Table of Contents

Kataria Industries IPO, launched by Kataria Industries Limited, a company incorporated in May 2004, aims to expand its manufacturing and supply capabilities for various industrial materials. With two state-of-the-art plants in Ratlam, Madhya Pradesh, Kataria Industries is a leading manufacturer of low relaxation prestressed concrete (LRPC) strands, steel wires, anchoring systems, single-wall HDPE pipes, couplers, and aluminum conductors. These products serve a wide range of sectors including infrastructure, roads, bridges, subways, railroads, high-rise buildings, nuclear reactors, LNG tanks, and power transmission lines. The company’s facilities are well-equipped with essential machinery and in-house testing to ensure high standards of quality.

Kataria Industries IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

16th July 2024 | 19th July 2024 | 22nd July 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 23rd July 2024 | 23rd July 2024 | 24th July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹54.58 Cr | ₹ 91.00 – ₹ 96.00 | 1200 Shares | 5,685,000 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 1200 | ₹ 1,15,200 |

| Retail(Max) | 1 | 1200 | ₹ 1,15,200 |

| Small-HNI (Min) | 2 | 2400 | ₹ 2,30,400 |

| Small-HNI (Max) | 8 | 9600 | ₹ 9,21,600 |

| Big-HNI (Min) | 9 | 10800 | ₹ 10,36,800 |

| RII (Retail) | NII | QIB |

| 35.00% | 15.00% | 50.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 100.00% | – | NSE SME |

| No | Objectives |

| 1 | Capital Expenditure for plant and machineries |

| 2 | Repayment of Debt |

| 3 | General corporate purposes |

| LEAD | REGISTRAR |

| INTERACTIVE FINANCIAL SERVICES LIMITED | BIGSHARE SERVICES PRIVATE LIMITED |

| Telephone | |

| info@katariagroup.co.in | 07412 299407 07412 261012 |

Kataria Industries IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Financial of Kataria Industries IPO

