Table of Contents

The Divine Power IPO is a significant opportunity to invest in Divine Power Energy Ltd, formerly known as PDRV Enterprises, a leading manufacturer of insulated and bare copper and aluminum wires and strips in India. The company produces Bare Copper, Aluminium Wire, Aluminium Strip, and Winding Wire or strips, primarily serving power distribution companies and transformer manufacturers. Key customers include Tata Power, Pashchimanchal Vidhyut Vitran Nigam, BSES, and other major power corporations. With a state-of-the-art manufacturing plant in Sahibabad, Ghaziabad, Divine Power Energy Ltd has a total installed capacity of 300 metric tonnes of aluminium and 400 metric tonnes of copper per month.

Divine Power IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

25th Jun 2024 | 27th Jun 2024 | 28thJun 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 01st July 2024 | 01st July 2024 | 2nd July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹ 22.76 Cr | ₹ 36.00 – ₹ 40.00 | 3000 Shares | 56.90,000 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 3000 | ₹ 1,20,000 |

| Retail(Max) | 1 | 3000 | ₹ 1,20,000 |

| Small-HNI (Min) | 2 | 6000 | ₹ 2,40,000 |

| Small-HNI (Max) | 8 | 24000 | ₹ 9,60,000 |

| Big-HNI (Min) | 9 | 27000 | ₹ 10,80,000 |

| RII (Retail) | NII | QIB |

| 35.00% | 15.00% | 50.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 100.00% | – | NSE SME |

| No | Objectives |

| 1 | To meet the working capital requirements of the Company |

| 2 | General Corporate Purpose |

| LEAD | REGISTRAR |

| KHAMBATTA SECURITIES LIMITED | Bigshare Services Private Limited |

| Telephone | |

| info@dpel.in | 011-36001992/ 2842 |

Divine Power IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Financial of Divine Power IPO

