Table of Contents

Gabriel Pet Straps IPO, founded in November 2020, excels in producing and distributing high-quality Pet Straps under the brand “Gabriel.” With widths ranging from 9mm to 32mm and thicknesses from 0.70mm to 1.30mm, the company blends virgin and non-virgin materials for superior quality. Committed to innovation, it offers customized packaging solutions across diverse industries. Embracing the “Waste to Best Process,” Gabriel Pet Straps IPO ensures stringent quality control and cutting-edge technology for every strap, providing a variety of sizes, colors, and printing options.

Gabriel Pet Straps IPO Dates

| IPO Open Date | IPO Closed Date | Allotment Date |

| 31st Jan 2024 | 2nd Feb 2024 | 5th Feb 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 6th Feb 2024 | 6th Feb 2024 | 7th Feb 2024 |

Gabriel Pet Straps IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Gabriel Pet Straps IPO Issue Details

| IPO Issue Size | IPO Issue Price | Market Lot |

| ₹8.06 Cr | ₹101.00 | 1200 Shares |

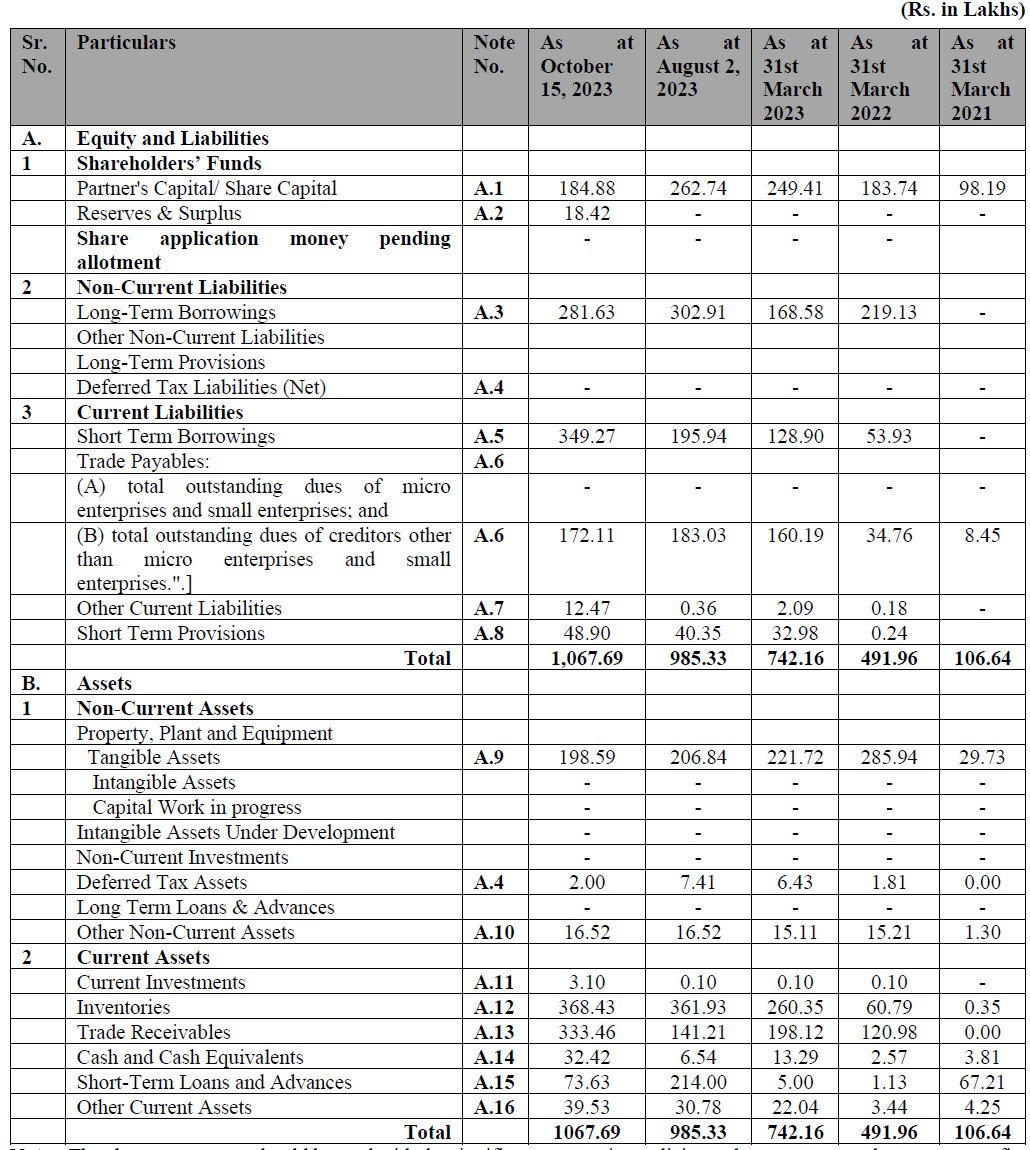

Financial of Gabriel Pet Straps IPO

| Particulars | Oct-23 | Aug-23 | Mar-23 | Mar-22 | Mar-21 |

| Assets | 1067.69 | 985.33 | 742.16 | 491.96 | 106.64 |

| Revenue | 424.89 | 478.19 | 1500.08 | 966.43 | 7.70 |

| Expense | 420.63 | 459.53 | 1420.28 | 973.82 | 7.70 |

| Net Worth | 203.3 | 262.74 | 249.41 | 183.74 | 98.19 |

