Utilizes automatic rotogravure printing machines up to 10 colors, involving the engravement of graphics onto a cylinder and transferring them onto a substrate.

– Components: Includes an engraved cylinder, ink tank, doctor blade, impression roller, and dryer.

3. Lamination Process:

– Description: Involves bonding multiple layers of materials using adhesives to create durable and versatile packaging solutions.

– Types: Wet lamination, dry lamination, solventless lamination, and ex-coating lamination.

4. Slitting/Rewinding Process:

– Description: Cuts large rolls of flexible substrates into narrower widths, creating smaller rolls for easier handling.

– Importance: Ensures clean, uniform edges and optimizes handling and usage.

5. Pouching Process:

– Description: Various types of pouches like central sealing, 3 side sealing, zipper pouch, and stand-up pouches are made using specific machines.

– Applications: Suitable for both dry food and liquid product packaging, offering significant retail shelf impact.

Business Strategies

1. Product Portfolio Expansion:

– Diversification: Into high-growth products like vacuum bags for cashews and rice.

– Investment: In working capital requirements to meet growing market demands.

2. Operational Efficiency:

– Process Improvement: Continuous investment in technology development and operational excellence.

3. Quality Standards:

– Adherence to Standards: Emphasis on quality review, corrective measures, and international certifications to maintain customer trust.

Competitive Strengths

1. Established Manufacturing Facilities:

– Control over Quality: Dynamic setup for end-to-end manufacturing activities.

2. Cost Leadership and Timely Execution:

– Efficient Processes: Use of quality raw materials, efficient manufacturing facilities, and harmonious workforce relations to meet large orders timely and cost-effectively.

3. Strong promoter background and experienced management team:

Our promoters and management team have significant experience and domain expertise. This enables us to anticipate and address market demands effectively. Their guidance and strategic direction have been instrumental in our growth and success. With more than a decade of experience in the flexible packaging industry, our promoters have built strong industry relationships and have a keen understanding of market trends.

4. Wide range of product offerings:

We offer a diverse product portfolio catering to various industries, including food and beverage, personal care, pharmaceuticals, agriculture, and more. This diversity allows us to address different customer needs and reduces dependency on any single industry, thereby mitigating risk.

5. Focus on sustainability:

Our commitment to sustainability and environmentally-friendly practices sets us apart in the industry. We aim to manufacture our products sustainably by focusing on “Reuse, Recycle, and Upcycle.” Our recycling initiatives contribute to the circular economy and reduce waste, which resonates well with our environmentally conscious customers.

6. Quality assurance and certifications:

We are an ISO Certified Company, holding certifications such as ISO 9001:2015 for Quality Management, ISO 22000:2018 for Food Safety Management, and ISO 45001:2018 for Occupational Health and Safety Management. These certifications validate the high standards of our products and processes, ensuring customer satisfaction and trust.

7. Strategic location:

Our manufacturing units are strategically located in Noida, Uttar Pradesh, which is well-connected to major markets and logistics hubs. This location provides us with logistical advantages, ensuring timely delivery of products to our customers.

8. Investment in technology and innovation:

We continually invest in advanced technology and equipment to enhance our production capabilities and maintain high-quality standards. This focus on innovation allows us to stay competitive and meet the evolving needs of our customers.

9. Strong customer base:

We have built a strong customer base, including reputed companies such as Pidilite, Adani Wilmar, and JVL. Our ability to meet their stringent quality requirements and delivery timelines has helped us establish long-term relationships with these customers.

10. Robust infrastructure:

Our well-equipped manufacturing facilities, extensive warehousing capabilities, and efficient inventory management processes enable us to handle large volumes and ensure smooth operations. This robust infrastructure supports our growth and scalability.