| Amounts in Lakhs ₹ | |||

| Particulars | FY-2024 | FY-2023 | FY-2022 |

| Assets | 8,889 | 7,253 | 6,276 |

| Revenue | 22,272 | 15,084 | 12,290 |

| Expense | 21,456 | 14,620 | 12,166 |

| Net Worth | 2,557 | 1,916 | 1,246 |

| Borrowing | 5,785 | 4,764 | 4,466 |

| EBITDA(%) | 6.76 | 6.87 | 4.66 |

| Reserves | 979 | 338 | 1,232 |

| PAT | 641 | 285 | 81 |

| EPS | 4.06 | 2.31 | 0.66 |

| Debt/Equity | 2.24 | 2.46 | 3.57 |

| Established | Website | Industry |

| 2001 | dpel.in | Metal Wire |

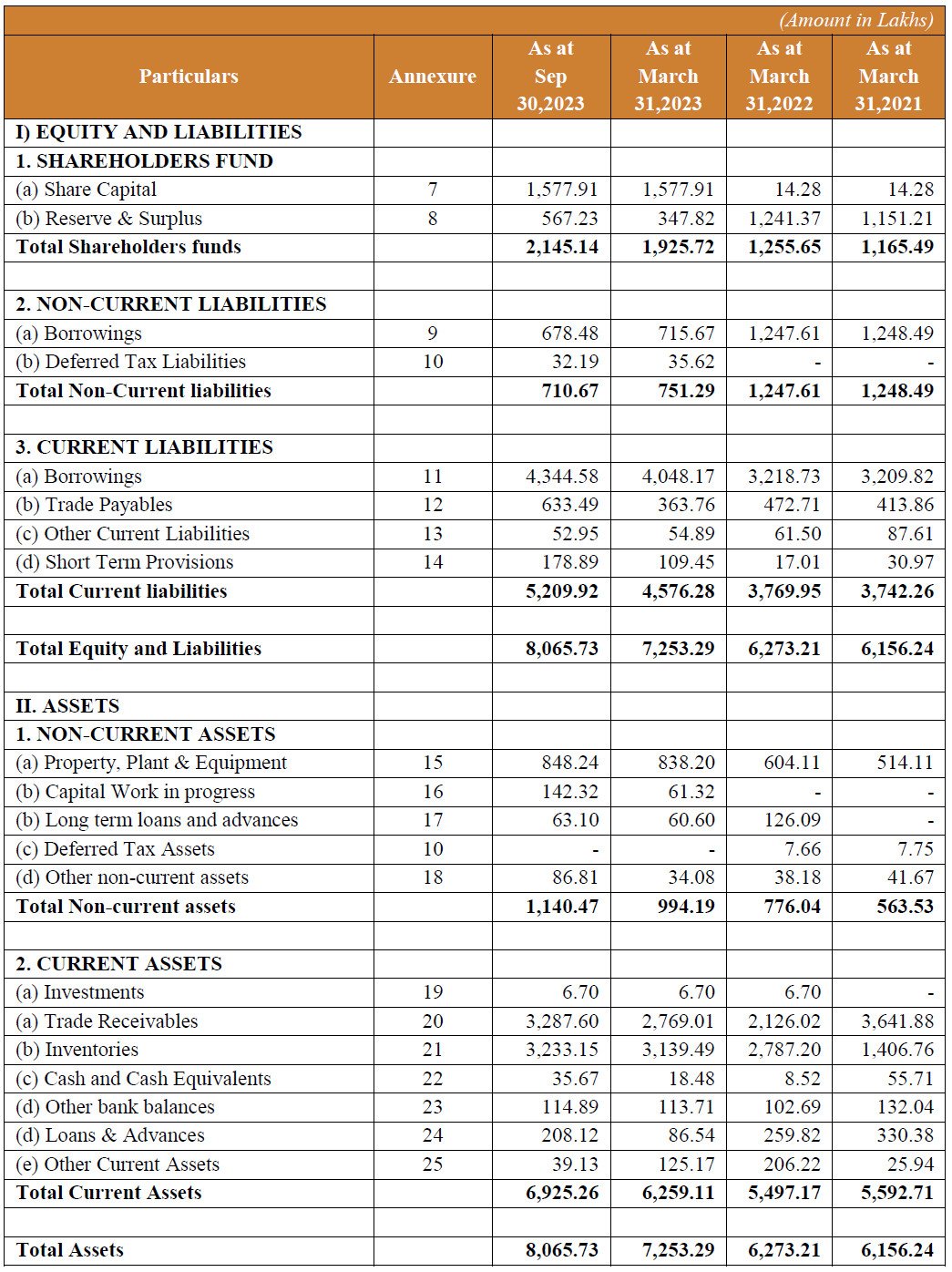

Statement of Assets and Liabilities

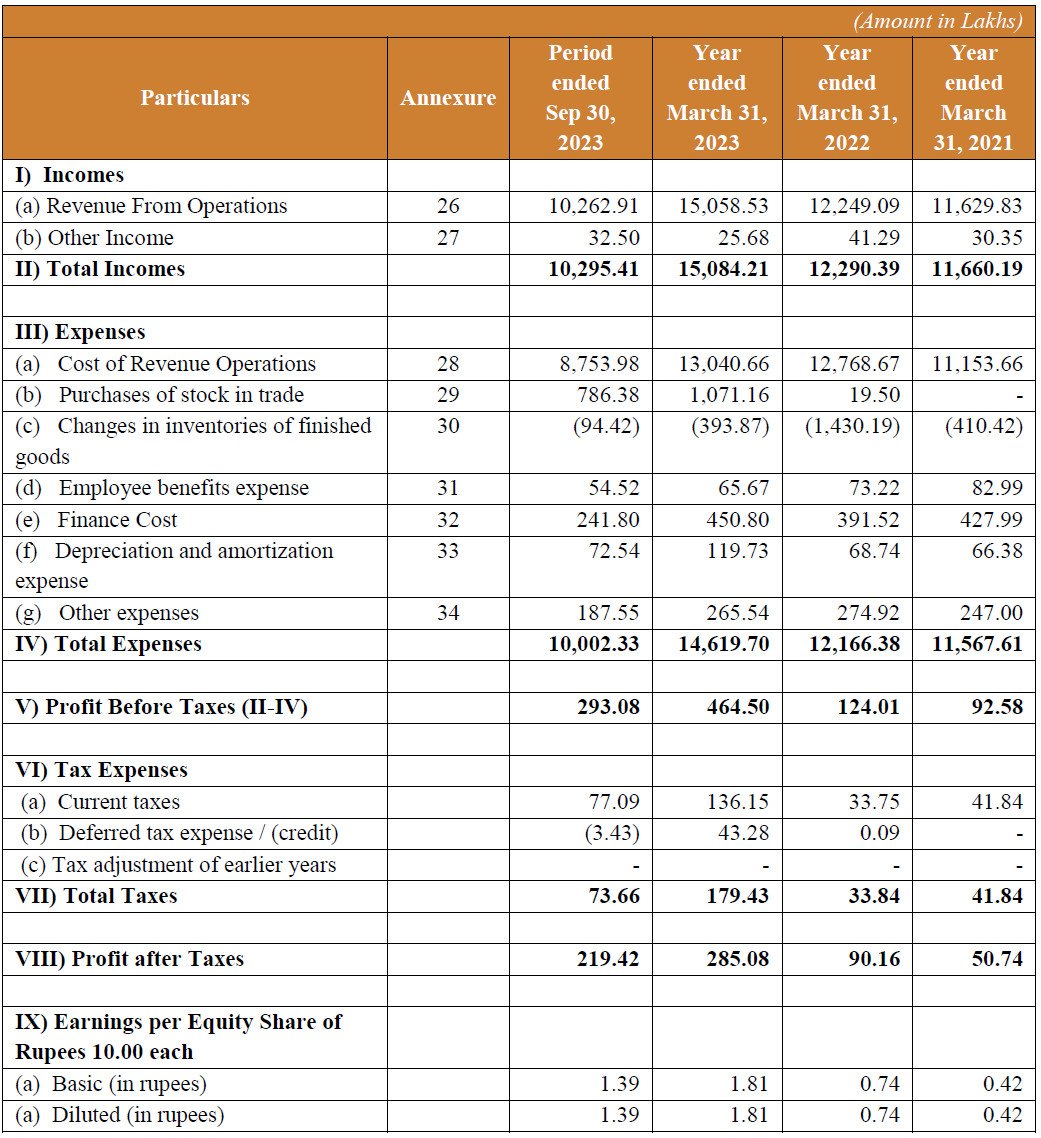

Statement of Profit and Loss

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Divine Power IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Divine Power IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Divine Power IPO and other offerings a more informed and confident endeavor.

1.Divine Power IPO key dates & Issue Details

The Divine Power IPO is set to open for subscription on 25th June 2024 and will close on 27th June 2024. Investors should note that the Divine Power IPO issue price is set between ₹36.00-40.00 per share. This IPO will be listed on the NSE SME platform, offering a unique opportunity for retail and institutional investors alike.

This Book Build Issue aims to raise ₹22.76 Cr through a fresh issue, with a face value of ₹10 per equity share. The promoters hold 100% pre-IPO, but their holding post-IPO will be determined after the issue. Retail investors are guaranteed at least 35% of the net issue, ensuring significant participation from small investors.

Divine Power IPO Important Dates

