Table of Contents

Embark on a sweet journey with Italian Edibles IPO, a confectionery powerhouse established in December 2009, boasting over 15 years of delectable expertise in the industry. Renowned for pioneering milk paste delights under the brand “Militry mali,” Italian Edibles has earned acclaim for its unique offerings, including egg chocolates with toys, making waves especially in Central India’s wafer market. Their partnership with Dharpal Premchand (BABA) for crafting irresistible jelly sweets underscores their commitment to quality and innovation. With a steadfast dedication to delivering premium confectionery delights at competitive prices, Italian Edibles continues to redefine taste sensations, spreading joy one bite at a time.

Italian Edibles IPO Dates

| IPO Open Date | IPO Closed Date | Allotment Date |

| 2nd Feb 2024 | 7th Feb 2024 | 8th Feb 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 9th Feb 2024 | 9th Feb 2024 | 12th Feb 2024 |

Italian Edibles IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Italian Edibles IPO Issue Details

| IPO Issue Size | IPO Issue Price | Market Lot |

| ₹26.66 Cr | ₹68.00 | 2000 Shares |

Financial of Italian Edibles IPO

| Particulars | Aug-23 | Mar-23 | Mar-22 | Mar-21 |

| Assets | 4824.64 | 4155.24 | 3905.45 | 3946.43 |

| Revenue | 3052.16 | 6330.09 | 7545.25 | 4899.44 |

| Expense | 2770.43 | 5992.96 | 7407.47 | 4786.93 |

| Net Worth | 1287.92 | 1078.24 | 814.03 | 583.82 |

| PBT | 281.73 | 337.13 | 137.77 | 112.50 |

| ROE | 0.18% | 0.28% | 0.11% | 0.16% |

| PAT | 209.68 | 264.21 | 80.21 | 86.52 |

| PAT Margin | 6.87% | 4.18% | 1.06% | 1.77% |

| EBITDA | 399.31 | 690.76 | 437.22 | 359.59 |

| EBITDA Margin | 13.08% | 10.91% | 5.79% | 7.34% |

| Fresh Issue | Offer for Sale | Issue Type |

Equity 3920000 (2665.60 Lakhs) | – | Fresh Issue |

| RII (Retail) | NII | QIB | Market Maker |

| 47.45% | 47.45% | – | 5.10% |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 2000 | 136000 |

