DelaPlex IPO emerged onto the scene in February 2004, marking its inception. It swiftly positioned itself as a frontrunner in delivering technology and software development solutions, along with offering consultancy services to elevate client growth, revenue, and market value. With a robust portfolio, DelaPlex IPO has forged strategic partnerships and honed expertise across diverse industries, ensuring access to cutting-edge technologies, tools, and software solutions. Renowned globally as a technology partner, DelaPlex IPO specializes in supply chain consulting, bespoke software development, cloud services, and data science solutions.

DelaPlex IPO Dates

| IPO Open Date | IPO Closed Date | Allotment Date |

| 25th Jan 2024 | 30th Jan 2024 | 31st Jan 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 31st Jan 2024 | 1st Feb 2024 | 2nd Feb 2024 |

India's First IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

DelaPlex IPO Issue Details

| IPO Issue Size | IPO Issue Price | Market Lot |

| ₹46.08 Cr | 186.00-192.00 | 600 Shares |

Financial of DelaPlex

| Particulars | Sep-23 | Mar-23 | Mar-22 | Mar-21 |

| Assets | 3,185.45 | 2,638.33 | 1,790.90 | 1,100.77 |

| Revenue | 2,814.28 | 5,521.81 | 5,034.06 | 3,633.30 |

| Expense | 2238.2 | 4460.88 | 4232.26 | 3118.16 |

| PBT | 576.08 | 1060.93 | 801.8 | 515.14 |

| PAT | 425.53 | 790.72 | 611.87 | 404 |

| ROE | 16.60% | 40.45% | 48.82% | 50.46% |

| Profit Ratio | 15.27% | 14.64% | 12.30% | 11.15% |

| Fresh Issue | Offer for Sale | Total Offer Size |

| 18,00,000 | 6,00,000 | 24,00,000 |

| RII (Retail) | NII | QIB |

| 50% | 21.44% | 28.56% |

| 1 Lot Amount | Min Small HNI Lots | Max Small HNI Lots | Min Big HNI Lots |

| 115200 | 2 Lots (1200 Shares) | 8 Lots (4800 Shares) | 9 Lots (5400 Shares) |

| Pre-Promoter | Post Promoter | Listing IN |

| 100% | 73.66% | NSE |

| Lead Manager | Registrar |

| Shreni Ltd. | Bigshare Services Pvt. Ltd. |

| Established | Website | Industry |

| 2004 | https://delaplex.in | IT-Software |

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first DelaPlex IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from DelaPlex IPO.

SwiftTopics.com’s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with DelaPlex IPO and other offerings a more informed and confident endeavor.

1. DelaPlex IPO key dates

The highly anticipated DelaPlex IPO is set to captivate investors with its offering. Scheduled to commence on 25th January 2024, the IPO presents an opportunity for investors to delve into the thriving market landscape. The IPO window will close on 30th January 2024, marking a limited-time opportunity for interested parties to participate.

Bolstering investor confidence, the basis of allotment for the DelaPlex IPO is slated for 31st January 2024, coinciding with the initiation of refunds. This meticulous timeline ensures transparency and efficiency throughout the IPO process. Moreover, shareholders can anticipate the seamless credit of shares to their demat accounts by 1st February 2024, streamlining the post-IPO proceedings.

Crucially, the DelaPlex IPO boasts a market lot of 600 shares, with each lot amounting to ₹115,200. Notably, for High Net Worth Individuals (HNIs), the minimum lot requirement stands at 1200 shares, emphasizing inclusivity within the investor spectrum. With an issue price ranging between ₹186.00 and ₹192.00, investors can strategically assess their investment decisions against prevailing market conditions.

Excitement peaks as the DelaPlex SME IPO gears up for its listing on 2nd February 2024, signaling the commencement of trading activities. As market participants eagerly await the IPO’s debut, DelaPlex IPO emerges as a focal point of discussion, embodying resilience and potential in the contemporary investment landscape. Explore the transformative possibilities of the DelaPlex IPO and embark on a journey of financial discovery.

2. DelaPlex IPO allotment Status

Dive into the excitement surrounding the DelaPlex IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your DelaPlex IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the DelaPlex IPO journey.

