Table of Contents

Rudra Gas Enterprise IPO: Pioneering Infrastructure Solutions

Founded in 2015, Rudra Gas Enterprise Limited specializes in gas distribution networks, fiber optic cables, and construction equipment rentals. With expertise in urban gas supply and fiber optics, the company ensures safe and efficient transportation of resources like CNG and PNG. Serving both public and private sectors, Rudra Gas Enterprise’s strategic prowess and industry knowledge drive its expansion and growth. Revenue stems from gas pipeline projects, fiber optic cable installations, and equipment rentals, positioning Rudra Gas Enterprise as an innovative leader in the infrastructure sector.

Rudra Gas Enterprise IPO Dates

| IPO Open Date | IPO Closed Date | Allotment Date |

| 8th Feb 2024 | 12th Feb 2024 | 13th Feb 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 14th Feb 2024 | 14th Feb 2024 | 15th Feb 2024 |

Rudra Gas Enterprise IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Rudra Gas Enterprise IPO Issue Details

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹14.16 Cr | ₹ 63.00 | 2000 Shares |

Financial of Rudra Gas Enterprise IPO

| Amounts in Lakhs ₹ | |||

| Particulars | FY-2021 | FY-2022 | FY-2023 |

| Assets | 1,960.50 | 2,804.92 | 3,380.56 |

| Revenue | 2,809.27 | 4,383.66 | 4,942.39 |

| EPS | 2.42 | 3.42 | 6.71 |

| Expense | 2635 | 4146 | 4483 |

| Net Worth | 267.07 | 446.48 | 798.5 |

| PBT | 179.68 | 240.03 | 474.11 |

| ROE (%) | 62.42 | 50.29 | 56.55 |

| PAT | 127.05 | 179.41 | 352.02 |

| EBITDA | 2.85 | 4.4 | 7.08 |

| Borrowing | 1008.22 | 1379.98 | 1738.34 |

| Fresh Issue | Offer for Sale | Issue Type | Total offer Size |

| ₹ 14.16 Cr | – | Fresh Issue | ₹ 14.16 Cr |

| RII (Retail) | NII | QIB | Anchor |

| 50% | 50% | – | – |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 2000 | 126000 |