| Amounts in Lakhs ₹ | |||

| Particulars | FY-2024 | FY-2023 | FY-2022 |

| Assets | 12,003 | 15,059 | 12,787 |

| Revenue | 34,149 | 33,393 | 25,049 |

| Expense | 1,776 | 1,209 | 549 |

| Net Worth | 4,550 | 3,584 | 2,806 |

| Borrowing | 6,337 | 10,696 | 9,142 |

| EBITDA(%) | 16.55 | 19.32 | 9.38 |

| Reserves | 3,002 | 3,320 | 2,542 |

| PAT | 1,002 | 778 | 738 |

| EPS | 4.43 | 4.10 | 0.78 |

| Debt/Equity | 0.25 | 0.44 | 0.52 |

| Established | Website | Industry |

| 2004 | katariaindustries.co.in | Steel & Iron |

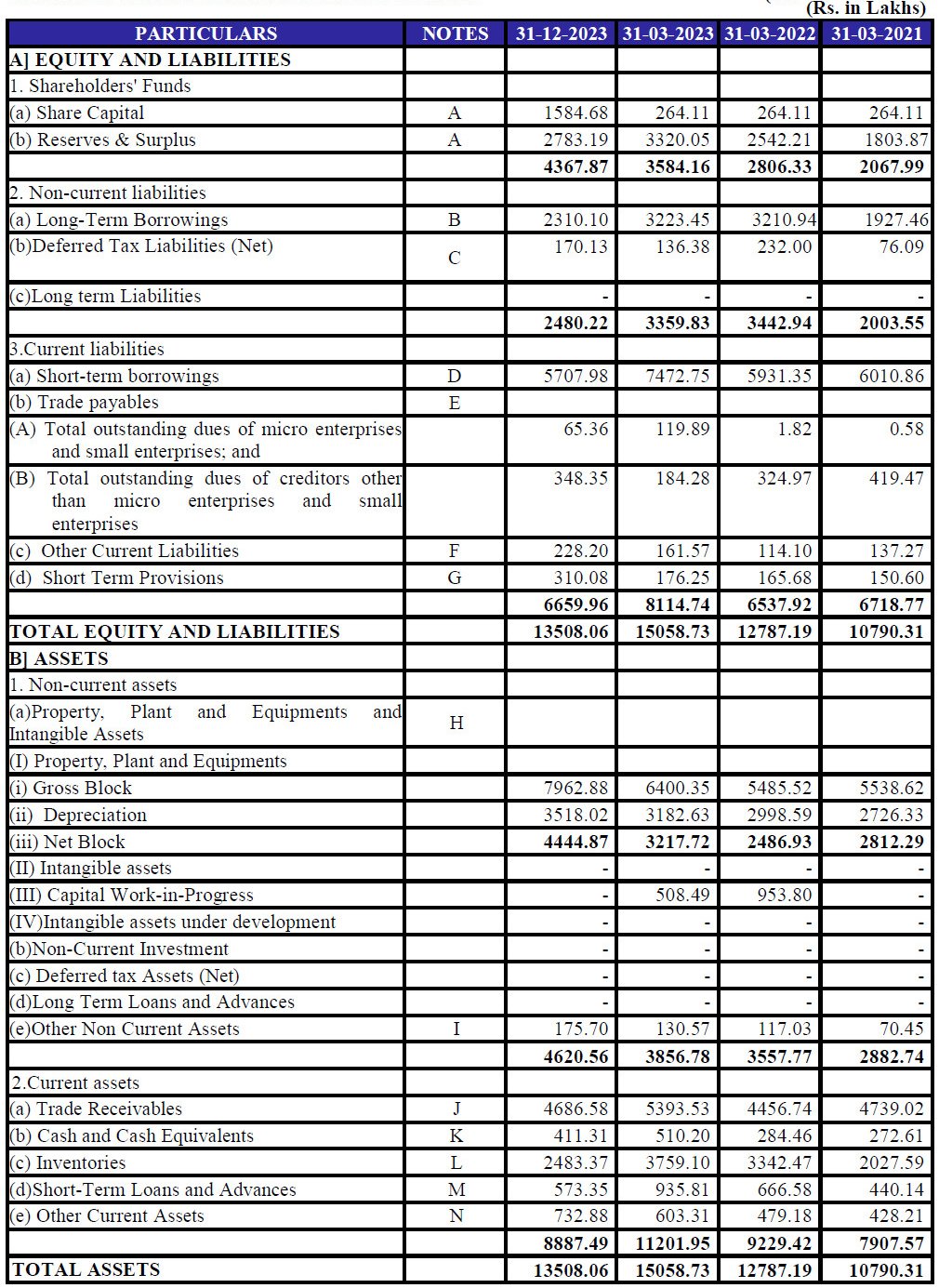

Statement of Assets and Liabilities

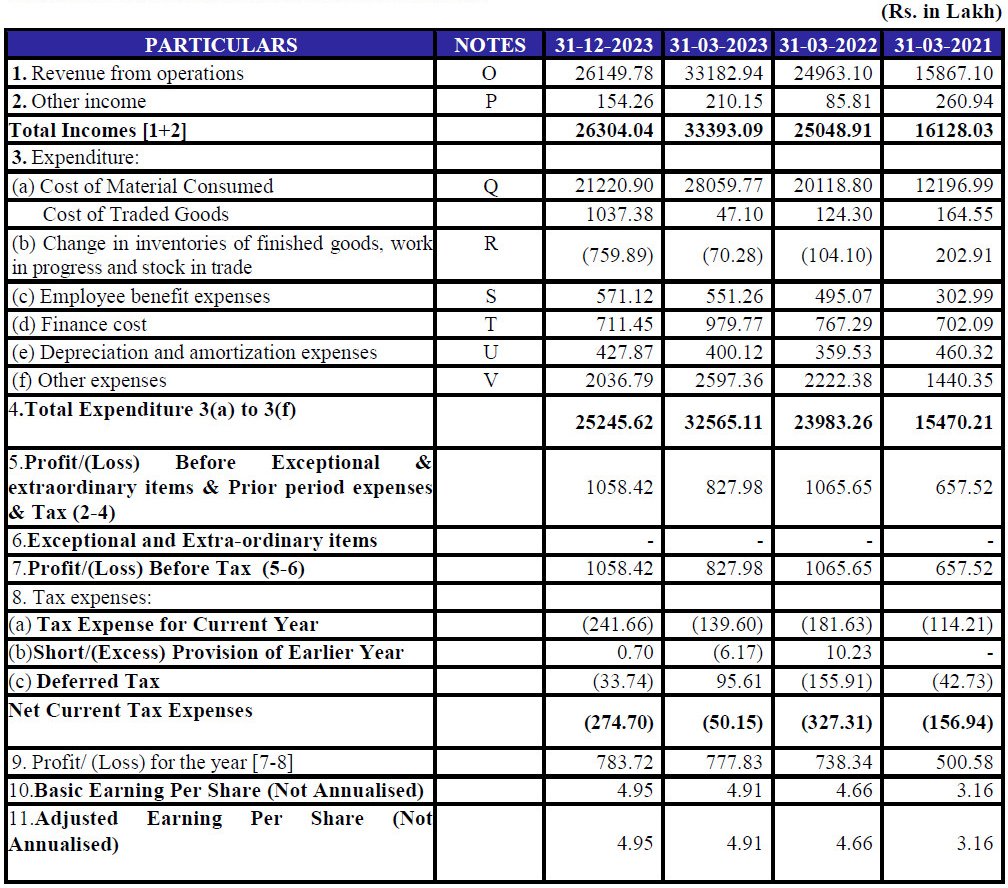

Statement of Profit and Loss

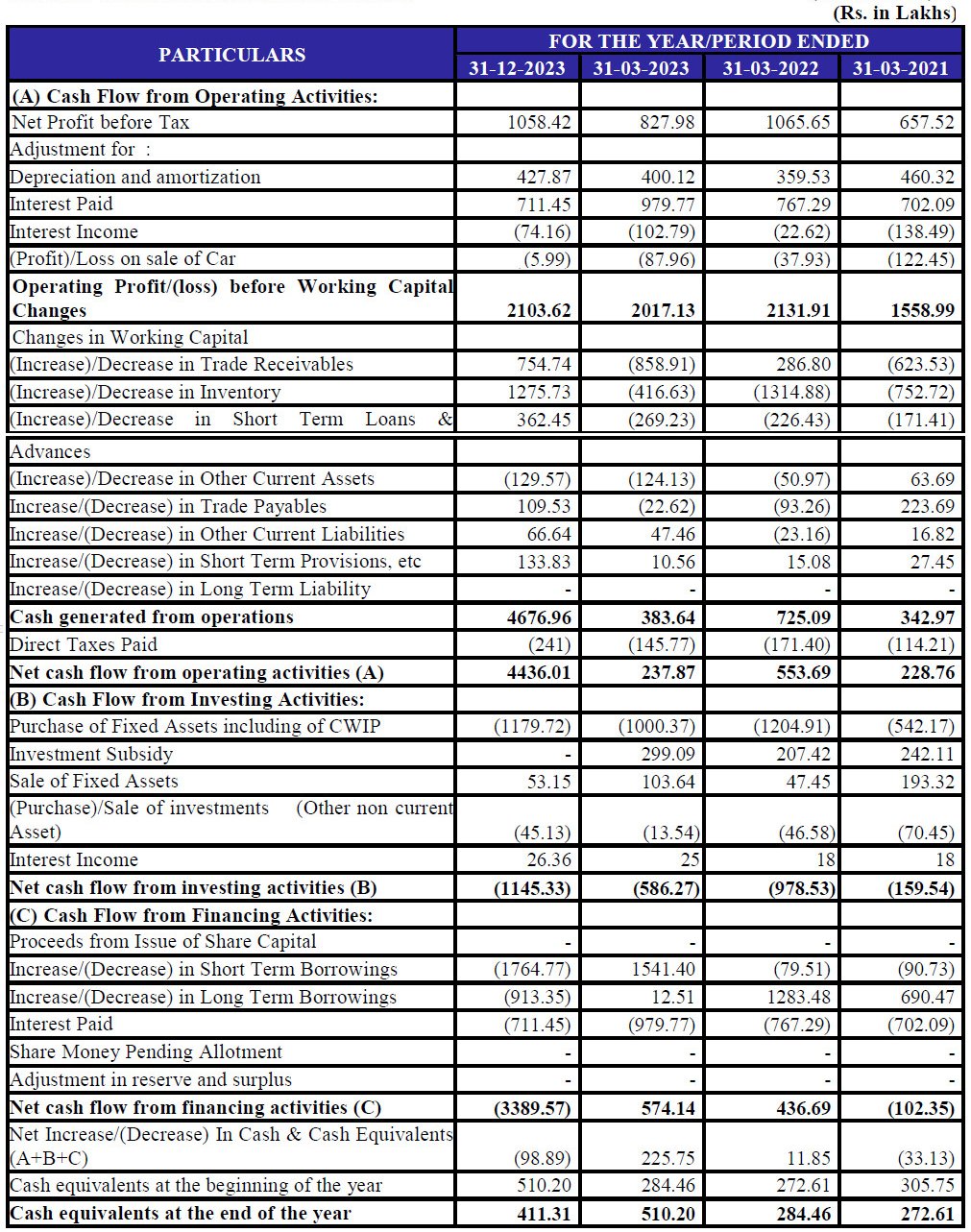

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Kataria Industries IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Kataria Industries IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Kataria Industries IPO and other offerings a more informed and confident endeavor.

1. Kataria Industries IPO key dates & Issue Details

The Kataria Industries IPO is set to launch on the 16th of July, 2024, providing a prime opportunity for investors to participate in this significant event. The IPO will remain open until the 19th of July, 2024, offering shares at a price range of ₹91.00 to ₹96.00 per share. This book build issue aims to raise ₹54.58 Cr through the fresh issuance of shares, each with a face value of ₹10.