| PBT | 31.27 | 19.7 | 80.32 | -5.25 | 0.00 |

| PAT | 17.3 | 13.32 | 51.96 | 3.68 | 0.00 |

| ROE | 7.43% | 5.20% | 23.99% | -2.61% | 0.00% |

| PAT Margin | 4.07% | 2.79% | 3.46% | 0.38% | – |

| EBITDA | 51.27 | 55.59 | 174.58 | 68.91 | 0.00 |

| EBITDA Margin | 12.07% | 11.63% | 11.64% | 7.13% | 0.00% |

| Fresh Issue | Offer for Sale | Issue Type |

Equity 798,000 (908.98 Lakhs) | – | Fresh Issue |

| RII (Retail) | NII | QIB |

| 50% | 50% | 0.00% |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 1200 | 121200 |

| Retail(Max) | 1 | 1200 | 121200 |

| Small-HNI (Min) | 2 | 2400 | 242400 |

| Small-HNI (Max) | 8 | 9600 | 969600 |

| Big-HNI (Min) | 9 | 10800 | 1090800 |

| Pre-Promoter | Post Promoter | Listing IN |

| 100% | 69.84% | BSE |

| Lead | Register |

| SHRENI SHARES LIMITED | BIGSHARE SERVICES PVT LTD |

| Established | Website | Industry |

| 2020 | gabrielpetstraps.com | Packaging |

| Contact Information | |

| Telephone | |

| investors@gabrielpetstraps.com | +91 8849254043 |

| Objective | |

| No | Objective |

| 1 | Repayment or prepayment, in full or in part, of borrowings availed by the company from banks, financial institutions and non-banking financial companies |

| 2 | Acquisition of land |

| 3 | Funding of capital expenditure requirements of the company towards set up of Solar Power Plant |

