Table of Contents

Nephro Care India IPO marks the opportunity to invest in Nephro Care India Limited, a comprehensive treatment center established in 2014 in Kolkata. As a one-stop destination for a variety of clinical and lifestyle solutions, Nephro Care India specializes in treatments for kidney failure. Their holistic treatment framework encompasses lifestyle, physiological, and spiritual aspects of well-being, supported by a team of specialist physicians, experienced paramedical staff, and a competent management team. Equipped with advanced diagnostic instruments and facilities, Nephro Care India ensures doctors can explore all diagnostic options, providing superior service and care under one roof for optimal clinical outcomes.

Nephro Care India IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

28th Jun 2024 | 02nd July 2024 | 03rd July 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 04th July 2024 | 04th July 2024 | 05th July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹41.26 Cr | ₹ 85.00 – ₹ 90.00 | 1600 Shares | 45.84,000 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 1600 | ₹ 1,44,000 |

| Retail(Max) | 1 | 1600 | ₹ 1,44,000 |

| Small-HNI (Min) | 2 | 3200 | ₹ 2,88,000 |

| Small-HNI (Max) | 6 | 9600 | ₹ 8,64,000 |

| Big-HNI (Min) | 7 | 11200 | ₹ 10,08,000 |

| RII (Retail) | NII | QIB |

| 35.00% | 15.00% | 50.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 85.02% | – | NSE SME |

| No | Objectives |

| 1 | Setting up of Multi Speciality Hospital in the name of “Vivacity Multi Specialty Hospital” (unit of Nephro Care) at Kolkata (Madhyamgaram), West Bengal |

| 2 | General Corporate Expenses |

| LEAD | REGISTRAR |

| CORPORATE CAPITALVENTURES PRIVATE LIMITED | Bigshare Services Private Limited |

| Telephone | |

| cs@nephrocareindia.com | +91 8017010197 |

Nephro Care India IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Financial of Nephro Care India IPO

