Table of Contents

The Bansal Wire Industries IPO, set to launch soon, showcases a company incorporated in December 1985 that has grown to become the largest producer of stainless steel wire and the second-largest producer of steel wire in India, with a production of 72,176 MTPA and 206,466 MTPA in FY 2023, representing a market share of 20% and about 4%, respectively. Bansal Wire Industries Limited, with its 38-year history, has consistently delivered quality products and established a strong presence in the steel wire industry. The company’s diversified portfolio serves sectors such as automotive, general engineering, infrastructure, hardware, consumer goods, energy and transmission, agriculture, and the automotive aftermarket. Operating under the brand name “BANSAL”.

Bansal Wire Industries IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

03rd July 2024 | 05th July 2024 | 08th July 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 09th July 2024 | 09th July 2024 | 10th July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹745.00 Cr | ₹ 243.00 – ₹ 256.00 | 58 Shares | 2,91.01,562 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 58 | ₹ 14,848 |

| Retail(Max) | 13 | 754 | ₹ 1,93,024 |

| Small-HNI (Min) | 14 | 812 | ₹ 2,07,872 |

| Small-HNI (Max) | 67 | 3886 | ₹ 9,94,816 |

| Big-HNI (Min) | 68 | 3944 | ₹ 10,09,664 |

| RII (Retail) | NII | QIB |

| 35.00% | 15.00% | 50.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 95.78% | – | BSE & NSE |

| No | Objectives |

| 1 | Repayment or prepayment of all or a portion of certain outstanding borrowings availed by our Company and our Subsidiary |

| 2 | Funding the working capital requirements of the company |

| 3 | General corporate purposes |

| LEAD | REGISTRAR |

| SBI Capital Markets Limited | KFin Technologies Limited |

| DAM Capital Advisors Limited |

| Telephone | |

| investorrelations@bansalwire.com | 011-2365 1891/92/93 |

Bansal Wire Industries IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Financial of Bansal Wire Industries IPO