The Kataria Industries IPO will be listed on the NSE SME platform. The retail quota is pegged at not less than 35% of the net issue, ensuring a substantial allocation for retail investors. The entire issue size of ₹54.58 Cr consists of fresh issues, making it a noteworthy event for the market. Pre-IPO, the promoter holding stands at 100%, with the post-IPO holding details yet to be disclosed. Investors should note that the discount applicable to the IPO is still to be determined.

The Kataria Industries IPO follows a tentative timeline, beginning with the basis of allotment date on the 22nd of July, 2024. Refunds will be initiated on the 23rd of July, 2024, coinciding with the credit of shares to Demat accounts. The much-anticipated listing date is scheduled for the 24th of July, 2024.

For those looking to invest in the Kataria Industries IPO, the market lot is set at 1200 shares, amounting to ₹115,200 for one lot. High net-worth individuals (HNIs) will need to purchase a minimum of 2400 shares, equivalent to two lots, with a total amount of ₹230,400. This structured lot size ensures that both retail and HNI investors have ample opportunity to participate in the IPO.

As we approach the Kataria Industries IPO opening, investors are encouraged to stay updated with the latest announcements and prepare for the key dates in this significant market event.

2. Kataria Industries IPO Allotment Status

Dive into the excitement surrounding the Kataria Industries IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Kataria Industries IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Kataria Industries IPO journey.

3. Introduction to Kataria Industries IPO: Business Overview and Model

Kataria Industries, a prominent name in the manufacturing and supply sector, is gearing up for its IPO. The Kataria Industries IPO aims to highlight the company’s robust business model and operational excellence. Engaged in the production of Low Relaxation Pre-stressed Concrete (LRPC) Strands, Steel Wires, Post-tensioning (PT) Anchorage Systems, HDPE Single Wall Corrugated (SWC) Sheathing Ducts, Couplers, and Aluminium Conductors, Kataria Industries caters to a wide range of sectors including Infrastructure, Roads, Bridges, Metros, Railways, High Rise Buildings, Atomic Reactors, LNG Tanks, and Power Transmission & Distribution Lines. The company’s commitment to quality is underscored by its ISO 9001:2015 certification for quality management systems.

