Table of Contents

Prizor Viztech IPO highlights a company founded in February 2017 that offers advanced security and surveillance solutions. Prizor Viztech Limited provides a comprehensive range of CCTV cameras used across various industries such as retail, government, education, and infrastructure. In 2022, Prizor Viztech expanded its product portfolio to include TVs, touch panels, and monitors of various sizes, manufactured by third parties under its brand name. The company’s products are divided into two main areas: security and surveillance solutions (network cameras, high-resolution analog cameras, network video recorders, digital video recorders) and LED TVs, monitors, and touch panels. Prizor Viztech has supplied its products to 17 states and 2 Union Territories in India.

Prizor Viztech IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

12th July 2024 | 16th July 2024 | 18th July 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 19th July 2024 | 19th July 2024 | 22nd July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹25.15 Cr | ₹ 82.00 – ₹ 87.00 | 1600 Shares | 28,91,200 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 1600 | ₹ 1,39,200 |

| Retail(Max) | 1 | 1600 | ₹ 1,39,200 |

| Small-HNI (Min) | 2 | 3200 | ₹ 2,78,400 |

| Small-HNI (Max) | 7 | 11200 | ₹ 9,74,400 |

| Big-HNI (Min) | 8 | 12800 | ₹ 11,13,600 |

| RII (Retail) | NII | QIB |

| 35.00% | 15.00% | 50.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 93.59% | 68.28% | NSE SME |

| No | Objectives |

| 1 | Security and Surveillance Solutions, including network cameras, high-definition analogue cameras, network video recorders, and digital video recorders |