| Retail(Max) | 1 | 2000 | 126000 |

| Small-HNI (Min) | 2 | 4000 | 252000 |

| Small-HNI (Max) | 7 | 14000 | 882000 |

| Big-HNI (Min) | 8 | 16000 | 1008000 |

| Pre-Promoter | Post Promoter | Listing IN |

| 99.99% | 73.03% | BSE |

| Established | Website | Industry |

| 2015 | rudragasenterprise.com | Gas Distribution |

| Contact Information | |

| Telephone | |

| cs@rudragasenterprise.com | +91 98751 39472 |

| No | Objective |

| 1 | To Meet Working Capital Requirements |

| 2 | General Corporate Expenses |

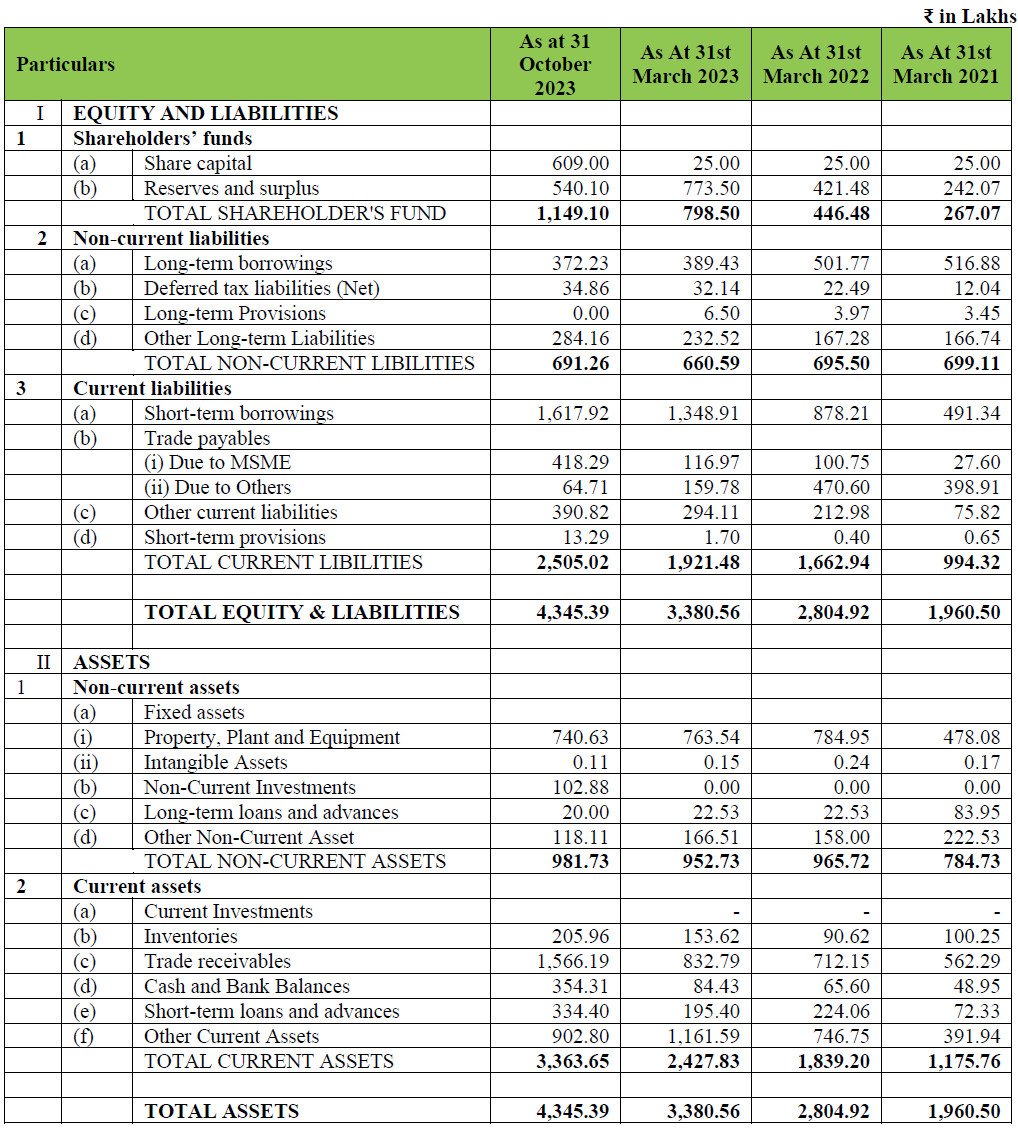

Statement of Assets and Liabilities

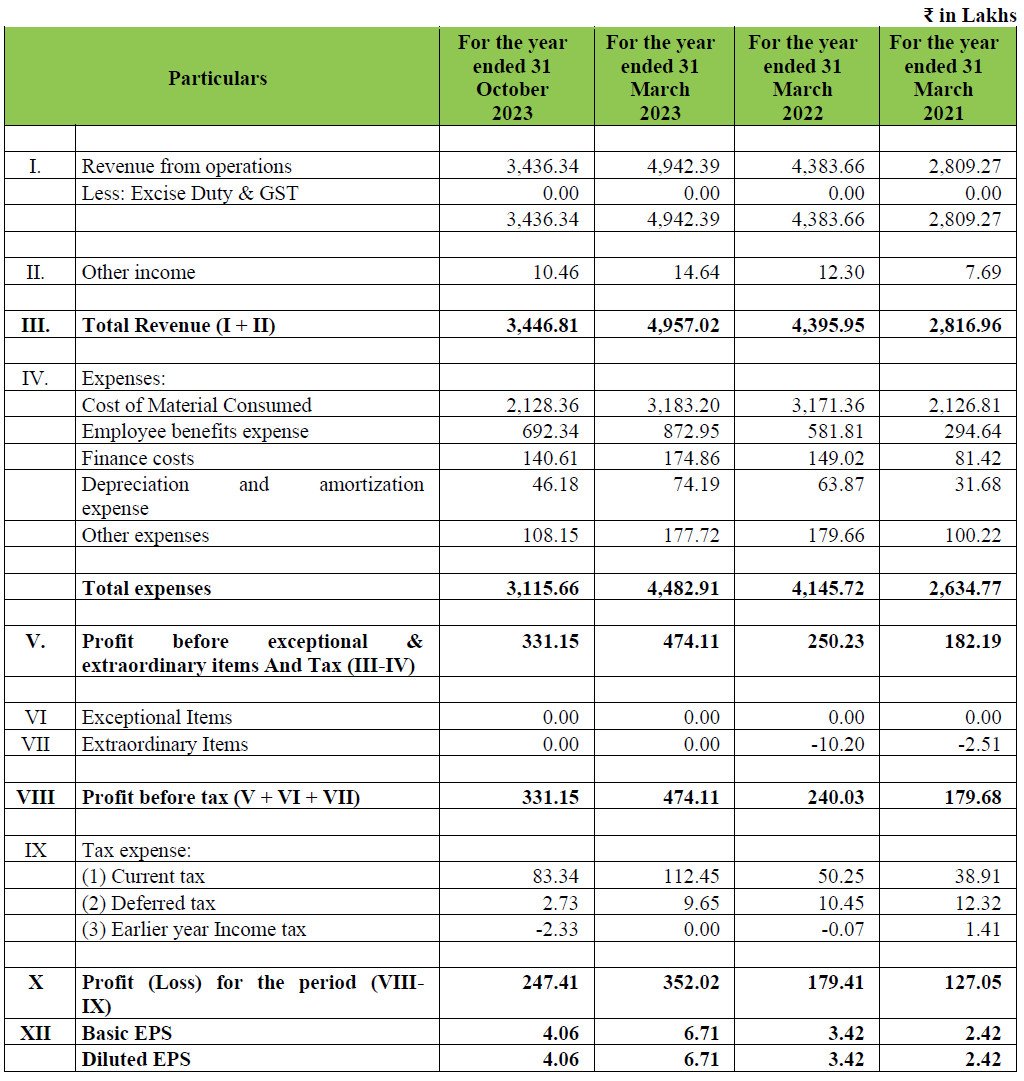

Statement of Profit and Loss

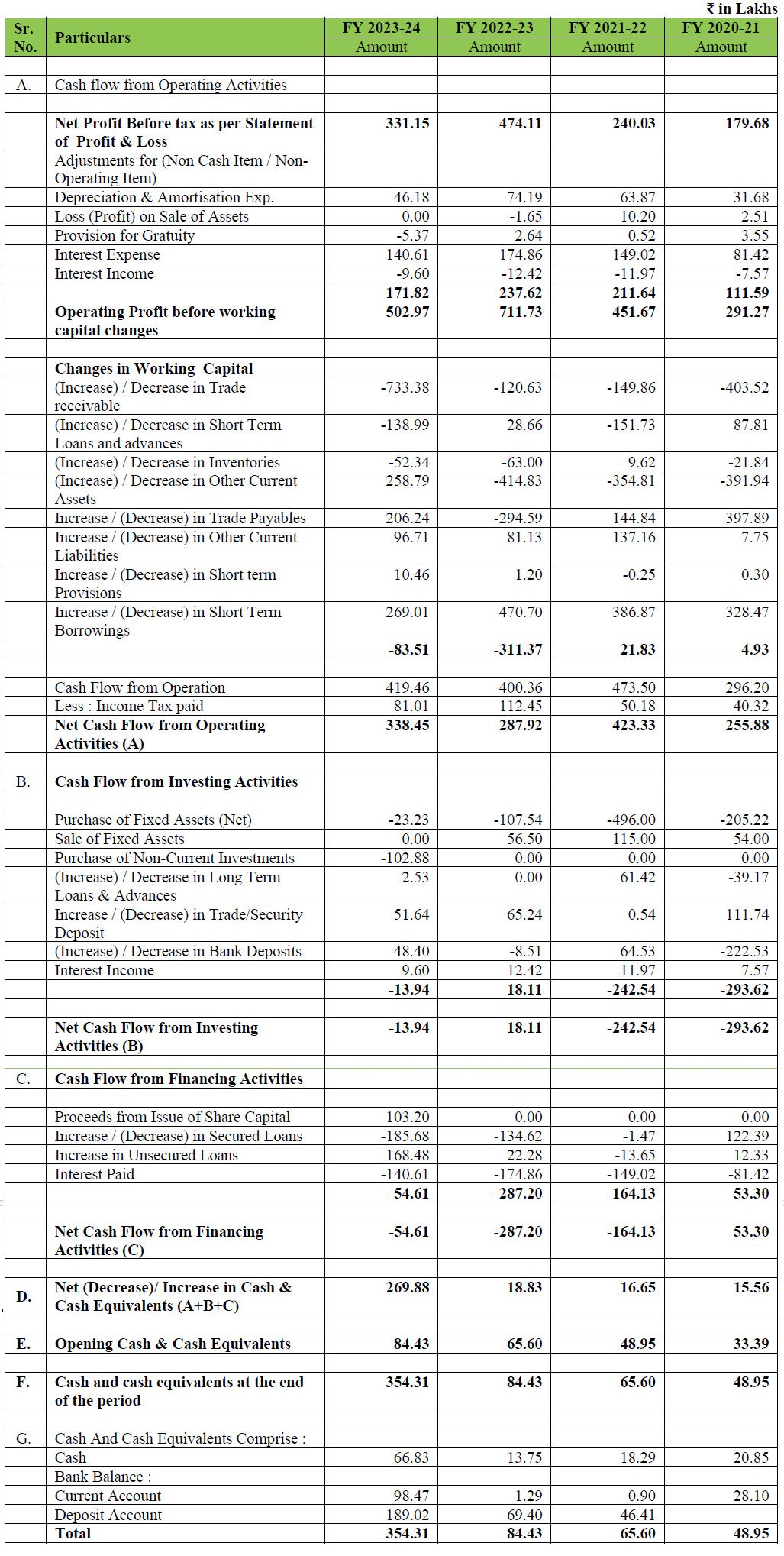

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Rudra Gas Enterprise IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Rudra Gas Enterprise IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Rudra Gas Enterprise IPO and other offerings a more informed and confident endeavor.

1. Rudra Gas Enterprise IPO key dates & Issue Details

- Rudra Gas Enterprise is set to make waves in the financial market with its SME IPO, marking an exciting opportunity for investors. The IPO opens its doors on 8th Feb 2024, presenting a golden chance for interested parties to participate in this venture. The issue price is fixed at ₹63.00 per share, with a substantial issue size of ₹14.16 Cr. This includes a fresh issue of ₹14.16 Cr, featuring a face value of ₹10 per equity share.

