Table of Contents

Petro Carbon and Chemicals Limited IPO brings forth a dynamic opportunity in the carbon industry landscape. Established in November 2007, Petro Carbon and Chemicals Limited, an ATHA Group entity, specializes in the production and distribution of calcined petroleum coke (CPC). As a part of the renowned Atha Group, a 70-year-old diversified Indian conglomerate headquartered in Kolkata, PCCL operates on a robust business model, primarily catering to a B2B clientele. Its clientele includes prestigious state-owned aluminum producers, graphite electrode and titanium dioxide manufacturers, and various metallurgical and chemical industries, alongside other steel manufacturers. With a focus on quality, reliability, and industry leadership, Petro Carbon and Chemicals Limited is poised to carve a distinct niche in the carbon industry landscape.

Petro Carbon and Chemicals Limited IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

25th Jun 2024 | 27th Jun 2024 | 28th Jun 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 01st July 2024 | 01st July 2024 | 2nd July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹ 113.16 Cr | ₹ 162.00 – ₹ 171.00 | 800 Shares | 66.17,600 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 800 | ₹ 1,36,800 |

| Retail(Max) | 1 | 800 | ₹ 1,36,800 |

| Small-HNI (Min) | 2 | 1600 | ₹ 2,73,600 |

| Small-HNI (Max) | 7 | 5600 | ₹ 9,57,600 |

| Big-HNI (Min) | 8 | 6400 | ₹ 10,94,400 |

| RII (Retail) | NII | QIB |

| 35.00% | 15.00% | 50.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 100.00% | – | NSE SME |

| No | Objectives |

| 1 | Achieve the benefits of listing the Equity Shares on the Stock Exchanges |

| 2 | Carry out the Offer for Sale of up to Equity Shares by the Selling Shareholders |

| LEAD | REGISTRAR |

| GYR Capital Advisors Private Limited | Bigshare Services Private Limited |

| Telephone | |

| pccl@athagroup.in | 033-40118400 |

Petro Carbon and Chemicals Limited IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