| 2 | LED televisions, Monitors & Touch Panels |

| LEAD | REGISTRAR |

| SHRENI SHARES LIMITED | Bigshare Services Private Limited |

| Telephone | |

| investors@prizor.in | +91 78618 04737 |

Prizor Viztech IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

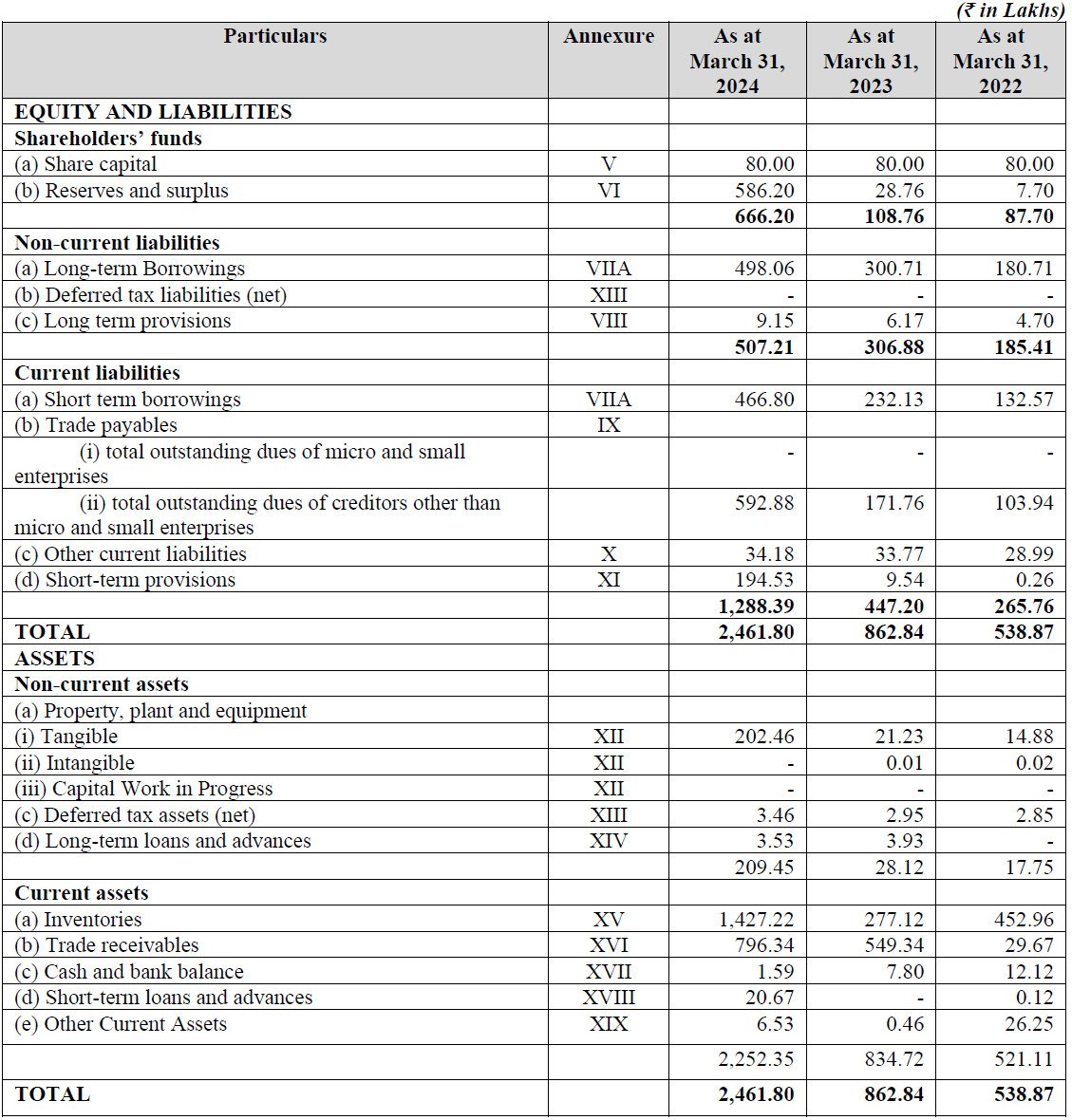

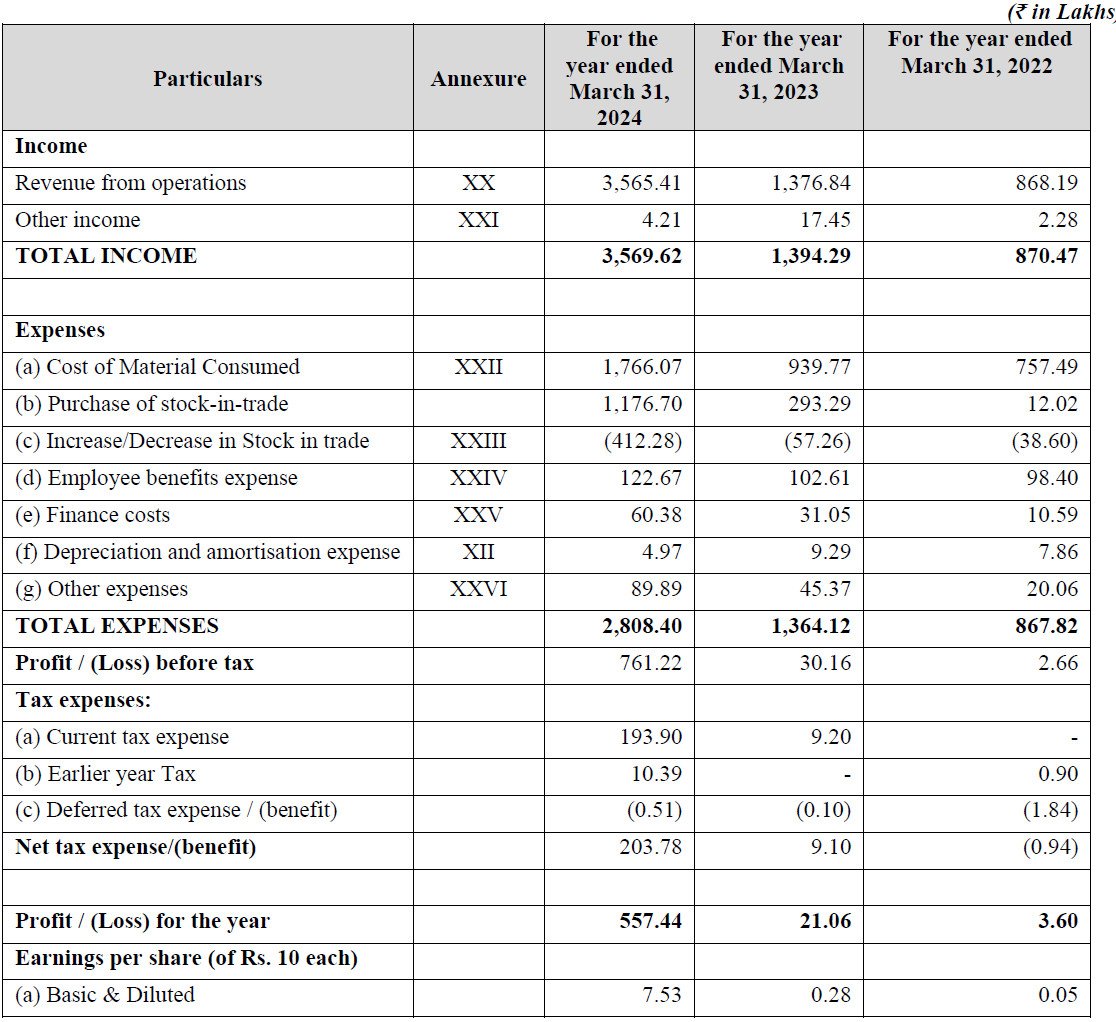

Financial of Prizor Viztech IPO

| Amounts in Lakhs ₹ | |||

| Particulars | FY-2024 | FY-2023 | FY-2022 |

| Assets | 2,462 | 863 | 539 |

| Revenue | 3,569 | 1,394 | 870 |

| Expense | 2,808 | 1,364 | 868 |

| Net Worth | 666 | 109 | 88 |

| Borrowing | 965 | 533 | 313 |

| EBITDA(%) | 23.06 | 3.85 | 2.17 |

| Reserves | 586 | 29 | 8 |

| PAT | 557 | 21 | 4 |

| EPS | 7.53 | 0.28 | 0.05 |

| Debt/Equity | 1.45 | 4.90 | 3.57 |

| Established | Website | Industry |

| 2017 | prizor.in | Electronics |

Statement of Assets and Liabilities

Statement of Profit and Loss

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Prizor Viztech IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Prizor Viztech IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Prizor Viztech IPO and other offerings a more informed and confident endeavor.

1. Prizor Viztech IPO key dates & Issue Details

The highly anticipated Prizor Viztech is set to open for subscription on July 12, 2024, and will close on July 16, 2024. This SME IPO is expected to draw significant interest from investors, with an issue price ranging between ₹82.00 to ₹87.00 per share. The Prizor Viztech will be listed on the NSE SME platform, with a substantial issue size of ₹25.15 crore. This amount will be raised entirely through a fresh issue of shares, providing the company with valuable capital for its growth initiatives.

Retail investors will be pleased to know that not less than 35% of the net issue is reserved for them, ensuring ample opportunity to participate in this exciting investment. The face value of each equity share in the Prizor Viztech is ₹10. The book build issue type further adds to the attractiveness of this offering.

Promoter holding in Prizor Viztech will see a change post-IPO, with pre-IPO holding at 93.59% and post-IPO at 68.28%. This reduction indicates a significant release of shares to the public, enhancing liquidity and investor engagement in the market.