| 4 | General corporate purposes |

Statement of Assets and Liabilities

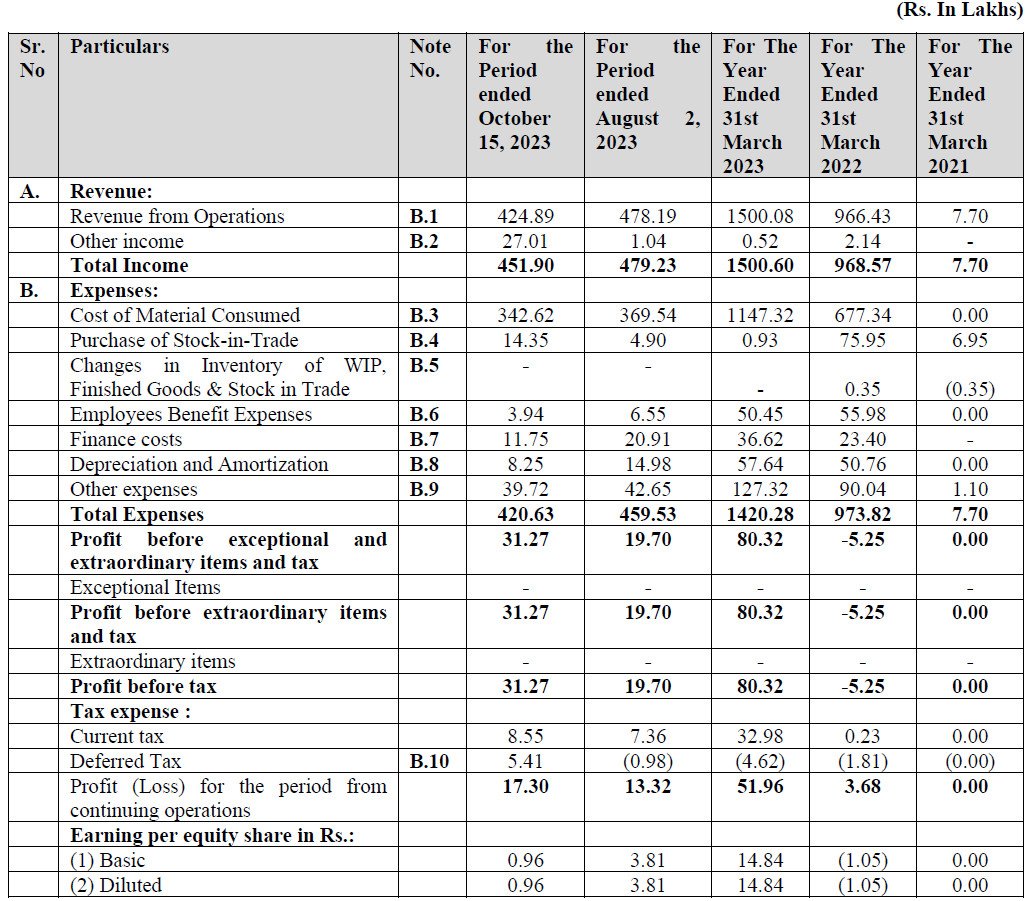

Statement of Profit and Loss

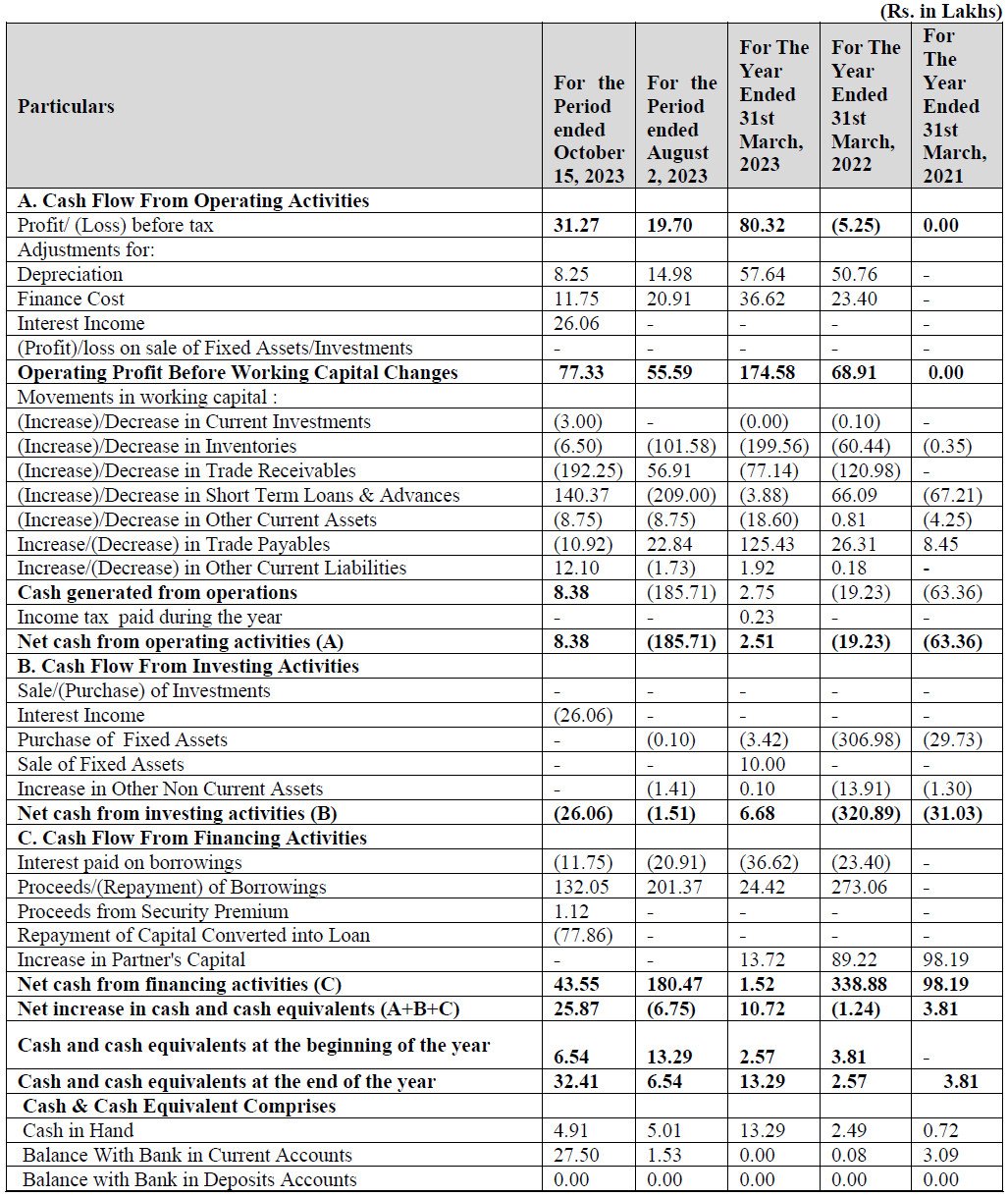

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Gabriel Pet Straps IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Gabriel Pet Straps IPO.

SwiftTopics.com’s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Gabriel Pet Straps IPO and other offerings a more informed and confident endeavor.

1. Gabriel Pet Straps IPO key dates & Issue Details

- Gabriel Pet Straps SME IPO is all set to make waves in the market, with its issue opening on 31st Jan 2024 and closing on 2nd Feb 2024. Priced at ₹101.00 per share, the IPO offers investors an opportunity to partake in the company’s growth journey. The issue size stands at ₹8.06 Cr, comprising entirely of fresh shares, with a face value of ₹10 per equity share.

- This Fixed Price Issue IPO is listed exclusively on BSE SME, offering a retail quota of 50% of the net offer. Gabriel Pet Straps SME IPO is poised to witness a reduction in promoter holding from 100.00% pre-IPO to 69.84% post-IPO, signaling an expansion of the company’s shareholder base.

- Investors eyeing Gabriel Pet Straps SME IPO have key dates to mark in their calendars. The Basis of Allotment Date is scheduled for 5th Feb 2024, followed by refunds initiation and credit of shares to demat accounts on 6th Feb 2024. Finally, the eagerly anticipated listing date is set for 7th Feb 2024.

