Table of Contents

Macobs Technologies Limited IPO introduces a pioneering player in the male grooming industry, established in October 2019. Specializing in below-the-belt grooming, Macobs Technologies operates exclusively through its e-commerce platform, https://menhood.in/, foregoing traditional retail outlets. Beyond its innovative product line, which includes specialized trimmers and male skincare essentials, the company advocates for societal change through digital platforms. By promoting open conversations and awareness about male grooming, Macobs Technologies aims to redefine industry standards. With a commitment to innovation and safety, their products cater specifically to the unique needs of men, emphasizing efficacy and customer satisfaction.

Macobs Technologies Limited IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

16th July 2024 | 19th July 2024 | 22nd July 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 23rd July 2024 | 23rd July 2024 | 24th July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹19.46 Cr | ₹ 71.00 – ₹ 75.00 | 1600 Shares | 2,595,200 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 1600 | ₹ 1,20,000 |

| Retail(Max) | 1 | 1600 | ₹ 1,20,000 |

| Small-HNI (Min) | 2 | 3200 | ₹ 2,40,000 |

| Small-HNI (Max) | 8 | 12800 | ₹ 9,60,000 |

| Big-HNI (Min) | 9 | 14400 | ₹ 10,80,000 |

| RII (Retail) | NII | QIB |

| 35.00% | 35.00% | 30.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 65.00% | – | NSE SME |

| No | Objectives |

| 1 | Customer Acquisition – Marketing & Awareness |

| 2 | Prepayment or repayment of a portion of certain outstanding borrowings availed by the company |

| 3 | Working Capital Requirements |

| 4 | General corporate purposes |

| 5 | To meet the Issue expenses |

| LEAD | REGISTRAR |

| SKI CAPITAL SERVICES LIMITED | MAASHITLA SECURITIES PRIVATE LIMITED |

| Telephone | |

| compliance@macobstech.com | +91 8062195170 |

Macobs Technologies Limited IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Financial of Macobs Technologies Limited IPO