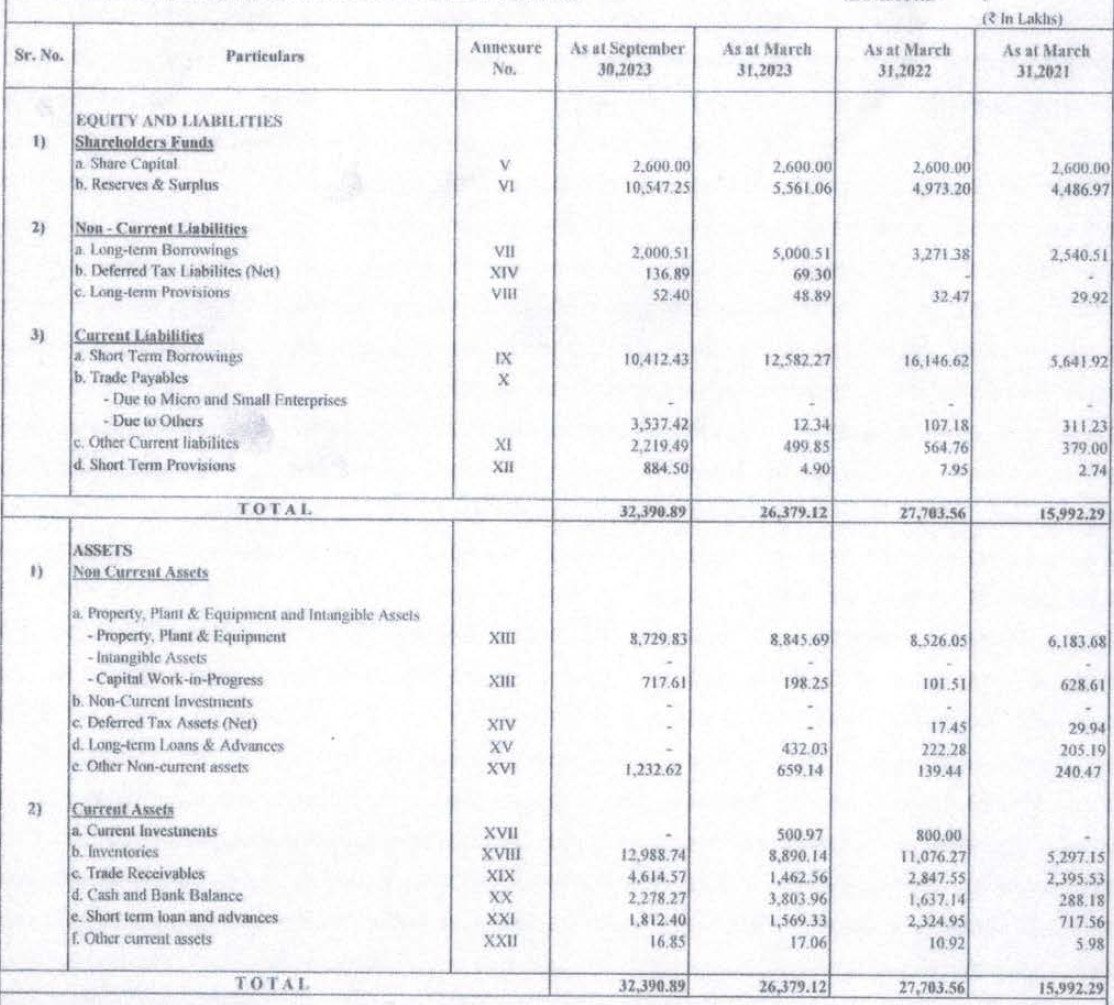

Financial of Petro Carbon and Chemicals Limited IPO

| Amounts in Lakhs ₹ | |||

| Particulars | FY-2023 | FY-2022 | FY-2021 |

| Assets | 26,379 | 27,704 | 15,992 |

| Revenue | 51,761 | 27,991 | 15,529 |

| Expense | 50,811 | 27,161 | 15,500 |

| Net Worth | 3,753 | 3,080 | 2,509 |

| Borrowing | 17,583 | 19,418 | 8,182 |

| EBITDA(%) | 3.13 | 4.31 | 1.83 |

| Reserves | 5,561.06 | 4,973.20 | 4,489.97 |

| PAT | 673 | 571 | 12 |

| EPS | 2.59 | 2.20 | 0.04 |

| Debt/Equity | 2.15 | 2.56 | 1.15 |

