Table of Contents

The Emcure Pharma IPO presents a unique opportunity to invest in Emcure Pharmaceuticals Limited, an Indian pharmaceutical company incorporated in April 1981. Emcure Pharma develops, manufactures, and markets a diverse range of pharmaceutical products across key therapeutic areas globally. With a competitive edge in the Indian market due to its differentiated product portfolio, Emcure Pharma holds a strong presence in gynecology, cardiovascular, vitamins, minerals and nutrients, HIV antivirals, blood products, and oncology/anti-neoplastics. Notably, Emcure Pharma ranks among the top ten Indian pharmaceutical companies in domestic sales for these therapeutic areas in the MAT financial year 2024.

Emcure pharma IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

03rd July 2024 | 05th July 2024 | 08th July 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 09th July 2024 | 09th July 2024 | 10th July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹1952.03 Cr | ₹ 960.00 – ₹ 1008.00 | 14 Shares | 1,93.65,364 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 14 | ₹ 14,112 |

| Retail(Max) | 14 | 196 | ₹ 1,97,568 |

| Small-HNI (Min) | 15 | 210 | ₹ 2,11,680 |

| Small-HNI (Max) | 70 | 980 | ₹ 9,87,840 |

| Big-HNI (Min) | 71 | 994 | ₹ 10,01,952 |

| RII (Retail) | NII | QIB |

| 35.00% | 15.00% | 50.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 98.90% | – | BSE & NSE |

| No | Objectives |

| 1 | Repayment and/ or prepayment of all or a portion of certain outstanding borrowings availed by the company |

| 2 | General corporate purposes |

| LEAD | REGISTRAR |

| Kotak Mahindra Capital Company | Link Intime India Private Limited |

| Axis Capital Limited | |

| Jefferies India Private Limited | |

| J.P. Morgan India Private Limited |

| Telephone | |

| investors@emcure.com | +91 20 3507 0033, +91 20 3507 0000 |

Emcure pharma IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Financial of Emcure pharma IPO