| Amounts in Lakhs ₹ | |||

| Particulars | FY-2024 | FY-2023 | FY-2022 |

| Assets | 1,443 | 595 | 153 |

| Revenue | 2,075 | 1,483 | 602 |

| Expense | 1,776 | 1,209 | 549 |

| Net Worth | 720 | 1 | 1 |

| Borrowing | 250 | 107 | 21 |

| EBITDA(%) | 16.55 | 19.32 | 9.38 |

| Reserves | 262.77 | 243.50 | 39.00 |

| PAT | 221.27 | 204.5 | 38.89 |

| EPS | 4.43 | 4.10 | 0.78 |

| Debt/Equity | 0.25 | 0.44 | 0.52 |

| Established | Website | Industry |

| 2018 | macobstech.com | E-COMMERCE |

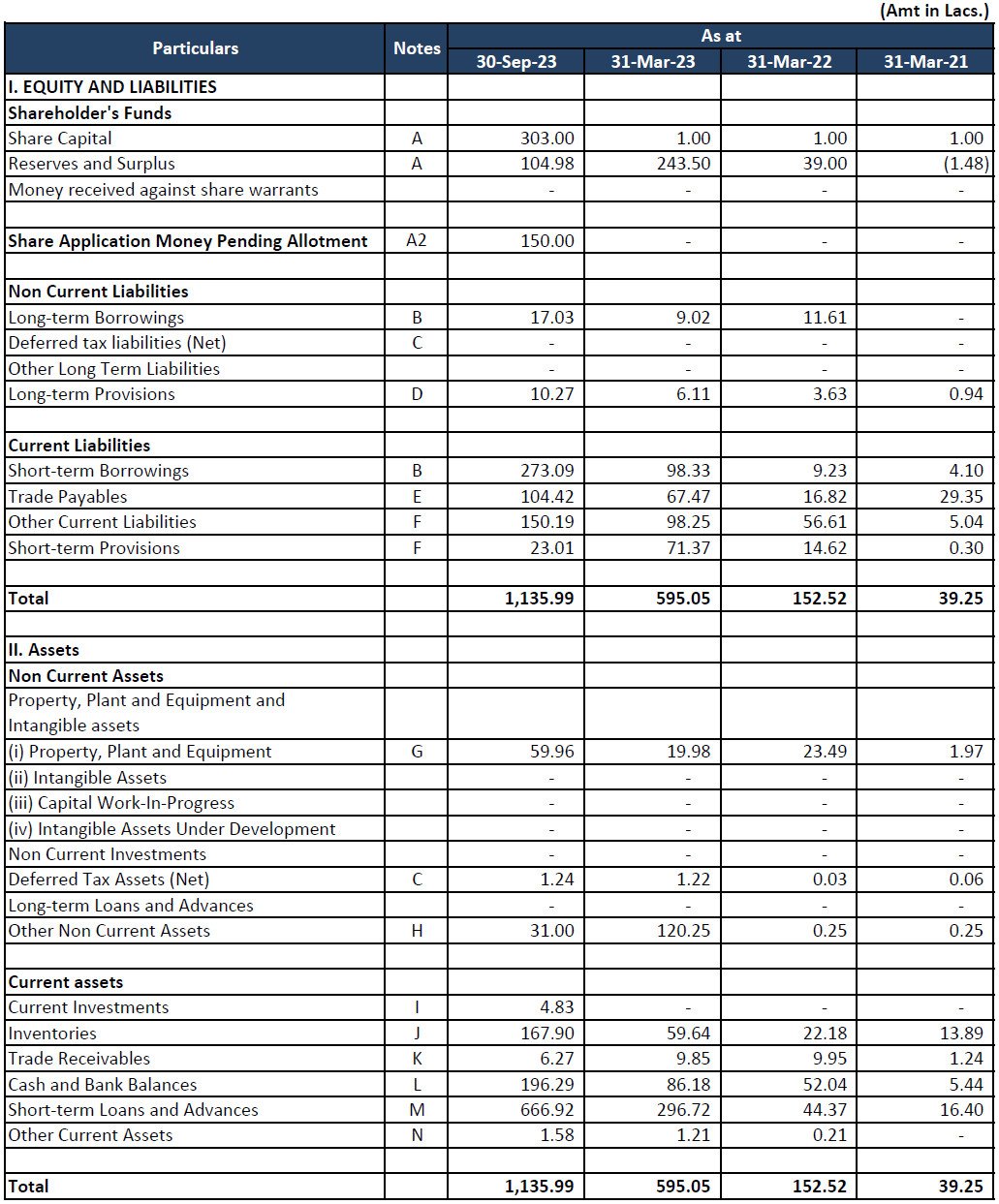

Statement of Assets and Liabilities

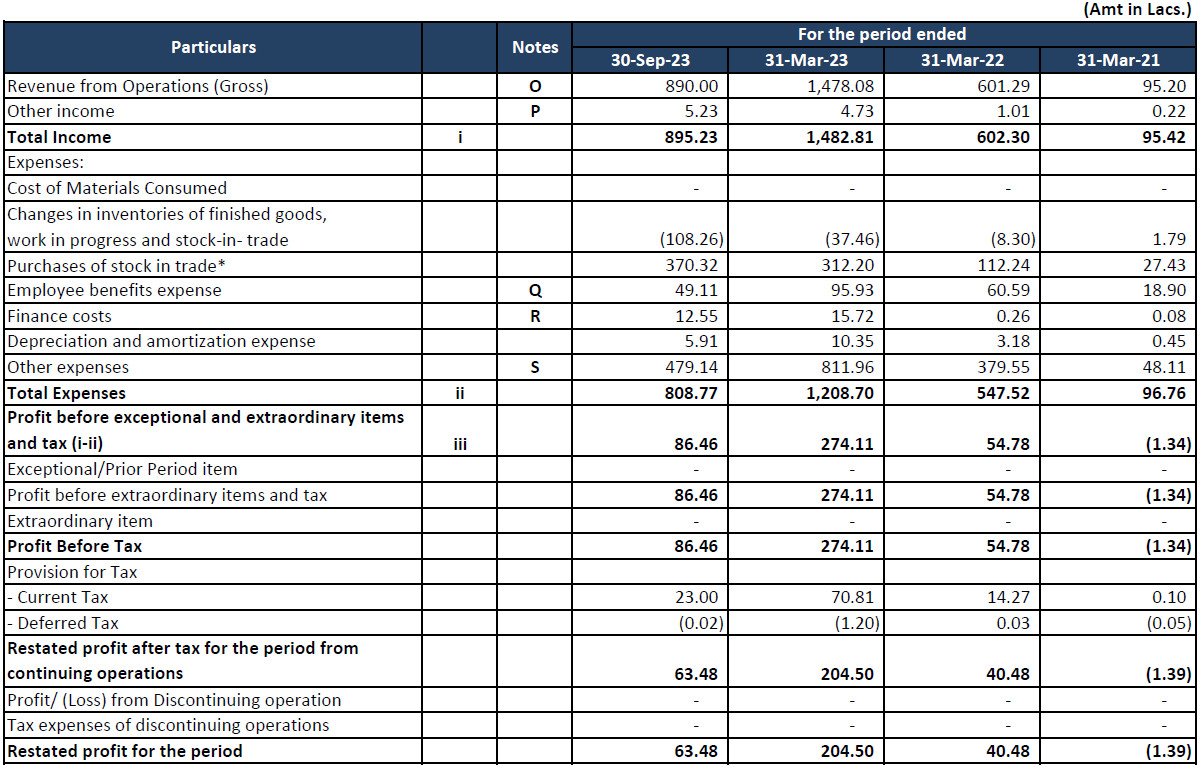

Statement of Profit and Loss

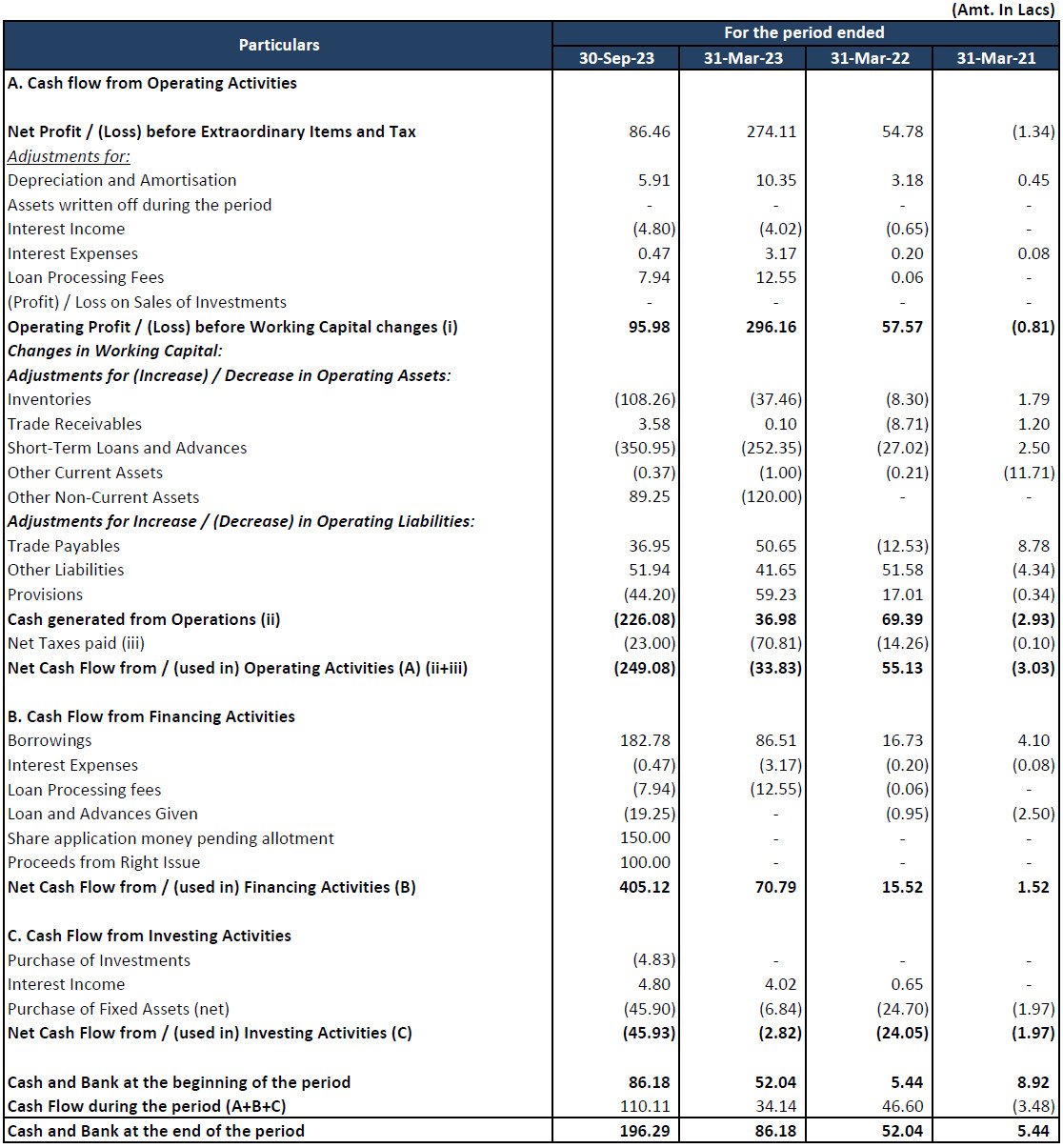

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Macobs Technologies Limited IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Macobs Technologies Limited IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Macobs Technologies Limited IPO and other offerings a more informed and confident endeavor.

1. Macobs Technologies Limited IPO key dates & Issue Details

The eagerly anticipated Macobs Technologies Limited IPO is set to open for subscription on 16th July 2024 and will close on 19th July 2024. This SME IPO is priced between ₹71.00 to ₹75.00 per share, offering an attractive investment opportunity for retail and institutional investors. The IPO aims to raise ₹19.46 crores through a fresh issue, which will be listed on the NSE SME platform. Notably, 35% of the offer is reserved for retail investors. This book build issue has a face value of ₹10 per equity share, with specific details on the SME IPO discount yet to be announced. Pre-IPO, the promoters hold 65% of the shares, and post-IPO promoter holding details will be disclosed later.