3. Introduction to DelaPlex

- Introducing DelaPlex, a pioneering force in technology and software development solutions, dedicated to empowering client companies worldwide. At DelaPlex, our core mission revolves around driving growth, revenue, and marketplace value through cutting-edge technology and strategic consulting expertise.

- As a global technology partner, DelaPlex specializes in Supply Chain Consulting, Custom Software Development, Cloud Services, and Data Science. With a focus on innovation and collaboration, we harness the latest advancements in software-defined data centers, cloud technologies, DevOps, security solutions, data analytics, and artificial intelligence to craft next-gen solutions tailored to address IT challenges.

- DelaPlex Limited (dpl), a subsidiary of DelaPlex INC., operates under the umbrella of its U.S.-based parent company, where DelaPlex INC. holds a majority stake. Our commitment to excellence is reflected in our diverse portfolio of services and solutions, designed to drive Supply Chain Transformation, Consultation, and Software Solutions for businesses across industries.

Why Supply Chain Transformation Matters:

- Supply chain transformation isn’t just a buzzword; it’s a pivotal strategy for businesses aiming to thrive in today’s dynamic marketplace. By embracing digital transformation and leveraging advanced technologies, companies can streamline operations, boost efficiency, and enhance quality control, ultimately leading to improved customer satisfaction and loyalty.

- Moreover, sustainability and risk mitigation are integral components of modern supply chains. By adopting eco-friendly practices and leveraging data-driven insights, businesses can reduce their carbon footprints and effectively manage supply chain disruptions, ensuring long-term resilience and competitiveness.

- At DelaPlex, we recognize that the future belongs to those who innovate and adapt. Through Supply Chain Transformation, businesses can future-proof their operations and stay ahead of the curve in an ever-evolving digital landscape.

- Discover the transformative potential of DelaPlex IPO and unlock new possibilities for your business. Join us in shaping the future of technology and supply chain excellence.