4. Financial Details of Sati Poly Plast

Financial Overview of Sati Poly Plast Limited

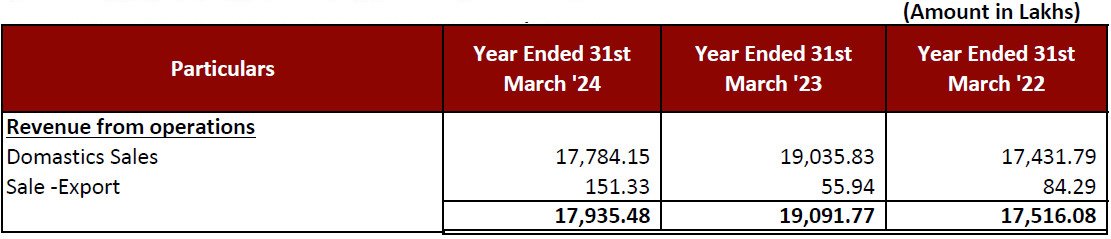

Sati Poly Plast Limited has showcased a notable financial performance over the recent years. For the financial year ending on March 31, 2024, the company experienced a revenue decrease of 6.05%, bringing in ₹17,940.98 lakhs compared to ₹19,096.69 lakhs in the previous year. However, despite the dip in revenue, the Profit After Tax (PAT) saw an increase of 6.39%, rising to ₹328.64 lakhs from ₹308.89 lakhs.

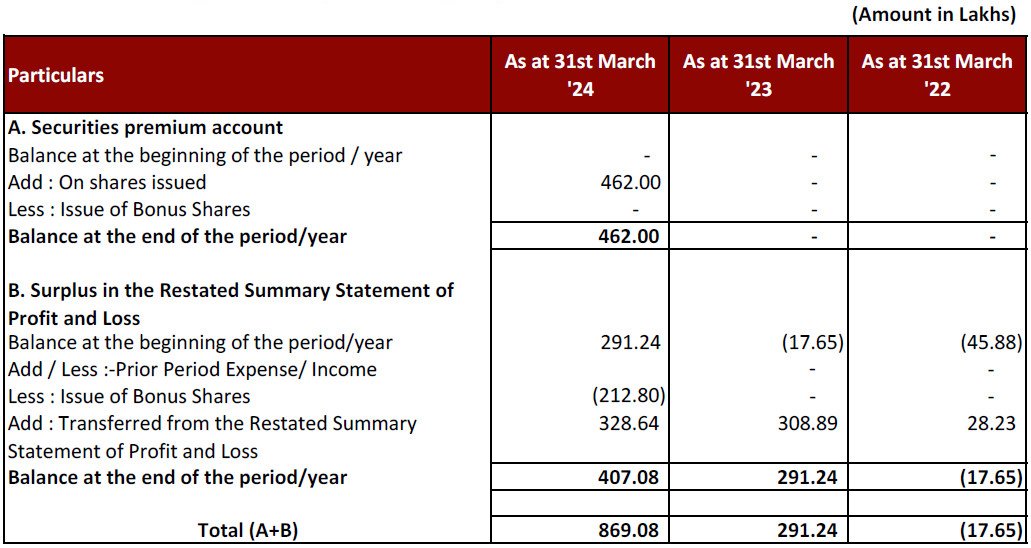

The company’s assets have grown significantly, standing at ₹5,637.57 lakhs as of March 31, 2024, up from ₹4,194.08 lakhs in the previous year. This growth is also reflected in the net worth, which surged to ₹1,230.28 lakhs from ₹397.64 lakhs. Sati Poly Plast Limited has successfully strengthened its reserves and surplus, moving from a negative position of -₹17.65 lakhs in FY 2022 to ₹869.08 lakhs in FY 2024.

Despite a slight reduction in total borrowing, which decreased to ₹2,520.14 lakhs from ₹2,630.50 lakhs, the company’s financial health appears robust. This is further corroborated by key financial ratios. The Earnings Per Share (EPS) remained stable at 9.70 for FY 2024, while the Price to Earnings (PE) ratio ranged between 12.68 and 13.40.

The Return on Net Worth (RONW) witnessed a dip, standing at 26.71% in FY 2024 compared to 77.68% in the previous year, indicating a more conservative but steady growth approach. The Net Asset Value (NAV) increased dramatically to ₹36.29 from ₹12.46, and the Return on Capital Employed (ROCE) was recorded at 20.45%, down slightly from 22.63% in FY 2023.

The company’s EBITDA margin improved to 5.17% from 4.59%, showcasing efficient operational management. Moreover, the Debt to Equity ratio has seen a significant improvement, dropping to 1.82 from 6.62, indicating better financial leverage and stability.

Overall, Sati Poly Plast Limited’s financial trajectory reflects a balanced growth strategy with a focus on strengthening core financial metrics, making the Sati Poly Plast IPO an intriguing opportunity for potential investors.