Important Dates for Macobs Technologies Limited IPO

Investors keen on the Macobs Technologies Limited IPO should note the following key dates. The basis of allotment is expected to be finalized by 22nd July 2024, followed by the initiation of refunds on 23rd July 2024. Shares will be credited to the demat accounts of successful applicants on the same day, 23rd July 2024. Finally, the listing date on the NSE SME is tentatively scheduled for 24th July 2024. These dates are crucial for investors to track the progress of their applications and the eventual listing of the shares.

Macobs Technologies Limited IPO Lot Details

The Macobs Technologies Limited IPO offers shares in lots of 1600, with each lot priced between ₹71.00 and ₹75.00, amounting to ₹120,000 per lot. For High Net-worth Individuals (HNIs), the minimum purchase requirement is two lots, or 3200 shares, translating to an investment of ₹240,000. This structured approach ensures a significant allotment for investors looking to make substantial investments in this promising SME IPO.

The Macobs Technologies Limited IPO presents a compelling opportunity for investors to participate in the growth of a dynamic company. With its strategic listing on the NSE SME and favorable pricing, it is poised to attract substantial interest from the investing community. Keep a close eye on the important dates and allotment details to make the most of this investment opportunity.

2. Macobs Technologies Limited IPO Allotment Status

Dive into the excitement surrounding the Macobs Technologies Limited IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Macobs Technologies Limited IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Macobs Technologies Limited IPO journey.

3. Introduction to Macobs Technologies Limited IPO

The Macobs Technologies Limited IPO marks a significant entry into the public market for a company operating within the male grooming industry. Specializing in below-the-belt grooming, Macobs Technologies Limited stands out by focusing exclusively on e-commerce channels, particularly through their website, [https://menhood.in/](https://menhood.in/). This approach addresses a notable market gap, especially in regions where discussions about such personal care aspects are limited. The company’s product range includes specialized trimmers for sensitive areas, hygiene products tailored for male skin, and a variety of self-care items, all developed with a commitment to innovation, safety, and effectiveness.

Market Overview and Strategy

Operating within the dynamic and rapidly evolving male grooming market, Macobs Technologies Limited targets the niche area of below-the-belt care. The male grooming market, traditionally focused on general skincare and shaving products, has expanded to include specialized grooming needs, driven by increasing awareness and acceptance of male personal care. Cultural shifts towards more sophisticated grooming routines among men and the influence of social media and digital marketing significantly shape consumer trends in this industry.

The Macobs Technologies Limited IPO allows the company to leverage the e-commerce boom, making their diverse range of products accessible to a broader audience. The company’s strategy includes localized marketing efforts, understanding regional consumer preferences, and using digital platforms to educate potential customers. This strategic approach highlights the importance of continuous innovation, adapting to consumer preferences, and effective marketing to capture and retain a diverse and evolving customer base.

Business Process and Client Base

The business process of Macobs Technologies Limited is streamlined and efficient, encompassing product sourcing, inventory management, product listing, digital marketing, customer order processing, order fulfillment, customer service, and data analysis. Their focus on direct-to-consumer sales means they cater to a vast and diverse customer base, making it impractical to delineate specific details about a small subset of top customers.

Operational Infrastructure

Macobs Technologies Limited operates from multiple locations across India, including their registered office in Jaipur, corporate office in Gurugram, correspondence office in Maharashtra, warehouse in Bangalore, and coworking offices in Telangana and Kolkata. Their e-commerce portal is hosted on cloud servers, eliminating the need for physical infrastructure. The company’s operational energy and water needs are modest and adequately met within their current premises.

Marketing Strategy

The marketing strategy of Macobs Technologies Limited focuses on digital marketing, targeted advertising, customer engagement and retention, market segmentation and personalization, e-commerce optimization, data-driven decision making, and educational and awareness campaigns. This comprehensive approach ensures that their marketing efforts are aligned with consumer behavior and preferences, driving growth and customer loyalty.

Business Strategy

The business strategy of Macobs Technologies Limited centers on providing innovative grooming solutions specifically tailored for men, particularly in the often-overlooked area of below-the-belt grooming. Their approach includes product innovation and diversity, educational resources and awareness, a customer-centric approach, open and empowering brand messaging, and an emphasis on well-being and confidence. This strategy not only differentiates the brand in a competitive market but also helps build a loyal customer base that resonates with the brand’s philosophy.

History and Corporate Matters

Originally incorporated as “Macobs Technologies Private Limited” on October 14, 2019, the company transitioned to “Macobs Technologies Limited” with a fresh Certificate of Incorporation issued on August 07, 2023. The Macobs Technologies Limited IPO represents a pivotal moment in the company’s history, poised to make a significant impact in the male grooming industry.