| Established | Website | Industry |

| 2007 | pccl.in | Minerals |

Statement of Assets and Liabilities

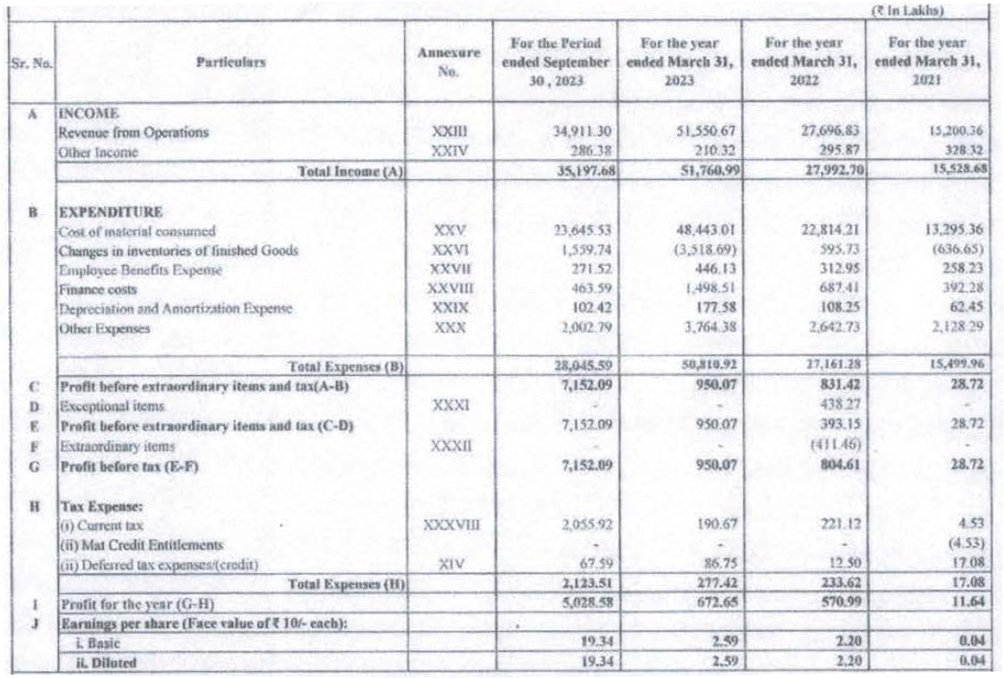

Statement of Profit and Loss

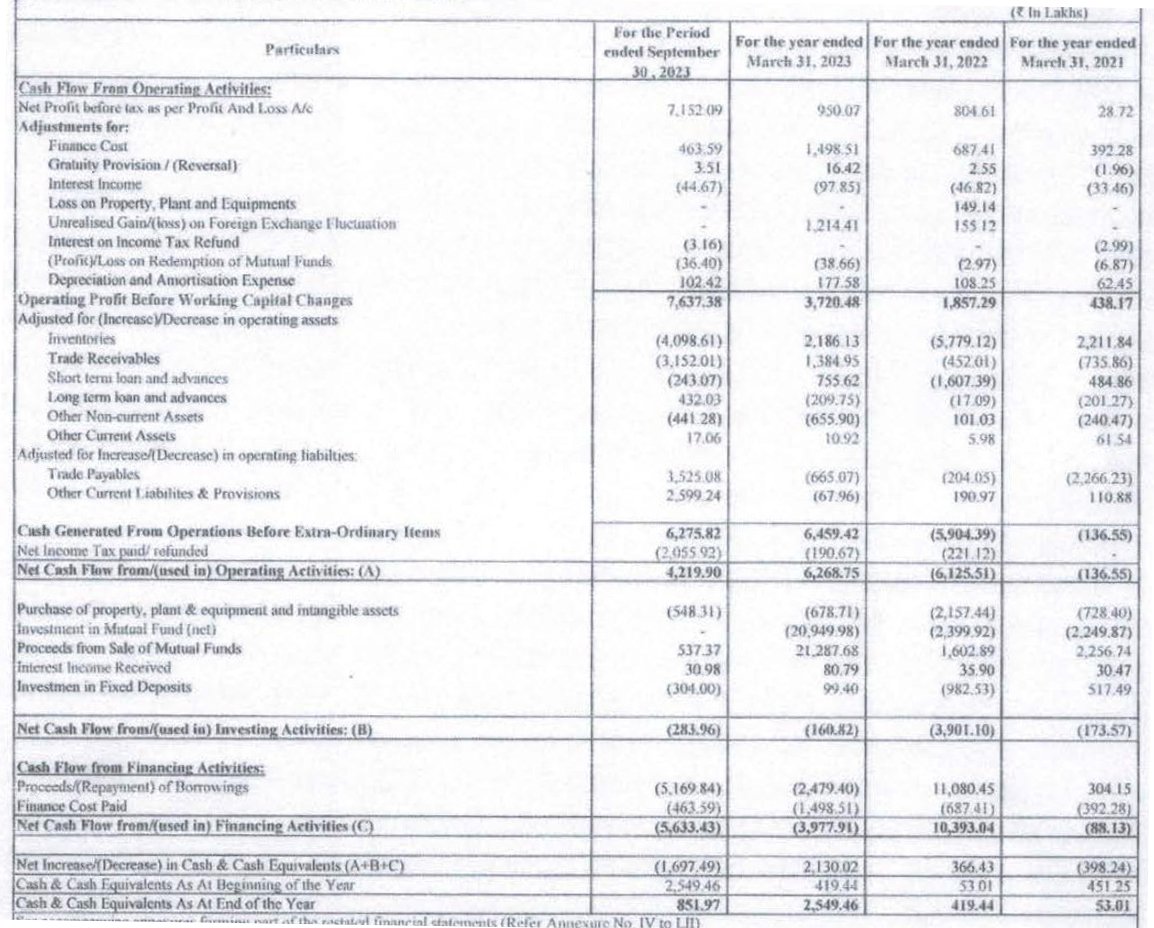

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Petro Carbon and Chemicals Limited IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Petro Carbon and Chemicals Limited IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Petro Carbon and Chemicals Limited IPO and other offerings a more informed and confident endeavor.