| Amounts in Lakhs ₹ | |||

| Particulars | FY-2023 | FY-2022 | FY-2021 |

| Assets | 831 | 463 | 113 |

| Revenue | 1,710 | 343 | 183 |

| Expense | 1,438 | 343 | 171 |

| Net Worth | 244 | 50 | 2 |

| Borrowing | 246 | 254 | 69 |

| EBITDA(%) | 21.33 | 3.67 | 8.47 |

| Reserves | 193.76 | -0.48 | 0.50 |

| PAT | 194.24 | -0.98 | 8.87 |

| EPS | 1.94 | -0.03 | 4.44 |

| Debt/Equity | 1.68 | 9.95 | 14.28 |

| Established | Website | Industry |

| 2014 | nephrocareindia.com | Healthcare |

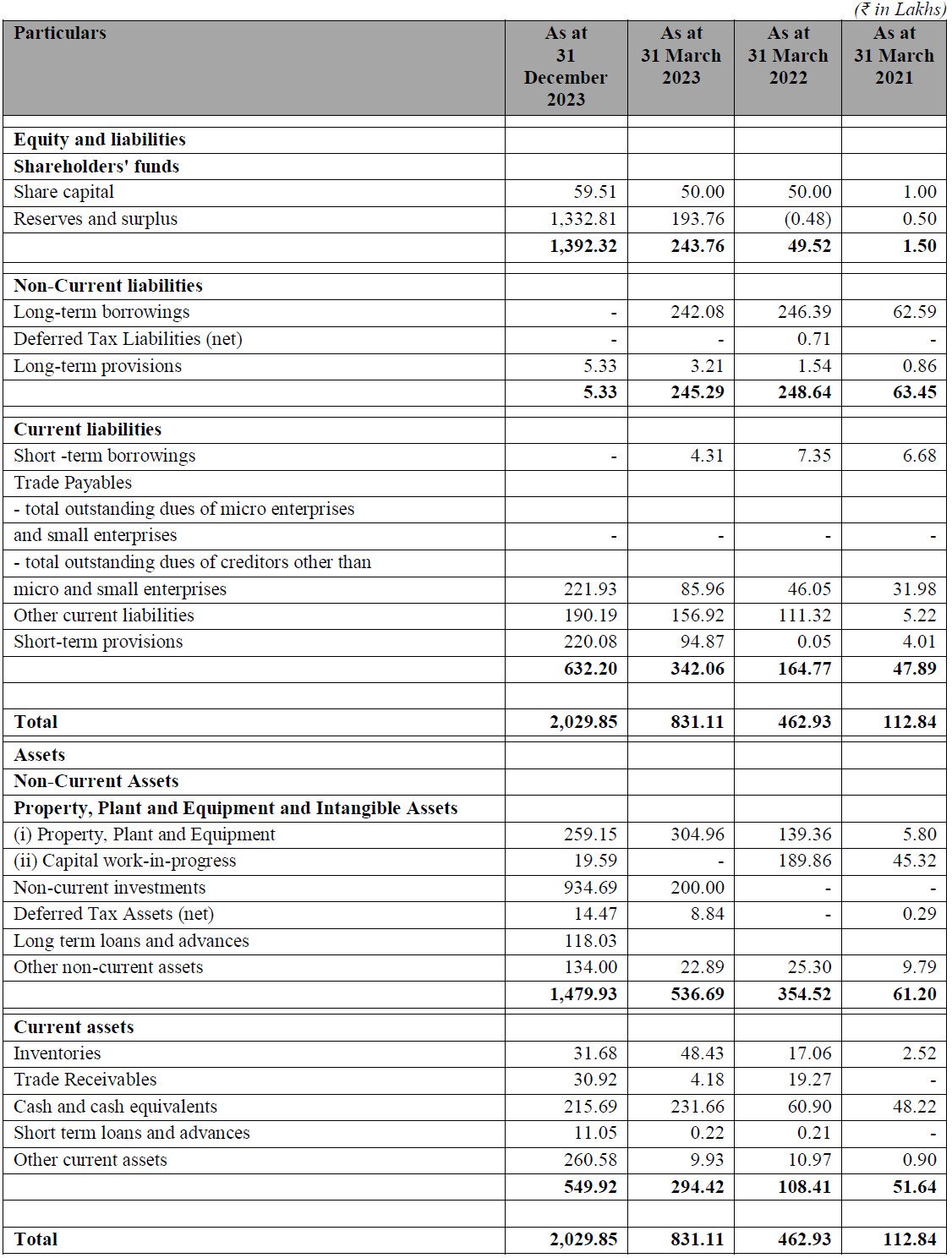

Statement of Assets and Liabilities

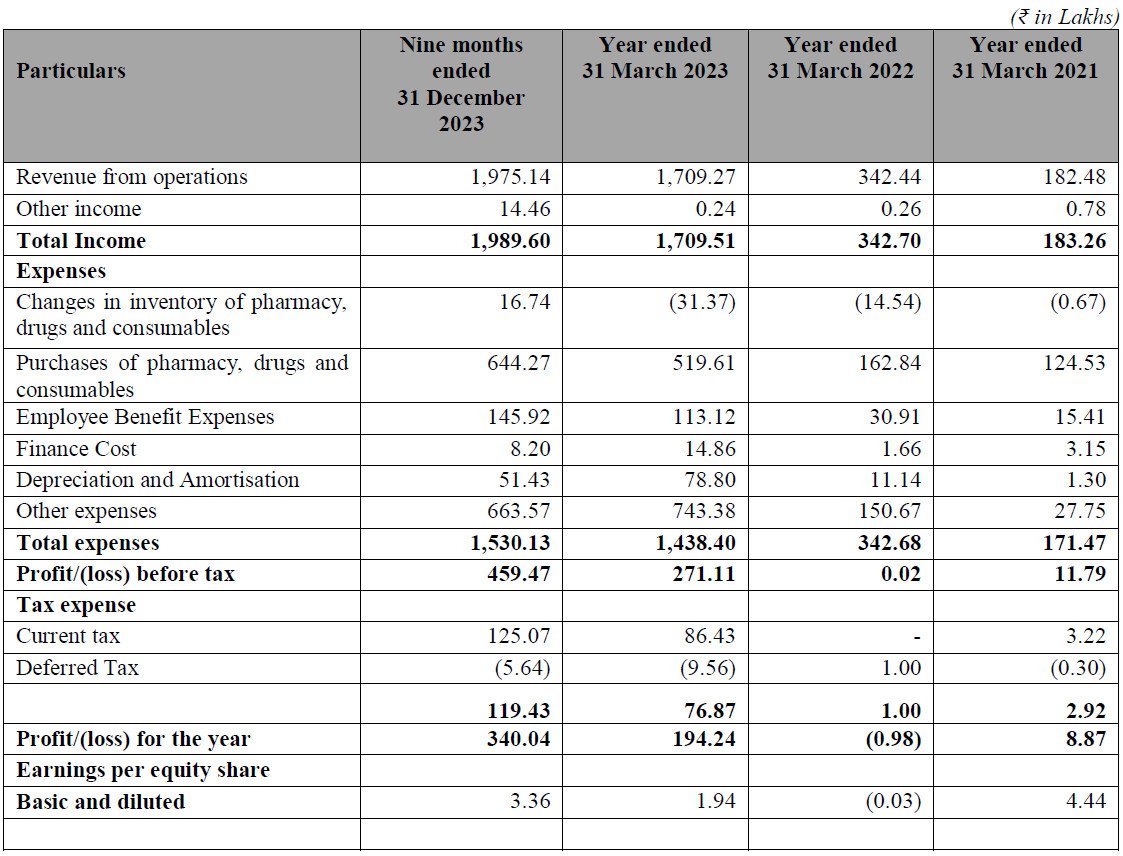

Statement of Profit and Loss

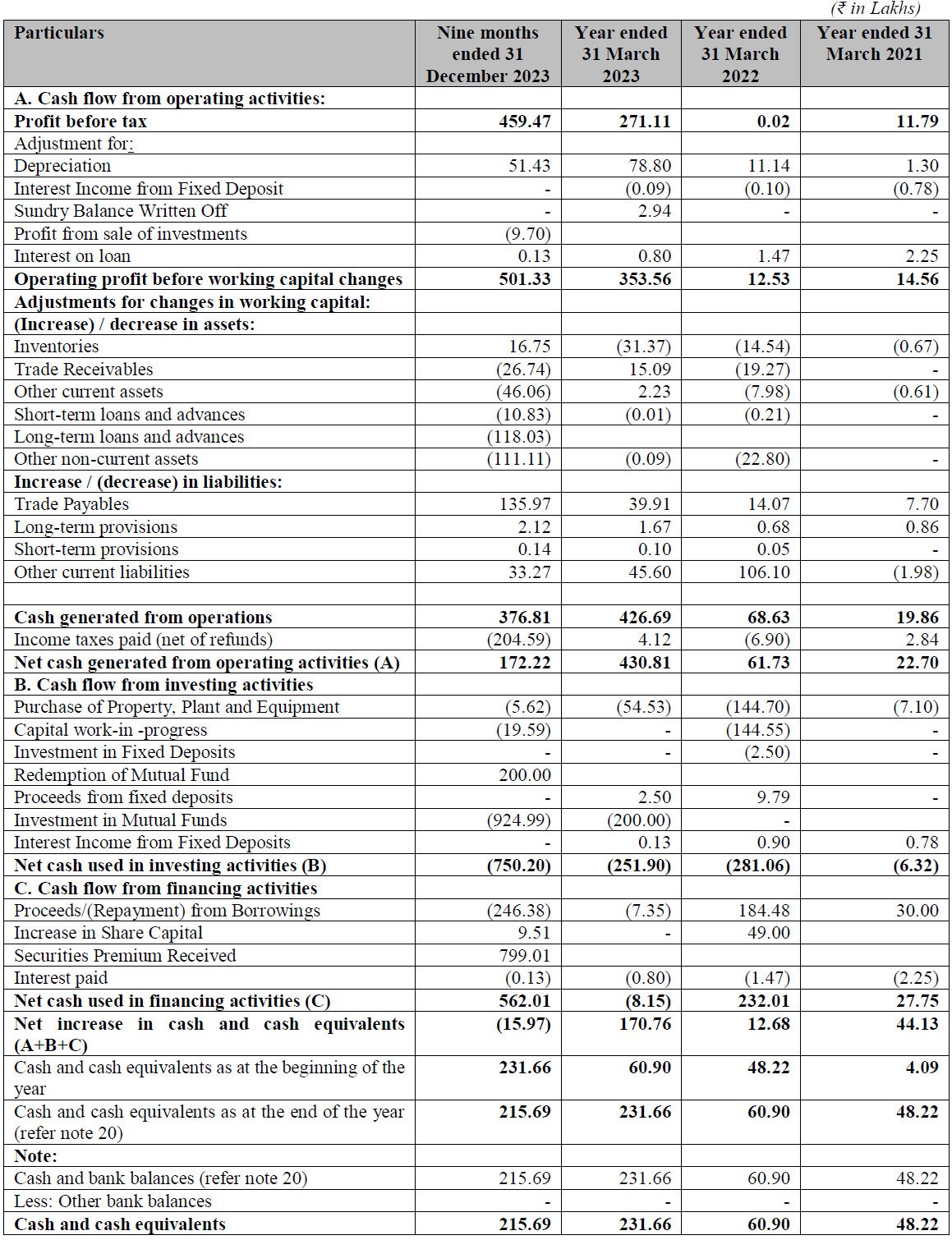

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Nephro Care India IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Nephro Care India IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Nephro Care India IPO and other offerings a more informed and confident endeavor.

1. Nephro Care India IPO key dates & Issue Details

The Nephro Care India IPO is set to open for subscription on June 28, 2024, and will close on July 2, 2024. This SME IPO is priced between ₹85.00 and ₹90.00 per share. Investors can expect the IPO to be listed on the NSE SME platform. The IPO type is a book build issue, with a total issue size of ₹41.26 crores, all of which is a fresh issue. Each equity share has a face value of ₹10. The retail quota for the Nephro Care India IPO is set at not less than 35% of the net issue, making it accessible for retail investors.

The important dates for the Nephro Care India IPO are as follows: the basis of allotment will be finalized by July 3, 2024, with refunds being initiated on July 4, 2024. Shares will be credited to demat accounts on the same day, July 4, 2024, and the IPO is expected to be listed on July 5, 2024. Please note these dates are tentative and subject to change.

For those interested in the Nephro Care India IPO, the market lot is 1600 shares, with the minimum lot amounting to ₹144,000. High Net Worth Individuals (HNI) will need to apply for a minimum of two lots, which totals 3200 shares and amounts to ₹288,000.

Promoter holding pre-IPO is at 85.02%, which will change post-IPO. The exact promoter holding post-IPO will be announced in due course. Stay tuned for updates on any potential IPO discount as details are yet to be determined. Investing in the Nephro Care India IPO could be a significant opportunity for those looking to invest in the healthcare sector.

2. Nephro Care India IPO Allotment Status

Dive into the excitement surrounding the Nephro Care India IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Nephro Care India IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Nephro Care India IPO journey.