Investors should keep a close watch on the important dates related to the Divine Power IPO. The basis of allotment will be determined by 28th June 2024. Refunds will be initiated by 1st July 2024, and the credit of shares to Demat accounts will also happen on 1st July 2024. Finally, the Divine Power IPO is expected to list on the NSE SME on 2nd July 2024.

Divine Power IPO Lot Details

The Divine Power IPO offers market lots of 3000 shares, with one lot amounting to ₹120,000. For High Net-worth Individuals (HNIs), the minimum subscription is 6000 shares, equating to 2 lots. This structure allows both small and large investors to participate in the IPO, making it a versatile investment option.

With the Divine Power IPO, investors have the opportunity to engage in a promising venture with well-defined dates and transparent processes. Keep an eye on the Divine Power IPO to ensure timely participation and potential growth in your investment portfolio.

2. Divine Power IPO Allotment Status

Dive into the excitement surrounding the Divine Power IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Divine Power IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Divine Power IPO journey.

3. Introduction to Divine Power IPO: Company Overview and Business Model

Incorporated on August 24, 2001, as ‘PDRV Enterprises Private Limited,’ our company underwent several name changes and structural transformations before becoming ‘Divine Power Energy Limited.’ This transformation highlights our adaptability and growth over the years. Initially renamed ‘Dee Power and Electricals Private Limited’ in January 2023, and subsequently ‘Divine Power Energy Private Limited’ in June 2023, we eventually converted into a public limited company on August 3, 2023. Today, Divine Power Energy Limited is a leading manufacturer of Bare Copper/Aluminium Wire, Bare Copper/Aluminium Strip, and Winding Copper/Aluminium Wire and Strip.