Prizor Viztech Important Dates

Investors should mark their calendars for the Prizor Viztech IPO’s important dates. The basis of allotment will be finalized on July 18, 2024, followed by the initiation of refunds on July 19, 2024. On the same day, successful bidders will see the credit of shares to their Demat accounts. The much-awaited Prizor Viztech listing date is tentatively scheduled for July 22, 2024. These dates are crucial for investors planning their financial strategies around the IPO.

Prizor Viztech Lots

The market lot for the Prizor Viztech is set at 1600 shares, with each lot amounting to ₹139200 at the upper price band. High Net Worth Individuals (HNIs) looking to make a larger investment can opt for a minimum of 3200 shares (2 lots), which will require an investment of ₹278400. This structured lot system ensures a streamlined and accessible investment process for various investor segments.

Stay tuned for more updates on the Prizor Viztech as we approach these key dates. The SME IPO market is abuzz with anticipation, and Prizor Viztech’s entry promises to be a significant event for investors seeking robust opportunities in the SME sector.

2. Prizor Viztech IPO Allotment Status

Dive into the excitement surrounding the Prizor Viztech IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about yourPrizor Viztech IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Prizor Viztech IPO journey.

3. Introduction to Prizor Viztech IPO: A Comprehensive Overview of Our Business Model

Prizor Viztech IPO is making headlines with our extensive range of security and surveillance solutions. We specialize in providing top-notch CCTV cameras that cater to various sectors such as retail, government, education, and infrastructure. In 2022, Prizor Viztech expanded its product line by introducing a variety of televisions, touch panels, and monitors manufactured by third parties under our brand name. Additionally, we offer advanced video management software that integrates surveillance features into a single monitor and location. Our commitment to quality and innovation has positioned us as a key player in the security and surveillance industry.