| Retail(Max) | 1 | 2000 | 136000 |

| Small-HNI (Min) | 2 | 4000 | 272000 |

| Small-HNI (Max) | 7 | 14000 | 952000 |

| Big-HNI (Min) | 8 | 16000 | 1088000 |

| Pre-Promoter | Post Promoter | Listing IN |

| 100% | 73.47% | NSE |

| Established | Website | Industry |

| 2009 | ofcoursegroup.com | Food |

| Contact Information | |

| Telephone | |

| italian_edibles@yahoo.com | +91 9826298268 |

| Objective | |

| No | Objective |

| 1 | Setting up of the proposed manufacturing unit. |

| 2 | Repayment of certain Borrowings |

| 3 | To meet incremental working capital requirements. |

| 4 | General Corporate Expenses. |

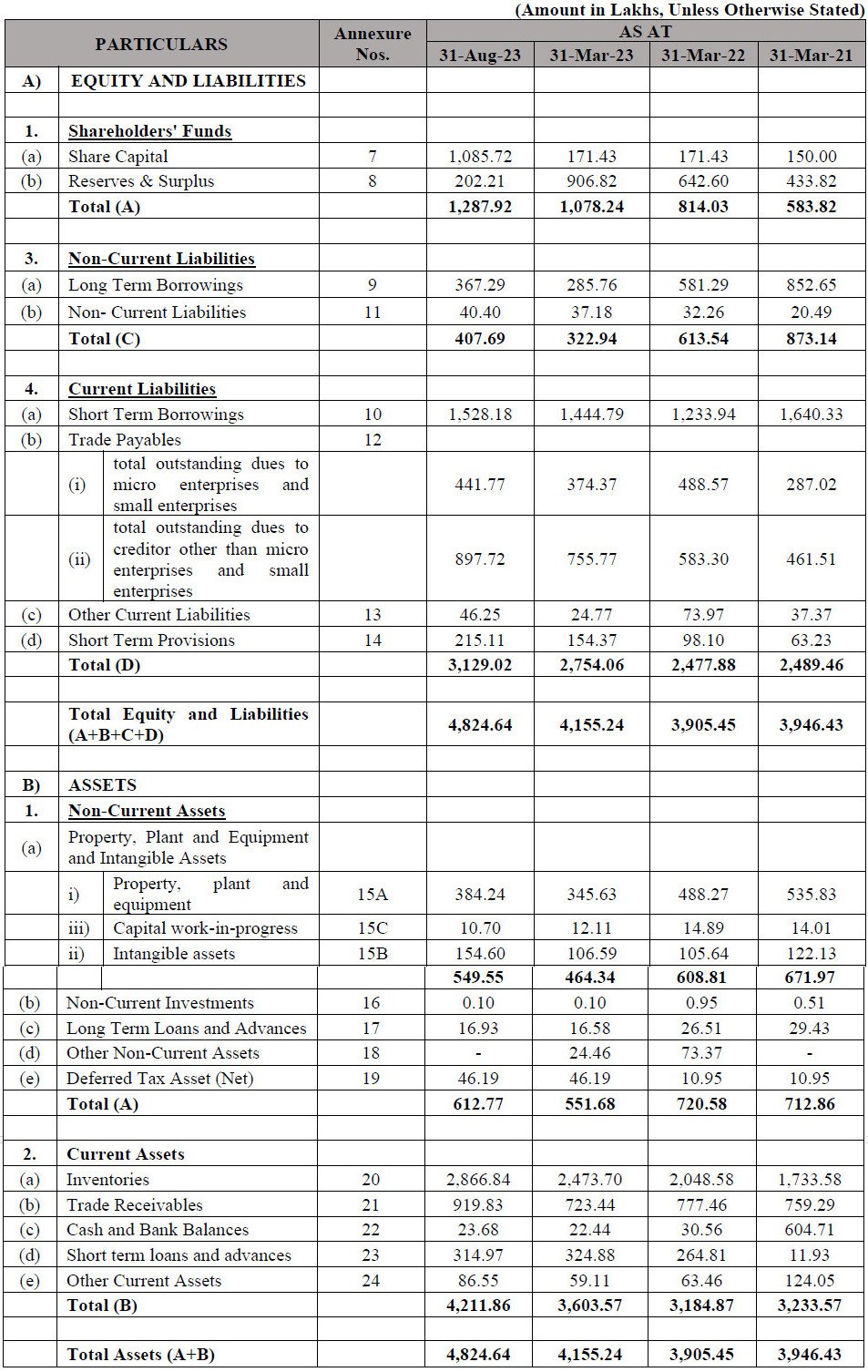

Statement of Assets and Liabilities

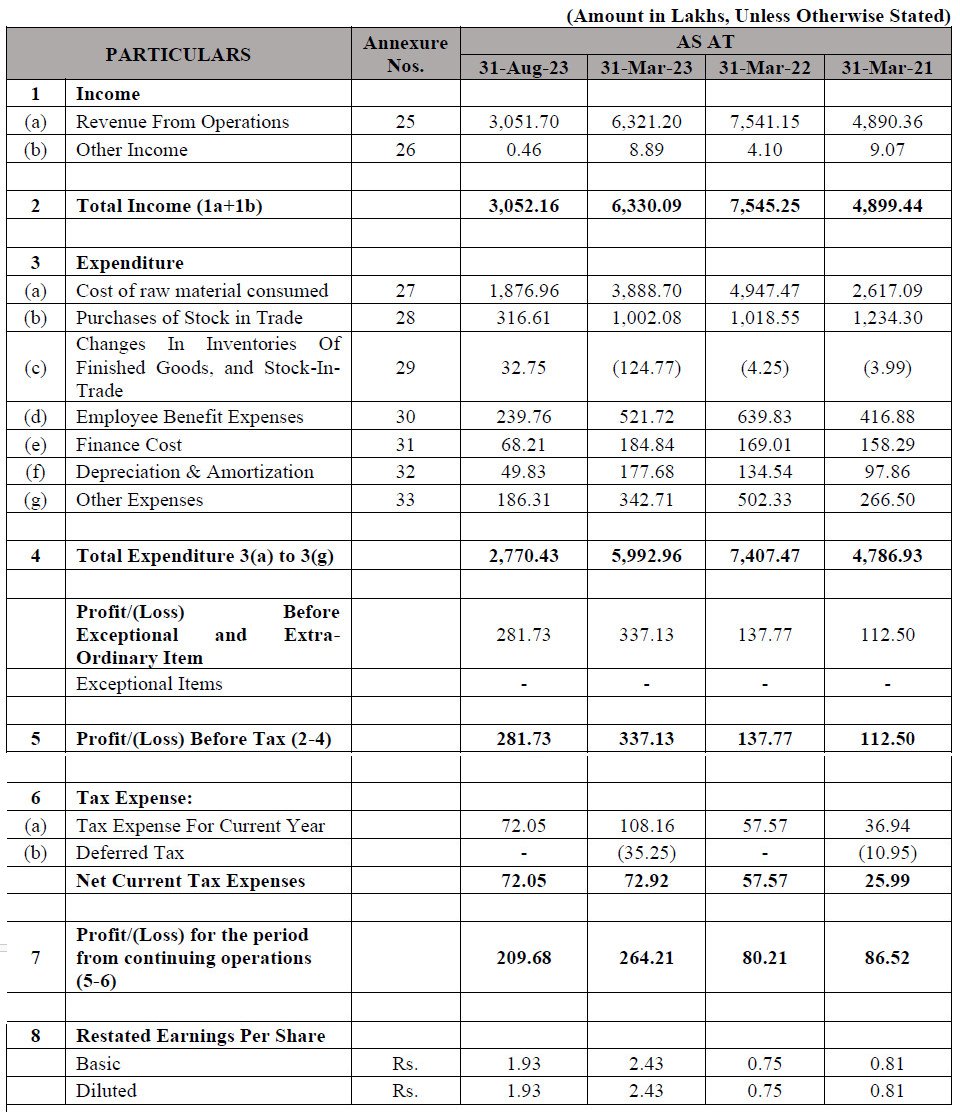

Statement of Profit and Loss

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Italian Edibles IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Italian Edibles IPO.

SwiftTopics.com’s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Italian Edibles IPO and other offerings a more informed and confident endeavor.

1. Italian Edibles IPO key dates & Issue Details

- Italian Edibles IPO, a promising venture in the culinary landscape, is set to embark on its initial public offering (IPO) journey. Scheduled to open on 2nd February 2024 and close on 7th February 2024, this SME IPO presents an opportune moment for investors to partake in the growth story of Italian cuisine. Priced at ₹68.00 per share, the IPO boasts a fixed price issue, with a total size of ₹26.66 Cr, exclusively offering fresh shares with a face value of ₹10 per equity share.

- Notably, the IPO will be listed on NSE SME, offering retail investors a significant opportunity with a 50% net offer quota. Post-IPO, the promoter holding will stand at 73.47%, indicating a strategic alignment with public participation. As per the IPO important dates, the basis of allotment is tentatively scheduled for 8th February 2024, followed by refunds initiation and credit of shares to demat accounts on 9th February 2024. The much-anticipated listing date for Italian Edibles SME IPO is set for 12th February 2024, promising an exciting debut on the stock market.