Business Model of Divine Power IPO

Our core business revolves around manufacturing insulated wires and strips essential for power distribution and transformer manufacturing. These products are vital for creating transformer coils, which play a crucial role in power transmission by converting electrical energy into magnetic energy and vice versa. Our range includes wires and strips insulated with materials such as paper, cotton, fiberglass, and super enamel. This versatility ensures our products meet various customer needs, from power distribution companies to electromagnetic coil manufacturers.

In recent years, we have expanded our product line to include fiberglass-covered wires and strips, used in manufacturing electromagnetic coils for lifting magnets. This expansion has opened up markets in Punjab, Bengaluru, Ahmedabad, and other regions. Additionally, we have started trading in super enameled wires and strips, with plans to manufacture these in response to market demand.

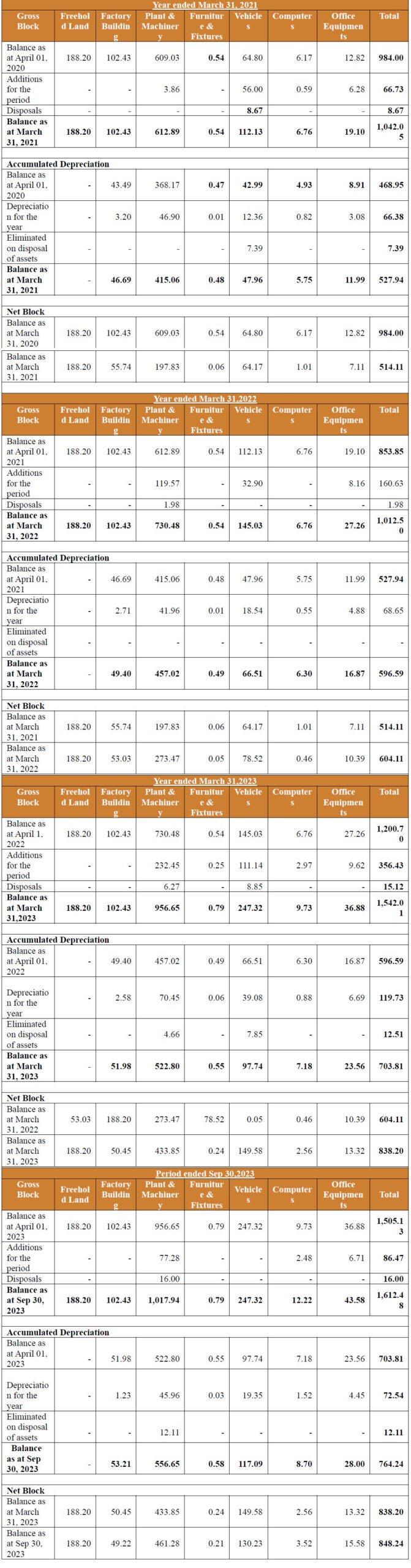

Manufacturing Capabilities

Our state-of-the-art manufacturing facility in Ghaziabad is equipped to produce 300 metric tonnes of aluminium and 400 metric tonnes of copper per month. The facility, spread over 1,777 square meters, includes advanced machinery such as Vertical Paper Covering Machines, Fiberglass Insulation Machines, and Wire Drawing Machines. This setup enables us to maintain high-quality production standards and meet the growing demands of the power distribution sector.

Market Presence and Clientele

Divine Power IPO enjoys a robust market presence in North India, catering to power distribution companies and transformer manufacturers in states like Uttar Pradesh, Delhi, Uttarakhand, Haryana, Punjab, and Bihar. We have also entered new markets, selling fiberglass insulated winding wires in Punjab, Karnataka, and Gujarat. Our esteemed clients include industry leaders like TATA Power Limited and various regional power corporations, ensuring a stable demand for our products.

Mission and Vision of Divine Power IPO

Our mission is to empower the future by providing high-quality insulated copper and aluminium wires and strips that fuel innovation and connectivity across India. We aim to be the premier manufacturer in our industry, recognized for excellence in quality, innovation, and sustainability. By continuously pushing boundaries and fostering technological advancements, we strive to contribute to a brighter, electrified future for all.

