Table of Contents

Rashi Peripherals IPO is finally arrived, marking a pivotal moment in the tech distribution landscape in India. As a leading national distribution partner for global technology brands, Rashi Peripherals Limited offers end-to-end value-added services from pre-sale activities to solutions design and technical support. Evolving from peripherals manufacturing to ICT product distribution, the company operates through two key verticals, PES and LIT. With an extensive distribution network comprising 50 branches and 62 warehouses as of Sep 30, 2022, Rashi Peripherals serves as a national distribution partner for 48 technology brands, including ASUS, Dell International, and HP India. As the anticipation builds around its IPO, Rashi Peripherals is poised to redefine the dynamics of tech distribution in India.

Rashi Peripherals IPO Dates

| IPO Open Date | IPO Closed Date | Allotment Date |

| 7th Feb 2024 | 9th Feb 2024 | 12th Feb 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 13th Feb 2024 | 13th Feb 2024 | 14th Feb 2024 |

Rashi Peripherals IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Rashi Peripherals IPO Issue Details

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹600.00 Cr | ₹ 295 – ₹ 311 | 48 Shares | 1,92,92,604 |

Financial of Rashi Peripherals IPO

| Amounts in Crore ₹ | |||

| Particulars | FY-2023 | FY-2022 | FY-2021 |

| Assets | 2798.6 | 2670.16 | 1594.39 |

| Revenue | 9454.28 | 9313.44 | 5925.05 |

| EPS | 29.5 | 43.57 | 31.2 |

| Net Worth | 700.12 | 575.07 | 394.19 |

| PBT | 164.63 | 239.84 | 178.86 |

| ROE | 17.60% | 31.66% | 33.07% |

| PAT | 123.25 | 182.07 | 130.38 |

| EBITDA | 267.61 | 305.21 | 215.22 |

| EBITDA Margin | 2.83% | 3.28% | 3.63% |

| Fresh Issue | Offer for Sale | Issue Type | Total offer Size |

| ₹ 7500 million | – | Fresh Issue | ₹ 7500 million |

| RII (Retail) | NII | QIB |

| 35% | 15% | 50% |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 48 | 14928 |

| Retail(Max) | 13 | 624 | 194064 |

| Small-HNI (Min) | 14 | 672 | 208992 |

| Small-HNI (Max) | 66 | 3168 | 985248 |

| Big-HNI (Min) | 67 | 3216 | 1000176 |

| Pre-Promoter | Post Promoter | Listing IN |

| 89.65% | 63.41% | NSE & BSE |

| Established | Website | Industry |

| 1989 | rptechindia.com | ICT Products |

| Contact Information | |

| Telephone | |

| investors@rptechindia.com | +91 22 6177 1771/72 |

| No | Objective |

| 1 | Prepayment or scheduled re-payment of all or a portion of certain outstanding borrowings availed by the Company |