- For those considering participation, the market lot for Gabriel Pet Straps SME IPO is 1200 shares, translating to an investment of ₹121200 for one lot. High net worth individuals (HNIs) are required to subscribe to a minimum of 2400 shares (2 lots).

- Gabriel Pet Straps IPO presents a compelling investment opportunity, with its attractive pricing, promising prospects, and a well-defined timeline for investors to engage with the offering. Stay tuned for updates as the IPO journey unfolds.

2. Gabriel Pet Straps IPO Allotment Status

Dive into the excitement surrounding the Gabriel Pet Straps IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Gabriel Pet Straps IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Gabriel Pet Straps IPO journey.

3. Introduction to Gabriel Pet Straps IPO: Crafting Quality Packaging Solutions

- Gabriel Pet Straps IPO traces its roots back to its inception as M/s. Gabriel Pet Straps LLP in November 2020, evolving into the esteemed public limited entity, M/s. Gabriel Pet Straps Limited, in August 2023. With a commitment to excellence, we specialize in the manufacturing and distribution of high-quality Pet Straps under the renowned brand name “Gabriel,” essential for heavy-duty material packaging.

- Our extensive product line ranges from 9mm to 32mm in width and boasts thicknesses between 0.70mm to 1.30mm. We blend virgin and non-virgin raw materials meticulously to ensure optimal product quality, harnessing innovative technologies to enhance customer experiences continuously.

- Proudly serving both domestic and international markets, Gabriel Pet Straps garners a PAN India presence, leveraging a robust distributor network across 10 states. Our tailored bulk packaging solutions cater to diverse industries, including Cotton Bales, Fiber, Packaging, Paper, and Waste Cloth sectors.

- Embracing the ethos of “Waste to Best Process,” our operations epitomize efficiency and sustainability. Bolstered by state-of-the-art extrusion lines and stringent quality control measures, we produce pet straps of varying sizes, colors, and customizable printing options, meeting the dynamic demands of our clientele.

- Under the adept leadership of our Managing Director, Mr. Shah Jay Pareshbhai, and Whole Time Directors, Mr. Varasada Vimal Dayabhai and Mr. Kavathiya Vivek Dharmendrabhai, Gabriel Pet Straps remains steadfast in its pursuit of excellence. Their visionary guidance propels our expansion efforts, financial strategies, and market outreach initiatives.

- At the heart of our operations lies a relentless commitment to quality assurance, championed by Mr. Kavathiya Vivek Dharmendrabhai, our dynamic Quality Head and Promoter. His profound expertise in process optimization ensures adherence to industry standards and organizational objectives, driving continuous improvement across all facets of our operations.

- Moreover, our customer-centric approach fosters meaningful engagements, empowering our sales team to glean valuable insights and anticipate industry trends. Through personalized interactions, we glean invaluable feedback, fueling product innovation and market responsiveness.

- In conclusion, Gabriel Pet Straps IPO epitomizes a commitment to excellence, sustainability, and customer satisfaction. With a compelling business model and unwavering dedication to quality, we stand poised to revolutionize the packaging industry landscape.

4. Financial Details of Gabriel Pet Straps: Driving Growth and Stability

- Gabriel Pet Straps IPO showcases robust financial performance, underscoring its trajectory of growth and resilience. The key financial indicators for various periods highlight the company’s steadfast commitment to excellence and financial prudence.

- Revenue from Operations paints a picture of consistent growth, with figures standing at ₹424.89 Lakhs for the period ended October 15, 2023, and ₹478.19 Lakhs for the period ended August 02, 2023. This upward trajectory is a testament to the company’s market presence and strategic positioning.

- The EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) figures reflect a healthy financial foundation, with values reaching ₹51.27 Lakhs and ₹55.59 Lakhs for the respective periods, demonstrating operational efficiency and profitability.