Core Values and Competitive Strengths

At Divine Power IPO, we are committed to quality excellence, innovation, sustainability, and financial responsibility. Our advanced manufacturing technology and diverse product range allow us to cater to varied industry needs. We pride ourselves on our customization capabilities, enabling us to meet specific customer requirements effectively. Our experienced team, led by promoters with over four decades of industry experience, drives our success and growth.

Strategic Growth Plans

To strengthen our brand value, we plan to enhance our market presence through various marketing initiatives and expand our customer base by increasing production and diversifying our product mix. Our focus on quality assurance, operational efficiency, and technological enhancements ensures that we remain competitive and relevant in the market.

Impact of COVID-19 on Divine Power IPO

Despite the global economic downturn caused by the COVID-19 pandemic, our operations remained largely unaffected as our products were classified as “Essential Products” by the government. This classification allowed us to continue operations under strict guidelines, ensuring minimal disruption to our business.

Divine Power IPO is poised for significant growth, driven by our commitment to quality, innovation, and sustainability. Our advanced manufacturing capabilities, diverse product range, and strategic growth plans position us as a leader in the insulated wire and strip manufacturing industry. As we continue to expand our market presence and product offerings, we remain dedicated to contributing to India’s energy security and sustainable development.

4. Financial Details of Divine Power

Divine Power IPO: Impressive Financial Growth

Divine Power Energy Limited has showcased remarkable financial growth, reinforcing the strength and potential of the Divine Power IPO. The company’s revenue saw a substantial increase of 47.65% from ₹15,084.20 Lakhs in the fiscal year ending March 31, 2023, to ₹22,272.00 Lakhs in the fiscal year ending March 31, 2024. This surge in revenue underscores the expanding market presence and operational efficiency of Divine Power IPO.

Significant Profit Increase

In line with the revenue growth, Divine Power Energy Limited’s profit after tax (PAT) soared by 124.82%, rising from ₹284.94 Lakhs in FY 2023 to ₹640.59 Lakhs in FY 2024. This significant increase in profit highlights the company’s robust financial health and its potential for delivering strong returns, making the Divine Power IPO an attractive investment opportunity.

Asset and Net Worth Growth

The total assets of Divine Power Energy Limited grew from ₹7,253.31 Lakhs in FY 2023 to ₹8,889.24 Lakhs in FY 2024. Concurrently, the net worth increased from ₹1,915.94 Lakhs to ₹2,556.53 Lakhs, reflecting the company’s solid financial foundation and its strategic asset management. Such growth metrics are indicative of the promising outlook for the Divine Power IPO.

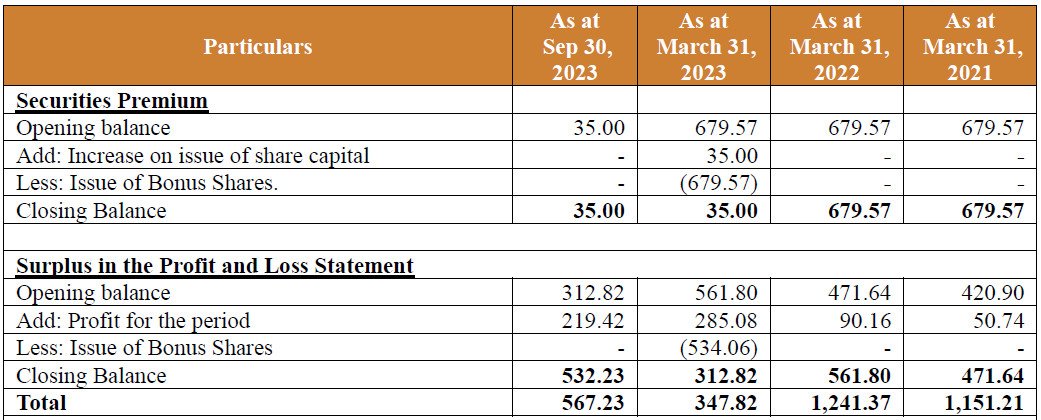

Reserves and Surplus Enhancement

The reserves and surplus of Divine Power Energy Limited witnessed an impressive rise from ₹338.03 Lakhs in FY 2023 to ₹978.62 Lakhs in FY 2024. This enhancement in reserves showcases the company’s prudent financial strategies and its ability to reinvest profits for future growth, further strengthening the prospects of the Divine Power IPO.