3. Introduction to Nephro Care India IPO: Business Model and Services

Founded in 2014 by Dr. Pratim Sengupta in Kolkata, Nephro Care India has established itself as a comprehensive medical service provider for renal patients. As of now, Nephro Care operates as a one-stop treatment center in Kolkata, offering a wide array of clinical and lifestyle solutions, along with renal insufficiency treatments. The clinic’s holistic treatment framework encompasses lifestyle, physiological, and spiritual wellness aspects. Nephro Care is staffed by expert doctors, well-trained paramedical professionals, and a skilled management team, all supported by robust clinical and investigative infrastructure. The treatment plans at Nephro Care are founded on core scientific principles, transparency, and ethics, ensuring the best medical care at affordable costs for local, national, and international patients.

Nephro Care India IPO is notable for its diverse service offerings at various locations. The registered office and operational clinic located in Salt Lake City, Kolkata, provides services including in-house dialysis, outpatient services in nephrology, diabetology, cardiology, ophthalmology, and neurology, an NABL accredited in-house pathology, an in-house pharmacy, advanced diagnostic facilities, a renal nutrition department, home care, the Mukti Lifestyle Support Program, and home dialysis. Additionally, Nephro Care operates another clinic in Chandernagore, offering similar comprehensive services. The company has also taken over a dialysis unit at HB 113, Salt Lake City, further expanding its reach and capabilities.

Renal insufficiency and kidney diseases are significant health concerns in India, with the Pradhan Mantri National Dialysis Program (PMNDP) reporting an annual addition of approximately 2.2 lakh new patients of End-Stage Renal Disease (ESRD), leading to a demand for 3.4 crore dialysis sessions each year. Nephro Care India IPO aims to address this demand through a holistic approach combining modern medicine and traditional yogic wisdom. The company’s vision is to touch the lives of one million kidney disease patients across India by leveraging its hub-and-spoke model.

Currently, Nephro Care serves around 900 chronic kidney disease (CKD) patients each month, employing five permanent doctors, ten visiting consultants, and seventy paramedical professionals across its flagship Salt Lake clinic and three satellite clinics. The company has also signed an agreement to lease a 60-bed hospital in Madhyamgram, Kolkata, with plans to convert it into a 100-bed multi-specialty hospital using a portion of the IPO proceeds.

Nephro Care India IPO is committed to continuous growth and expansion. The company plans to open three new satellite clinics in Alipurduar, Shyambazar, and Balasore, enhancing its service reach. Equipped with advanced diagnostic equipment and facilities, Nephro Care ensures comprehensive patient care under one roof, aiming for optimum clinical outcomes. The company’s founder, Dr. Pratim Sengupta, a leading nephrologist with over 20 years of clinical experience, has performed more than 1,000 kidney transplants and is a pioneer in holistic renal care.

Nephro Care India’s competitive strengths lie in bridging the gap between day care and tertiary care services, addressing unmet patient needs through its multidimensional engagement framework. Services like Mukti, Home Dialysis, Home Care, and a wide range of diagnostic facilities ensure comprehensive care for patients. The company’s strategic objectives include expanding its hub-and-spoke network, enhancing operational efficiency, attracting skilled healthcare professionals, and leveraging technology to improve patient experience.

By continuously investing in its infrastructure, recruiting high-quality medical professionals, and optimizing operations, Nephro Care India IPO aims to strengthen its position as a leading provider of renal care in India. The company’s focus on extending clinical services outside its clinics and across the patient’s lifetime further underscores its commitment to holistic and patient-centric care. Leveraging technological advancements, enhancing academic and research efforts, and maintaining strategic partnerships with renowned institutes are integral to Nephro Care’s growth strategy and its mission to provide superior healthcare services to kidney disease patients across India.

For more information about Nephro Care India IPO and its business model, stay tuned to updates as the company continues to innovate and expand its reach in the healthcare sector.