- Furthermore, the EBITDA Margin underscores the company’s ability to generate value from its operations, with percentages standing at 12.07% and 11.63% for the periods ended October 15, 2023, and August 02, 2023, respectively.

- Profit After Tax (PAT) figures reveal a positive trend, with the company reporting ₹17.30 Lakhs and ₹13.32 Lakhs for the respective periods, indicating sustainable growth and financial stability.

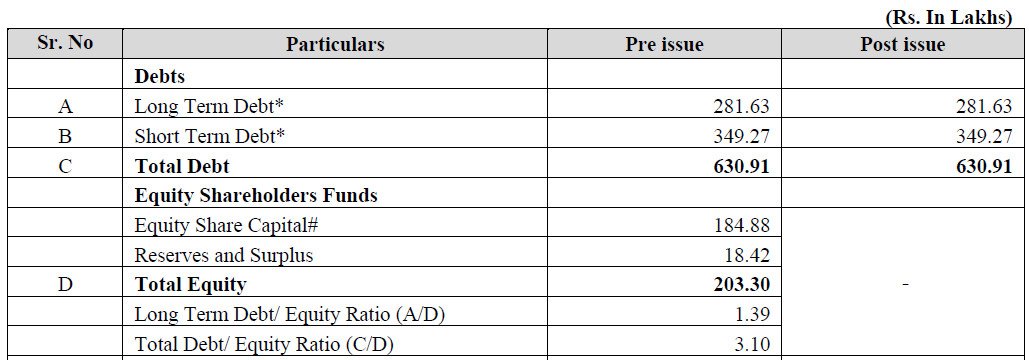

- Gabriel Pet Straps IPO also maintains a prudent approach to financial management, as evidenced by its Debt-Equity Ratio. The figures stand at 3.10 and 1.90 for the periods ended October 15, 2023, and August 02, 2023, respectively, reflecting a commitment to balanced capital structures and financial health.

- Moreover, the Current Ratio, a measure of liquidity, showcases the company’s ability to meet short-term obligations comfortably. With values ranging from 1.46 to 2.12 for the periods under consideration, Gabriel Pet Straps IPO demonstrates sound liquidity management and operational resilience.

- Gabriel Pet Straps IPO stands as a beacon of financial strength and stability, poised to capitalize on emerging opportunities and drive sustained growth in the packaging industry.