- To enhance accessibility, the retail quota is set at an impressive 50% of the net offer, ensuring a broad participation base. The IPO will be listed on BSE SME, adding another layer of appeal to potential investors.

- Promoting transparency, the Basis of Allotment Date is tentatively scheduled for 13th Feb 2024, followed by Refunds Initiation and Credit of Shares to Demat on 14th Feb 2024. The much-anticipated SME IPO Listing Date is projected to be on 15th Feb 2024.

- Notably, the market lot comprises 2000 shares, and investors can engage with a minimum investment of ₹126,000 for one lot. For High Net Worth Individuals (HNIs), a minimum of 4000 shares (2 lots) is required, offering flexibility in investment choices.

- This IPO is marked by a notable shift in promoter holdings, with a pre-IPO stake of 99.99% reducing to 73.03% post-IPO. As Rudra Gas Enterprise gears up for this transformative step, the keyword “Rudra Gas Enterprise IPO” emerges as a focal point for investors seeking to capitalize on this dynamic financial opportunity.

2. Rudra Gas Enterprise IPO allotment Status

Dive into the excitement surrounding the Rudra Gas Enterprise IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Rudra Gas Enterprise IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Rudra Gas Enterprise IPO journey.

3. Introduction to Rudra Gas Enterprise IPO: Building Infrastructure for Tomorrow