| Amounts in Crores ₹ | |||

| Particulars | FY-2024 | FY-2023 | FY-2022 |

| Assets | 1,264 | 749 | 695 |

| Revenue | 2,471 | 2,423 | 2,205 |

| Expense | 2,364 | 2,341 | 2,127 |

| Net Worth | 422 | 283 | 223 |

| Borrowing | 681 | 422 | 413 |

| EBITDA(%) | 6.04 | 4.73 | 5.13 |

| Reserves | 359 | 273 | 214 |

| PAT | 79 | 60 | 57 |

| EPS | 6.18 | 4.70 | 4.49 |

| Debt/Equity | 1.48 | 1.49 | 1.85 |

| Established | Website | Industry |

| 1985 | bansalwire.com | Steel & Iron |

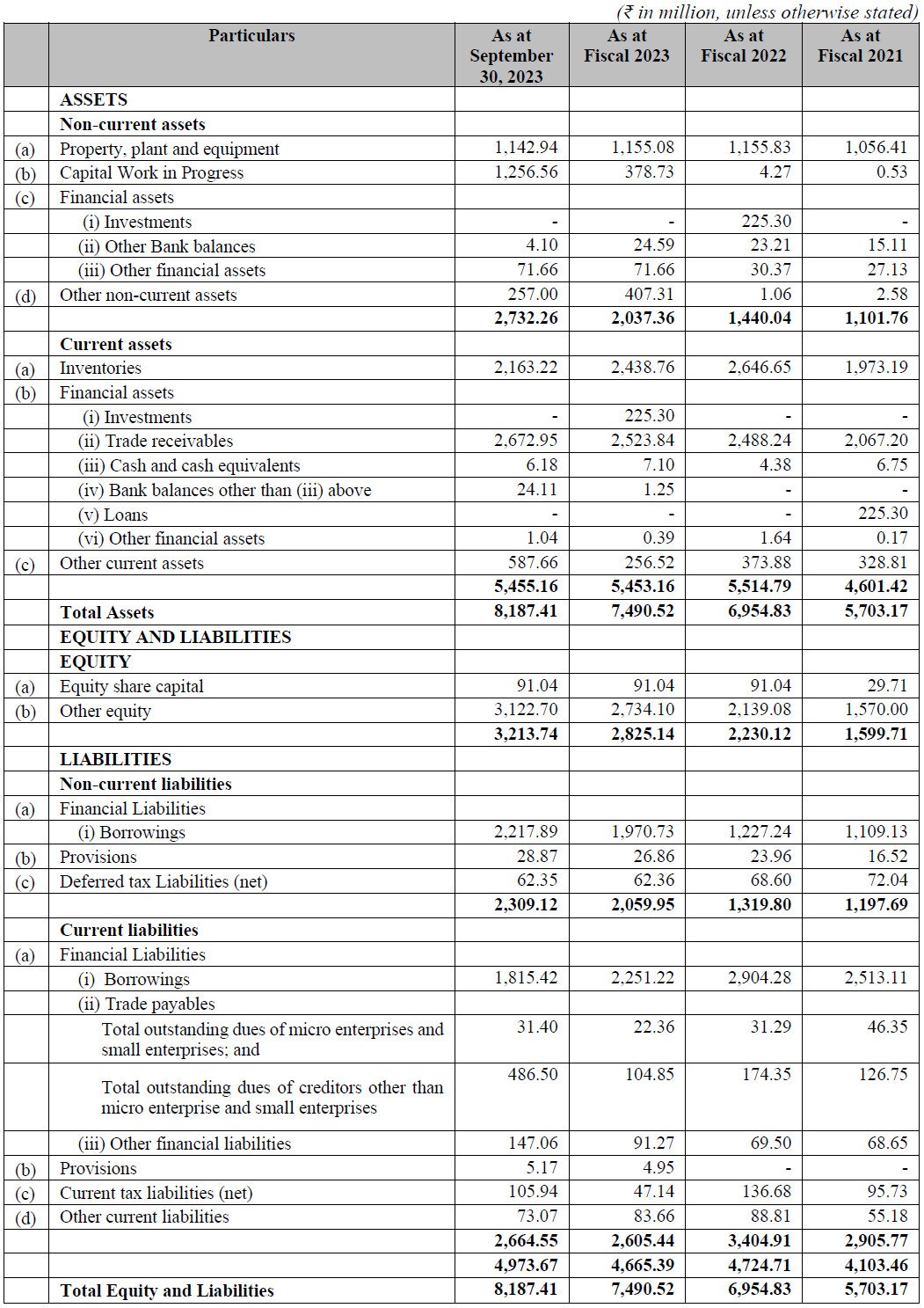

Statement of Balance Sheet

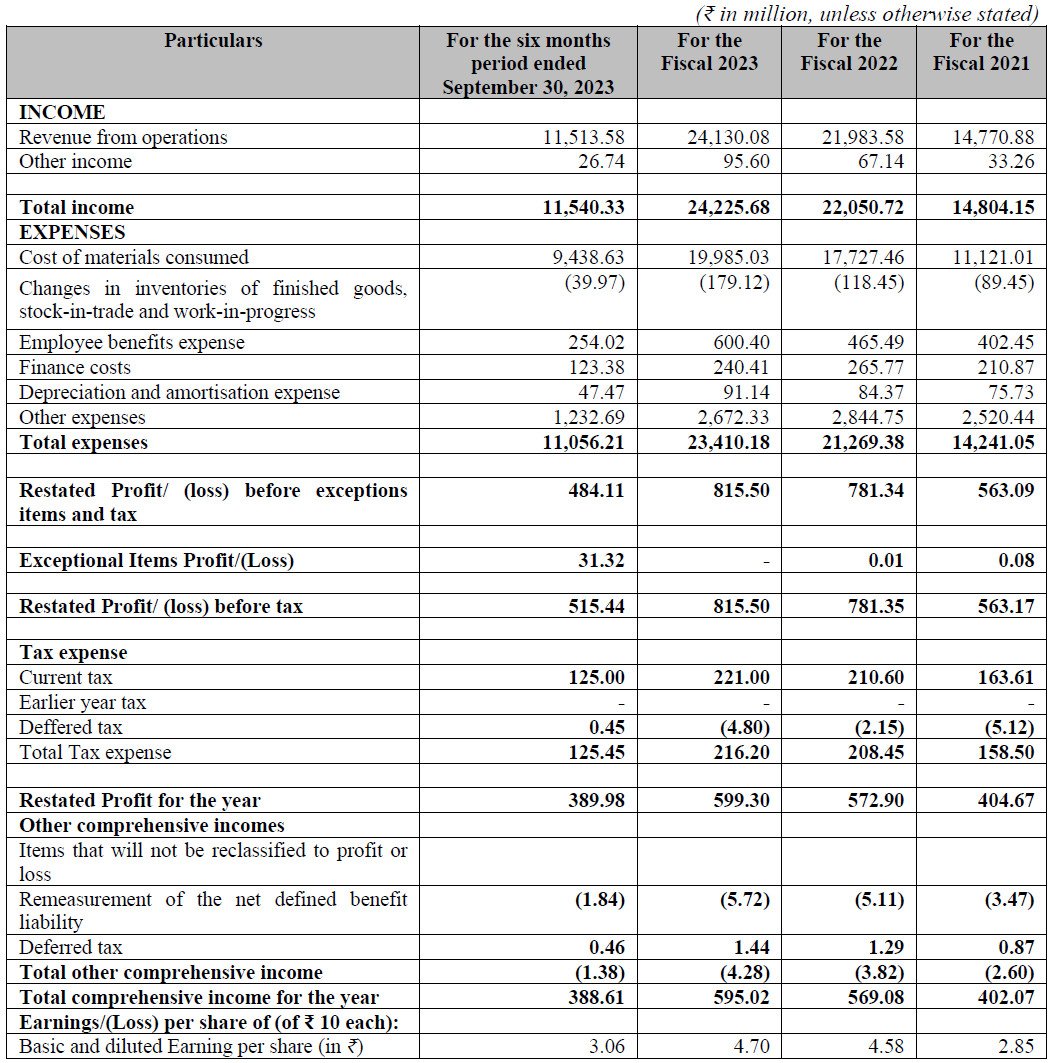

Statement of Profit and Loss

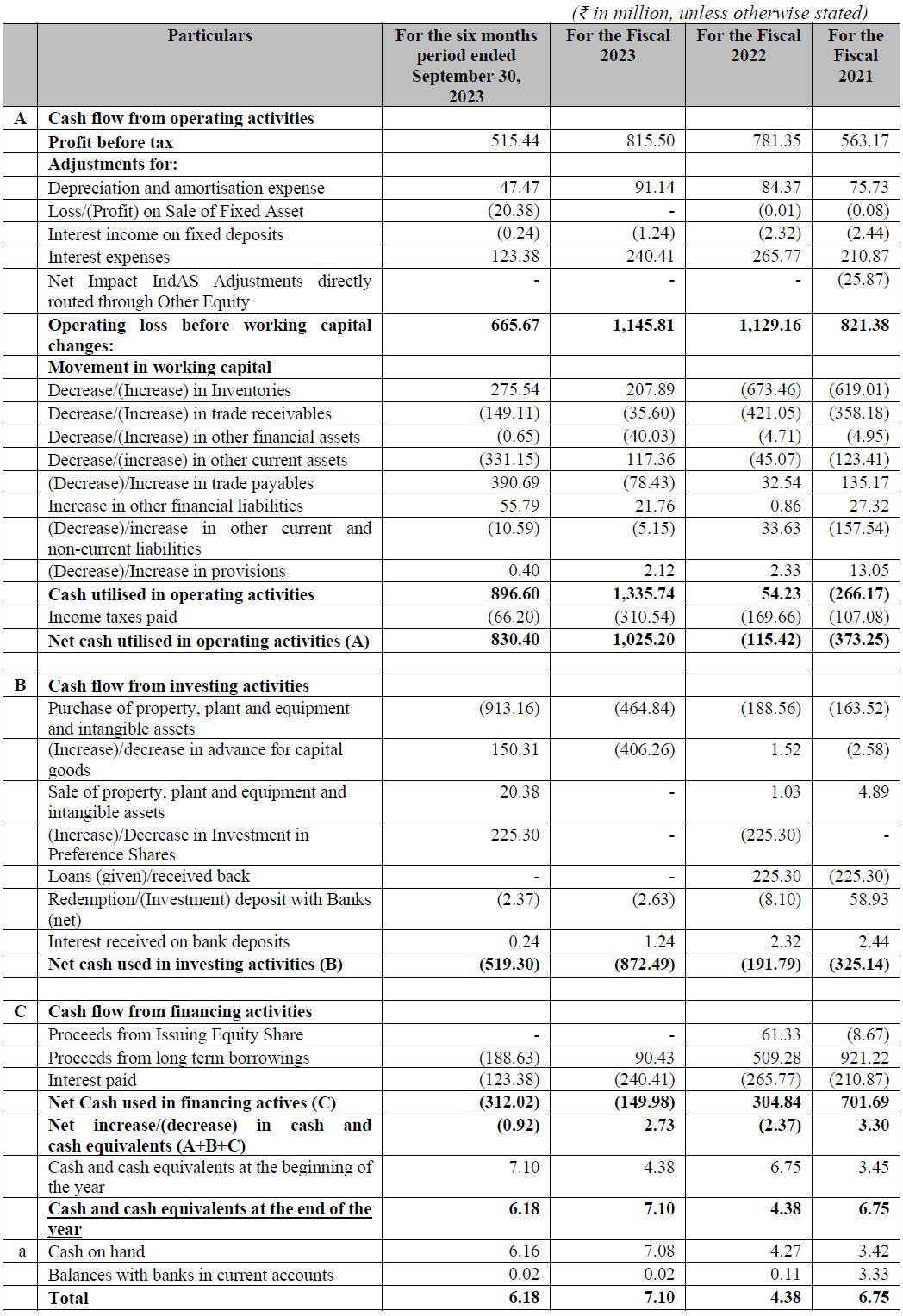

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Bansal Wire Industries IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Bansal Wire Industries IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Bansal Wire Industries IPO and other offerings a more informed and confident endeavor.

1. Bansal Wire Industries IPO key dates & Issue Details

The highly anticipated Bansal Wire Industries IPO is set to open for subscription on 3rd July 2024 and will close on 5th July 2024. This IPO has garnered significant attention with an issue price range of ₹243.00 to ₹256.00 per share. The Bansal Wire Industries IPO will be listed on both BSE and NSE, marking a significant milestone for the company.