4. Financial Details of Nephro Care India

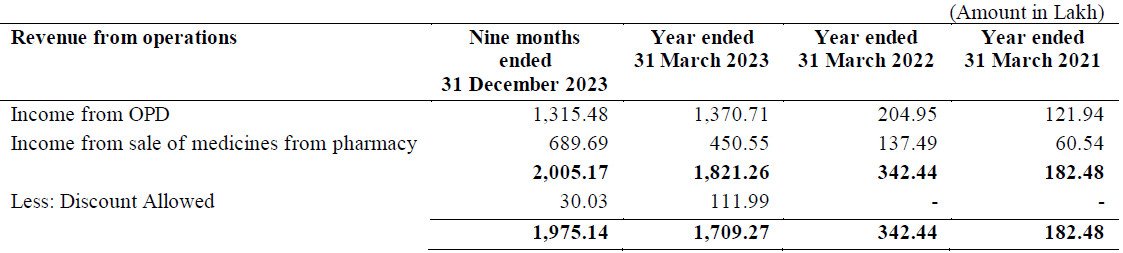

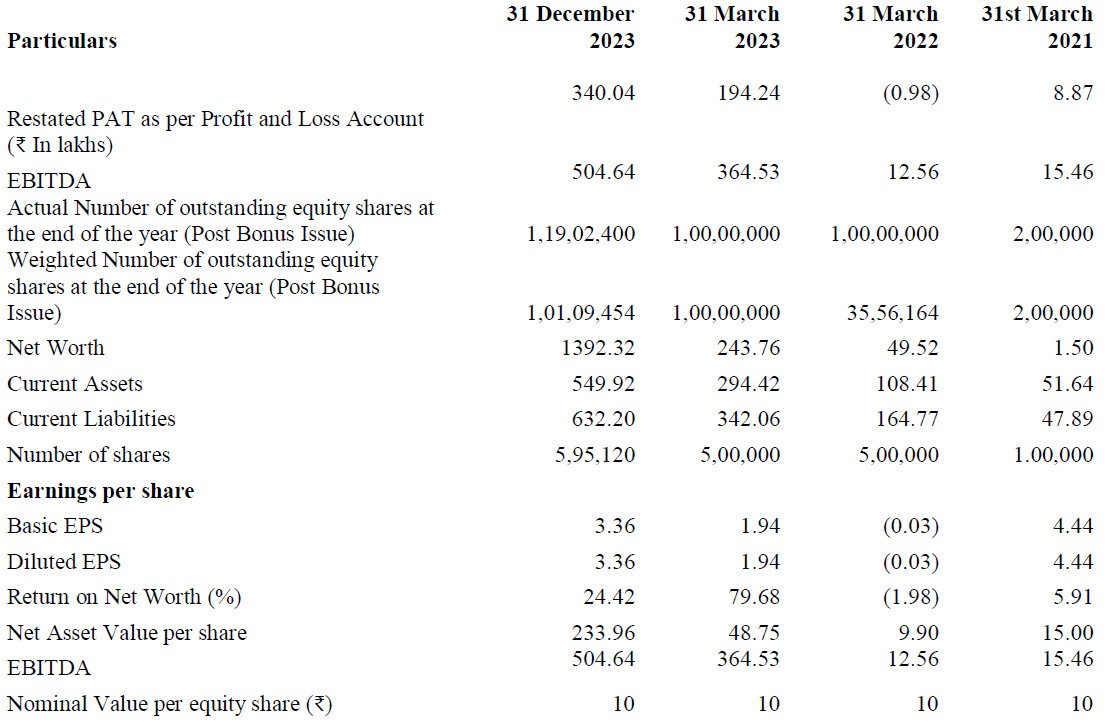

Nephro Care India IPO has shown remarkable financial performance over recent years. Between the financial years ending March 31, 2022, and March 31, 2023, the company’s revenue surged by an impressive 398.84%, while profit after tax (PAT) skyrocketed by an astounding 19,920.41%. This exponential growth reflects Nephro Care India’s commitment to expanding its services and enhancing operational efficiency.