- Rudra Gas Enterprise Limited, formerly known as Rudra Gas Enterprise Private Limited, marks its journey as a pioneer in the infrastructure sector. Incorporated under the Companies Act, 2013, on September 7, 2015, the company underwent a significant transformation to become a public limited entity on August 25, 2023. Led by the visionaries Mr. Kush Sureshbhai Patel, Mr. Kashyap Sureshbhai Patel, and Mrs. Manjulaben Sureshbhai Patel, the company embodies over 24 years of collective experience in the infrastructure industry.

- Dedicated to integrated pipeline projects, Rudra Gas Enterprise specializes in gas distribution networks, fiber cable installations, and the renting of construction machinery and vehicles. The company’s forte lies in offering comprehensive solutions for city gas distribution, encompassing pipeline construction, civil works, and operation and maintenance services for Compressed Natural Gas (CNG) and Piped Natural Gas (PNG).

- With a commitment to reliability and quality, Rudra Gas Enterprise has emerged as a trusted partner in critical sectors, ensuring the safe and efficient transportation of vital resources. The company’s client base includes prominent players in both the public and private sectors of the city gas distribution and telecommunication industries.

- Under the dynamic leadership of its promoters, Rudra Gas Enterprise has executed over 50 projects, amounting to approximately ₹12,708 Lakhs in completed projects. Leveraging technical expertise and industry knowledge, the company continues to expand its geographical and client presence while exploring new avenues for growth.