Investors should note that the Bansal Wire Industries IPO is a Book Build Issue with a total issue size of ₹745.00 Cr, entirely consisting of fresh issues. With a face value of ₹5 per equity share, this IPO has a retail quota of not less than 35% of the net issue. The promoter holding pre-IPO stands at 95.78%, with post-IPO holding details yet to be announced.

Important dates to remember for the Bansal Wire Industries IPO include the basis of allotment on 8th July 2024, initiation of refunds on 9th July 2024, and the credit of shares to demat accounts also on 9th July 2024. The IPO listing date is tentatively set for 10th July 2024.

For potential investors, the market lot is 58 shares, and the minimum investment amount for one lot is ₹14848. Small HNI investors looking to invest between ₹2-10 lakh can subscribe to a minimum of 812 shares (14 lots) amounting to ₹207872. Meanwhile, big HNI investors aiming to invest over ₹10 lakh can subscribe to a minimum of 3944 shares (68 lots), totaling ₹1009664.

Stay tuned for more updates on the Bansal Wire Industries IPO and ensure you mark these key dates on your calendar to make informed investment decisions.

2. Bansal Wire Industries IPO Allotment Status

Dive into the excitement surrounding the Bansal Wire Industries IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Bansal Wire Industries IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Bansal Wire Industries IPO journey.

3. Introduction to Bansal Wire Industries IPO: A Leader in Steel Wire Manufacturing

Bansal Wire Industries stands as the largest stainless steel wire manufacturer and the second largest steel wire manufacturer by volume in India. With a production of 72,176 MTPA and 206,466 MTPA respectively in Fiscal 2023, Bansal Wire Industries commands a 20% market share in stainless steel wires and approximately 4% in steel wires (Source: CRISIL Report). The company was incorporated in 1985 and has since built a robust reputation for delivering quality products, carving out a significant niche in the steel wire industry. As the Bansal Wire Industries IPO approaches, it’s essential to understand the company’s legacy, operational excellence, and expansive product portfolio.

Bansal Wire Industries has diversified its offerings across various sectors, including automotive, general engineering, infrastructure, hardware, consumer durables, power and transmission, agriculture, and auto replacement. The company manufactures over 3,000 stock-keeping units (SKUs), with wire sizes ranging from 0.04 mm to 15.65 mm, the highest variety among Indian steel wire manufacturers. The Bansal Wire Industries IPO reflects the company’s growth and strategic initiatives, including its de-risking strategy where no single customer accounts for more than 5% of sales, ensuring a balanced and resilient business model.

Operating on a “Cost Plus model,” Bansal Wire Industries stays immune to commodity price fluctuations. The promoters’ experience in the steel wire manufacturing business dates back to 1938, spanning three generations. The company boasts a pan-India presence and exports to over 50 countries, solidifying its position in the international market. As part of its expansion, Bansal Wire Industries is setting up India’s largest single-location steel wire manufacturing facility in Dadri, which will be among the largest in Asia. This strategic move aligns with the Bansal Wire Industries IPO objectives, highlighting the company’s ability to adapt and scale its operations based on industry demands.

Marketing products under the brand name ‘BANSAL,’ the company enjoys strong market recognition and has maintained a customer retention ratio above 60% over recent fiscal years. The Bansal Wire Industries IPO aims to leverage this brand equity to further expand its market presence. The company operates in three broad segments: high carbon steel wire, mild steel wire (low carbon steel wire), and stainless steel wire. The upcoming plant in Dadri will introduce a new segment of specialty wires, enhancing the company’s product offerings and market reach.

Bansal Wire Industries, the flagship company of the Bansal Group, derives significant marketing and operational benefits, such as procuring raw materials in bulk at competitive prices and maintaining dealer loyalty. The company recently acquired a 76.15% shareholding in BSPL, making it a subsidiary that produces high carbon wires for automotives, galvanized mild steel wire for cables, and stainless steel wires for exports. This acquisition aligns with the strategic goals of the Bansal Wire Industries IPO, emphasizing the company’s commitment to growth and operational excellence.

The company’s manufacturing capabilities are spread across four facilities in India, with a combined installed capacity of 259,000 MTPA of mild steel, high carbon, and stainless steel wires. The new facility in Dadri will have an installed capacity of 346,000 MTPA, set to commence operations in phases during the current and upcoming fiscal years. This expansion underscores the Bansal Wire Industries IPO’s potential to provide economies of scale and a competitive edge in the market.

Bansal Wire Industries prides itself on its extensive product portfolio, catering to over 5,000 customers across various sectors. The Bansal Wire Industries IPO aims to capitalize on this diverse customer base, with no single customer contributing more than 5% of sales and no sector accounting for more than 25% of sales. The company’s robust network and ability to switch production lines based on industry demands demonstrate its resilience and adaptability.

The Bansal Wire Industries IPO is a testament to the company’s long-standing track record of generating operating profits and maintaining a successful and sustainable business. The company has built a resilient business model, navigating challenges such as the Indian banknote demonetization in 2016 and the COVID-19 pandemic. With an impressive customer retention ratio and a well-integrated manufacturing ecosystem, Bansal Wire Industries is well-positioned for continued growth and success.