Situated in Ratlam, Madhya Pradesh, Kataria Industries operates two well-equipped manufacturing plants. The company expanded its wire division capacity to 19,830 MT in the fiscal year 2019-20, and further to 38,000 MT in the fiscal year 2021-22. Additionally, the production of Post-tensioning Anchorage and SWC Sheathing Duct & Coupler began in the same year. The combined annual capacity includes 38,000 MT for the Wire Division, 792,000 units for the PTS Division, 900,000 meters of HDPE SWC Duct Pipe, and 9,000 MT for the Conductor Division.

Over the years, Kataria Industries has sold its products across India and internationally, in countries such as Dubai, Qatar, Nepal, Iran, Oman, Bahrain, and Brazil. Incorporated in 2004, the company initially engaged in the manufacturing and supply of various ingots, wires, pipes, and tubes, along with plastic products. However, in 2013, the Plastic and Wind Mill Divisions were transferred to focus on core business competencies.

In 2022-23, Kataria Industries purchased a wind farm in Dewas, Madhya Pradesh, for captive electricity consumption at their Ratlam plant. The company’s leadership includes Promoter and Managing Director Mr. Arun Kataria and Whole Time Director and CFO Mr. Anoop Kataria, both of whom bring significant expertise and strategic vision to the organization.

The Kataria Industries IPO highlights the company’s continuous efforts to improve and expand its processes and technologies. The management prioritizes technology and excellent service delivery, ensuring client satisfaction with a wide range of equipment and a focus on high standards of service.

Competitive Strengths of Kataria Industries IPO

1. Approved Supplier for Government Projects: Kataria Industries is an approved supplier for various government and commercial projects in sectors like Infrastructure, Roads, Bridges, Metros, Railways, and more. The company’s commitment to quality and extensive experience positions it strongly for future projects, enhancing its competitive edge.

2. In-house Manufacturing with Stringent Quality Control: The company ensures seamless production with an in-house facility certified for ISO 9001:2015 quality management systems. Rigorous testing at each manufacturing stage guarantees adherence to high-quality standards, further validated by third-party NABL accredited laboratories.

3. Comprehensive Product Range: Kataria Industries offers a wide range of products, including PT Anchorage and Sheathing Ducts along with LRPC Strands. These products, such as anchor cones, anchor heads, wedges, and SWC ducts, cater to specific client requirements and are crucial for various infrastructure projects.

4. Wide Geographical Reach: The company has cultivated strong relationships with domestic and international customers, contributing to its sustained growth. Despite not having long-term supply agreements, Kataria Industries enjoys repeat business from many clients, demonstrating trust and quality service.

5. Experienced Management Team: The leadership team, including Mr. Arun Kataria and Mr. Anoop Kataria, brings vast industry experience and strategic direction. Their expertise and relationships have enhanced the company’s operational capabilities and customer access.

Key Strategies for Kataria Industries IPO

1. Expanding Market Presence and Product Portfolio: The company aims to penetrate new markets and enhance its presence in existing segments by offering technically advanced products cost-effectively. With a focus on increasing exports, Kataria Industries plans to introduce new products such as Bridge Bearings, Expansion Joints, and more.

2. Strengthening Customer Relationships and Brand: Kataria Industries intends to continue building strong customer relationships and enhancing the brand “Kataria Tenasyo” through dedicated efforts and promotional initiatives, driving increased sales and profitability.

3. Improving Operational Efficiency: The company is committed to enhancing operational efficiency through continuous process improvements, rigorous quality checks, and technology investments, aiming for zero defects and rejections.

4. Rationalizing Indebtedness: Kataria Industries focuses on reducing its indebtedness by repaying or prepaying certain borrowings from the IPO proceeds. This strategy aims to maintain a favorable debt-equity ratio and support business growth and expansion.

The Kataria Industries IPO presents a promising opportunity for investors to participate in a company with a strong business model, competitive strengths, and strategic growth plans.