| Amounts in Crores ₹ | |||

| Particulars | FY-2024 | FY-2023 | FY-2022 |

| Assets | 7,806 | 6,673 | 6,063 |

| Revenue | 6,715 | 6,032 | 5,919 |

| Expense | 5,978 | 5,278 | 4,946 |

| Net Worth | 2,952 | 2,501 | 1,988 |

| Borrowing | 2,092 | 2,202 | 2,102 |

| EBITDA(%) | 19.01 | 20.24 | 23.54 |

| Reserves | 2,722.40 | 2,293.77 | 1,791.03 |

| PAT | 527.58 | 561.85 | 702.56 |

| EPS | 27.49 | 29.36 | 36.55 |

| Debt/Equity | 0.67 | 0.83 | 0.99 |

| Established | Website | Industry |

| 1981 | emcure.com | Pharmaceuticals |

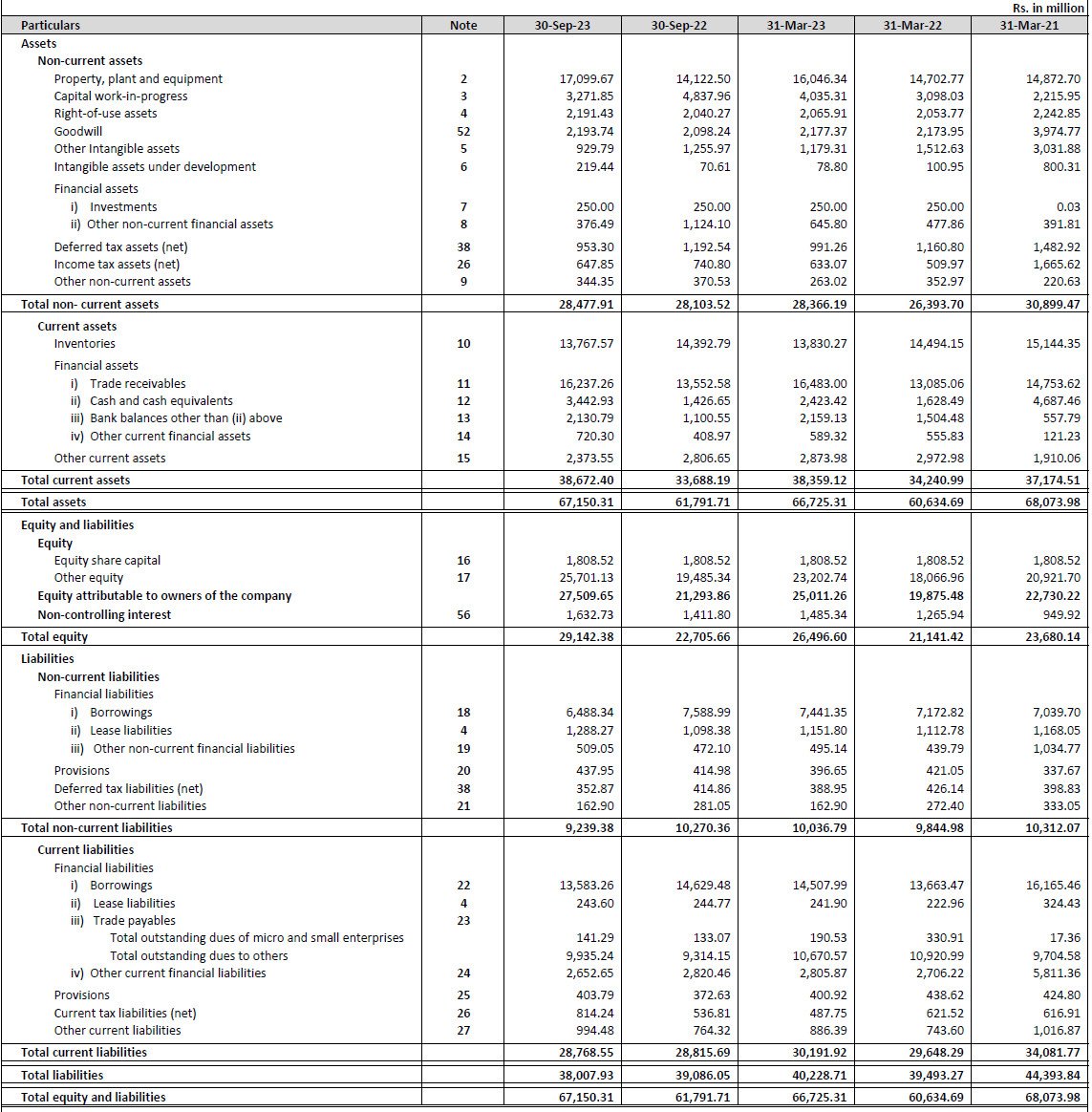

Statement of Balance Sheet

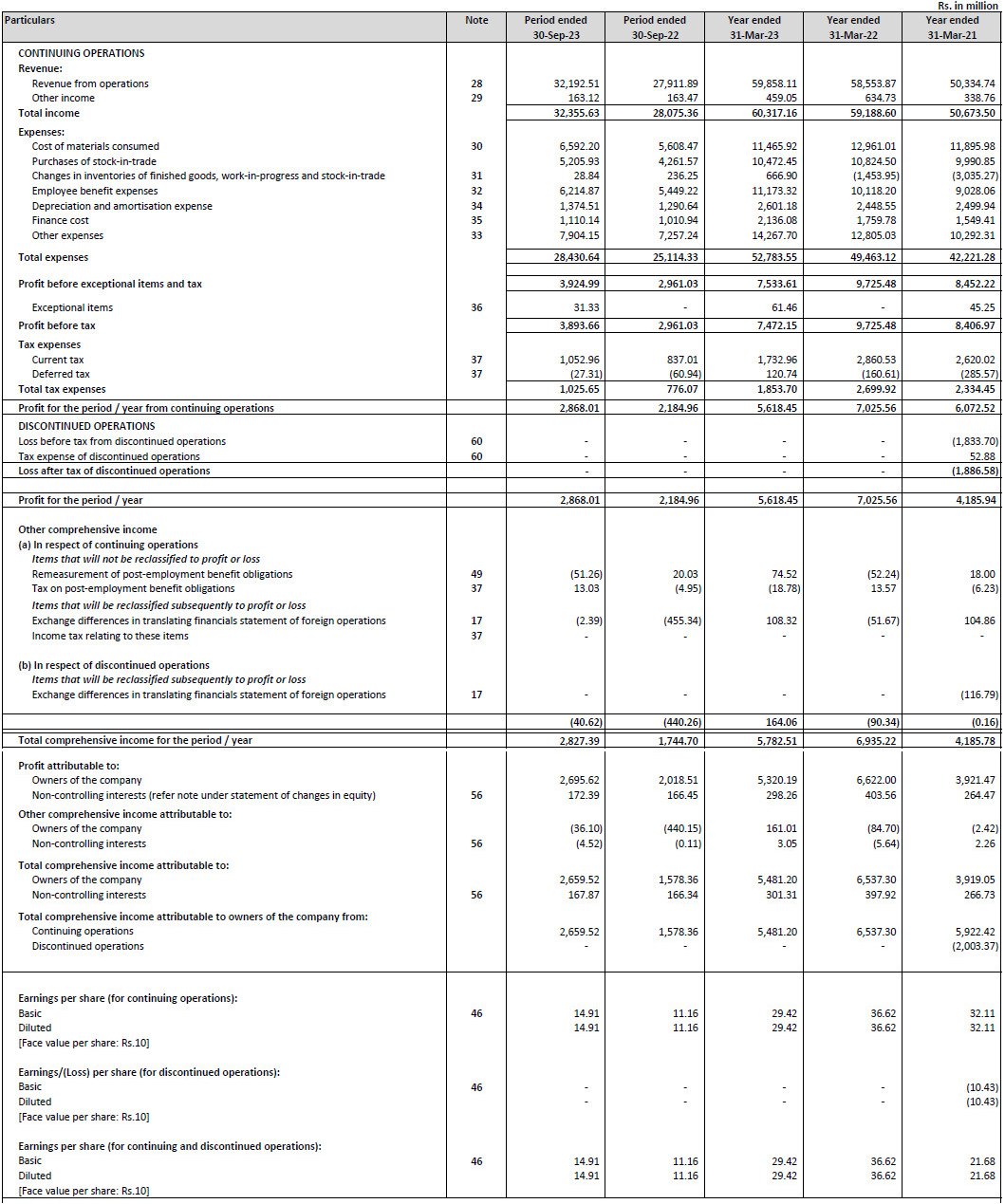

Statement of Profit and Loss

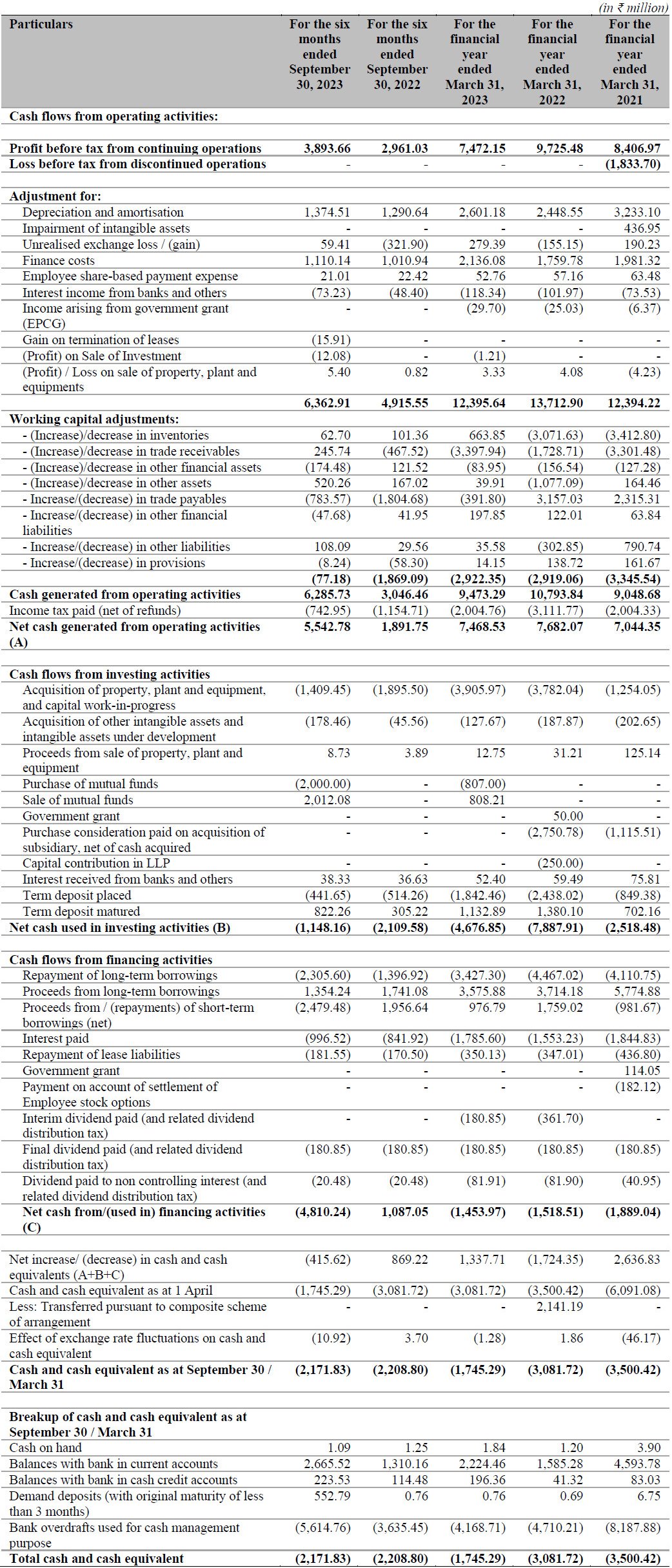

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Emcure pharma IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Emcure pharma IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Emcure pharma IPO and other offerings a more informed and confident endeavor.

1. Emcure pharma IPO key dates & Issue Details

The Emcure Pharma IPO is scheduled to open for subscription on 3rd July 2024 and will close on 5th July 2024. Investors can participate in the IPO at an issue price ranging between ₹960.00 and ₹1008.00 per share. The IPO will be listed on both BSE and NSE, with a book build issue type and a total issue size of ₹1952.03 Cr. This includes an offer for sale amounting to ₹1152.03 Cr and a fresh issue worth ₹800.00 Cr. The face value of each equity share is ₹10, and employees are offered a discount of ₹90.00 per share. Notably, the retail quota for this IPO is set to be not less than 35% of the net issue. Prior to the IPO, promoter holding is at 98.90%.