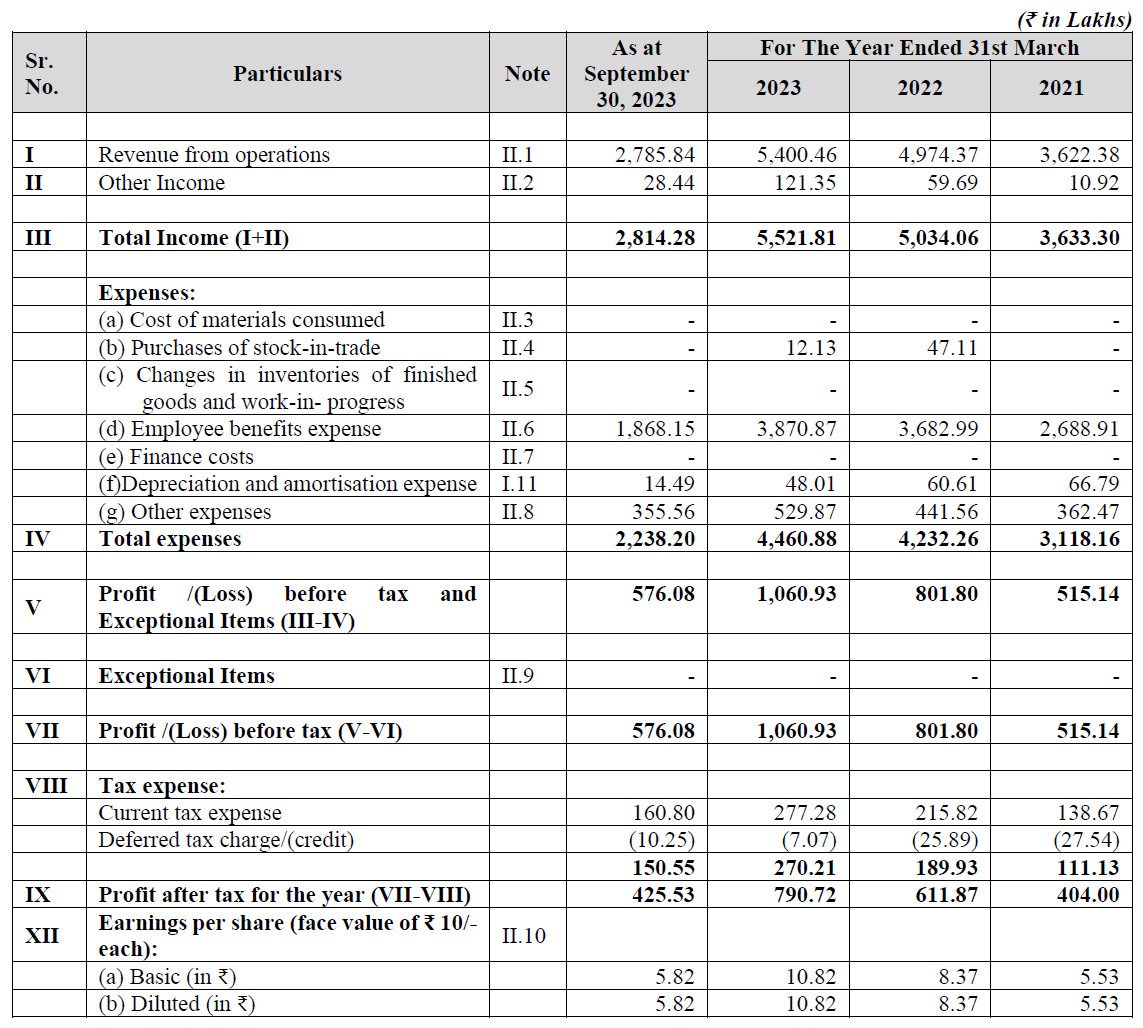

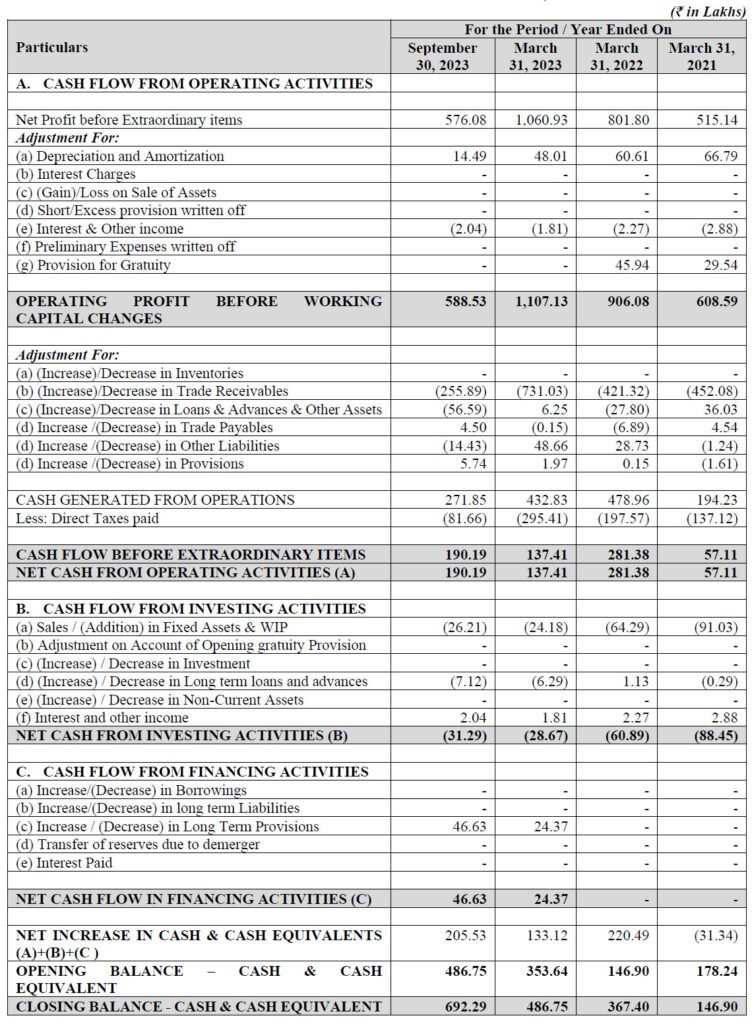

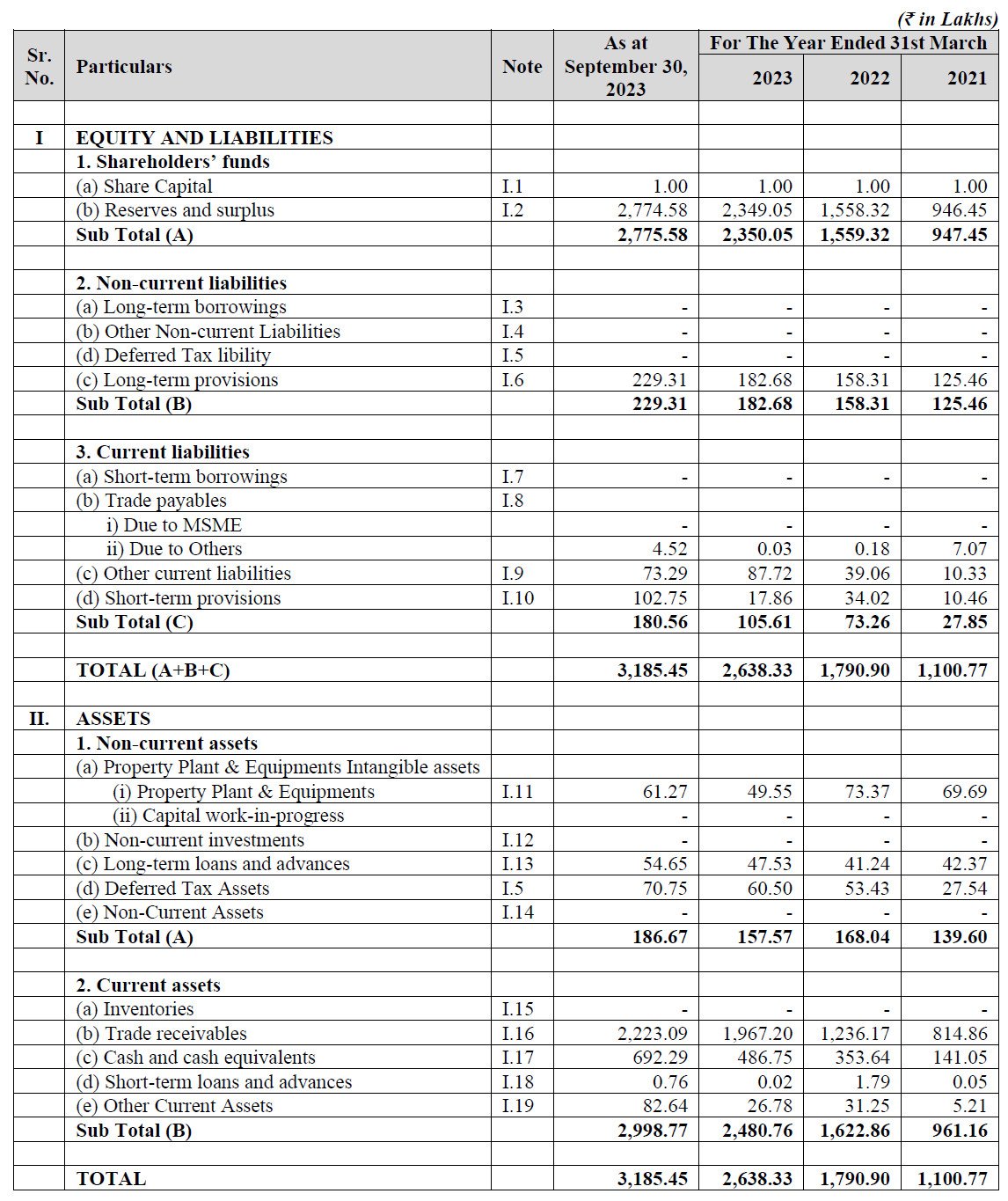

4. Financial Details of DelaPlex

DelaPlex IPO showcases a remarkable trajectory of growth and financial stability, as reflected in its financial performance over the years. As of September 30, 2023, DelaPlex boasts impressive assets totaling ₹3,185.45 Lakhs, indicating a substantial increase from previous periods. This robust asset base underscores DelaPlex’s solid foundation and potential for expansion in the market.