4. Financial Details of Kataria Industries

Kataria Industries IPO: Financial Overview and Performance

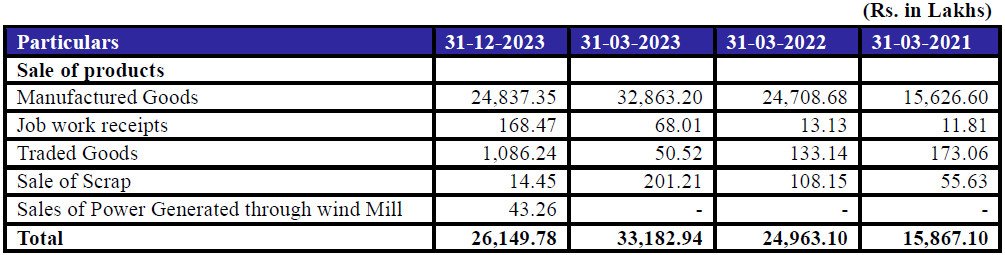

The Kataria Industries IPO showcases a company with a solid financial foundation and impressive growth metrics. For the fiscal year ending March 31, 2024, Kataria Industries Limited reported a revenue increase of 2.26% compared to the previous year. Revenue figures stood at ₹34,148.63 lakhs, up from ₹33,393.09 lakhs in the year ending March 31, 2023, and ₹25,048.91 lakhs in 2022. This consistent revenue growth underscores the company’s robust market presence and operational efficiency.

The profit after tax (PAT) also saw a significant rise, increasing by 28.83% to ₹1,002.11 lakhs in 2024, compared to ₹777.83 lakhs in 2023 and ₹738.34 lakhs in 2022. This notable increase in profitability highlights Kataria Industries’ successful strategies in cost management and revenue optimization.

Examining the asset base, Kataria Industries reported assets amounting to ₹12,002.84 lakhs for the year ending March 31, 2024, showing a slight decrease from ₹15,058.73 lakhs in 2023 but an increase from ₹12,787.19 lakhs in 2022. This reflects the company’s efficient asset utilization and strategic investments.

The net worth of Kataria Industries grew significantly, reaching ₹4,549.56 lakhs in 2024, up from ₹3,584.16 lakhs in 2023 and ₹2,806.33 lakhs in 2022. Reserves and surplus were recorded at ₹3,001.58 lakhs in 2024, showing a slight decrease from ₹3,320.05 lakhs in 2023 but an increase from ₹2,542.21 lakhs in 2022.

In terms of debt management, total borrowings decreased substantially to ₹6,337.11 lakhs in 2024 from ₹10,696.20 lakhs in 2023 and ₹9,142.29 lakhs in 2022, reflecting the company’s focus on rationalizing indebtedness and maintaining a healthier balance sheet.

Kataria Industries IPO: Valuations and Margins

The Kataria Industries IPO is underpinned by strong financial metrics, making it an attractive proposition for investors. The earnings per share (EPS) for the fiscal years 2022, 2023, and 2024 were reported at 4.66, 4.91, and 6.32, respectively, demonstrating a consistent upward trend. The price-to-earnings (PE) ratio for 2024 is estimated to be between 14.40 and 15.19, indicating a fair valuation range for potential investors.

Return on Net Worth (RONW) percentages were 26.31% in 2022, 21.70% in 2023, and 22.03% in 2024, highlighting the company’s ability to generate substantial returns on shareholders’ equity. The net asset value (NAV) also increased, reaching 28.71 in 2024, up from 22.62 in 2023 and 17.71 in 2022.

Return on Capital Employed (ROCE) percentages show a notable improvement, with 17.40% in 2024, up from 9.31% in 2023 and 12.23% in 2022. The EBITDA margin also saw a recovery, reaching 6.76% in 2024, compared to 4.75% in 2023 and 7.31% in 2022, indicating better operational efficiency and profitability.

The debt-to-equity ratio improved significantly, dropping to 1.38 in 2024 from 2.98 in 2023 and 3.26 in 2022. This reduction reflects Kataria Industries’ effective debt management and strategic focus on maintaining a balanced capital structure.

Investors looking into the Kataria Industries IPO will find a company with a strong financial track record, efficient debt management, and promising growth prospects. The company’s strategic initiatives and robust financial performance make the Kataria Industries IPO a compelling investment opportunity.