| 2 | Funding working capital requirements of the Company |

| 3 | General Corporate Expenses. |

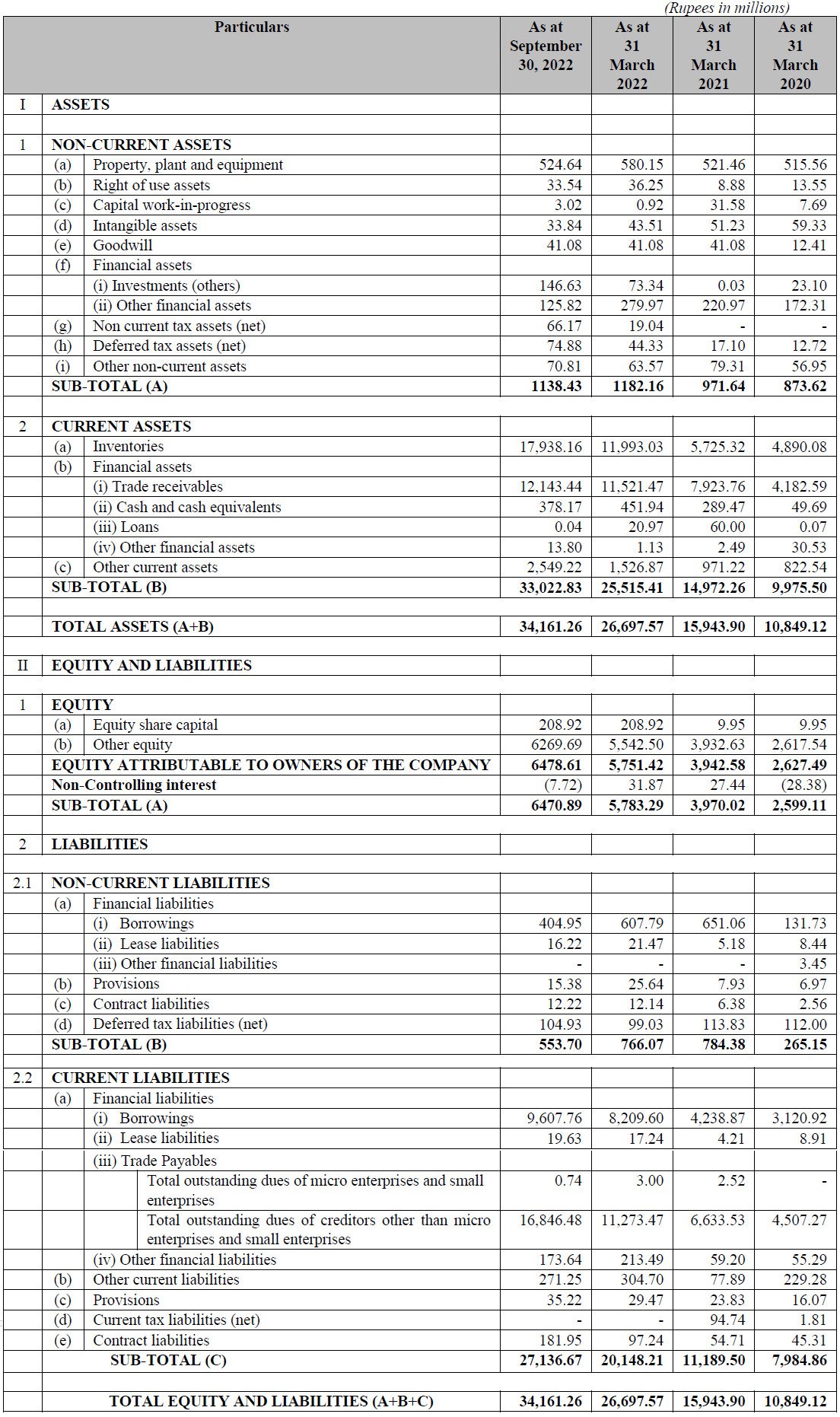

Statement of Assets and Liabilities

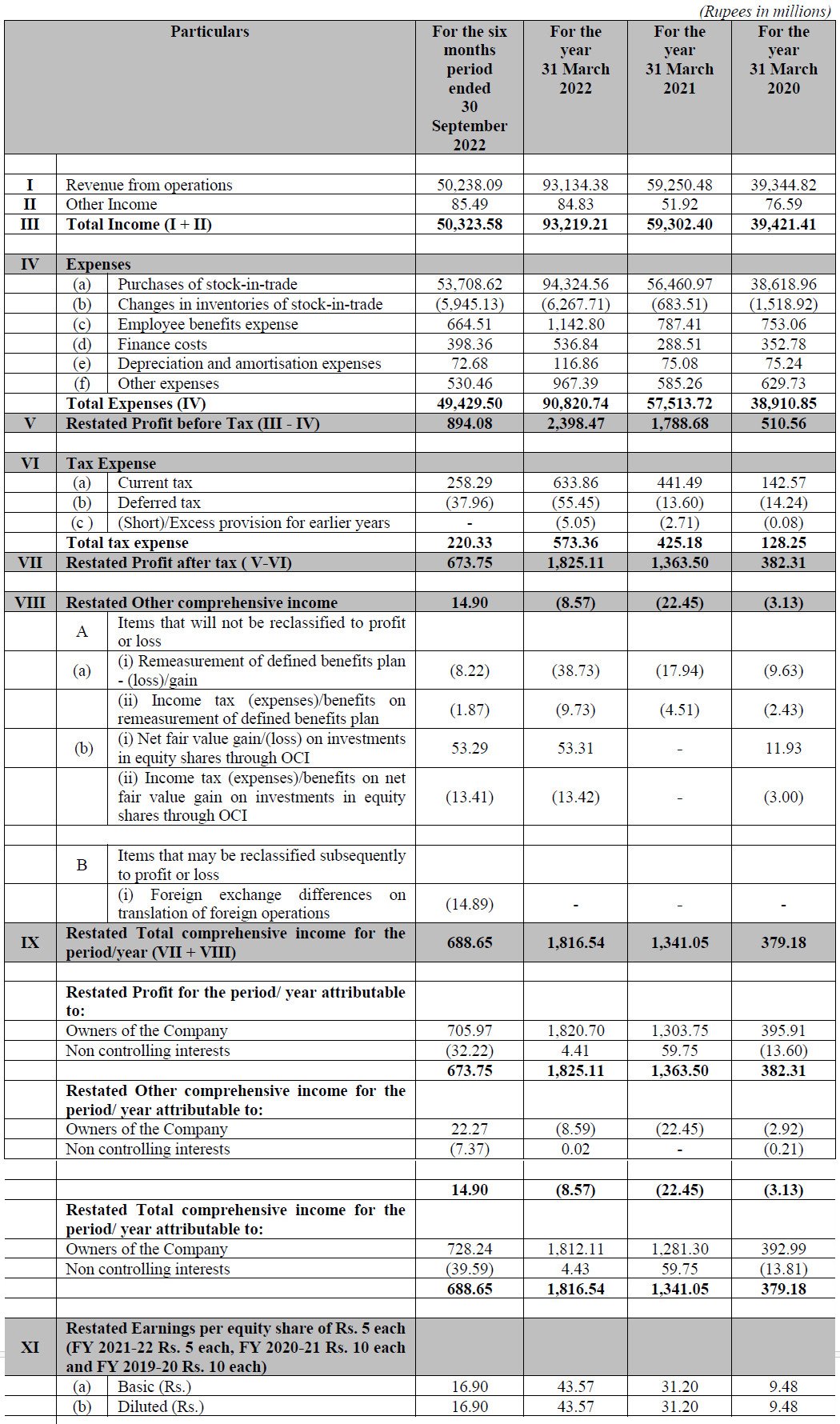

Statement of Profit and Loss

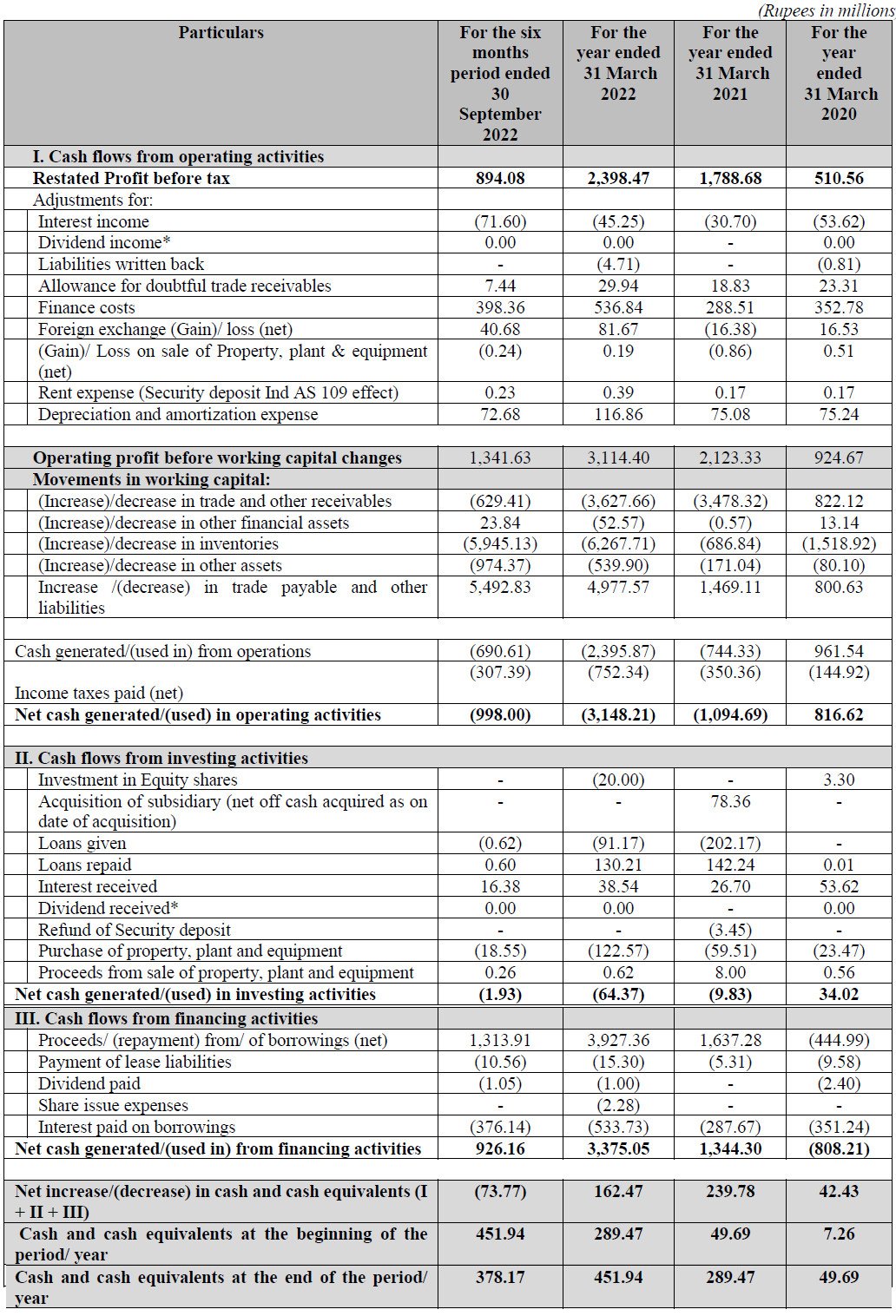

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Rashi Peripherals IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Rashi Peripherals IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Rashi Peripherals IPO and other offerings a more informed and confident endeavor.

1. Rashi Peripherals IPO key dates & Issue Details

- Are you looking to invest in Rashi Peripherals IPO? Here are the key details you need to know. The IPO of