In summary, the Bansal Wire Industries IPO represents an opportunity to invest in a market leader with a strong brand, diversified portfolio, and strategic growth initiatives. The company’s commitment to operational excellence, customer satisfaction, and market expansion underscores the potential for sustainable growth and profitability.

4. Financial Details of Bansal Wire Industries Limited

The financial performance of Bansal Wire Industries reveals a company with a solid growth trajectory and impressive margins. The Bansal Wire Industries IPO presents a unique opportunity for investors to partake in a well-established market player.

Valuations and Margins

In the fiscal years leading up to the Bansal Wire Industries IPO, the company demonstrated a consistent upward trend in its earnings per share (EPS). For FY 2022, the EPS stood at 4.49, which increased to 4.70 in FY 2023, and is projected to reach 6.18 in FY 2024 pre-issue. Post-issue, the EPS is expected to be 5.03. The price-to-earnings (PE) ratio for FY 2024 is anticipated to be between 39.32 and 41.42 pre-issue, and 48.29 to 50.88 post-issue.

The return on net worth (RONW) has shown some fluctuation, with a decline from 25.69% in FY 2022 to 21.21% in FY 2023, and a further decrease to 18.27% in FY 2024. The net asset value (NAV) has seen a robust increase from 17.49 in FY 2022 to 22.16 in FY 2023, reaching 33.13 in FY 2024. EBITDA margins have also improved from 5.13% in FY 2022 to 6.04% in FY 2024, highlighting the company’s operational efficiency. The return on capital employed (ROCE) remained stable, around 18%, reflecting consistent performance. The debt-to-equity ratio has improved from 1.85 in FY 2022 to 1.48 in FY 2024, showcasing better financial leverage management.

Financial Information (Restated)

Bansal Wire Industries Limited has shown remarkable growth in its financial metrics. The company’s revenue increased by 1.99%, from ₹2,422.57 crore in FY 2023 to ₹2,470.89 crore in FY 2024. The profit after tax (PAT) saw a substantial rise of 31.48%, from ₹59.93 crore in FY 2023 to ₹78.80 crore in FY 2024. This significant increase in profitability underscores the company’s efficiency and market strength, making the Bansal Wire Industries IPO an attractive proposition.

The company’s assets grew significantly from ₹695.48 crore in FY 2022 to ₹1,264.01 crore in FY 2024. The net worth also saw a substantial increase from ₹223.01 crore in FY 2022 to ₹422.37 crore in FY 2024. The reserves and surplus increased from ₹213.91 crore in FY 2022 to ₹358.64 crore in FY 2024, reflecting strong retained earnings and financial health. Total borrowing rose from ₹413.15 crore in FY 2022 to ₹681.14 crore in FY 2024, indicating the company’s strategic use of debt for growth and expansion.

These financial metrics highlight the robust financial foundation and growth potential of Bansal Wire Industries as it moves towards its IPO. The Bansal Wire Industries IPO offers investors an opportunity to invest in a company with a proven track record, solid financial performance, and strategic growth initiatives. The combination of increasing revenue, improving profit margins, and strong asset growth makes the Bansal Wire Industries IPO a compelling investment opportunity.