Statement Of Revenue From Operations

Statement of Other Income

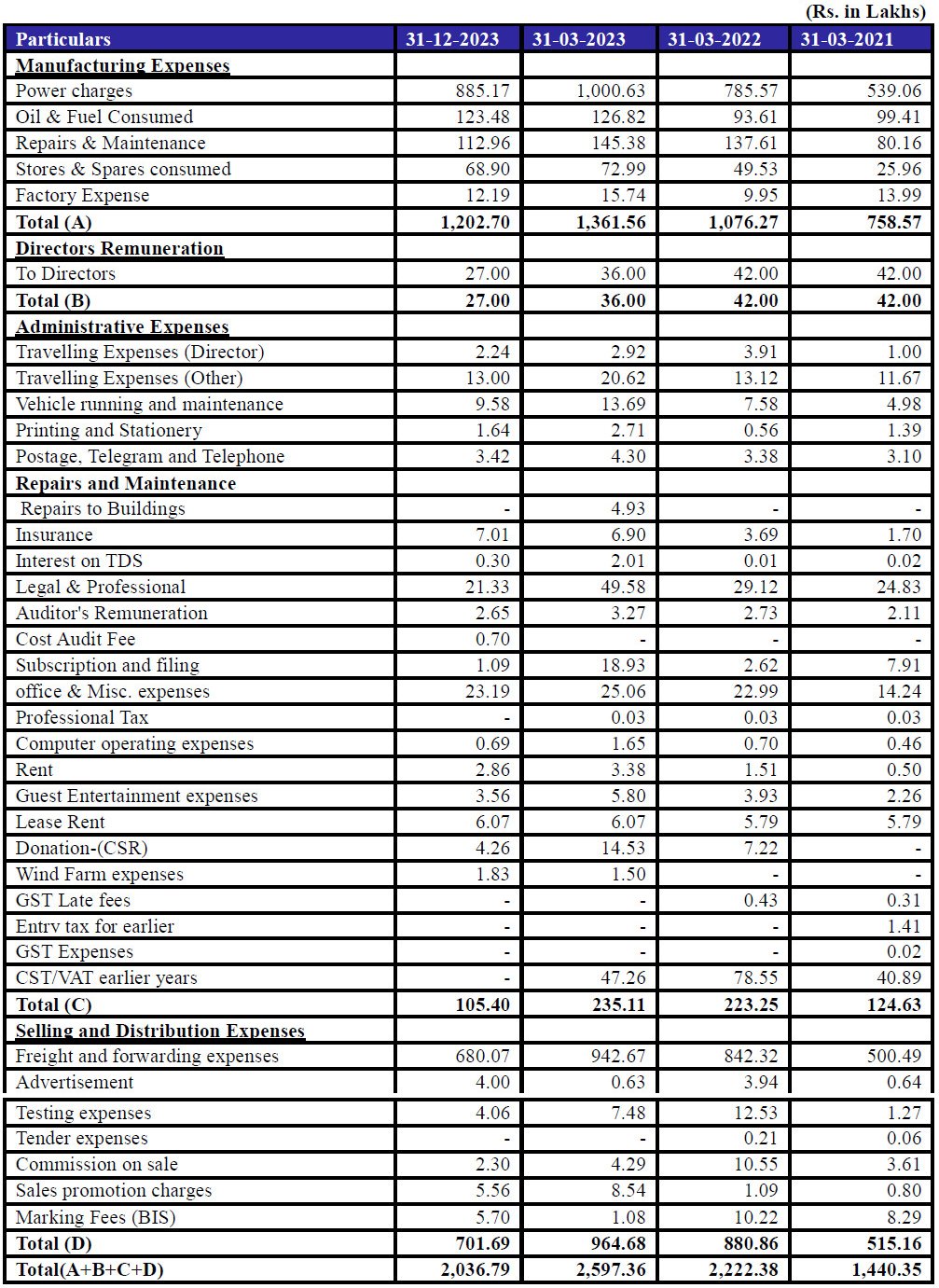

Statement of Other Expenses

Statement of Reserves & Surplus

Statement of Equity Share Capital

Statement of Capitalisation

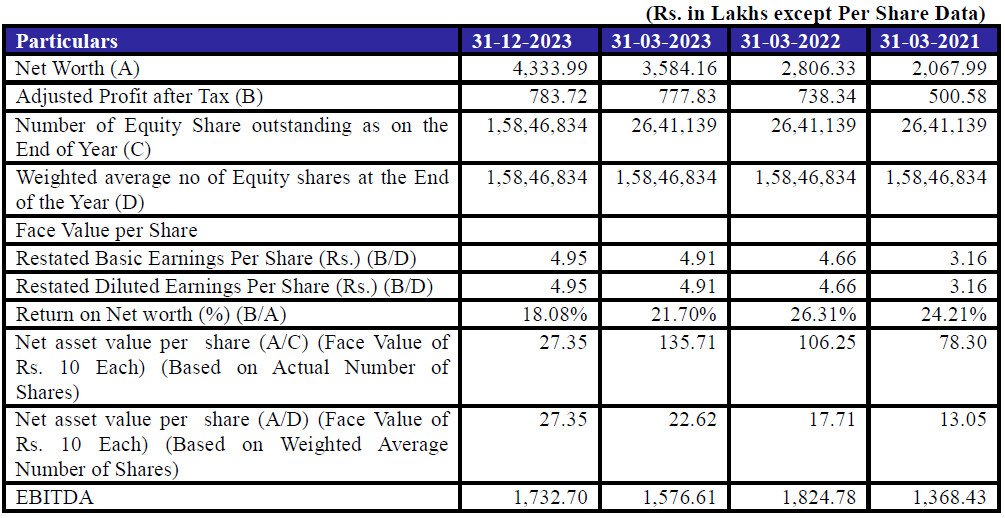

RATIO ANALYSIS

Financial Ratios

5. Kataria Industries IPO FAQs

Kataria Industries IPO Details

The Kataria Industries IPO opens on July 16, 2024, and closes on July 19, 2024.

The Kataria Industries IPO is priced between ₹91.00 and ₹96.00 per share.

The Kataria Industries IPO will be listed on the NSE SME.

The total issue size of the Kataria Industries IPO is ₹54.58 crore.

The Kataria Industries IPO is a Book Build Issue.

The face value of each equity share in the Kataria Industries IPO is ₹10.

The retail quota for the Kataria Industries IPO is not less than 35% of the net issue.

The minimum investment amount for the Kataria Industries IPO is ₹115,200 for one lot of 1200 shares.

The lot size for the Kataria Industries IPO is 1200 shares.

The shares will be credited to the demat accounts of the investors on July 23, 2024.

Kataria Industries Business Model

Kataria Industries manufactures Low Relaxation Pre-stressed Concrete (LRPC) Strands and Steel Wires, Post-tensioning Anchorage Systems, HDPE Single Wall Corrugated Sheathing Ducts, Couplers, and Aluminium Conductors.

Kataria Industries’ products are utilized in sectors including infrastructure, roads, bridges, flyovers, metros, railways, high-rise buildings, atomic reactors, LNG tanks, and power transmission & distribution lines.

Kataria Industries’ manufacturing plants are located in Ratlam, Madhya Pradesh.

The annual capacity of Kataria Industries’ wire division is 38,000 metric tons.

Kataria Industries exports its products to countries including Dubai, Qatar, Nepal, Iran, Oman, Bahrain, and Brazil.

Kataria Industries Financial Data

Kataria Industries’ revenue for the year ending March 31, 2024, was ₹34,148.63 lakhs.

Kataria Industries’ profit after tax (PAT) increased by 28.83% between 2023 and 2024.

The debt-to-equity ratio of Kataria Industries for the fiscal year 2024 is 1.38.

The Return on Net Worth (RONW) percentage for Kataria Industries in 2024 was 22.03%.

Kataria Industries’ assets decreased from ₹15,058.73 lakhs in 2023 to ₹12,002.84 lakhs in 2024.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Kataria Industries IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Kataria Industries IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Kataria Industries IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Kataria Industries IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.