1.Petro Carbon and Chemicals Limited IPO key dates & Issue Details

The eagerly anticipated Petro Carbon and Chemicals Limited IPO is set to open for subscription from June 25, 2024, to June 27, 2024. This SME IPO offers a price range of ₹162.00 to ₹171.00 per share, targeting a total issue size of ₹113.16 Cr. Investors can look forward to this Book Build Issue type, with shares to be listed on the NSE SME exchange. The face value of each equity share is ₹10. The offering comprises an offer for sale amounting to ₹113.16 Cr.

Retail investors will be pleased to know that not less than 35.00% of the offer is reserved for them, ensuring ample opportunity to participate in the Petro Carbon and Chemicals Limited IPO. The market lot size for this IPO is 800 shares, with each lot amounting to ₹136,800. High Net Worth Individuals (HNI) will need to bid for a minimum of 1600 shares, equating to two lots.

Important Dates for Petro Carbon and Chemicals Limited IPO

Investors should mark their calendars for the critical dates of the Petro Carbon and Chemicals Limited IPO. The basis of allotment is scheduled for June 28, 2024, swiftly followed by the initiation of refunds and credit of shares to demat accounts on July 1, 2024. The IPO is expected to list on July 2, 2024, allowing investors to trade shares of Petro Carbon and Chemicals Limited on the NSE SME platform.

The Petro Carbon and Chemicals Limited IPO represents a significant opportunity for investors looking to capitalize on the growth potential of this company. Stay tuned for more updates and ensure you participate within the subscription window to secure your stake in this promising IPO.

2. Divine Power IPO Allotment Status

Dive into the excitement surrounding the Petro Carbon and Chemicals Limited IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Petro Carbon and Chemicals Limited IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Petro Carbon and Chemicals Limited IPO journey.

3. Introduction to Petro Carbon and Chemicals Limited IPO

Petro Carbon and Chemicals Limited (“PCCL”), part of the esteemed ATHA Group, is a key player in the carbon industry, specializing in the manufacturing and marketing of Calcined Petroleum Coke (CPC). The ATHA Group, a distinguished Indian conglomerate with a legacy spanning over 70 years, founded PCCL in 1957 in Odisha as a Mining and Minerals company. Over the past decade, the group has strategically diversified, integrating both forward and backward operations, resulting in consistent performance and growth. This overview aims to provide detailed insights into the “Petro Carbon and Chemicals Limited IPO.”

PCCL operates primarily on a B2B model, supplying CPC to renowned aluminum manufacturing government companies, graphite electrode and titanium dioxide manufacturers, as well as various metallurgical, chemical, and steel industries. Recognized for its excellence, PCCL received the prestigious NALCO VIKRETA UTKARSH PURASKAR in 2018, highlighting its position as a top supplier to the National Aluminium Company Limited.

Strategic Operations and Manufacturing Facility

PCCL’s manufacturing plant, operational since 1975, is located in Haldia, West Bengal. The plant, revamped and upgraded in 2008, boasts a capacity of approximately 93,744 tons per annum of CPC and spans an area of around 30 acres. The strategic location within the port perimeter facilitates efficient logistics and distribution, significantly benefiting the “Petro Carbon and Chemicals Limited IPO” prospects.

The plant is well-equipped with state-of-the-art machinery, including RPC unloading conveyor belts, storage facilities, rotary kiln and cooler process equipment, and advanced automation systems. These facilities ensure high-quality production processes, making CPC an essential material for the aluminum, steel, and various other industries.

Financial Performance and Growth Strategy

PCCL has demonstrated a strong track record of financial performance, with substantial income and profit growth over recent years. For the fiscal years 2023, 2022, and 2021, as well as the six months ended September 30, 2023, the company’s total income and profit after tax reflect its robust financial health. This financial stability is a key highlight for potential investors considering the “Petro Carbon and Chemicals Limited IPO.”

The company’s strategic business model focuses on vertical integration, technological innovation, and strategic partnerships. These initiatives have led to significant operational expansion and performance enhancement, reinforcing PCCL’s position in the market.

Competitive Advantages and Business Strategies

PCCL’s strategic location, efficient logistics, and advanced infrastructure provide significant competitive advantages. The company’s focus on adopting environment-friendly technologies and continuous compliance with environmental laws underscores its commitment to sustainability. Additionally, PCCL places a strong emphasis on research and development to innovate and improve production processes.