Key dates for the Emcure Pharma IPO are crucial for investors. The basis of allotment date is tentatively set for 8th July 2024. Refunds initiation and the credit of shares to Demat accounts are both expected on 9th July 2024. Finally, the IPO listing date is slated for 10th July 2024. These dates are tentative and subject to change as further announcements are made.

Emcure Pharma IPO Lots

Investors looking to participate in the Emcure Pharma IPO should note the lot size and pricing details. The market lot for the IPO is set at 14 shares, with the amount for one lot being ₹14112. Small HNI investors, with investments ranging from ₹2 to ₹10 lakh, can subscribe to a minimum of 15 lots (210 shares) amounting to ₹211680. Big HNI investors, with investments above ₹10 lakh, can subscribe to a minimum of 71 lots (994 shares) totaling ₹1001952.

By keeping these details in mind, investors can strategically plan their investments in the Emcure Pharma IPO, ensuring they do not miss out on this significant opportunity.

2. Emcure pharma IPO Allotment Status

Dive into the excitement surrounding the Emcure pharma IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Emcure pharma IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Emcure pharma IPO journey.

3. Introduction to Emcure Pharma IPO: Business Overview and Model

Emcure Pharma is a leading Indian pharmaceutical company engaged in the development, manufacturing, and global marketing of a broad range of pharmaceutical products across major therapeutic areas. With a strong focus on research and development (R&D), Emcure Pharma has built a differentiated product portfolio that includes orals, injectables, and biotherapeutics. This portfolio has allowed the company to target markets in over 70 countries, with significant presence in India, Europe, and Canada.

According to the CRISIL Report, Emcure Pharma was ranked the 13th largest pharmaceutical company in India by domestic sales for MAT September 2023 and held the largest market share in the gynecology and HIV antivirals therapeutic areas.

Emcure Pharma’s domestic sales have seen rapid growth, contributing to 50.84% of total revenue for the six months ended September 30, 2023. The company’s domestic sales grew at a CAGR of 10.80% between MAT September 2019 and MAT September 2023, outperforming the Indian pharmaceutical market, which grew at a CAGR of 8.23%. Emcure Pharma’s competitive advantage in the domestic market is driven by its diversified product portfolio, covering key therapeutic areas such as gynecology, cardiovascular, HIV antivirals, and oncology.

The company’s international presence spans over 70 countries, with sales outside India accounting for 49.16% of total revenue for the six months ended September 30, 2023. Emcure Pharma’s export growth has been robust, with a CAGR of 18.32% between the Financial Years 2019 and 2023, outperforming the overall Indian pharmaceutical exports. The company’s international success is attributed to both organic growth and strategic acquisitions, supported by a strong R&D foundation with over 1,800 dossiers filed globally and 201 patents granted as of September 30, 2023.