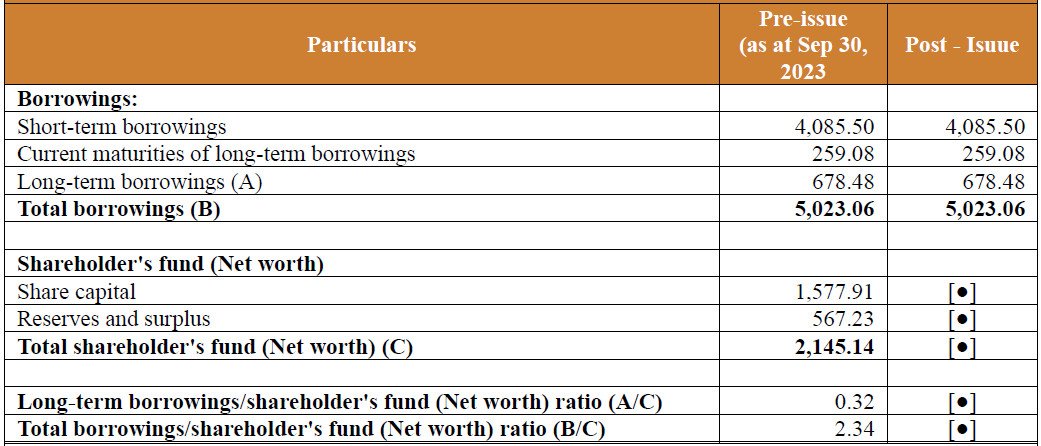

Debt and Borrowing Insights

Despite the growth in various financial parameters, the total borrowing saw a moderate increase, reaching ₹5,785.44 Lakhs in FY 2024 from ₹4,763.84 Lakhs in FY 2023. However, the debt-to-equity ratio improved from 3.57 in FY 2022 to 2.24 in FY 2024, demonstrating the company’s effective debt management. This improved ratio is a positive indicator for potential investors in the Divine Power IPO.

Mid-Year Financial Performance

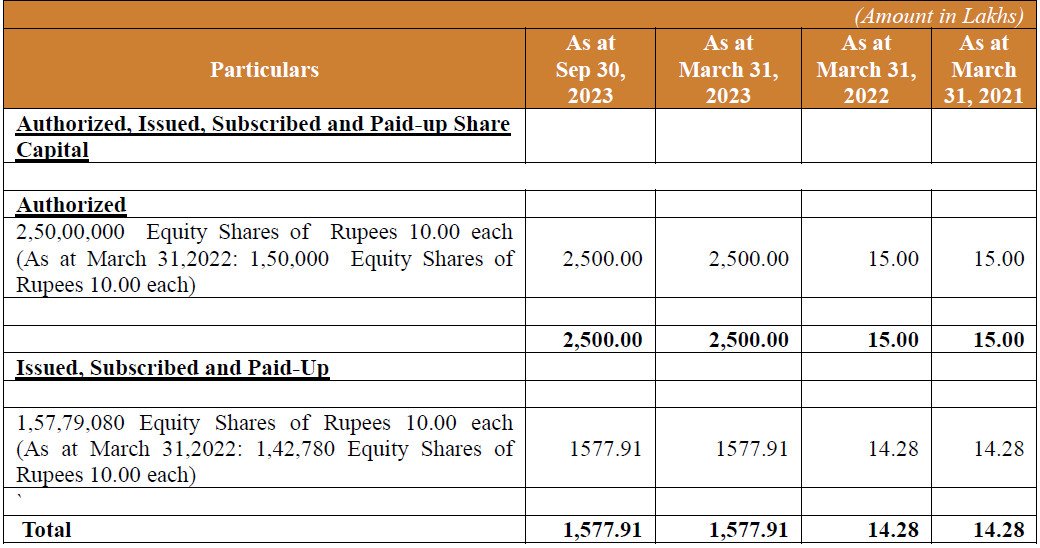

For the six-month period ending September 30, 2023, Divine Power Energy Limited reported a total income of ₹10,295.41 Lakhs and a profit of ₹219.42 Lakhs. The net worth for this period was ₹2,145.14 Lakhs, with reserves and surplus at ₹567.23 Lakhs. These figures reflect the company’s consistent performance and financial stability, further enhancing the attractiveness of the Divine Power IPO.