The experienced management team and skilled workforce further bolster PCCL’s market position. With a strategic focus on expanding capacities and enhancing market presence, PCCL aims to maintain its dominance in the calcined pet coke sector, making the “Petro Carbon and Chemicals Limited IPO” a promising investment opportunity.

The “Petro Carbon and Chemicals Limited IPO” offers a unique investment opportunity in a company with a strong heritage, robust financial performance, and strategic growth initiatives. With its well-established operations, strategic location, and commitment to innovation and sustainability, PCCL is well-positioned to capitalize on the growth potential of the Indian carbon industry.

4. Financial Details of Petro Carbon and Chemicals Limited

Investors eyeing the Petro Carbon and Chemicals Limited IPO can gain valuable insights from the company’s financial performance over recent years. Between the financial years ending March 31, 2023, and March 31, 2022, the company witnessed an impressive 84.92% increase in revenue, coupled with a notable 17.8% rise in profit after tax (PAT). Let’s delve into the financial key performance indicators (KPIs) and valuations of Petro Carbon and Chemicals Limited.

Financial KPIs Overview:

Revenue Growth: Petro Carbon and Chemicals Limited experienced significant revenue growth, with revenue from operations soaring by 86.12% between FY 2021-22 and FY 2022-23.

EBITDA Margin: The company’s EBITDA margin surged to 21.19% in the period ending September 30, 2023, showcasing enhanced operational efficiency compared to previous fiscal years.

Profitability Ratios: Petro Carbon and Chemicals Limited demonstrated robust profitability, with PAT margin reaching 14.40% and return on net worth standing at an impressive 57.26% in FY 2022-23.

Debt-Equity Ratio: The company maintained a healthy debt-equity ratio of 0.94, indicating a balanced capital structure and prudent financial management.

Valuations and Margins:

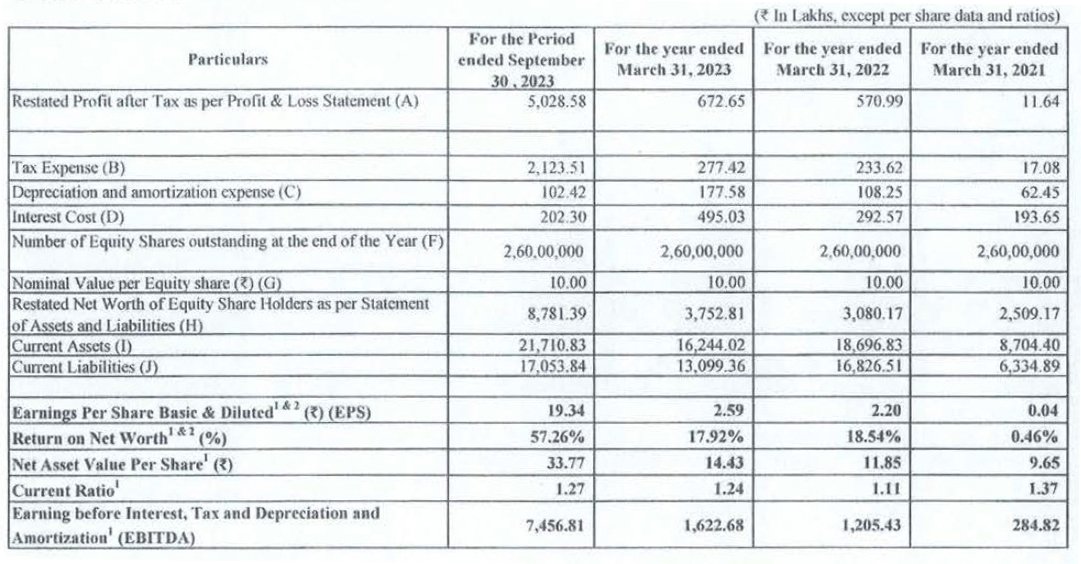

Earnings Per Share (EPS): The EPS witnessed a substantial growth trajectory, reaching 2.59 in FY 2023 from 0.04 in FY 2021, reflecting the company’s profitability enhancement.

Price-Earnings Ratio (PE Ratio): With a PE ratio ranging from 62.55 to 66.02 in FY 2023, Petro Carbon and Chemicals Limited’s stock valuation indicates investor confidence in the company’s growth prospects.