As of the latest data, Prizor Viztech IPO has successfully distributed our products across 17 states and 2 union territories in India. Our reach spans from Andhra Pradesh to West Bengal, including union territories like Andaman and Nicobar Islands and Jammu and Kashmir. Established in 2017 by experienced promoters Ms. Mitali Dasharathbharthi Gauswami and Mr. Gauswami Dasharathbharthi Gopalbharthi, our company has grown under their leadership, leveraging their combined industry experience of over 18 years. Our technical and marketing teams further strengthen our operations, ensuring we stay ahead of market trends and customer needs.

Product Portfolio and Quality Commitment

The Prizor Viztech IPO product portfolio is divided into two main categories: Security and Surveillance Solutions, which include network and high-definition analog cameras, network video recorders, and digital video recorders; and our range of LED televisions, monitors, and touch panels. Our dedication to quality is highlighted by our accreditation with ISO 9001:2015 and ISO 14001:2015 for management systems, as well as ISO 27001:2013 for information security. Our CCTV products meet Bureau of Indian Standards, and our LED televisions comply with IS 616 standards.

Our registered office, workshops, and warehouses are strategically located in Ahmedabad. We source components from various suppliers, both domestic and international, and our technical team assembles the surveillance cameras, ensuring stringent quality checks at every stage. The year 2022 marked a significant milestone as we began offering televisions, touch panels, and monitors under the “PRIZOR” brand name.

Government Initiatives and Certifications

Prizor Viztech IPO is a registered vendor under the Government of India’s “Make in India” initiative, particularly benefiting from the Government e-Marketplace (GEM) scheme. This initiative promotes domestic manufacturing and reduces reliance on foreign goods. For the fiscal year ending March 31, 2024, our revenue from GEM stood at Rs. 9.45 Lakhs, underscoring our contribution to the local manufacturing sector.

Product Features and Specifications

Our product lineup includes a diverse range of surveillance cameras such as HD cameras, face detection cameras, and network ANPR cameras, each with unique features tailored to various applications. We also offer network and mobile digital video recorders, interactive panels, monitors, and a selection of LED televisions. Each product is designed to meet the highest standards of performance and reliability, backed by comprehensive warranties.

Strengths and Strategies of Prizor Viztech IPO

Prizor Viztech IPO’s success is driven by our wide product portfolio, strong client relationships, and high-quality standards. Our extensive product range caters to multiple industry verticals, ensuring we meet diverse customer needs. Our commitment to quality is evident through various certifications and rigorous testing procedures. Leveraging the experience of our promoters and directors, we continuously innovate and adapt to market demands.

Our marketing strategies, including exhibitions, roadshows, and dealer meets, have been instrumental in building brand awareness and customer loyalty. As part of our growth strategy, we plan to set up display centers to enhance brand visibility and expand our customer base. We are committed to innovation and strengthening our R&D capabilities to meet the evolving demands of our customers and regulatory requirements.

Prizor Viztech IPO stands out in the security and surveillance industry with our diverse product offerings, commitment to quality, and strategic growth initiatives. Our experienced leadership and dedicated team continue to drive our success, ensuring we remain at the forefront of technological advancements and customer satisfaction. Stay tuned for more updates and insights into the Prizor Viztech IPO, as we continue to expand our presence and impact in the market.

4. Financial Details of Prizor Viztech

Prizor Viztech IPO has showcased a remarkable financial performance over the recent years, highlighting its substantial growth and robust business model. Between the financial years ending March 31, 2023, and March 31, 2024, Prizor Viztech Limited saw an astounding revenue increase of 155.95%. The profit after tax (PAT) surged by an impressive 2546.91%, underscoring the company’s financial strength and operational efficiency.

For the financial year ending March 31, 2024, Prizor Viztech IPO reported assets amounting to ₹2,461.80 Lakhs, a significant rise from ₹862.84 Lakhs in the previous year. The revenue for the same period stood at ₹3,568.62 Lakhs, a substantial increase from ₹1,394.29 Lakhs in the previous financial year. The profit after tax soared to ₹557.44 Lakhs, a remarkable leap from ₹21.06 Lakhs in the prior year.