Valuation and Margins

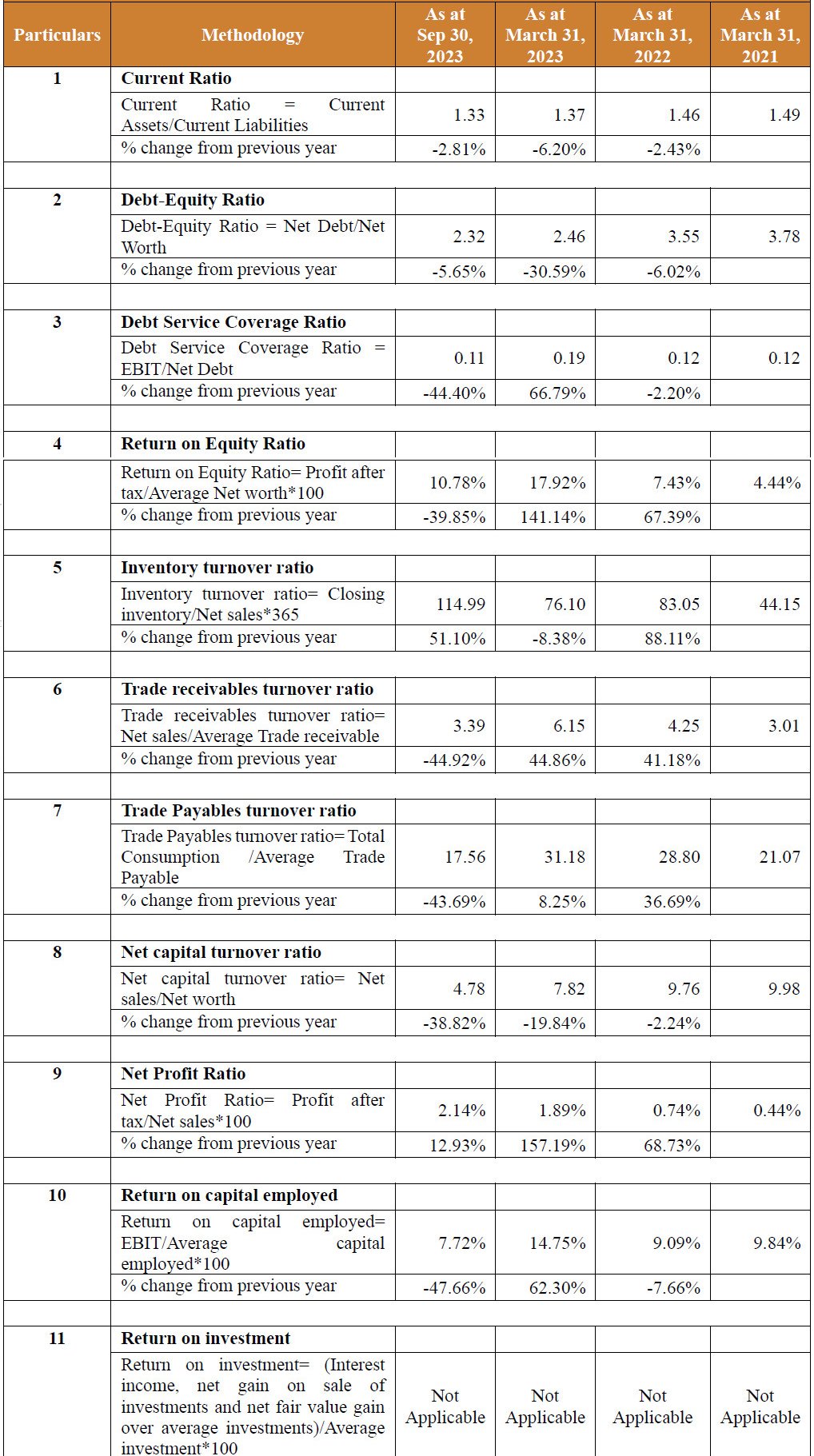

The valuation metrics of Divine Power IPO reveal promising figures. The earnings per share (EPS) rose from 0.66 in FY 2022 to 4.06 in FY 2024. The return on net worth (RONW) increased from 6.46% in FY 2022 to 25.06% in FY 2024. The net asset value (NAV) per share also showed growth, reaching 16.20 in FY 2024 from 10.15 in FY 2022.