- Investors keen on participating in Italian Edibles SME IPO can do so with a market lot of 2000 shares, equivalent to ₹136,000 for a single lot. High net-worth individuals (HNIs) are encouraged to invest a minimum of 4000 shares (2 lots) to capitalize on this culinary investment opportunity. Stay tuned for more updates as Italian Edibles SME IPO embarks on its journey, offering investors a delectable slice of the Italian culinary market.

2. Italian Edibles IPO Allotment Status

Dive into the excitement surrounding the Italian Edibles IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Italian Edibles IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Italian Edibles IPO journey.

3. Introduction to Italian Edibles IPO: Crafting Sweet Success

- Italian Edibles IPO emerges as a flavorful venture, rooted in a rich history of culinary expertise and innovation. Originally incorporated as Italian Edibles Private Limited in 2009 under the Companies Act, the company transitioned to Italian Edibles Limited in 2023, marking a significant milestone in its journey. With a compelling mantra of “Sharing is Everything” and “Delightful Creation and Boundless Joy,” Italian Edibles has been a stalwart in the confectionery domain for the past 14 years.

Expanding Palate of Confectionery Delights

- Italian Edibles delights palates with an extensive array of confectionery offerings, ranging from traditional Indian sweets like Rabdi to modern indulgences like Chocolate Paste. With a diverse portfolio encompassing over 56 products across seven categories, including Lollipops, Hard Candies, and Jelly Candies, the company caters to the varied tastes and preferences of consumers across India and abroad.