Emcure Pharma’s manufacturing capabilities are extensive, with 13 facilities across India capable of producing a wide range of dosage forms, including complex injectables, biotherapeutics, and APIs. This vertical integration allows Emcure Pharma to maintain cost efficiency, ensure quality, and secure the availability of essential raw materials.

Emcure Pharma IPO Strengths and Strategies

Emcure Pharma’s strengths include a solid domestic market position, demonstrated brand-building capabilities, a large and growing international product portfolio, strong R&D capabilities, and extensive manufacturing capacity. The company is led by experienced promoters and a professional management team.

To increase market share in the domestic market, Emcure Pharma plans to leverage its growing product portfolio, invest in brand development, expand its sales and marketing team, and implement patient awareness programs. The company aims to enhance its market presence in key therapeutic areas and increase penetration in rural and semi-rural parts of India.

Emcure Pharma also intends to continue in-licensing branded and patented products from multinational pharmaceutical companies to supplement its product range. The company is focused on increasing the penetration of its key brands and launching new differentiated products to address unmet patient needs.

The Emcure Pharma IPO presents a significant opportunity for investors looking to capitalize on the company’s robust growth and strong market presence. With a well-rounded business model, extensive product portfolio, and strategic growth plans, Emcure Pharma is well-positioned to continue its success in both domestic and international markets. The Emcure Pharma IPO is a testament to the company’s ongoing commitment to innovation, quality, and market expansion.

4. Financial Details of Emcure pharma

Emcure Pharmaceuticals Limited has demonstrated steady growth in its financial performance over the past few years. For the financial year ending March 31, 2024, the company’s revenue increased by 11.33% compared to the previous year, reaching ₹6,715.24 crore. However, the profit after tax (PAT) saw a decline of 6.1%, dropping from ₹561.85 crore in FY 2023 to ₹527.58 crore in FY 2024. Despite this drop in PAT, the company’s assets grew significantly, from ₹6,672.53 crore in FY 2023 to ₹7,806.16 crore in FY 2024.

The net worth of Emcure Pharmaceuticals also showed an upward trend, increasing from ₹2,501.13 crore in FY 2023 to ₹2,952.28 crore in FY 2024. This growth is further supported by the increase in reserves and surplus, which rose from ₹2,293.77 crore to ₹2,722.40 crore over the same period. Emcure Pharma’s total borrowings decreased slightly, from ₹2,202.42 crore in FY 2023 to ₹2,091.94 crore in FY 2024, reflecting improved financial management and reduced debt levels.

Emcure Pharma Valuations and Margins

The Emcure Pharma IPO valuations provide a comprehensive view of the company’s financial health and investor potential. The Earnings Per Share (EPS) for FY 2024 (pre-issue) is ₹27.49, which is expected to be ₹26.34 post-issue. The Price-to-Earnings (PE) ratio for FY 2024 is projected to be between 34.92 and 36.66 pre-issue, and between 36.44 and 38.26 post-issue, indicating a robust valuation despite the slight drop in EPS.

In terms of profitability, the Return on Net Worth (RONW) has seen a decline from 33.32% in FY 2022 to 16.87% in FY 2024. The Net Asset Value (NAV) per share increased from ₹109.69 in FY 2022 to ₹162.93 in FY 2024, highlighting the company’s growing asset base. The Return on Capital Employed (ROCE) also experienced a decrease, moving from 29.69% in FY 2022 to 19.37% in FY 2024. Emcure Pharma’s EBITDA margin dropped from 23.54% in FY 2022 to 19.01% in FY 2024, reflecting changes in operational efficiency.

The debt-to-equity ratio has improved over the years, decreasing from 0.99 in FY 2022 to 0.67 in FY 2024, indicating a stronger equity position and reduced reliance on debt financing.

The financial data of Emcure Pharma IPO reflects a company that is growing in revenue and assets, with a strong focus on reducing debt and increasing net worth. While there have been some declines in profitability metrics such as PAT and RONW, the overall financial health remains robust, making Emcure Pharma IPO a compelling consideration for investors. With its strategic growth plans and a strong presence in the pharmaceutical industry, Emcure Pharma is well-positioned for continued success.