This introduction to the Macobs Technologies Limited IPO provides a comprehensive overview of the company’s business model, market strategy, operational infrastructure, and marketing efforts, highlighting their commitment to innovation, customer satisfaction, and market leadership in the male grooming industry.

4. Financial Details of Macobs Technologies Limited

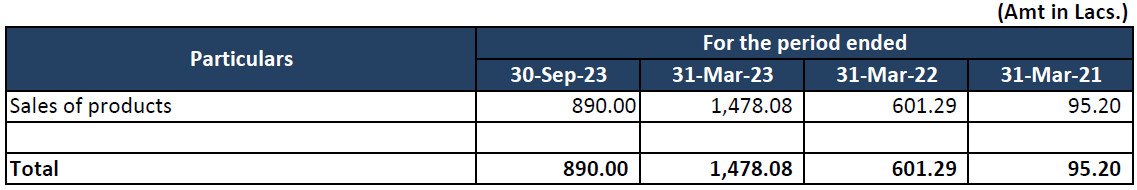

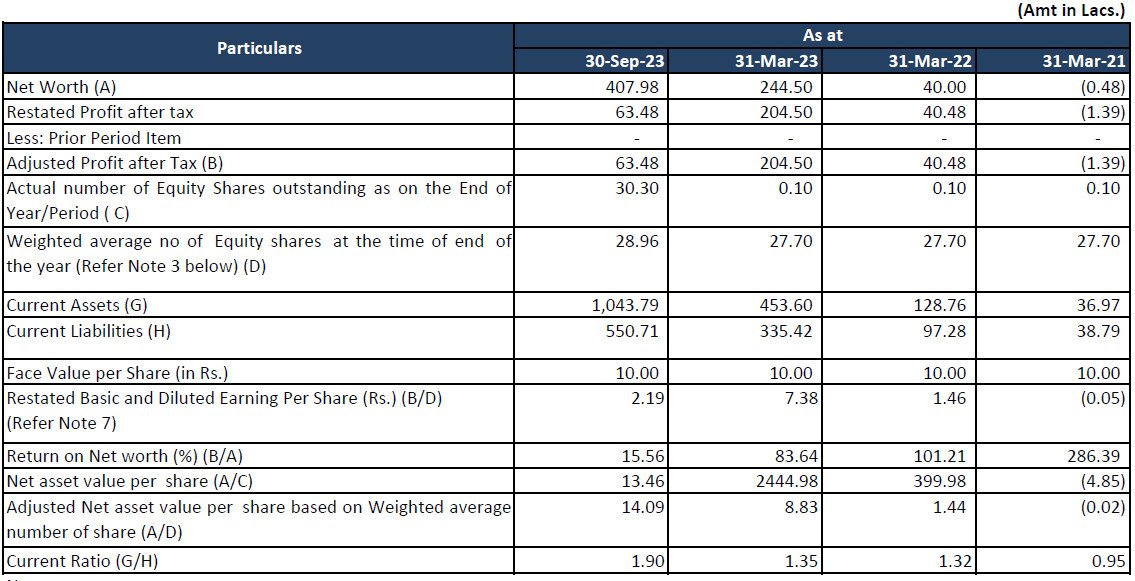

The financial performance of Macobs Technologies Limited IPO reflects a robust growth trajectory, with significant improvements in revenue and profit margins. For the financial year ending March 31, 2024, the company’s revenue surged by 39.91%, reaching ₹2,074.67 lakhs, up from ₹1,482.81 lakhs in the previous year. Correspondingly, the profit after tax (PAT) increased by 8.2%, from ₹204.50 lakhs in FY 2023 to ₹221.27 lakhs in FY 2024. This impressive growth underscores the company’s strategic initiatives and strong market presence.