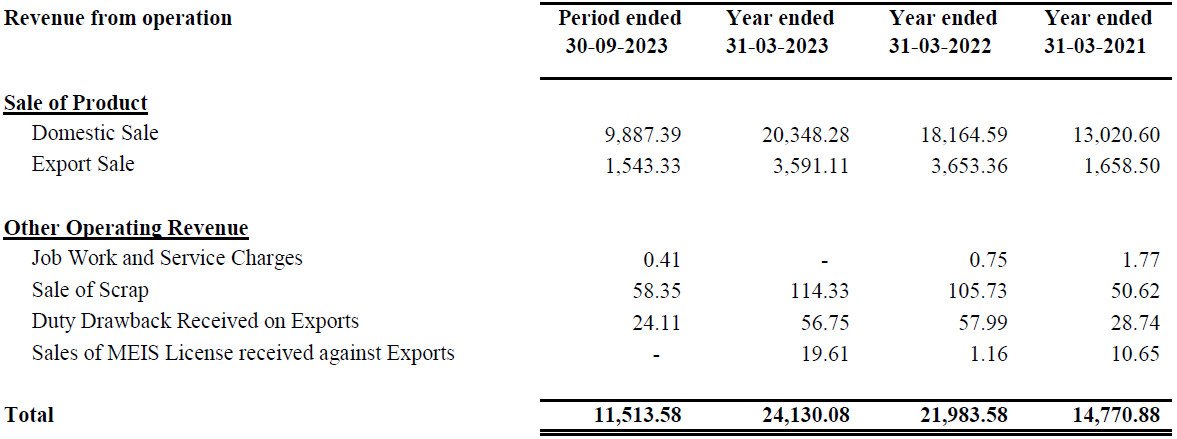

Statement Of Revenue From Operations

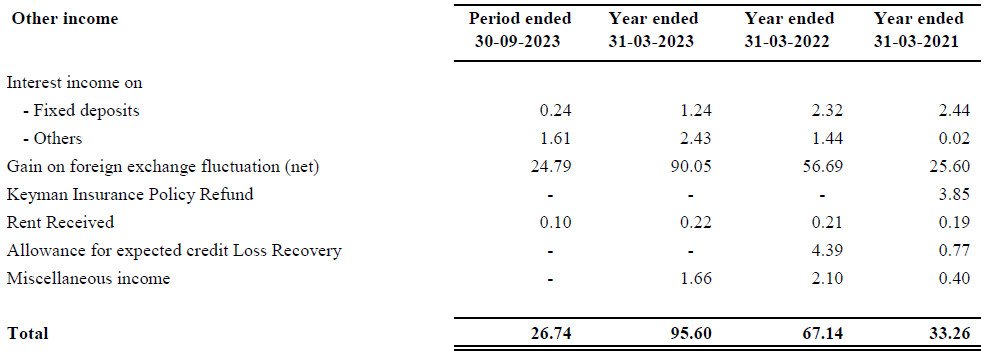

Statement of Other Income

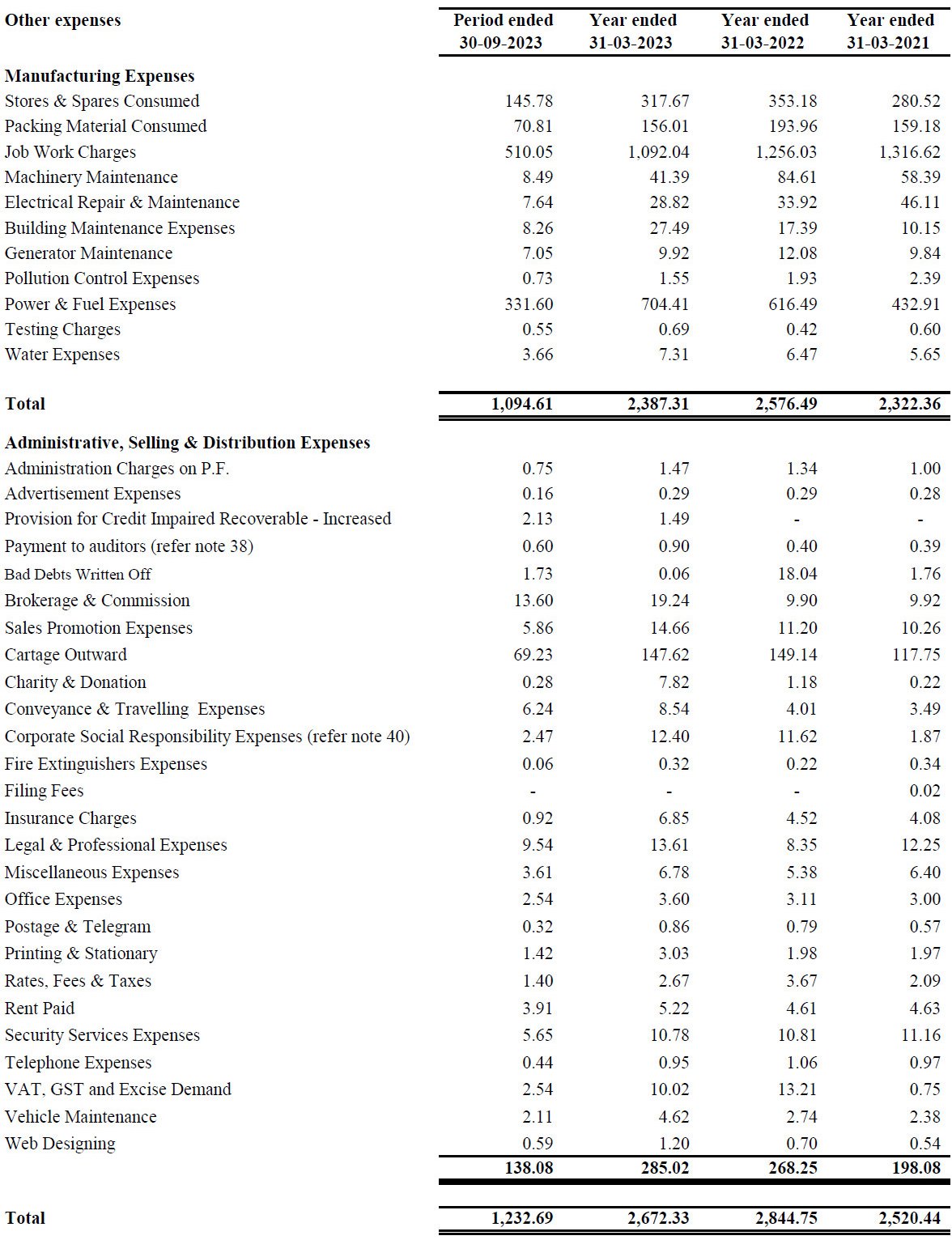

Statement of Other Expenses

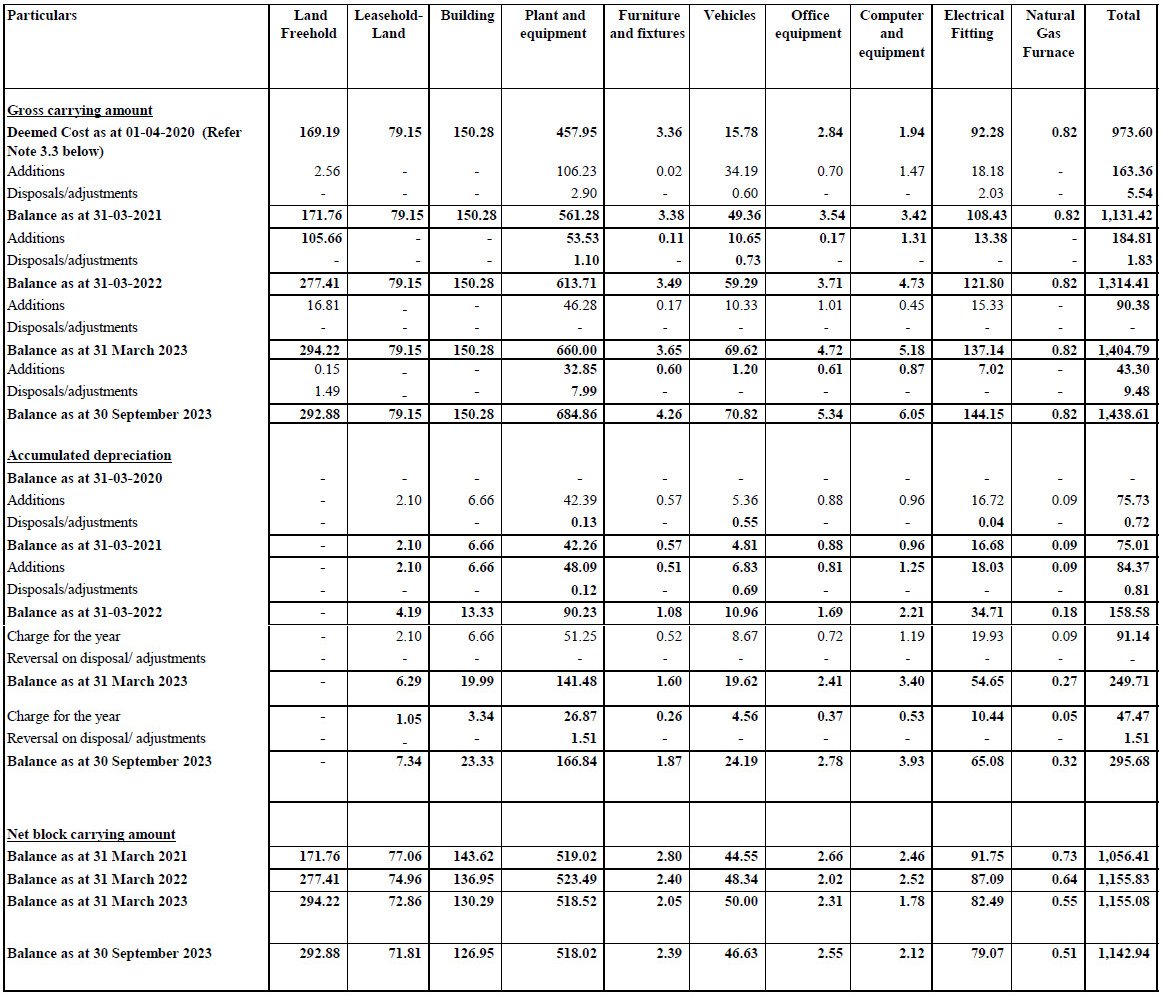

Statement of Property, Plant and Equipment

Statement of Borrowing

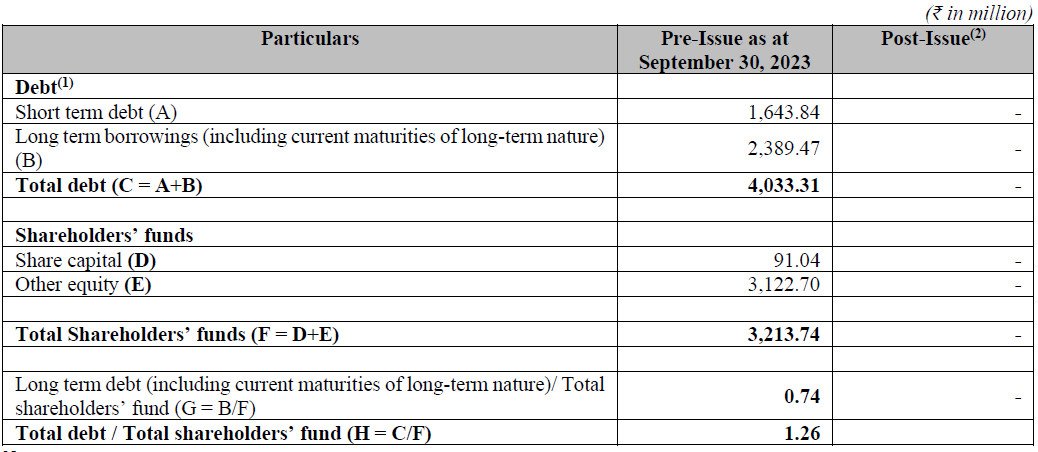

Statement of Capitalisation

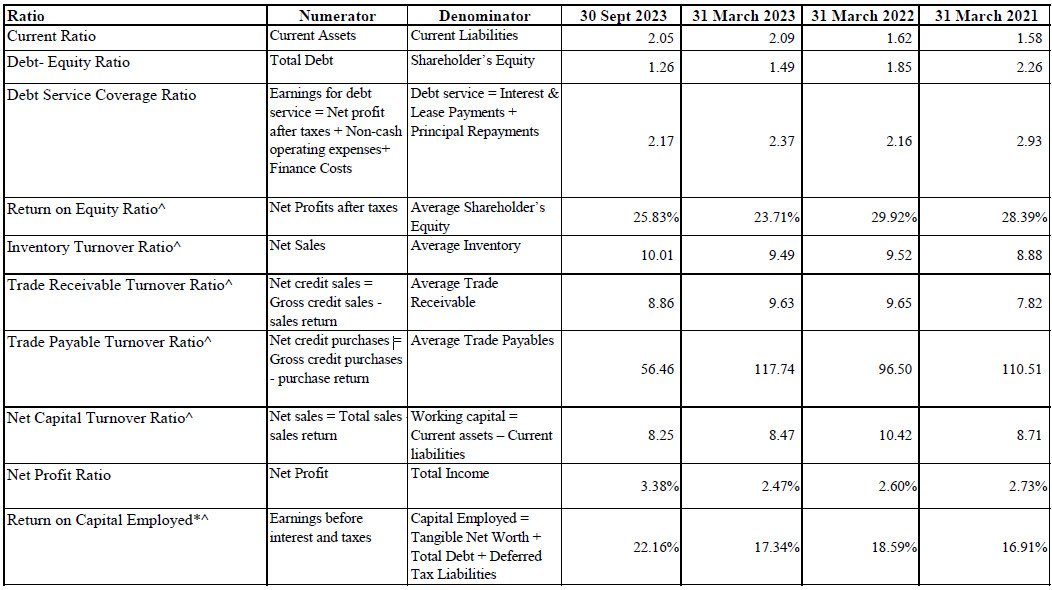

Financial Ratios

5.Bansal Wire Industries IPO FAQs

Bansal Wire Industries IPO Details

The Bansal Wire Industries IPO opens on July 3, 2024.

The Bansal Wire Industries IPO closes on July 5, 2024.

The issue price range for the Bansal Wire Industries IPO is ₹243.00 to ₹256.00 per share.

The Bansal Wire Industries IPO is a Book Build Issue.

The size of the Bansal Wire Industries IPO issue is ₹745.00 crore.