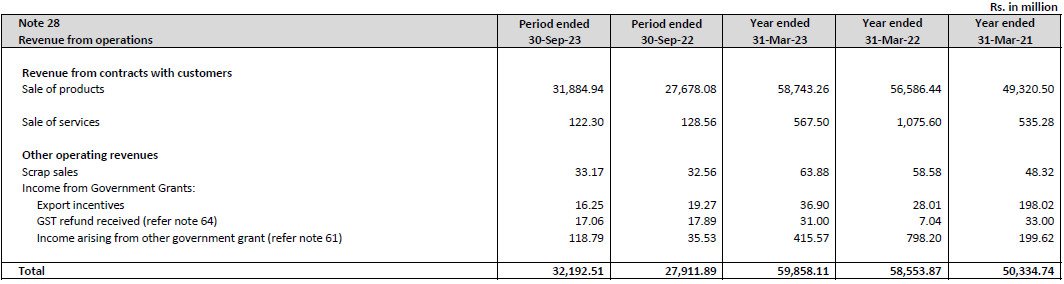

Statement Of Revenue From Operations

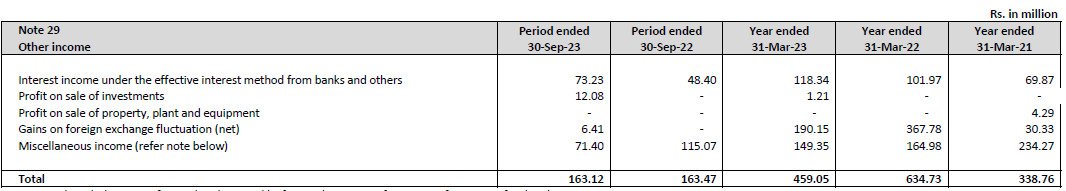

Statement of Other Income

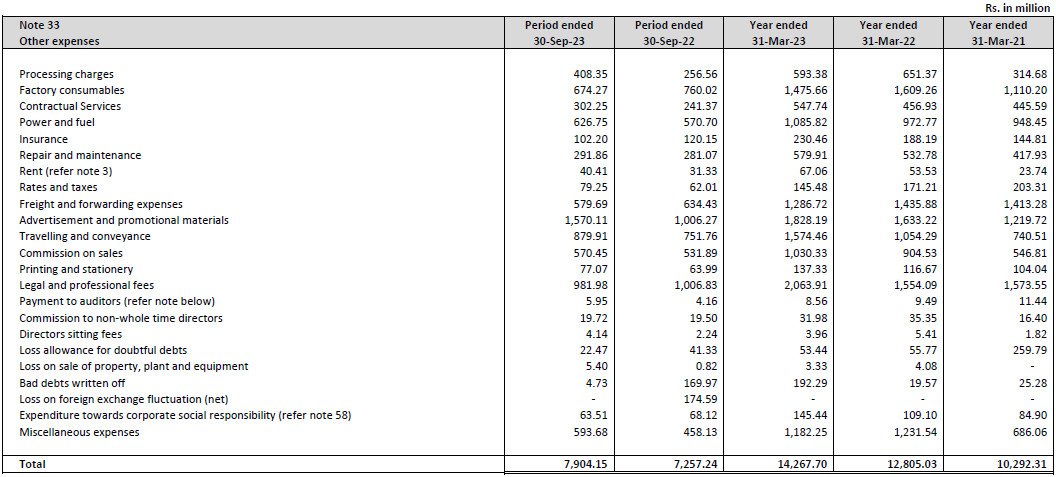

Statement of Other Expenses

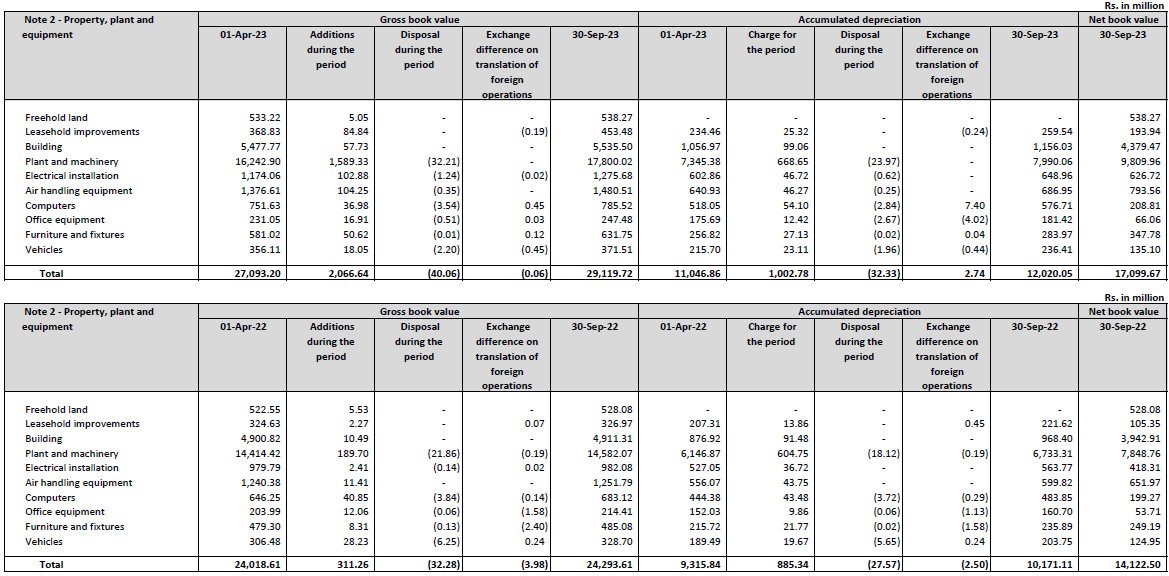

Statement of Property, Plant and Equipment

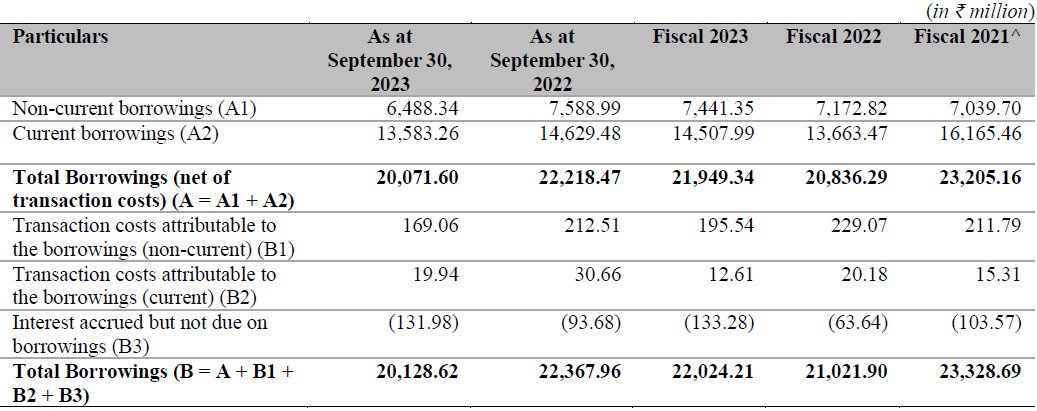

Statement of Borrowing

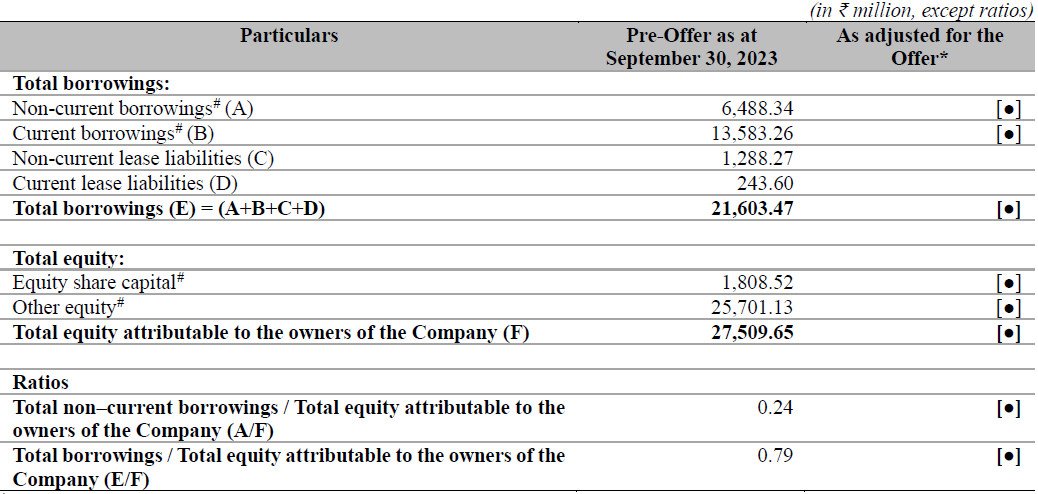

Statement of Capitalisation

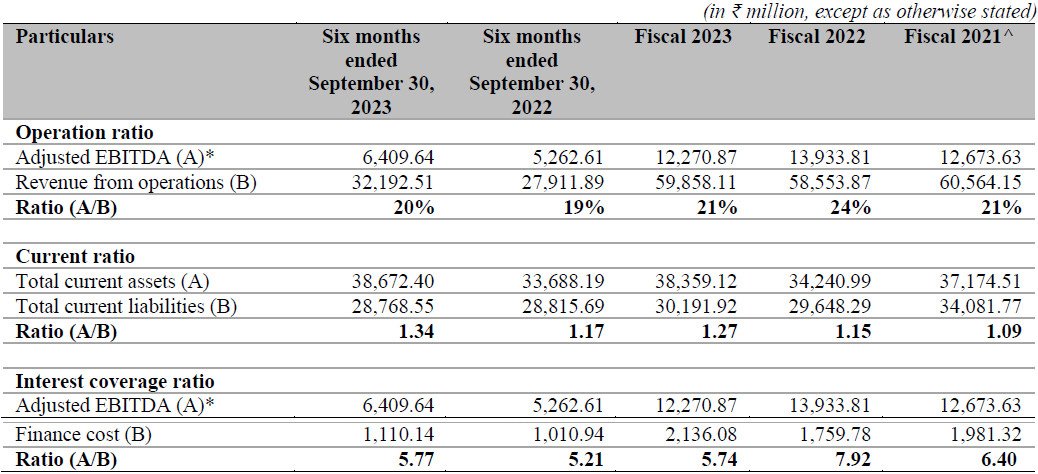

Financial Ratios

5.Emcure Pharma IPO FAQs

Emcure Pharma IPO Details

The Emcure Pharma IPO is scheduled to open on July 3, 2024.

The Emcure Pharma IPO will close on July 5, 2024.

The issue price range for the Emcure Pharma IPO is between ₹960.00 and ₹1008.00 per share.

The Emcure Pharma IPO will be listed on both the BSE and NSE.

The total issue size of the Emcure Pharma IPO is ₹1952.03 crore.

The fresh issue in the Emcure Pharma IPO is ₹800.00 crore.

The offer for sale is ₹1152.03 crore.

The face value of each equity share is ₹10.

Yes, employees are offered a discount of ₹90.00 per share in the Emcure Pharma IPO.