Asset and Financial Position

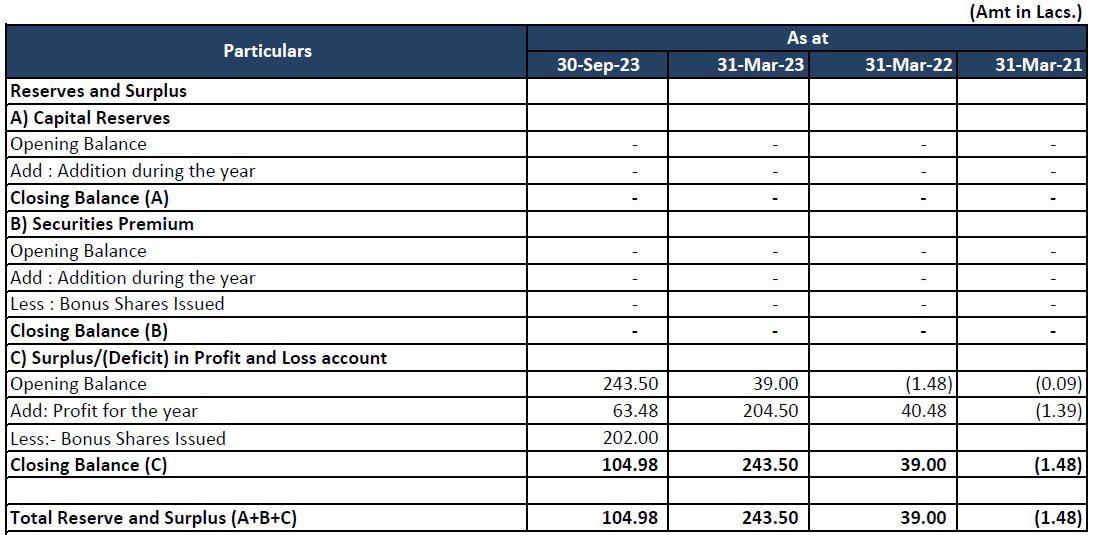

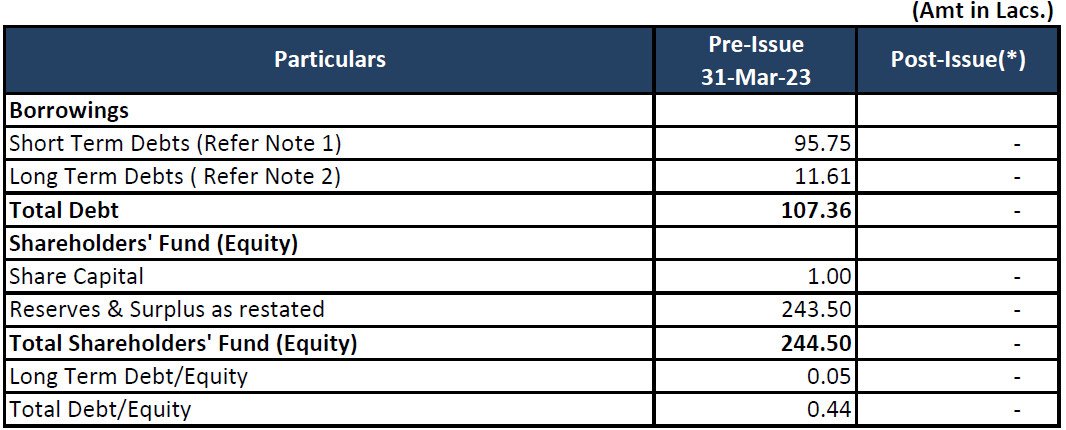

As of March 31, 2024, Macobs Technologies Limited IPO reported total assets of ₹1,443.44 lakhs, a substantial increase from ₹595.05 lakhs in FY 2023 and ₹152.51 lakhs in FY 2022. The company’s net worth also saw a remarkable rise, reaching ₹720.00 lakhs in FY 2024 from a mere ₹1.00 lakh in FY 2023. This growth in net worth is accompanied by an increase in reserves and surplus, which stood at ₹262.77 lakhs in FY 2024, compared to ₹243.50 lakhs in FY 2023 and ₹39.00 lakhs in FY 2022. Additionally, the total borrowing increased to ₹250.14 lakhs in FY 2024 from ₹107.35 lakhs in FY 2023, indicating the company’s strategic investment in growth and expansion.

Valuation and Margins

The valuation metrics of Macobs Technologies Limited IPO highlight its financial health and market potential. The earnings per share (EPS) increased from 0.78 in FY 2022 to 4.10 in FY 2023 and further to 4.43 in FY 2024. The price-to-earnings (PE) ratio for FY 2024 is estimated to be between 16.03 and 16.93, reflecting investor confidence in the company’s growth prospects.

The return on net worth (RONW) for Macobs Technologies Limited IPO stands at 22.52% in FY 2024, a decrease from 83.64% in FY 2023 and 97.23% in FY 2022, indicating a more sustainable growth trajectory. The net asset value (NAV) has significantly improved, reaching 13.65 in FY 2024, up from 3.40 in FY 2023 and 0.56 in FY 2022. Furthermore, the return on capital employed (ROCE) remains robust at 30.53% in FY 2024, though it has decreased from 106.02% in FY 2023 and 96.30% in FY 2022.

Debt and Profitability Ratios

Macobs Technologies Limited IPO maintains a healthy debt-to-equity ratio of 0.25 in FY 2024, improving from 0.44 in FY 2023 and 0.52 in FY 2022. The company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) margin is 16.55% in FY 2024, slightly down from 19.32% in FY 2023 but up from 9.38% in FY 2022. These financial indicators demonstrate the company’s effective management of debt and profitability, positioning it well for future growth.

The Macobs Technologies Limited IPO showcases a compelling financial performance, underpinned by strong revenue growth, robust asset base, and healthy profitability margins. Investors considering the Macobs Technologies Limited IPO can be assured of the company’s solid financial foundation and promising market potential.