Furthermore, DelaPlex’s revenue figures portray a dynamic business model, with revenue standing at ₹2,814.28 Lakhs for the period ending September 30, 2023. Despite fluctuations in revenue over the years, DelaPlex has consistently demonstrated resilience and adaptability in generating substantial income streams.

STATEMENT OF STANDALONE PROFIT & LOSS, AS RESTATED

Profit After Tax (PAT) is another key indicator of DelaPlex’s financial health, with PAT amounting to ₹425.53 Lakhs for the period ending September 30, 2023. This noteworthy profitability underscores DelaPlex’s efficiency in managing costs and maximizing returns, instilling confidence among investors eyeing the DelaPlex IPO.

STATEMENT OF STANDALONE CASH FLOW, AS RESTATED

Moreover, DelaPlex’s net worth and reserves and surplus reflect a trajectory of steady growth and value creation. With a net worth of ₹2,775.58 Lakhs and reserves and surplus amounting to ₹2,774.58 Lakhs as of September 30, 2023, DelaPlex exemplifies sound financial management and strategic resource allocation.

STATEMENT OF ASSETS AND LIABILITIES

As investors consider participating in the DelaPlex IPO, these financial metrics serve as compelling indicators of DelaPlex’s strength and potential in the market. With a solid asset base, robust revenue generation, healthy profitability, and strong net worth, DelaPlex stands poised to embark on a new chapter of growth and innovation through its IPO offering. Explore the transformative opportunities of the DelaPlex IPO and seize the chance to be part of a dynamic journey towards success.

5. DelaPlex IPO FAQs

1. DelaPlex's Financial Performance

DelaPlex has showcased a trajectory of growth, with increasing assets, revenue, and profitability over the years.

2. DelaPlex’s Asset Base

DelaPlex’s asset base is bolstered by strategic investments, acquisitions, and organic growth initiatives.

3. DelaPlex’s Revenue Generation

DelaPlex leverages its expertise in technology and software development to offer innovative solutions and consulting services to clients worldwide, thereby driving revenue.

4. DelaPlex’s Profitability

DelaPlex has maintained a consistent level of profitability, reflecting its ability to manage costs and maximize returns effectively.

5. DelaPlex’s Net Worth and Reserves

DelaPlex’s net worth is calculated based on its assets minus liabilities, representing the value of the company’s equity.

6. DelaPlex’s Investment Considerations

Investors should assess DelaPlex’s financial performance, market outlook, competitive positioning, and growth prospects before making investment decisions.

7. DelaPlex’s Market Outlook

The market outlook for companies like DelaPlex is positive, driven by increasing demand for technology solutions and digital transformation initiatives across industries.

8. DelaPlex IPO Process

The timeline for DelaPlex IPO includes the opening and closing dates for subscription, allotment date, refund initiation, credit of shares to demat, and listing date.

9. DelaPlex’s Corporate Structure

DelaPlex Limited is a subsidiary of DelaPlex INC., where DelaPlex INC. holds a majority stake, influencing the company’s strategic direction and operations.

10. DelaPlex’s Business Strategy

DelaPlex’s core focus lies in supply chain transformation, consultation, and software solutions, leveraging technology and innovation to drive client growth and operational excellence.

11. Supply Chain Transformation

DelaPlex helps businesses maximize the value of their supply chains by identifying opportunities, developing roadmaps, and deploying cutting-edge solutions to enhance efficiency and agility.

12. Consultation and Software Solutions

DelaPlex offers a comprehensive suite of consulting services, including supply chain consulting, custom software development, cloud services, and data science solutions.

13. Client Base

DelaPlex works closely with a diverse range of clients, including global brands and companies across industries, forming strategic partnerships to deliver innovative solutions.

14. Sustainability Initiatives

DelaPlex integrates sustainability practices into its supply chain solutions, aiming to reduce environmental impact and help clients meet their sustainability goals.

15. Risk Management

DelaPlex employs advanced analytics, market intelligence, and agile methodologies to anticipate and mitigate supply chain disruptions, ensuring business continuity and resilience.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding DelaPlex IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the DelaPlex IPO. This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in DelaPlex IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the DelaPlex IPO journey.

Thank you for choosing swifttopics.com, and we look forward to assisting you with any information you may require.