- Revenue generation stems from three primary business verticals: Gas Pipeline Projects, Fiber Cable Projects, and Renting of Construction Machineries and vehicles. With a robust order book position of approximately ₹32,783 Lakhs as of October 31, 2023, Rudra Gas Enterprise stands poised for continued growth and expansion.

- As a quality-conscious entity, Rudra Gas Enterprise remains dedicated to enhancing its service portfolio and complementing client projects. With a focus on execution excellence and a forward-looking approach, the company is primed to embark on a transformative journey, shaping the infrastructure landscape for tomorrow.

- In conclusion, Rudra Gas Enterprise IPO presents a compelling opportunity for investors to participate in a visionary enterprise poised for sustained growth and innovation in the infrastructure sector.

4. Unveiling Rudra Gas Enterprise IPO: A Financial Perspective

- As investors gear up for the Rudra Gas Enterprise IPO, a closer look at the company’s financial performance unveils a promising trajectory of growth and profitability. The restated standalone financial information reflects significant strides made by Rudra Gas Enterprise Limited over the years, positioning it as a compelling investment opportunity.

- Between the financial years ending on March 31, 2023, and March 31, 2022, Rudra Gas Enterprise witnessed a notable 12.76% increase in revenue, coupled with an impressive 96.21% surge in profit after tax (PAT). This upward momentum underscores the company’s resilience and strategic prowess in navigating dynamic market landscapes.

- The financial key performance indicators (KPIs) offer deeper insights into Rudra Gas Enterprise’s financial health and operational efficiency. Revenue from operations showcases a consistent growth trajectory, with revenues amounting to ₹3,436.34 Lakhs for the period ended on October 31, 2023. The gross profit margin has shown a commendable improvement, reaching 38.06%, reflecting enhanced operational efficiency and cost management strategies.

- Rudra Gas Enterprise’s ability to generate robust earnings before interest, taxes, depreciation, and amortization (EBITDA) is evident, with a margin of 14.77% for the period under review. The company’s profitability metrics, including PAT margin and return on equity (RoE), underscore its commitment to delivering sustainable returns to stakeholders.

- Furthermore, Rudra Gas Enterprise demonstrates a prudent approach to capital allocation, as reflected in its return on capital employed (RoCE) and net fixed asset turnover ratios. The efficient management of working capital, as evidenced by net working capital days, underscores the company’s operational agility and liquidity management strategies.

- Operating cash flows highlight Rudra Gas Enterprise’s ability to generate cash from its core operations, providing a solid foundation for future growth initiatives and capital expenditure.

- In conclusion, the financial data of Rudra Gas Enterprise IPO paints a picture of a resilient and forward-thinking enterprise poised for continued success in the infrastructure sector. As investors explore opportunities in the IPO market, Rudra Gas Enterprise emerges as a beacon of financial strength and growth potential, making it a compelling choice for investment portfolios.