Rashi Peripherals is scheduled to open on 7th Feb 2024, with a closing date set for 9th Feb 2024. Priced between ₹295.00-311.00 Per Share, the IPO issue size stands at ₹600.00 Cr, with the entire amount being a Fresh Issue. Rashi Peripherals IPO is a Book Build Issue, listed on both BSE and NSE.

- For retail investors, there is a significant opportunity as the Retail Quota constitutes not less than 35% of the Net Issue. The face value of each equity share is ₹5. Promoter holding pre-IPO stands at 89.65%, while post-IPO, it will be reduced to 63.41%.

- In terms of important dates, the Basis of Allotment Date is slated for 12th Feb 2024, followed by Refunds Initiation and Credit of Shares to Demat on 13th Feb 2024. The IPO Listing Date is confirmed for 14th Feb 2024.

- For investors considering participation, the Market Lot is set at 48 Shares, with 1 Lot amounting to ₹14928. Depending on investment size, small HNIs (2-10 Lakh) are required to apply for a minimum of 672 shares (14 lots), while big HNIs (10+ Lakh) need to apply for a minimum of 3216 shares (67 lots).

- Stay updated with the latest information on Rashi Peripherals IPO and consider its potential in your investment portfolio.

2. Rashi Peripherals IPO allotment Status

Dive into the excitement surrounding the Rashi Peripherals IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Rashi Peripherals IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Rashi Peripherals IPO journey.