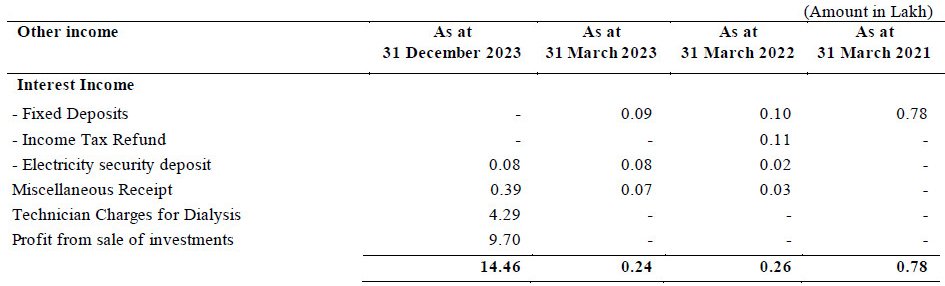

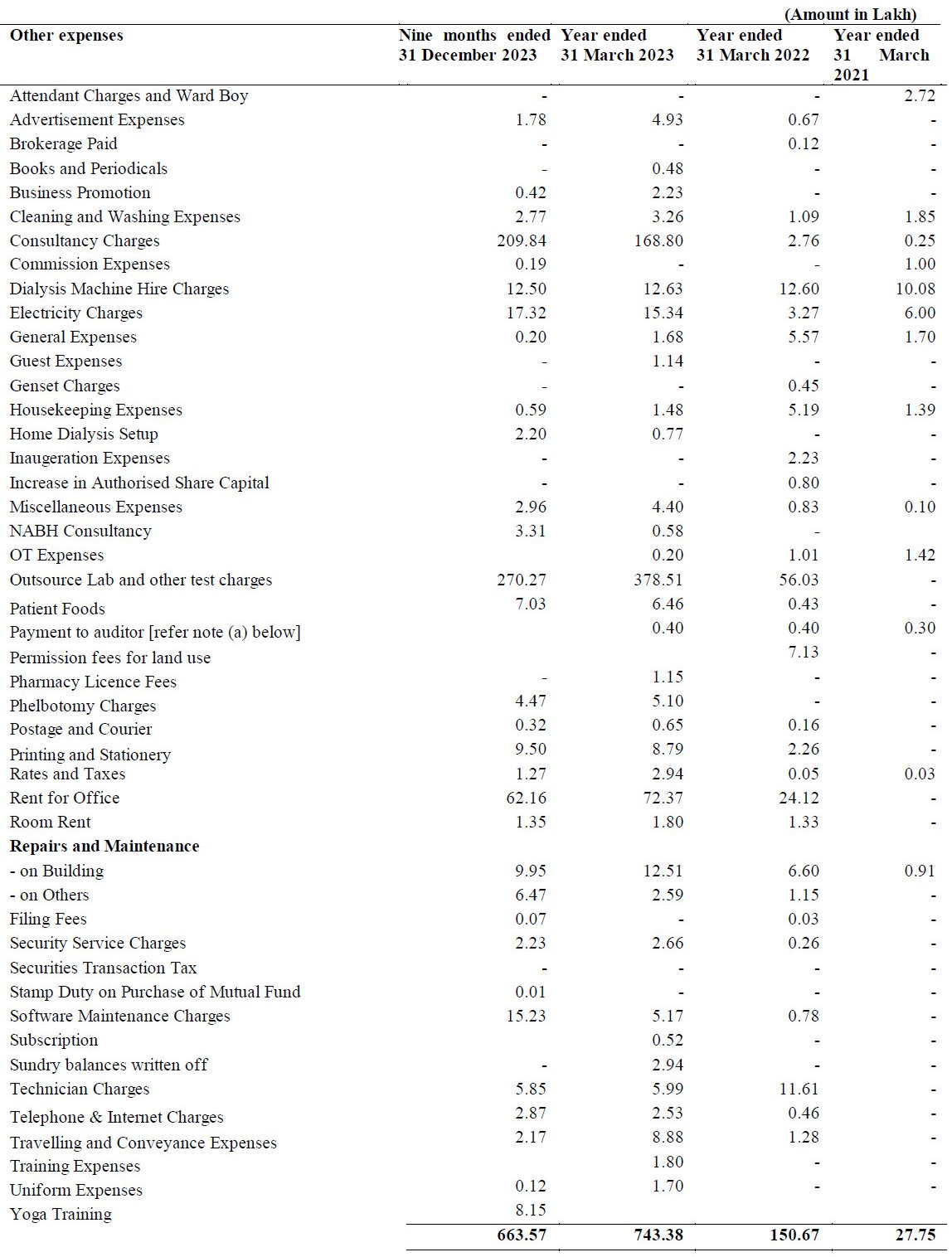

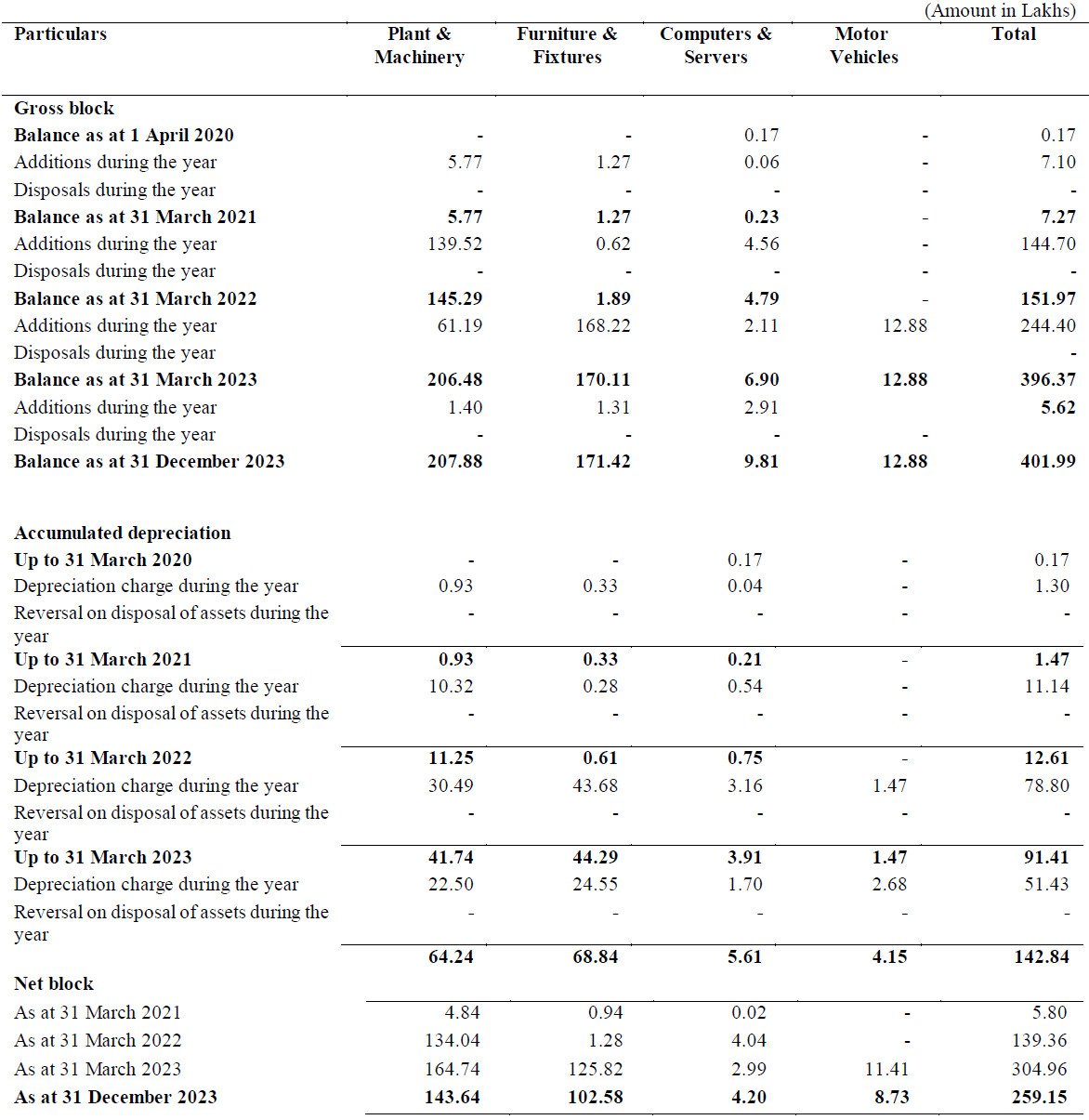

As of December 31, 2023, Nephro Care India reported assets amounting to ₹2,029.85 lakhs, a significant increase from ₹831.11 lakhs recorded on March 31, 2023. The company’s revenue for the period ended December 31, 2023, stood at ₹1,989.60 lakhs, showing a notable rise from ₹1,709.51 lakhs for the year ended March 31, 2023. Comparatively, the revenue for the year ending March 31, 2022, was ₹342.70 lakhs, highlighting the substantial growth over a short period. Profit after tax for the period ended December 31, 2023, reached ₹340.04 lakhs, up from ₹194.24 lakhs as of March 31, 2023. In contrast, the company had reported a loss of ₹0.98 lakhs for the year ending March 31, 2022.