Statement Of Revenue From Operations

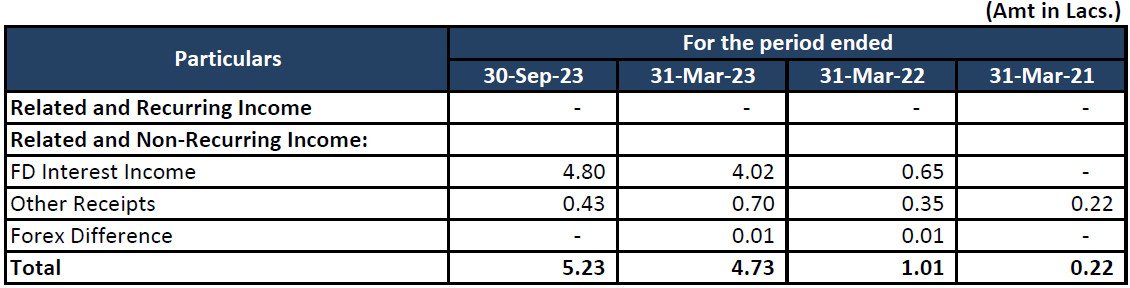

Statement of Other Income

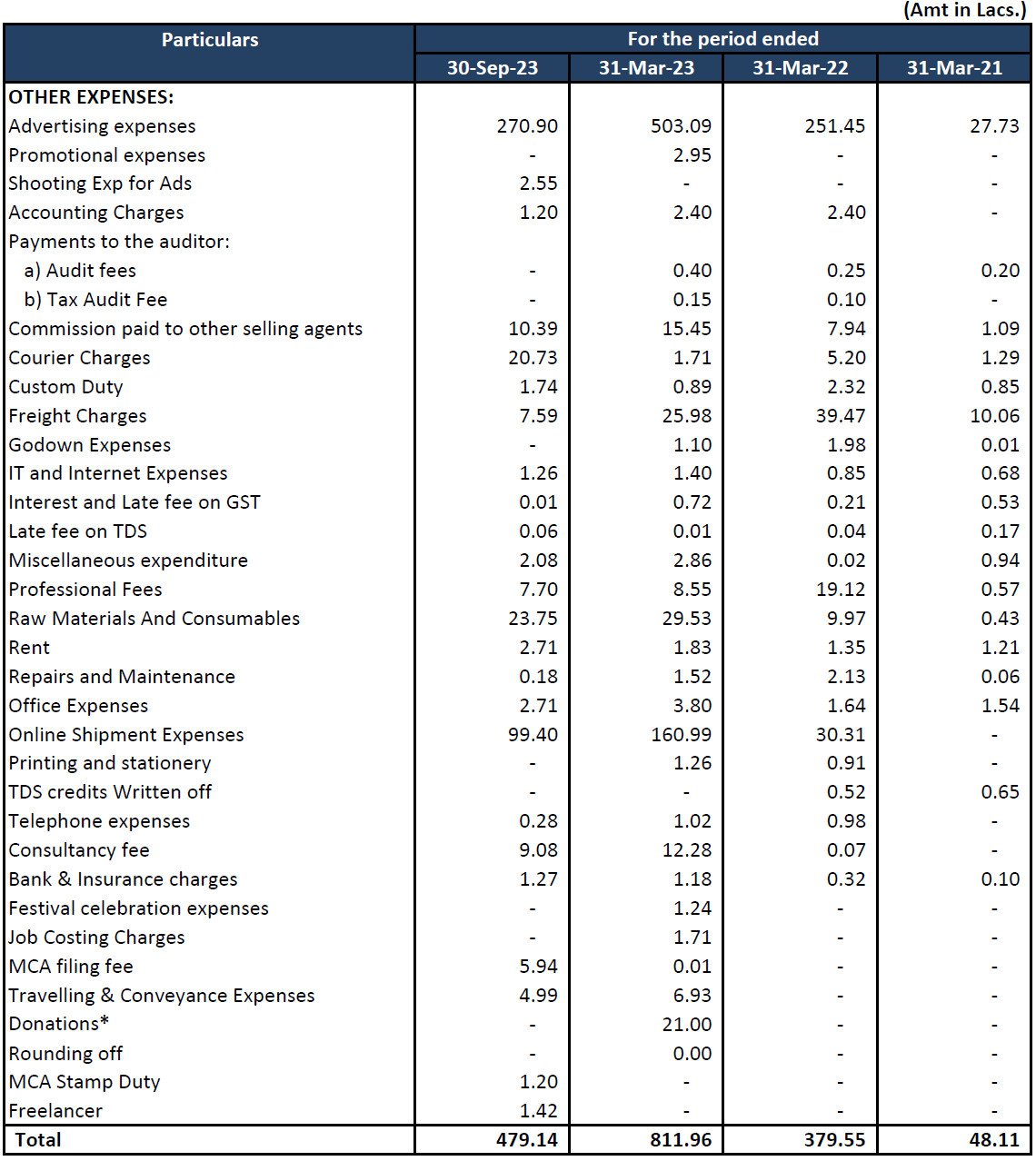

Statement of Other Expenses

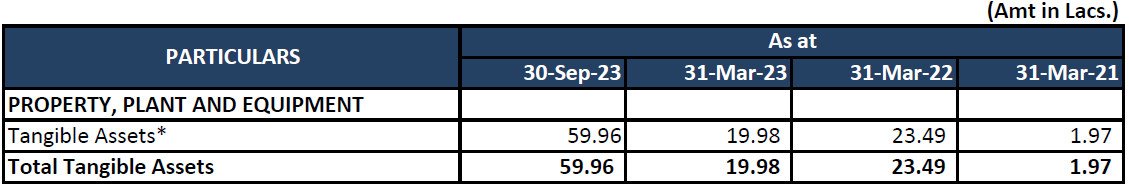

Statement of Property, Plant and Equipment

Statement of Reserves & Surplus

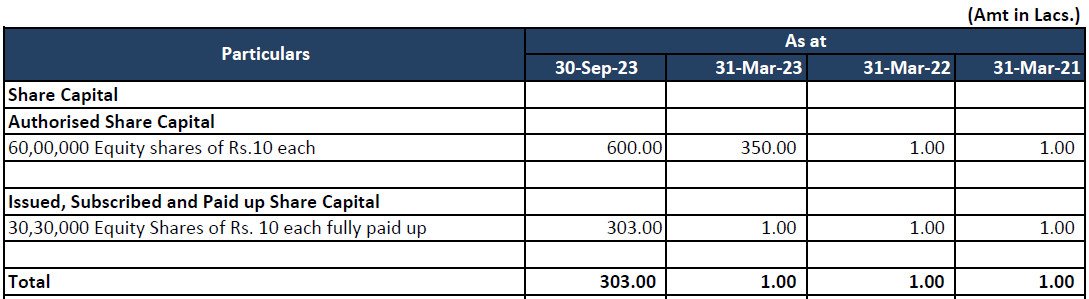

Statement of Equity Share Capital

Statement of Capitalisation

RATIO ANALYSIS

Financial Ratios

5. Macobs Technologies Limited IPO FAQs

IPO Details

The Macobs Technologies Limited IPO opens on July 16, 2024, and closes on July 19, 2024.

The issue price range for the Macobs Technologies Limited IPO is ₹71.00 to ₹75.00 per share.

The total issue size of the Macobs Technologies Limited IPO is ₹19.46 crore.

The specific number of shares offered in the Macobs Technologies Limited IPO is not provided but can be inferred from the total issue size and issue price range.

The Macobs Technologies Limited IPO is a book build issue.

IPO Dates

The basis of allotment date for the Macobs Technologies Limited IPO is July 22, 2024.

Refunds for the Macobs Technologies Limited IPO will be initiated on July 23, 2024.

The shares will be credited to the demat accounts on July 23, 2024.

The listing date for the Macobs Technologies Limited IPO is July 24, 2024.

The Macobs Technologies Limited IPO will be listed on the NSE SME.

Issue Details

The face value of each share in the Macobs Technologies Limited IPO is ₹10 per equity share.

35.00% of the offer is allocated to retail investors.

The market lot size for the Macobs Technologies Limited IPO is 1600 shares.

The minimum amount required to invest is ₹120,000 (1600 shares x ₹75).

Business Model

Macobs Technologies Limited focuses on the male grooming industry, specifically specializing in below-the-belt grooming.

Macobs Technologies Limited conducts its business exclusively through e-commerce channels, such as their website menhood.in.

Macobs Technologies Limited offers specialized trimmers, hygiene products tailored for male skin, and a variety of self-care items.

No, Macobs Technologies Limited does not maintain physical stores; it operates solely through online channels.

Financial Data

The revenue for the year ending March 31, 2024, was ₹2,074.67 lakhs.

The profit after tax for the year ending March 31, 2024, was ₹221.27 lakhs.

The net worth of Macobs Technologies Limited as of March 31, 2024, is ₹720.00 lakhs.

The EPS for FY 2024 is 4.43.

The RONW percentage for FY 2024 is 22.52%.

The debt-to-equity ratio in FY 2024 is 0.25.

The EBITDA margin for FY 2024 is 16.55%.

The total borrowing as of March 31, 2024, was ₹250.14 lakhs.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Macobs Technologies Limited IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Macobs Technologies Limited IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Macobs Technologies Limited IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Macobs Technologies Limited IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.