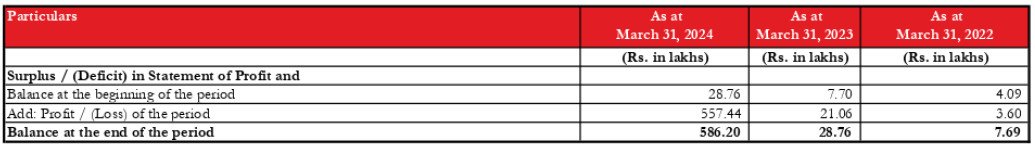

Balance Sheet Highlights

Prizor Viztech IPO’s net worth grew to ₹666.20 Lakhs by March 31, 2024, compared to ₹108.76 Lakhs in the previous year. The reserves and surplus also saw a significant increase, reaching ₹586.20 Lakhs from ₹28.76 Lakhs. Additionally, the company’s total borrowing stood at ₹964.86 Lakhs, up from ₹532.84 Lakhs in the previous year, reflecting the company’s strategic investments and growth initiatives.

Prizor Viztech Valuations & Margins

The valuation metrics for Prizor Viztech IPO indicate a solid financial footing. For the fiscal year 2024, the earnings per share (EPS) were 7.53, a notable increase from 0.28 in 2023 and 0.05 in 2022. The PE ratio for 2024 is estimated between 10.89 and 11.55, reflecting the market’s positive perception of the company’s growth potential.

The return on net worth (RONW) saw a dramatic rise, reaching 83.67% in 2024, compared to 19.36% in 2023 and 4.10% in 2022. The net asset value (NAV) also improved significantly to 9.00 in 2024 from 1.47 in 2023 and 1.19 in 2022.

Profitability and Leverage

Prizor Viztech IPO demonstrated strong profitability metrics with a return on equity (ROE) of 143.86% in 2024, up from 21.44% in 2023 and 4.19% in 2022. The EBITDA margin also showed substantial growth, reaching 23.06% in 2024 from 3.85% in 2023 and 2.17% in 2022. Furthermore, the company’s debt/equity ratio improved to 1.45 in 2024, down from 4.90 in 2023 and 3.57 in 2022, indicating better financial management and reduced leverage.

The financial data of Prizor Viztech IPO illustrates a company on a robust growth trajectory, with significant improvements in revenue, profitability, and financial health. These metrics highlight Prizor Viztech IPO’s strong market position and its potential for sustained growth. Investors and stakeholders can look forward to the continued success and expansion of Prizor Viztech IPO in the security and surveillance industry.