3. Introduction to Rashi Peripherals (RP TECH) : Leading Distributor of Global Technology Brands

- Established as a cornerstone in the Indian distribution landscape, Rashi Peripherals IPO emerges as a pivotal player in the realm of information and communications technology (“ICT”) products. With a robust distribution network and soaring revenues, Rashi Peripherals stands tall among the nation’s value-added national distribution partners for global technology brands. As per the Technopak Report, our stature is underlined by our commendable revenue growth, positioning us as one of the fastest-growing distributors in India between Fiscal 2020 and Fiscal 2022.

Legacy of Excellence

- Founded in 1989, Rashi Peripherals boasts over three decades of expertise in the distribution of ICT products within India. Our journey commenced with the manufacturing of peripherals and transitioned seamlessly with the liberalization of the Indian IT sector in 1991. Since then, we have played a pivotal role in facilitating the entry of numerous global technology brands into the Indian market, thereby formalizing and streamlining the distribution landscape. Over the years, our operations have expanded, and as of September 30, 2022, we have distributed a staggering 293.63 million units of ICT products, establishing one of the most extensive distribution networks in India.

Business Verticals

- Rashi Peripherals operates primarily through two core business verticals:

- Personal Computing, Enterprise and Cloud Solutions (PES): This vertical encompasses the distribution of personal computing devices, enterprise solutions, embedded designs/products, and cloud computing solutions.

- Lifestyle and IT Essentials (LIT): Under this vertical, we distribute a diverse range of products, including components like graphic cards, CPUs, and motherboards, storage and memory devices, lifestyle peripherals and accessories such as keyboards, mice, monitors, and gaming accessories, power equipment like UPS and inverters, as well as networking and mobility devices.

Market Share Overview

- In Fiscal 2022, Rashi Peripherals maintained a significant market presence across various segments. Our market share, by value, reflects our stronghold in key product categories:

- – PES: Laptops (10%), Desktops (15%), Routers (30%), Switches (5%)

– LIT: CPUs (40%), Motherboards (20%), Graphic Cards (46%), Hard Drives (27%), Pen Drives (50%), Keyboards and Mice (20%), Monitors (25%), UPS (10%)

(Source: Technopak Report)

- With a steadfast commitment to excellence and a proven track record of success, Rashi Peripherals IPO embodies a compelling investment opportunity in the dynamic landscape of technology distribution in India. Join us as we continue to redefine the benchmarks of excellence in the industry.

4. Financial Details of Rashi Peripheral (RP Tech): Financial Snapshot of Rashi Peripherals Limited (RP Tech): Insights for Investors

- Rashi Peripherals Limited, the focal point of the upcoming IPO, presents a compelling financial outlook encapsulating its growth trajectory and performance over recent periods. Delving into the restated consolidated figures, it’s evident that Rashi Peripherals experienced a marginal increase in revenue by 1.58% while witnessing a -32.42% decline in profit after tax (PAT) between the financial years ending March 31, 2023, and March 31, 2022.

Revenue and Profit Analysis

- As of September 30, 2023, Rashi Peripherals recorded assets worth ₹4,058.64 Crore, showcasing a substantial rise compared to the previous periods. The revenue figures for the same period stood at ₹5,473.27 Crore, reflecting a dynamic operational landscape. However, the profit after tax (PAT) for the same period amounted to ₹72.02 Crore, signaling a notable decrease compared to the previous financial years.

Robust Revenue Growth and Profitability

- Rashi Peripherals has showcased remarkable growth in revenue from operations over the fiscal years, with a compelling Compound Annual Growth Rate (CAGR) of 53.85% between Fiscal 2020 and Fiscal 2022. Despite facing fluctuations, the company recorded a substantial revenue of ₹50,238.09 million in the six months ended September 30, 2022. Moreover, the restated profit after tax (PAT) witnessed a noteworthy CAGR of 118.49% during the same period, standing at ₹1,825.11 million in Fiscal 2022.