Return on Capital Employed (ROCE): The company’s ROCE demonstrated consistent improvement, reaching 10.88% in FY 2022-23, highlighting efficient capital utilization.

Debt Management: Despite fluctuations, Petro Carbon and Chemicals Limited maintained a reasonable debt-equity ratio, reflecting prudent debt management practices.

The financial data presented underscores Petro Carbon and Chemicals Limited’s strong growth trajectory, profitability, and prudent financial management practices. Investors evaluating the Petro Carbon and Chemicals Limited IPO can leverage these insights to make informed investment decisions, considering the company’s robust performance and promising future prospects in the carbon industry.

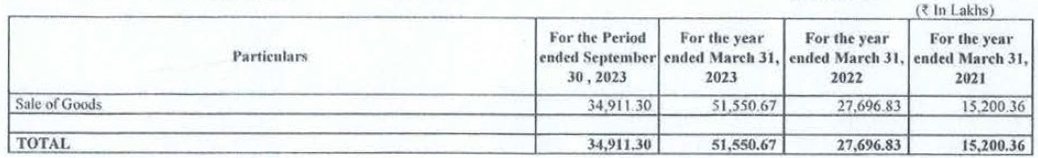

Statement Of Revenue From Operations

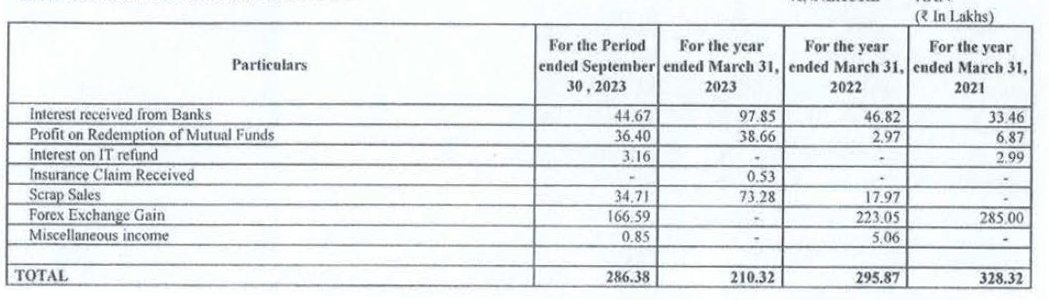

Statement of Other Income

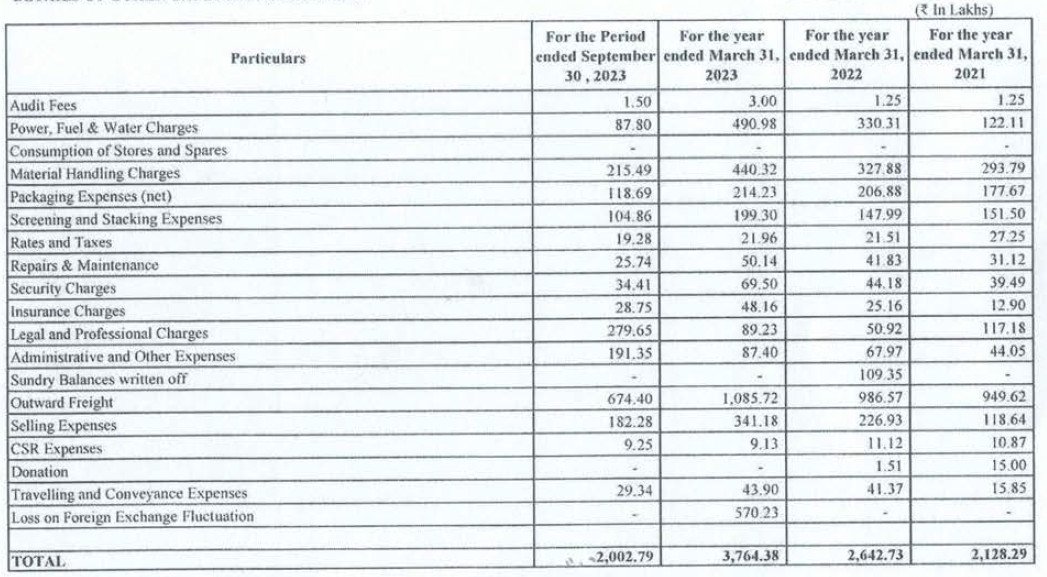

Statement of Other Expenses

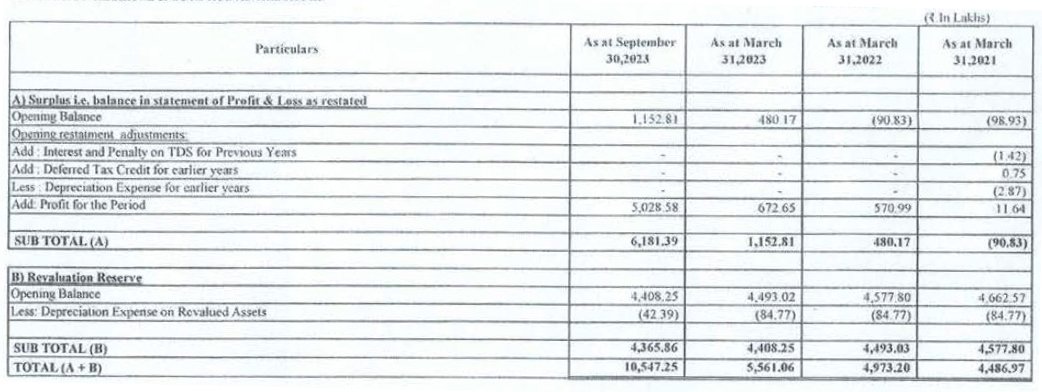

Statement of Reserves & Surplus

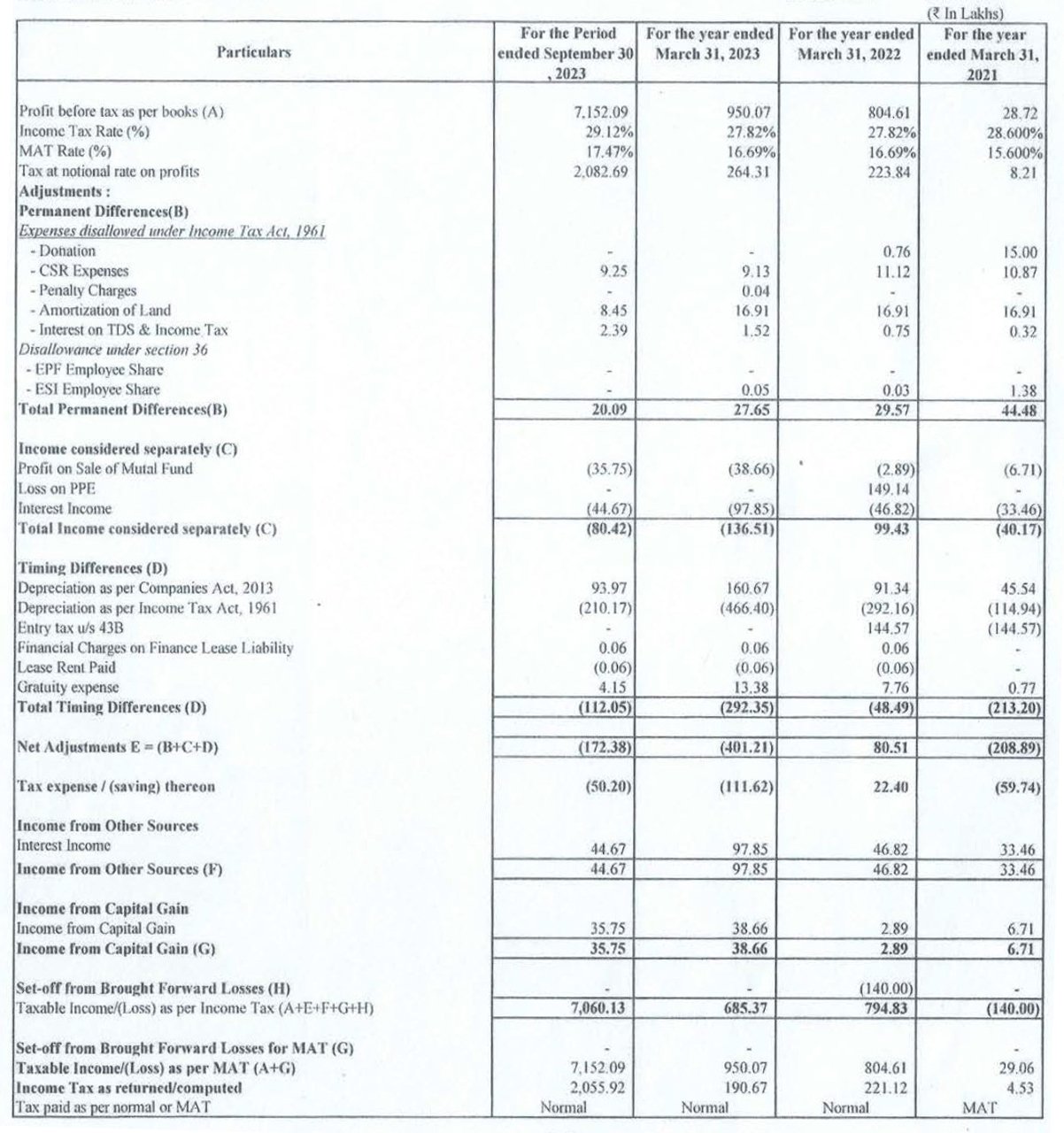

Statement of Tax Shelter

Financial Ratios

5. Petro Carbon and Chemicals Limited IPO FAQs

The Petro Carbon and Chemicals Limited IPO is scheduled to open on June 25, 2024.

The Petro Carbon and Chemicals Limited IPO will close on June 27, 2024.

The price range for the Petro Carbon and Chemicals Limited IPO is ₹162.00 to ₹171.00 per share.

The Petro Carbon and Chemicals Limited IPO will be listed on the NSE SME exchange.

The issue size of the Petro Carbon and Chemicals Limited SME IPO is ₹113.16 Cr.