Culinary Footprint and Market Penetration

- Driven by a commitment to quality and innovation, Italian Edibles has carved a niche in both domestic and international markets. Serving consumers in rural and semi-urban areas across 22 states in India, the company’s products add sweetness to festivals, celebrations, and everyday moments. Additionally, Italian Edibles exports its confectionery delights to countries like Nigeria, Yemen, Senegal, and Sudan, expanding its global footprint and culinary influence.

Manufacturing Excellence and Quality Assurance

- Operating two state-of-the-art manufacturing units in Indore, Madhya Pradesh, Italian Edibles ensures the highest standards of quality and hygiene. With certifications including FSAAI, ISO 22000:2018, and FIEO, the company’s manufacturing processes adhere to stringent quality control measures, guaranteeing consistency and excellence in every bite.

Visionary Leadership and Strategic Growth

- At the helm of Italian Edibles are Mr. Akshay Makhija and Mr. Ajay Makhija, whose visionary leadership and strategic acumen have propelled the company’s rapid expansion and market penetration. Backed by a dedicated team with extensive experience in the consumer goods and food and beverages industry, Italian Edibles is poised to capitalize on future growth opportunities and solidify its position as a leader in the confectionery segment.

Conclusion

- Italian Edibles IPO represents more than just a business venture; it embodies a legacy of passion, innovation, and sweetness. With a robust product portfolio, a strong distribution network, and a commitment to excellence, Italian Edibles is poised to redefine the confectionery landscape, one delectable treat at a time. As investors embark on this journey, they join a flavorful legacy built on the pillars of quality, creativity, and boundless joy.

4. Financial Details of Italian Edibles

Unlocking the Financial Flavor of Italian Edibles IPO

- Italian Edibles Limited unveils its financial journey, reflecting resilience, growth, and strategic prowess. As of August 31, 2023, the company’s revenue stands at ₹3,052.16 Lakhs, showcasing a trajectory of dynamic performance over the years. Delving deeper, Italian Edibles witnessed a 16.1% decrease in revenue between the financial years ending March 31, 2023, and March 31, 2022, yet experienced a remarkable 229.4% surge in profit after tax (PAT) during the same period, signaling strategic agility and efficiency.

Financial Highlights:

- Italian Edibles’ assets have steadily ascended to ₹4,824.64 Lakhs as of August 31, 2023, underscoring the company’s robust financial foundation and investment potential. Moreover, the net worth of the company reflects a positive trajectory, reaching ₹1,287.92 Lakhs, indicative of sustained growth and shareholder value creation.

Strategic Insights:

- The company’s financial performance is a testament to its astute management and market adaptability. Despite fluctuations in revenue, Italian Edibles has demonstrated resilience and agility, leveraging its resources to optimize profitability and enhance shareholder returns. The substantial increase in PAT from ₹80.21 Lakhs in FY 2021 to ₹209.68 Lakhs in FY 2023 underscores the company’s commitment to sustainable growth and operational excellence.

Building Resilience and Value:

- Italian Edibles’ reserves and surplus reflect a strategic accumulation of resources, standing at ₹202.21 Lakhs as of August 31, 2023. This prudent financial management underscores the company’s commitment to fortifying its financial position, driving innovation, and seizing emerging opportunities in the dynamic confectionery market.

- As investors explore the tantalizing opportunity presented by Italian Edibles IPO, the company’s robust financial performance stands as a beacon of promise and potential. With a steadfast commitment to quality, innovation, and strategic growth, Italian Edibles is poised to redefine the confectionery landscape, offering investors a delectable slice of success in the culinary market. As the company continues to chart its course towards prosperity, investors can anticipate a journey flavored with growth, resilience, and enduring value.