The minimum lot size for the Emcure Pharma IPO is 14 shares.

Emcure Pharma IPO Dates

The basis of allotment date is tentatively set for July 8, 2024.

Refunds will be initiated on July 9, 2024.

Shares will be credited to Demat accounts on July 9, 2024.

The Emcure Pharma IPO listing date is tentatively scheduled for July 10, 2024.

Emcure Pharma Business Model

Emcure Pharma focuses on therapeutic areas including gynecology, cardiovascular, HIV antivirals, and oncology.

Emcure Pharma has a presence in over 70 countries.

Emcure Pharma’s competitive advantage in the domestic market is driven by its differentiated product portfolio.

Sales in India contributed to 50.84% of Emcure Pharma’s total revenue for the six months ended September 30, 2023.

Emcure Pharma plans to leverage its growing product portfolio, invest in brand development, expand its sales team, and implement patient awareness programs.

Emcure Pharma has 13 manufacturing facilities and 5 dedicated R&D facilities in India, with a strong team of qualified scientists driving its research and development efforts.

Emcure Pharma Financial Data

Emcure Pharma’s revenue for the financial year ending March 31, 2024, was ₹6,715.24 crore.

Emcure Pharma’s profit after tax dropped by 6.1%, from ₹561.85 crore in FY 2023 to ₹527.58 crore in FY 2024.

Emcure Pharma’s total assets value as of March 31, 2024, was ₹7,806.16 crore.

The EPS for Emcure Pharma in FY 2024 (pre-issue) is ₹27.49.

The projected PE ratio for Emcure Pharma post-issue in FY 2024 is between 36.44 and 38.26.

Emcure Pharma’s debt-to-equity ratio improved from 0.99 in FY 2022 to 0.67 in FY 2024.

Emcure Pharma’s EBITDA margin for FY 2024 was 19.01%.

Emcure Pharma’s net worth increased from ₹2,501.13 crore in FY 2023 to ₹2,952.28 crore in FY 2024.

Emcure Pharma’s revenue grew by 11.33% between FY 2023 and FY 2024.

Emcure Pharma’s Return on Capital Employed (ROCE) in FY 2024 was 19.37%.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Emcure pharma IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Emcure pharma IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Emcure pharma IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Emcure pharma IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.