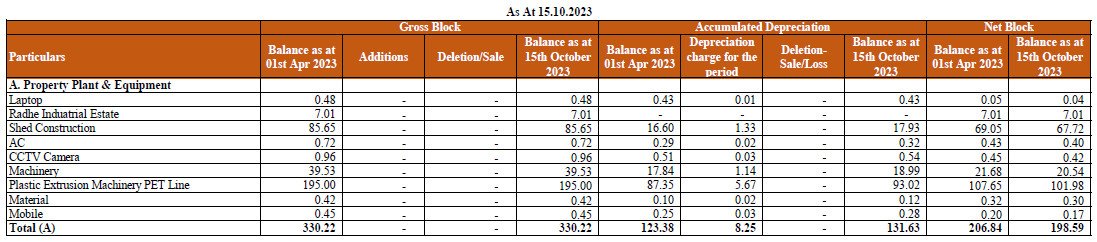

Gabriel Pet Straps Statement of Property, plant and Equipment

Gabriel Pet Straps Statement of Capitalization

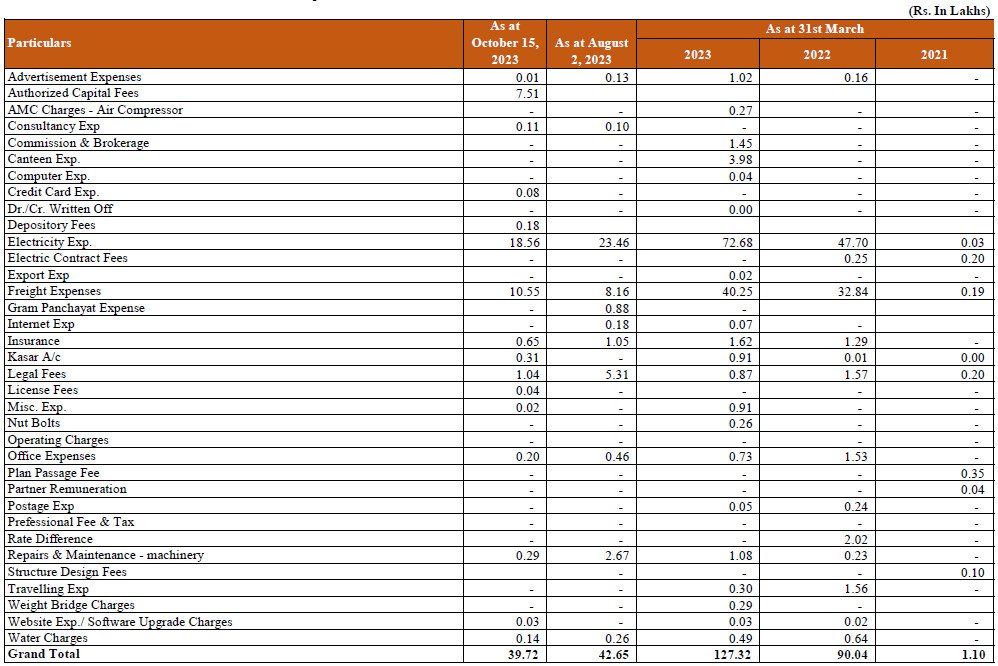

Gabriel Pet Straps Statement of Other Expenses

Statement of Share Capital, Reserves & Surplus

5. Gabriel Pet Straps IPO FAQs

Gabriel Pet Straps IPO opened on January 31st, 2024.

Gabriel Pet Straps IPO closed on February 2nd, 2024.

Gabriel Pet Straps IPO was issued at ₹101.00 per share.

Gabriel Pet Straps IPO is listed on BSE SME.

The issue size of Gabriel Pet Straps IPO is ₹8.06 crore.

The face value per equity share of Gabriel Pet Straps IPO is ₹10.

The retail quota for Gabriel Pet Straps IPO is 50% of the net offer.

Gabriel Pet Straps IPO is a Fixed Price Issue.

The Promoter Holding Post IPO of Gabriel Pet Straps is 69.84%.

The Basis of Allotment Date for Gabriel Pet Straps IPO is February 5th, 2024.

Refunds for Gabriel Pet Straps IPO are initiated on February 6th, 2024.

Shares for Gabriel Pet Straps IPO are credited to Demat accounts on February 6th, 2024.

The Market Lot for Gabriel Pet Straps IPO is 1200 shares.

One lot amount for Gabriel Pet Straps IPO is ₹121,200.

HNI lots required for Gabriel Pet Straps IPO are 2400 shares (2 lots).

Gabriel Pet Straps is engaged in manufacturing and selling pet straps used in heavy material packaging.

Gabriel Pet Straps utilizes virgin content raw materials like hot washed pet bottle flakes and non-virgin content raw materials like used pet straps grinding.

Gabriel Pet Straps offers customized packaging solutions to industries including Cotton Bales, Fiber, Packaging, Paper, and Waste Cloth.

Gabriel Pet Straps maintains stringent quality control measures and testing machinery to ensure the standard of quality in its products.

Gabriel Pet Straps’ financial performance has shown consistent revenue growth, improving EBITDA margins, and a positive PAT margin over the years, indicative of its financial stability and growth trajectory.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Gabriel Pet Straps IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Gabriel Pet Straps IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Gabriel Pet Straps IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Gabriel Pet Straps IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.