Efficiency and Profitability Ratios

The return on capital employed (ROCE) improved from 8.87% in FY 2022 to 18.05% in FY 2024, indicating better utilization of capital. The EBITDA margin stood at 6.76% in FY 2024, reflecting the company’s operational efficiency. The debt-to-equity ratio further decreased to 2.24 in FY 2024, demonstrating effective debt management.

The financial data of Divine Power Energy Limited underscores a robust and growing financial profile, making the Divine Power IPO a compelling investment prospect. With significant increases in revenue, profit, assets, and efficient debt management, the company is well-positioned for future growth and success. Potential investors in the Divine Power IPO can expect promising returns and long-term value.

Statement of Property, Plant and Equipment

Statement of Reserves & Surplus

Statement of Equity Share Capital

Statement of Capitalisation

Financial Ratios

5.Divine Power IPO FAQs

Divine Power IPO Details Details

The issue price range for the Divine Power IPO is ₹36.00-40.00 per share.

The Divine Power IPO opens on June 25, 2024.

The Divine Power IPO closes on June 27, 2024.

The size of the Divine Power IPO issue is ₹22.76 Crores.

The Divine Power IPO will be listed on the NSE SME platform.

The face value of each share in the Divine Power IPO is ₹10.

The Divine Power IPO is a Book Build Issue

The retail quota for the Divine Power IPO is not less than 35% of the net issue.

Divine Power IPO Dates

The basis of allotment date for the Divine Power IPO is June 28, 2024 (tentative).

Refunds for the Divine Power IPO will be initiated on July 1, 2024 (tentative).

The shares will be credited to Demat accounts on July 1, 2024 (tentative).

The listing date for the Divine Power IPO is July 2, 2024 (tentative).

Divine Power IPO Issue Details

The market lot for the Divine Power IPO is 3000 shares.

The minimum amount required to apply for one lot is ₹120,000.

The minimum number of shares required for an HNI application is 6000 shares (2 lots).

Divine Power Business Model

Divine Power Energy Limited manufactures Bare Copper/Aluminium Wire, Bare Copper/Aluminium Strip, Winding Copper/Aluminium Wire, and Winding Copper/Aluminium Strip.

Divine Power’s products are primarily used by power distribution companies and transformer manufacturers to manufacture transformers and repair normal wear and tear.

Recently, Divine Power has started manufacturing wires/strips covered with fiberglass, used in electromagnetic coils for lifting magnets, and started trading super enameled wires and strips.

Divine Power Energy Limited serves reputed clients such as TATA Power Limited, Pashchimanchal Vidyut Vitran Nigam Limited, BSES, Madhyanchal Vidyut Vitaran Nigam Limited, and others.

The COVID-19 pandemic had a limited impact on Divine Power’s operations as their product was deemed essential, allowing them to continue operations under strict guidelines.

Divine Power Financial Data

The revenue for Divine Power Energy Limited in FY 2024 was ₹22,272.00 Lakhs.

Divine Power Energy Limited’s profit after tax (PAT) increased by 124.82% in FY 2024 compared to FY 2023.

The total assets of Divine Power Energy Limited at the end of FY 2024 were ₹8,889.24 Lakhs.

Divine Power Energy Limited’s net worth at the end of FY 2024 was ₹2,556.53 Lakhs.

The debt-to-equity ratio of Divine Power Energy Limited in FY 2024 is 2.24.

The EPS for Divine Power Energy Limited increased from 0.66 in FY 2022 to 4.06 in FY 2024.

The return on capital employed (ROCE) for Divine Power Energy Limited in FY 2024 was 18.05%.

The EBITDA margin for Divine Power Energy Limited in FY 2024 was 6.76%.

The reserves and surplus of Divine Power Energy Limited at the end of FY 2024 were ₹978.62 Lakhs.

Divine Power Energy Limited’s net worth increased by ₹640.59 Lakhs from FY 2023 to FY 2024.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Divine Power IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Divine Power IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Divine Power IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Divine Power IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.