Statement Of Revenue From Operations

Statement of Other Income

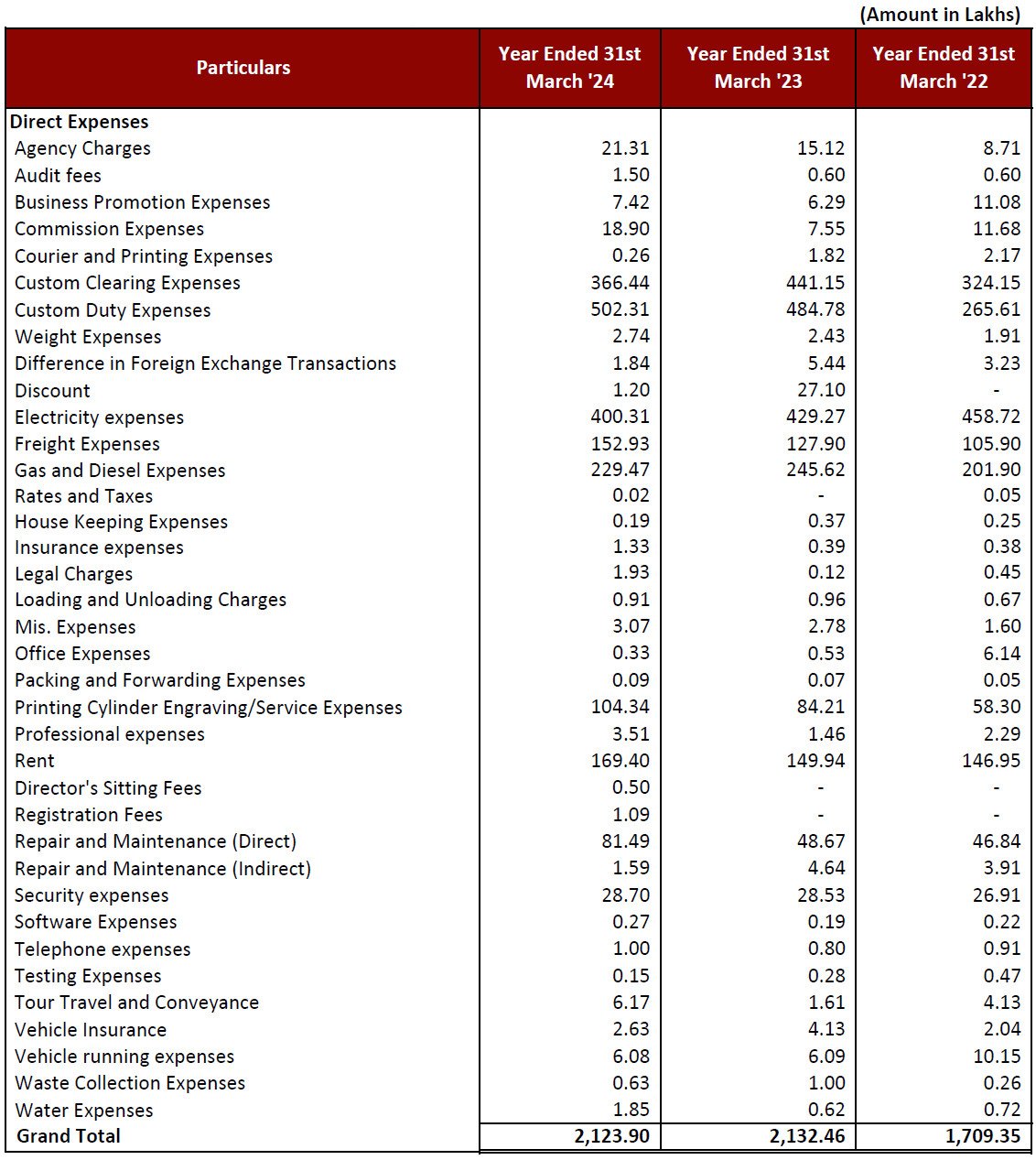

Statement of Other Expenses

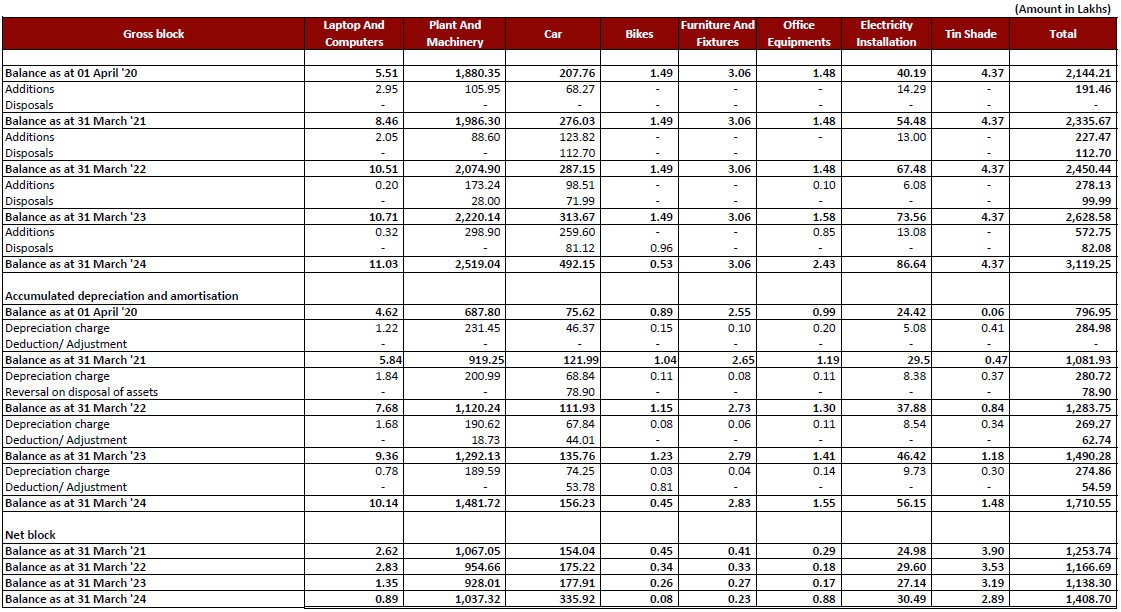

Statement of Property, Plant and Equipment

Statement of Reserves & Surplus

Statement of Equity Share Capital

Statement of Capitalisation

5. Sati Poly Plast IPO FAQs

The Sati Poly Plast IPO is the initial public offering of shares by Sati Poly Plast Limited, aimed at raising capital from the public for business expansion and other corporate purposes.

The exact opening date for the Sati Poly Plast IPO is yet to be announced. Keep an eye on official announcements and financial news for updates.

The closing date for the Sati Poly Plast IPO will be announced alongside the opening date. Investors should monitor official sources for the most accurate information.

The price band for the Sati Poly Plast IPO is yet to be disclosed. It will be announced closer to the IPO date.

The minimum lot size, which indicates the smallest number of shares that can be bid for, will be specified in the IPO prospectus upon announcement.

The primary objectives include funding business expansion, paying off existing debts, and general corporate purposes.

Sati Poly Plast Limited is engaged in the manufacturing and distribution of high-quality poly plastic products, serving a wide range of industrial applications.