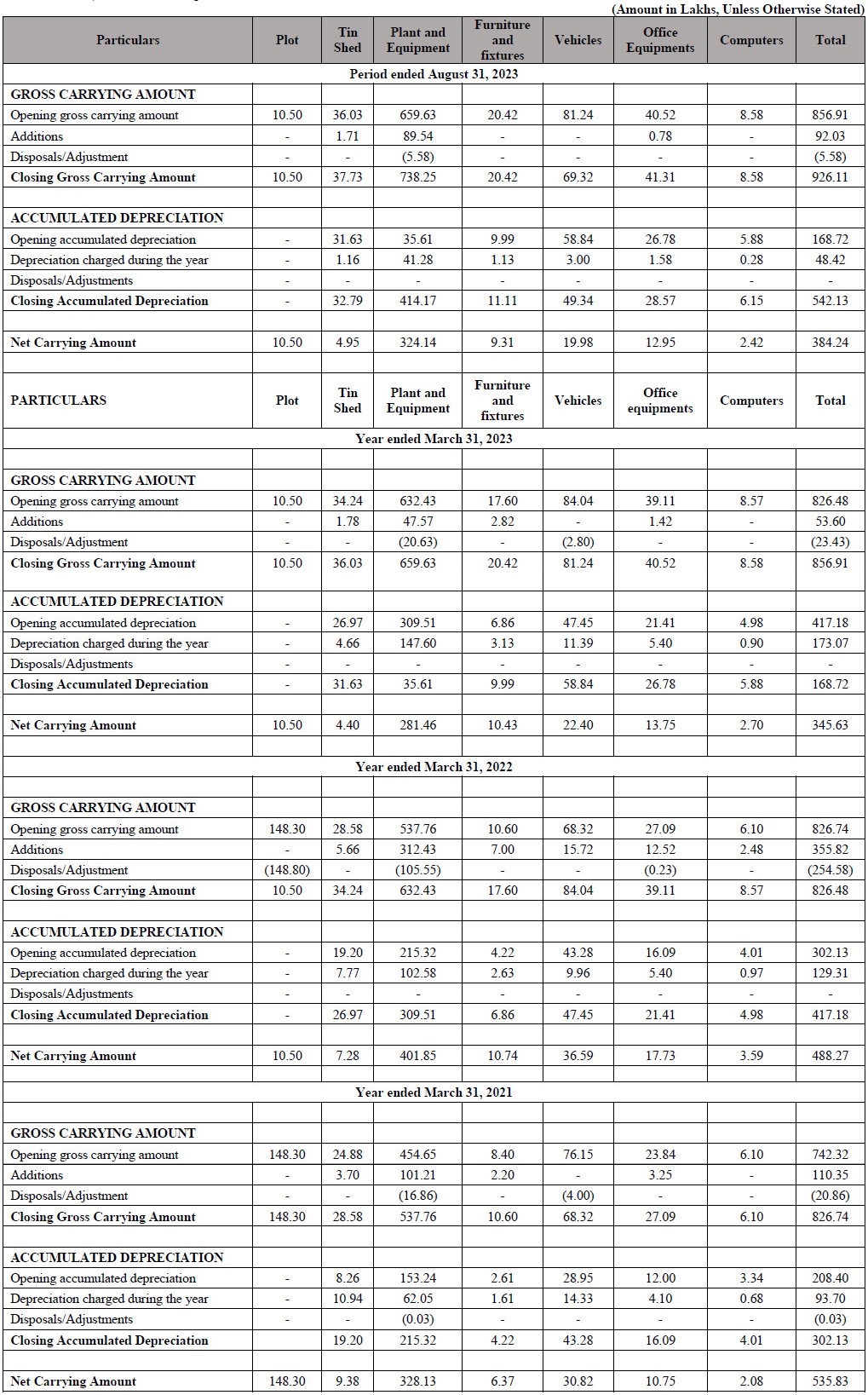

Italian Edibles IPO Statement of Property, plant and Equipment

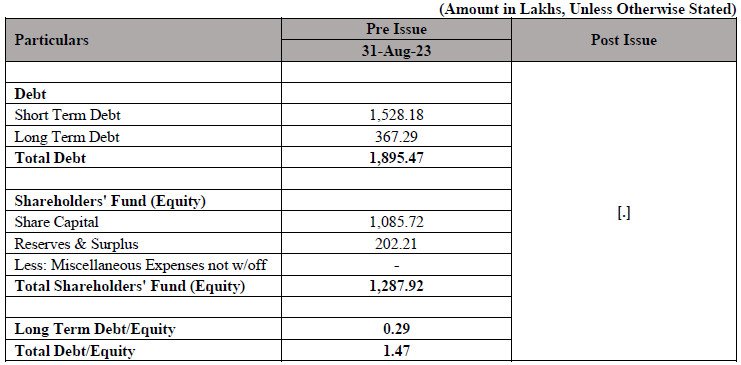

Italian Edibles IPO Statement of Capitalization

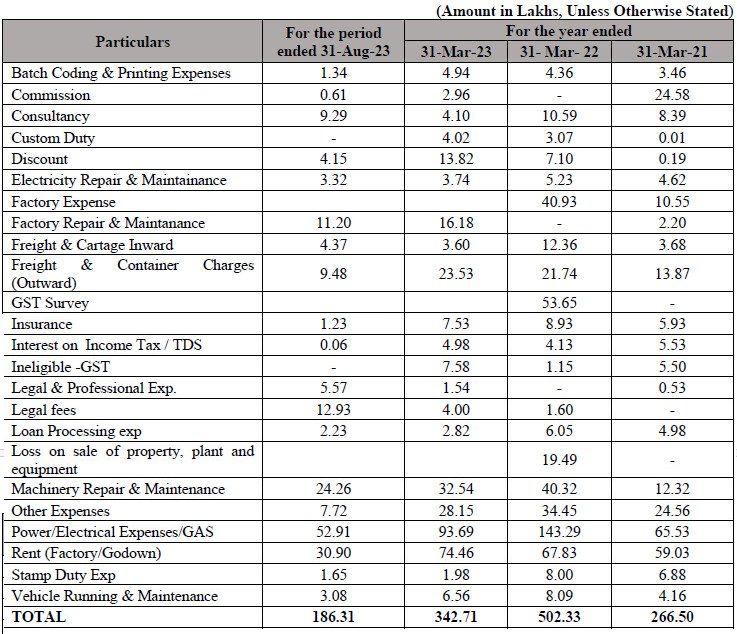

Italian Edibles IPO Statement of Other Expenses

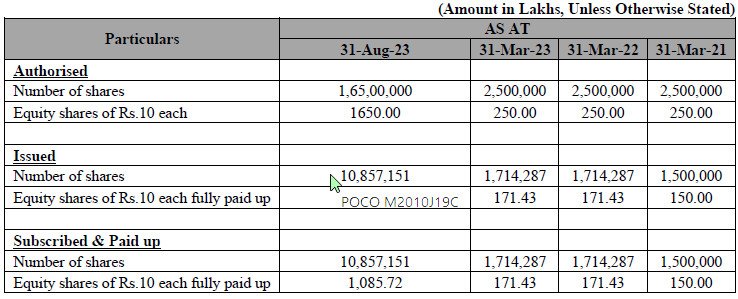

Statement of Share Capital

5. Italian Edibles IPO FAQs

Italian Edibles IPO is scheduled to open on 2nd February 2024.

The closing date for Italian Edibles IPO is 7th February 2024.

The issue price of Italian Edibles IPO is ₹68.00 per share.

Italian Edibles IPO will be listed on NSE SME.

The retail quota for Italian Edibles IPO is 50% of the net offer.

Italian Edibles IPO is a fixed price issue.

The issue size of Italian Edibles IPO is ₹26.66 Cr.

The fresh issue component in Italian Edibles IPO is ₹26.66 Cr.

The face value of Italian Edibles IPO shares is ₹10 per equity share.

The promoter holding post IPO for Italian Edibles is 73.47%.

The basis of allotment date for Italian Edibles IPO is tentatively set for 8th February 2024.

Refunds for Italian Edibles IPO are expected to be initiated on 9th February 2024.

The credit of shares to demat for Italian Edibles IPO is tentatively scheduled for 9th February 2024.

The SME IPO listing date for Italian Edibles is set for 12th February 2024.

Italian Edibles offers a range of confectionery products including Rabdi, Milk Paste, Chocolate Paste, Lollipops, Candies, Jelly Candies, Multi-Grain Puff Rolls, and Fruit Based Products.

Italian Edibles primarily sells its products in rural and semi-urban areas of India, as well as exports to countries like Nigeria, Yemen, Senegal, and Sudan.

Italian Edibles operates two manufacturing units located in Gram Palda and Prabhu Toll Kanta, both in Indore, Madhya Pradesh.

Italian Edibles’ manufacturing units are FSAAI, ISO 22000:2018, and FIEO certified.

Italian Edibles’ revenue has shown fluctuations, with a decrease between 2022 and 2023 but significant growth from 2021 to 2022.

The profit after tax margin for Italian Edibles as of August 31, 2023, is 6.87%.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Italian Edibles IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Italian Edibles IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Italian Edibles IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Italian Edibles IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.