Financial Stability and Reserves

- In terms of financial stability, Rashi Peripherals exhibited a commendable increase in net worth, with the latest figure reaching ₹772.74 Crore as of September 30, 2023. The reserves and surplus also showcased a positive trajectory, indicating a robust financial foundation for the company. On the borrowing front, the total borrowing as of the same period amounted to ₹1,395.20 Crore, underlining the company’s strategic approach to financial management.

Comparative Analysis

- A comparative analysis of Rashi Peripherals’ financial performance reveals its commitment to growth and resilience in navigating market dynamics. While revenue streams showcase resilience and potential for expansion, the company is poised to address challenges and optimize profitability in the evolving market landscape.

Margin Analysis and Financial Ratios

- While profitability metrics exhibit fluctuations, Rashi Peripherals maintained a PAT margin of 1.96% in Fiscal 2022, reflecting prudent financial management. The debt/equity ratio, a key indicator of financial leverage, remained relatively stable, standing at 1.52 in Fiscal 2022. Return on Equity (ROE) and Return on Capital Employed (ROCE) illustrate the company’s ability to generate returns for its shareholders and efficiently utilize capital resources, despite experiencing fluctuations.

Operational Efficiency and Performance Indicators

- Operational efficiency is evident in the company’s Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), which experienced a substantial CAGR of 80.33% between Fiscal 2020 and Fiscal 2022, reaching ₹3,052.17 million in Fiscal 2022. The EBITDA margin, a critical measure of operational profitability, stood at 3.28% in Fiscal 2022, showcasing Rashi Peripherals’ ability to generate profits from its core business activities.

Strategic Management of Working Capital

- Rashi Peripherals demonstrates effective management of working capital, with working capital days fluctuating within a manageable range over the years. Despite facing challenges, the company maintained its operational liquidity and efficiency, ensuring smooth business operations and financial stability.

Investment Considerations

- As investors evaluate the potential of Rashi Peripherals IPO, analyzing its financial and operational performance provides valuable insights. With a track record of revenue growth, profitability, and operational efficiency, Rashi Peripherals presents an enticing investment opportunity in the dynamic landscape of technology distribution.

(Source: Financial data provided by Rashi Peripherals IPO)

- Stay informed and empowered as you explore the prospects of investing in Rashi Peripherals IPO, leveraging insights from its financial and operational performance to make informed investment decisions.