The face value of each equity share of Petro Carbon and Chemicals Limited IPO is ₹10.

Petro Carbon and Chemicals Limited operates primarily on a B2B model, supplying Calcined Petroleum Coke (CPC) to various industries including aluminum manufacturing, graphite electrodes, titanium dioxide, metallurgical, chemical, and steel industries.

Calcined Petroleum Coke (CPC) serves as a crucial raw material in the manufacturing of aluminum, steel, and various carbon-based products, making it indispensable for Petro Carbon and Chemicals Limited’s operations.

Petro Carbon and Chemicals Limited has witnessed substantial revenue growth, with revenue increasing by 84.92% between FY 2022-23 and FY 2021-22. Additionally, profit after tax (PAT) rose by 17.8% during the same period.

Key financial indicators include revenue growth, EBITDA margin, PAT margin, return on net worth, return on capital employed, and debt-equity ratio.

Important dates include the opening and closing dates of the IPO, basis of allotment date, refunds initiation date, credit of shares to demat date, and listing date.

Petro Carbon and Chemicals Limited intends to utilize the proceeds from its IPO for business expansion, technology upgrades, working capital requirements, and strategic investments.

Competitive strengths include a well-established market position, strategic location of manufacturing facilities, strong financial performance, experienced management team, and focus on innovation and sustainability.

Petro Carbon and Chemicals Limited stands out due to its robust financial performance, efficient operations, strategic partnerships, and commitment to environmental sustainability.

Petro Carbon and Chemicals Limited strategically locates its manufacturing facilities near ports and major transportation networks, ensuring seamless movement of raw materials and finished products.

Growth strategies include business diversification, forward and backward integrations, acquisition of projects, capacity expansions, and focus on vertical integration and technological innovation.

Petro Carbon and Chemicals Limited’s revenue from operations has experienced significant growth, indicating a strong demand for its products and services across various industries.

Petro Carbon and Chemicals Limited maintains a healthy financial position through efficient cost management, prudent debt management, and consistent revenue growth.

Risks may include market volatility, industry competition, regulatory changes, raw material price fluctuations, and macroeconomic factors impacting demand.

The carbon industry is competitive, but Petro Carbon and Chemicals Limited differentiate themselves through product quality, operational efficiency, customer relationships, and innovation, allowing them to maintain a strong market position.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Petro Carbon and Chemicals Limited IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Petro Carbon and Chemicals Limited IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Petro Carbon and Chemicals Limited IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Petro Carbon and Chemicals Limited IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.