The company has shown a revenue decrease of 6.05% and a PAT increase of 6.39% for the year ending March 31, 2024, indicating a strong profit growth despite a slight dip in revenue.

Key metrics include a net worth of ₹1,230.28 lakhs, reserves and surplus of ₹869.08 lakhs, and a total borrowing of ₹2,520.14 lakhs as of March 31, 2024.

The Earnings Per Share (EPS) for FY 2024 is 9.70.

The PE ratio for the Sati Poly Plast IPO ranges between 12.68 and 13.40.

The RONW for FY 2024 is 26.71%.

The NAV for FY 2024 is ₹36.29.

The ROCE for FY 2024 is 20.45%.

The EBITDA margin for FY 2024 is 5.17%.

The Debt to Equity ratio for FY 2024 is 1.82.

Investors can apply through their bank’s ASBA (Application Supported by Blocked Amount) service or through their trading accounts with registered brokers.

The listing date will be announced after the IPO closes and the allotment process is completed.

Sati Poly Plast shares are expected to be listed on major Indian stock exchanges such as NSE and BSE.

Potential risks include market volatility, industry-specific risks, and the company’s financial performance post-IPO. Investors should review the IPO prospectus for a detailed risk analysis.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Sati Poly Plast IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Sati Poly Plast IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Sati Poly Plast IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Sati Poly Plast IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.