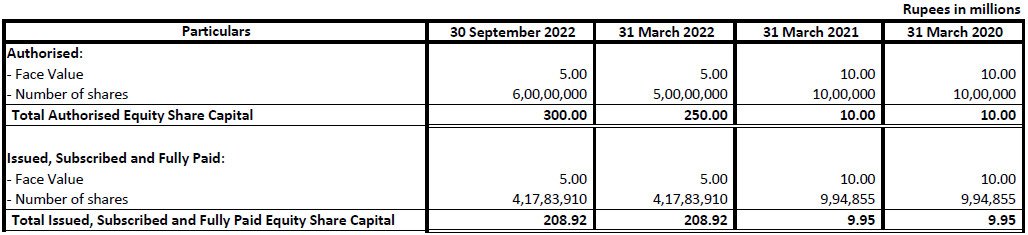

Rashi Peripherals's Statement of Equity Share Capital

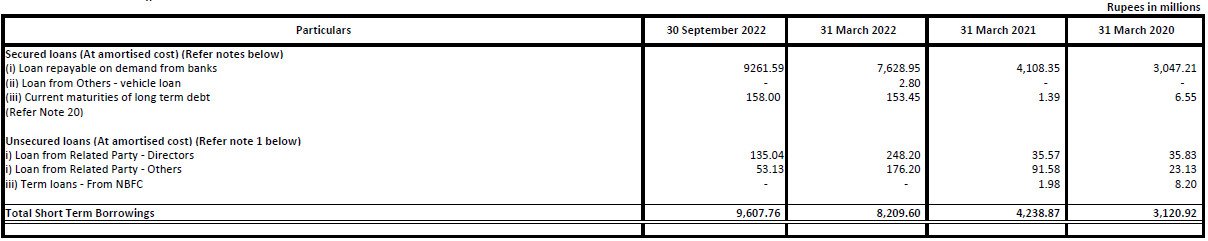

Rashi Peripherals's Statement of Borrowing

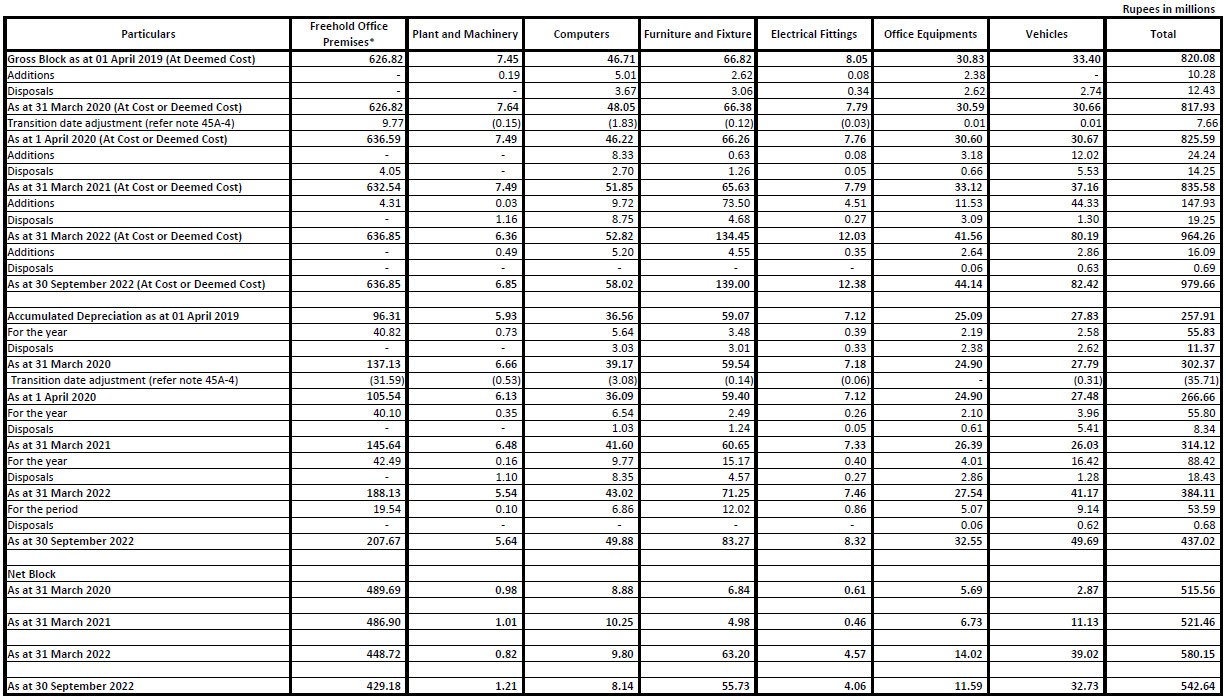

Rashi Peripherals's Statement of Property, plant and equipment

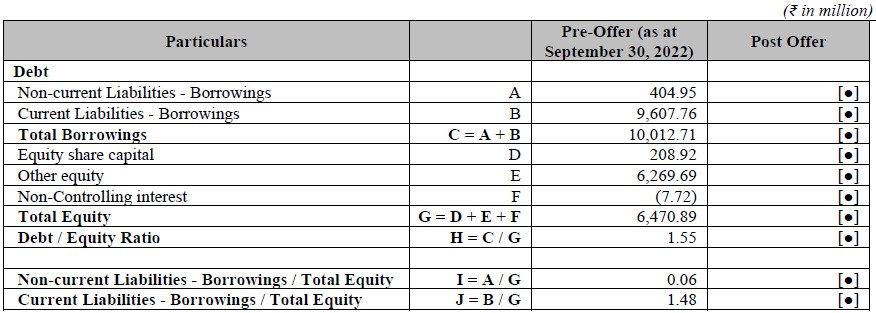

Rashi Peripherals's Statement of Capitalization

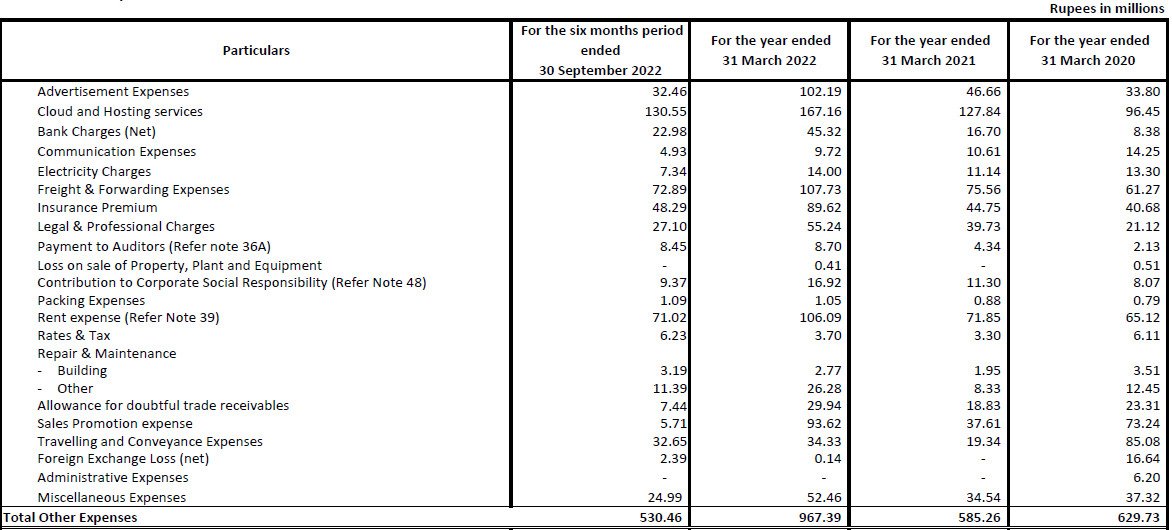

Rashi Peripherals's Statement of Other expenses

5. Rashi Peripherals IPO FAQs

Rashi Peripherals IPO Details

Rashi Peripherals IPO is set to open on 7th Feb 2024.

The closing date for Rashi Peripherals IPO is 9th Feb 2024.

The price range for Rashi Peripherals IPO per share is ₹295.00-311.00.

Rashi Peripherals IPO will be listed on BSE and NSE.

Rashi Peripherals IPO Dates

The basis of allotment date for Rashi Peripherals IPO is 12th Feb 2024.

Refunds for Rashi Peripherals IPO will be initiated on 13th Feb 2024.

Rashi Peripherals IPO is scheduled to be listed on 14th Feb 2024.

Rashi Peripherals IPO Issue Details

The size of Rashi Peripherals IPO issue is ₹600.00 Cr.

Yes, Rashi Peripherals IPO is a book build issue.

The face value of Rashi Peripherals IPO equity share is ₹5.

Rashi Peripherals Business Model

Rashi Peripherals primarily operates as a value-added national distribution partner for global technology brands in India.

Rashi Peripherals offers end-to-end value-added services including pre-sale activities, solutions design, technical support, marketing services, credit solutions, and warranty management services.

Rashi Peripherals Financial Data

Rashi Peripherals’ revenue in Fiscal 2022 was ₹93,134.38 million.

Rashi Peripherals’ profit after tax dropped by -32.42% between March 31, 2023, and March 31, 2022.

The CAGR of Rashi Peripherals’ revenue from Fiscal 2020 to Fiscal 2022 was 53.85%.

The EBITDA margin of Rashi Peripherals in Fiscal 2022 was 3.28%.

Rashi Peripherals’ assets increased by 67.25% from March 31, 2021, to March 31, 2022.

The debt/equity ratio of Rashi Peripherals in Fiscal 2022 was 1.52.

The Return on Equity (ROE) of Rashi Peripherals in Fiscal 2021 was 39.69%.

Rashi Peripherals distributed 293.63 million units of ICT products between Fiscal 2002 and September 30, 2022.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Rashi Peripherals IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Rashi Peripherals IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Rashi Peripherals IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Rashi Peripherals IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.