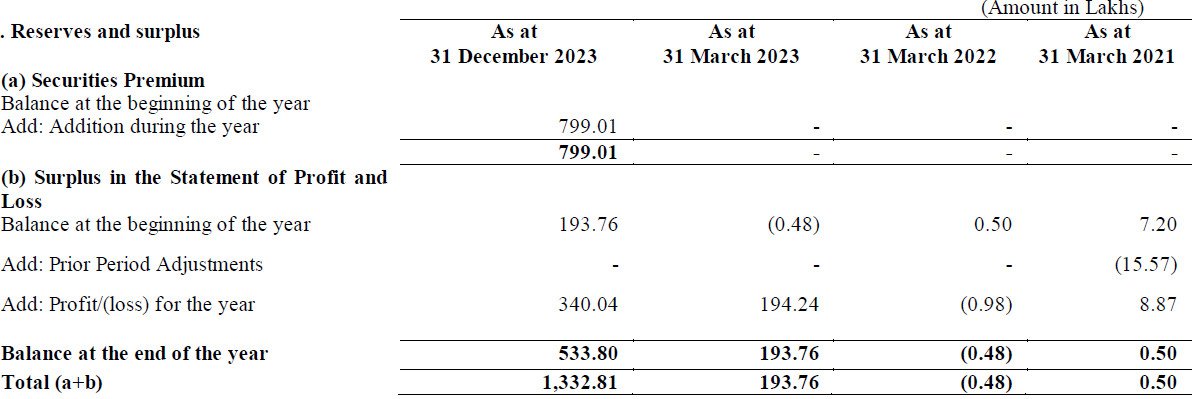

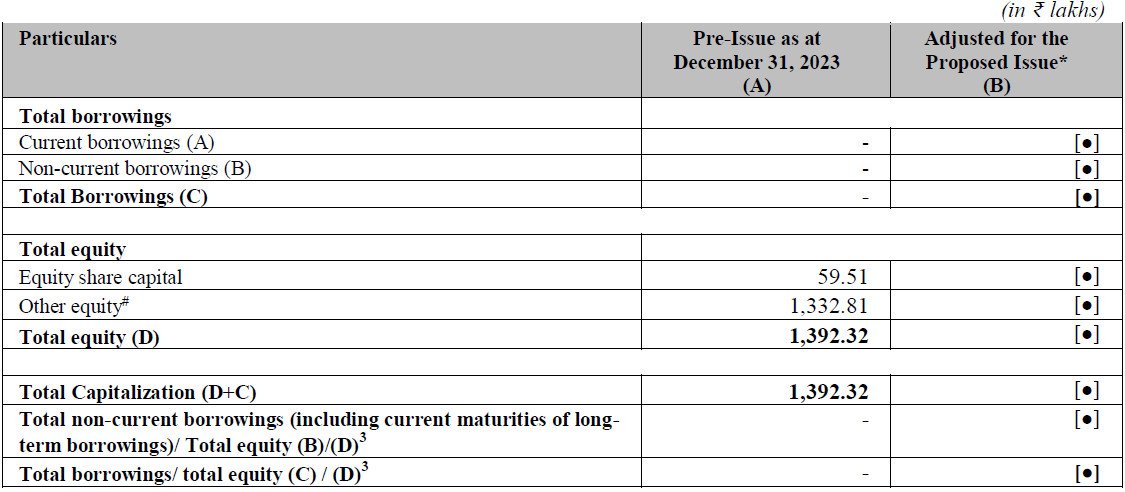

The net worth of Nephro Care India as of December 31, 2023, was ₹1,392.32 lakhs, a significant rise from ₹243.76 lakhs on March 31, 2023. For the year ending March 31, 2022, the net worth was ₹49.52 lakhs, further emphasizing the company’s strong financial trajectory. Reserves and surplus increased to ₹1,332.81 lakhs as of December 31, 2023, from ₹193.76 lakhs on March 31, 2023. In comparison, reserves and surplus were negative at ₹-0.48 lakhs for the year ending March 31, 2022. Total borrowings stood at ₹246.39 lakhs as of March 31, 2023, slightly down from ₹253.74 lakhs in the previous year.

Nephro Care India IPO Valuations and Margins

Nephro Care India IPO has demonstrated significant improvements in its valuations and margins, highlighting its strong market position and potential for future growth. The earnings per share (EPS) for the financial year 2023 was ₹1.94, a notable improvement from ₹-0.03 in 2022, though a slight decline from ₹4.44 in 2021. The price-to-earnings (PE) ratio for 2023 ranged between 43.81 and 46.39, indicating strong investor confidence in the company’s future performance.

The return on net worth (RONW) for 2023 was 79.68%, a substantial turnaround from the negative -1.98% in 2022, though it was exceptionally high at 591.33% in 2021. The net asset value (NAV) for the financial year 2023 was ₹2.44, up from ₹0.50 in 2022 and ₹0.75 in 2021. The return on capital employed (ROCE) also saw a significant rise to 71.09% in 2023 from 4.13% in 2022, indicating improved operational efficiency and profitability.

The EBITDA margin for Nephro Care India IPO increased to 21.33% in 2023 from 3.67% in 2022, showcasing the company’s effective cost management and revenue generation strategies. In 2021, the EBITDA margin was 8.47%. The debt-to-equity ratio also improved significantly, standing at 1.68 in 2023, down from 9.95 in 2022 and 14.28 in 2021, reflecting the company’s efforts to reduce leverage and strengthen its financial stability.

The robust financial growth of Nephro Care India IPO underscores the company’s ability to enhance its revenue streams and profitability. The notable increase in EPS, RONW, and EBITDA margins for the financial year 2023 reflects the company’s strategic focus on improving operational efficiencies and expanding its service offerings. As Nephro Care India continues to leverage its strengths and expand its market reach, the financial metrics indicate a promising future for the company and its stakeholders.

For investors considering the Nephro Care India IPO, these financial details provide a comprehensive overview of the company’s growth trajectory and financial health. Stay updated on Nephro Care India IPO as the company continues to make significant strides in the healthcare sector.

Statement Of Revenue From Operations

Statement of Other Income

Statement of Other Expenses

Statement of Property, Plant and Equipment

Statement of Reserves & Surplus

Statement of Capitalisation

Financial Ratios

5.Nephro Care India IPO FAQs

Nephro Care India IPO Details

The issue price range for Nephro Care India IPO is ₹85.00 to ₹90.00 per share.

The Nephro Care India IPO opens on June 28, 2024.

The Nephro Care India IPO closes on July 2, 2024.

The total issue size of Nephro Care India IPO is ₹41.26 crore.

Nephro Care India IPO is a Book Build Issue.

Nephro Care India IPO will be listed on the NSE SME platform.

The face value of Nephro Care India shares in the IPO is ₹10 per equity share.

Nephro Care India IPO Dates

The basis of allotment for Nephro Care India IPO will be finalized on July 3, 2024.

Refunds for Nephro Care India IPO will be initiated on July 4, 2024.

Shares will be credited to Demat accounts on July 4, 2024.

The tentative listing date for Nephro Care India IPO is July 5, 2024.

Nephro Care India IPO Issue Details

One market lot in Nephro Care India IPO consists of 1,600 shares.

The minimum amount required to apply for one lot is ₹144,000.

The minimum number of shares required for HNI investors is 3,200 shares (2 lots), amounting to ₹288,000.

Nephro Care India's Business Model

Nephro Care India was founded by Dr. Pratim Sengupta in 2014.

Nephro Care India is based in Kolkata.

Nephro Care India offers in-house dialysis, outpatient services in nephrology, diabetology, cardiology, ophthalmology, and neurology, NABL accredited pathology, pharmacy, diagnostic facilities, renal nutrition, home care, and home dialysis.

Nephro Care India operates one flagship clinic in Salt Lake, Kolkata, and three satellite clinics, including locations in Chandannagar and another in Salt Lake (HB 113).

Nephro Care India's Financial Data

Nephro Care India’s revenue for the period ending December 31, 2023, was ₹1,989.60 lakhs.

Nephro Care India’s profit after tax increased from ₹-0.98 lakhs in 2022 to ₹194.24 lakhs in 2023.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Nephro Care India IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Nephro Care India IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Nephro Care India IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Nephro Care India IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.