Statement Of Revenue From Operations

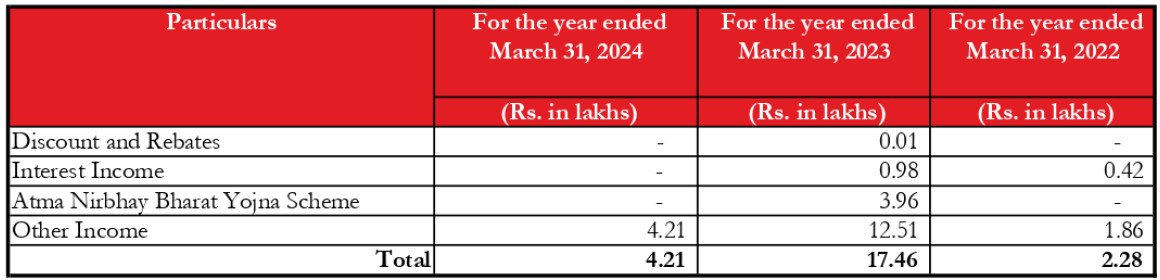

Statement of Other Income

Statement of Other Expenses

Statement of Reserves & Surplus

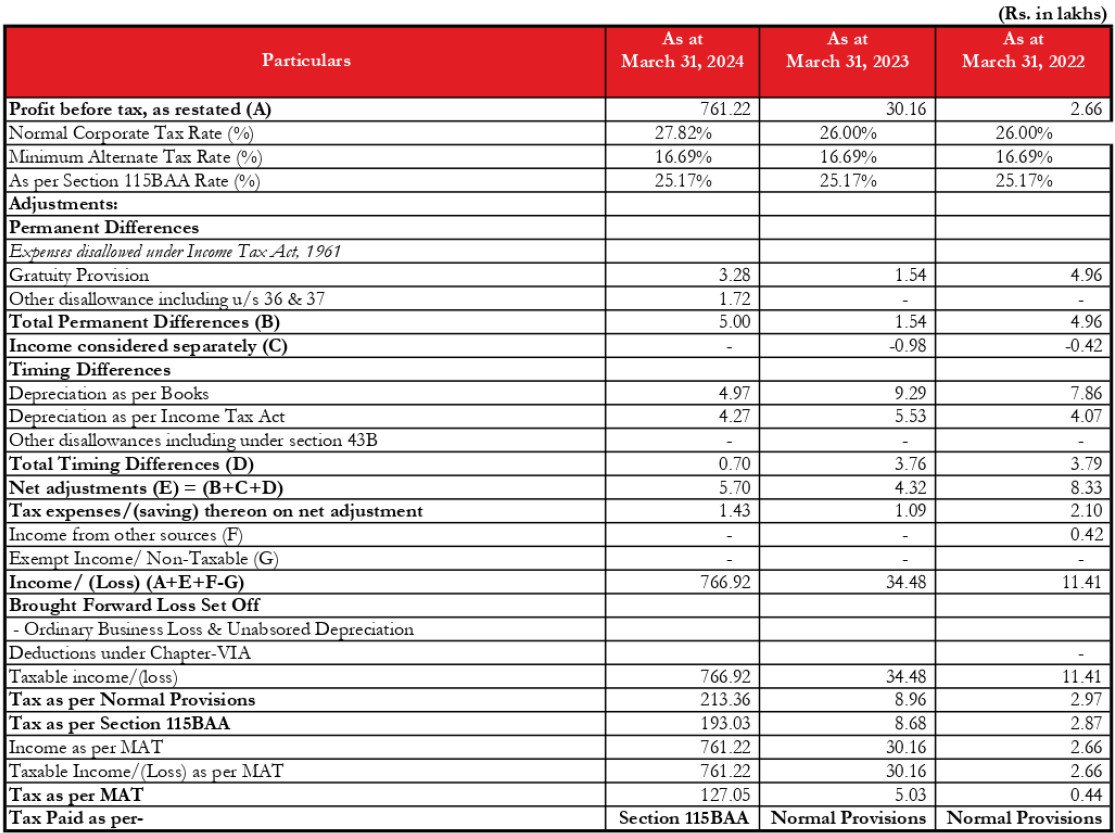

Statement of Tax Shelter

Statement of Capitalisation

5. Prizor Viztech IPO FAQs

Prizor Viztech IPO Details

The Prizor Viztech IPO issue opens on July 12, 2024.

The Prizor Viztech IPO closes on July 16, 2024.

The issue price range for the Prizor Viztech IPO is ₹82.00 to ₹87.00 per share.

The Prizor Viztech IPO issue size is ₹25.15 Crores.

The face value of Prizor Viztech IPO shares is ₹10 per equity share.

Prizor Viztech IPO Dates

The basis of allotment for the Prizor Viztech IPO will be announced on July 18, 2024.

Refunds will be initiated on July 19, 2024, for the Prizor Viztech IPO.

The shares will be credited to the demat accounts on July 19, 2024.

The expected listing date for the Prizor Viztech IPO on NSE SME is July 22, 2024.

The minimum lot size for retail investors in the Prizor Viztech IPO is 1600 shares.

Prizor Viztech IPO Issue Details

The Prizor Viztech IPO is a Book Build Issue.

Not less than 35% of the net issue is reserved for retail investors in the Prizor Viztech IPO.

The promoters of Prizor Viztech Limited are Ms. Mitali Dasharathbharthi Gauswami and Mr. Gauswami Dasharathbharthi Gopalbharthi.

The promoter holding before the Prizor Viztech IPO is 93.59%.

The promoter holding after the Prizor Viztech IPO will be 68.28%.

Prizor Viztech Business Model

Prizor Viztech Limited offers security and surveillance solutions, including CCTV cameras, LED televisions, monitors, and touch panels.

Prizor Viztech expanded its product portfolio in the year 2022.

Prizor Viztech supplies its products to 17 states and 2 union territories in India.

Prizor Viztech is a registered vendor under the “Make in India” (GEM) initiative.

Prizor Viztech’s workshops are accredited with ISO 9001:2015, ISO 14001:2015, and ISO 27001:2013 certifications.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Prizor Viztech IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Prizor Viztech IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Prizor Viztech IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Prizor Viztech IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.