The face value of the shares in the Bansal Wire Industries IPO is ₹5 per equity share.

The Bansal Wire Industries IPO will be listed on the BSE and NSE.

The retail quota for the Bansal Wire Industries IPO is not less than 35% of the net issue.

Bansal Wire Industries IPO Dates

The tentative basis of allotment date is July 8, 2024.

Refunds will be initiated on July 9, 2024.

Shares will be credited to Demat accounts on July 9, 2024.

The tentative listing date for the Bansal Wire Industries IPO is July 10, 2024.

Bansal Wire Industries Business Model

Bansal Wire Industries serves sectors including automotive, general engineering, infrastructure, hardware, consumer durables, power and transmission, agriculture, and auto replacement.

Bansal Wire Industries manufactures over 3,000 SKUs.

Bansal Wire Industries operates on a “Cost Plus model” to stay immune to commodity price fluctuations.

No single customer accounts for more than 5% of sales, and no individual sector or segment constitutes more than 25% of sales.

Bansal Wire Industries Financial Data

The EPS was 4.49 in FY 2022 and 4.70 in FY 2023.

The revenue increased from ₹2,422.57 crore in FY 2023 to ₹2,470.89 crore in FY 2024.

The PAT was ₹59.93 crore in FY 2023 and ₹78.80 crore in FY 2024.

The net worth of Bansal Wire Industries as of March 31, 2024, was ₹422.37 crore.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Bansal Wire Industries IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Bansal Wire Industries IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Bansal Wire Industries IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Bansal Wire Industries IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.