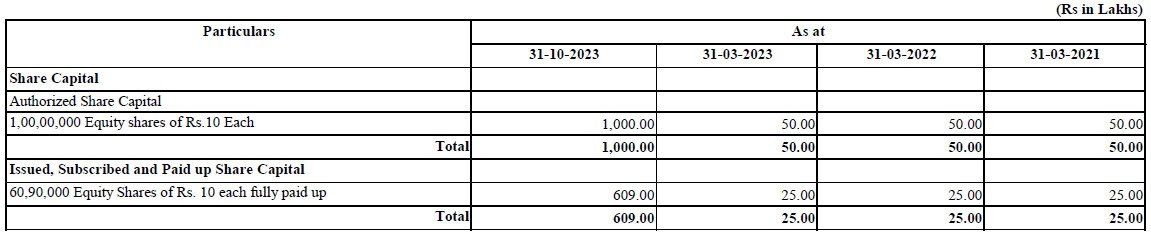

Statement of Share Capital

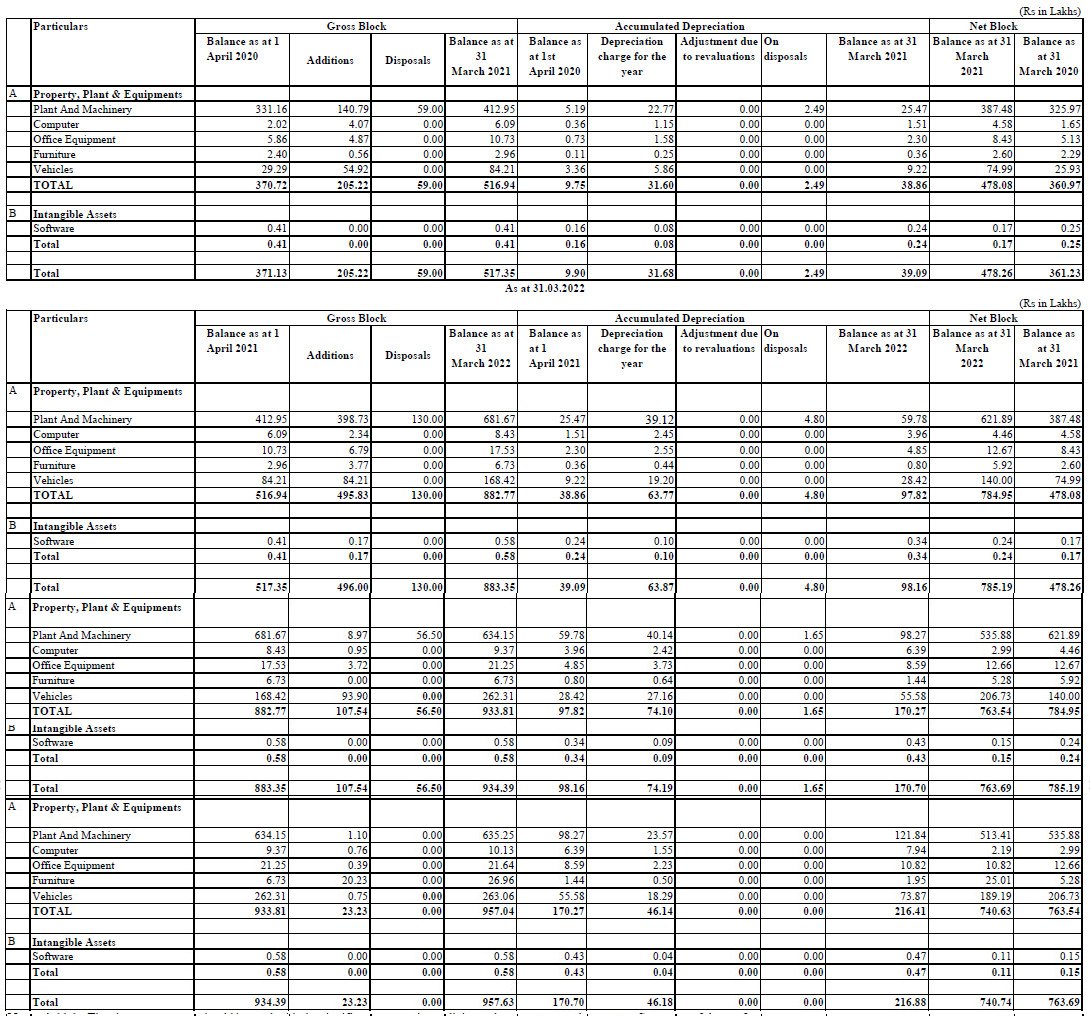

Statement of Property, Plant and Equipment

STATEMENT OF RESERVES AND SURPLUS

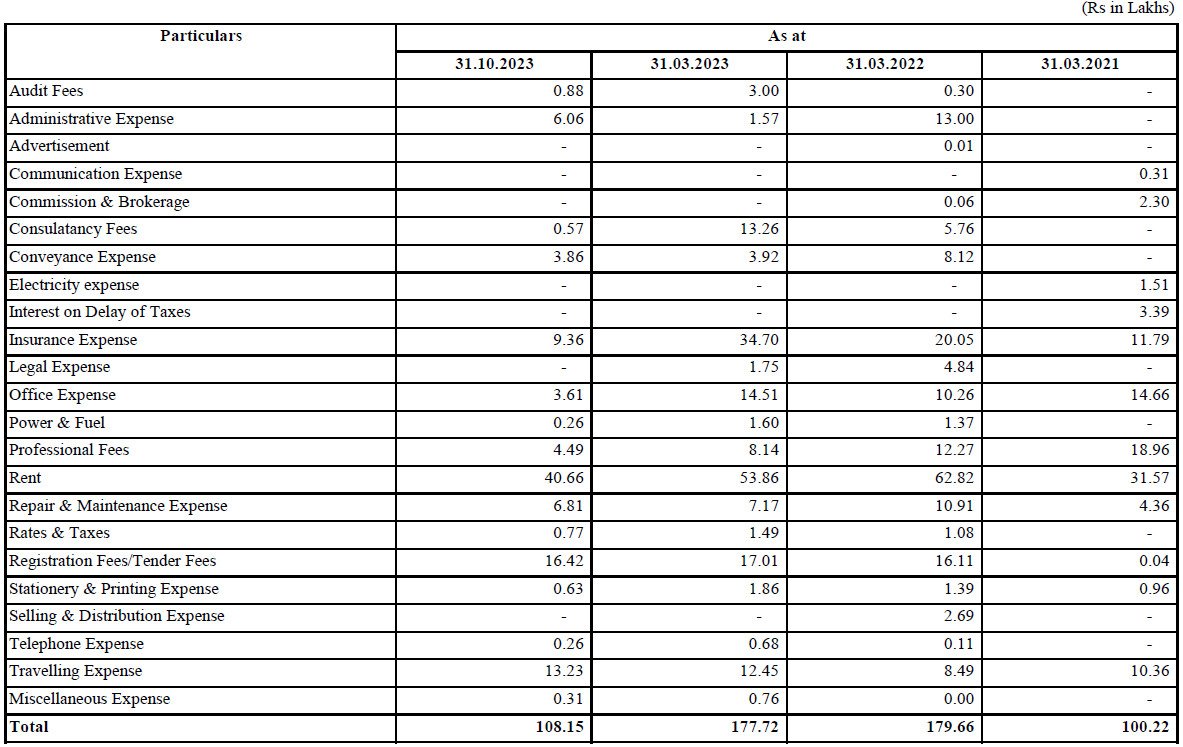

Rudra Gas Enterprise's Statement of Other Expenses

5. Rudra Gas Enterprise IPO FAQs

Rudra Gas Enterprise IPO refers to the initial public offering of shares by Rudra Gas Enterprise Limited, a company engaged in infrastructure projects.

The Rudra Gas Enterprise IPO opens on 8th Feb 2024 and closes on 12th Feb 2024.

The issue price of Rudra Gas Enterprise IPO is ₹63.00 per share.

Rudra Gas Enterprise IPO will be listed on BSE SME.

The retail quota for Rudra Gas Enterprise IPO is 50% of the net offer.

The face value of Rudra Gas Enterprise IPO shares is ₹10 per equity share.

The SME IPO issue size of Rudra Gas Enterprise is ₹14.16 Cr.

The basis of allotment date for Rudra Gas Enterprise IPO is tentatively scheduled for 13th Feb 2024.

Refunds for Rudra Gas Enterprise IPO are tentatively scheduled to be initiated on 14th Feb 2024.

Shares for Rudra Gas Enterprise IPO are tentatively scheduled to be credited to demat accounts on 14th Feb 2024.

The SME IPO listing date for Rudra Gas Enterprise is tentatively scheduled for 15th Feb 2024.

Rudra Gas Enterprise is primarily engaged in infrastructure projects including gas distribution networks, fiber cable installations, and renting of construction machinery and vehicles.

Rudra Gas Enterprise’s revenue has shown growth, with a 12.76% increase between the financial years ending March 31, 2023, and March 31, 2022.

Rudra Gas Enterprise’s profit after tax (PAT) rose by 96.21% between the financial years ending March 31, 2023, and March 31, 2022.

Financial KPIs of Rudra Gas Enterprise include revenue from operations, gross profit margin, EBITDA margin, PAT margin, return on equity (RoE), return on capital employed (RoCE), net fixed asset turnover, and operating cash flows.

Rudra Gas Enterprise has successfully executed more than 50 projects, with major completed projects totaling approximately ₹12,708 Lakhs.

As of October 31, 2023, Rudra Gas Enterprise’s assets amount to ₹4,345.39 Lakhs.

Rudra Gas Enterprise’s net worth as of October 31, 2023, stands at ₹1,149.10 Lakhs.

As of October 31, 2023, Rudra Gas Enterprise’s total borrowing amounts to ₹1,990.15 Lakhs.

Rudra Gas Enterprise has 54 working capital days as of October 31, 2023.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Rudra Gas Enterprise IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Rudra Gas Enterprise IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Rudra Gas Enterprise IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Rudra Gas Enterprise IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.