Table of Contents

Allied Blenders and Distillers IPO presents an exciting opportunity to invest in the largest Indian-owned foreign liquor company (IMFL) and the third largest IMFL company in India by annual sales volume from FY 2014 to FY 2021. Established in 2008, Allied Blenders and Distillers Limited launched its flagship product, Officer’s Choice Whisky, in 1988, which became one of the best-selling whisky brands globally between 2016 and 2019. With a diverse product portfolio that includes 10 major IMFL brands such as whisky, brandy, rum, and vodka, the company boasts several “Millionaire Brands” like Officer’s Choice Whisky, Sterling Reserve, and Officer’s Choice Blue, each selling over one million 9-litre cases annually.

Allied Blenders and Distillers IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

25th Jun 2024 | 27th Jun 2024 | 28thJun 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 01st July 2024 | 01st July 2024 | 2nd July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹ 1,500 Cr | ₹ 267.00 – ₹ 282.00 | 53 Shares | 5,33.80,783 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 53 | ₹ 14,893 |

| Retail(Max) | 13 | 689 | ₹ 1,93,609 |

| Small-HNI (Min) | 14 | 742 | ₹ 2,08,502 |

| Small-HNI (Max) | 67 | 3551 | ₹ 9,97,831 |

| Big-HNI (Min) | 68 | 3604 | ₹ 10,12,724 |

| RII (Retail) | NII | QIB |

| 35.00% | 15.00% | 50.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 96.21% | 80.91% | BSE & NSE |

| No | Objectives |

| 1 | Prepayment or scheduled repayment of a portion of certain outstanding borrowings availed by the Company |

| 2 | General Corporate Purpose |

| LEAD | REGISTRAR |

| ICICI Securities Limited | Link Intime India Private Limited |

| Nuvama Wealth Management Limited | |

| ITI Capital Limited |

| Telephone | |

| Complianceofficer @abdindia.com | +91 22 43001111 |

Allied Blenders and Distillers IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Financial of Allied Blenders and Distillers IPO

| Amounts in Crores ₹ | |||

| Particulars | FY-2023 | FY-2022 | FY-2021 |

| Assets | 2,488 | 2,248 | 2,299 |

| Revenue | 7,117 | 7,208 | 6,398 |

| Expense | 6,921 | 7,001 | 6,185 |

| Net Worth | 406 | 404 | 382 |

| Borrowing | 781 | 847 | 955 |

| EBITDA(%) | 6.23 | 7.73 | 9.07 |

| Reserves | 357 | 357 | 328 |

| PAT | 1.60 | 1.48 | 2.51 |

| EPS | 0.07 | 0.06 | 0.10 |

| Debt/Equity | 1.85 | 2.05 | 2.39 |

| Established | Website | Industry |

| 2008 | abdindia.com | Beverages |

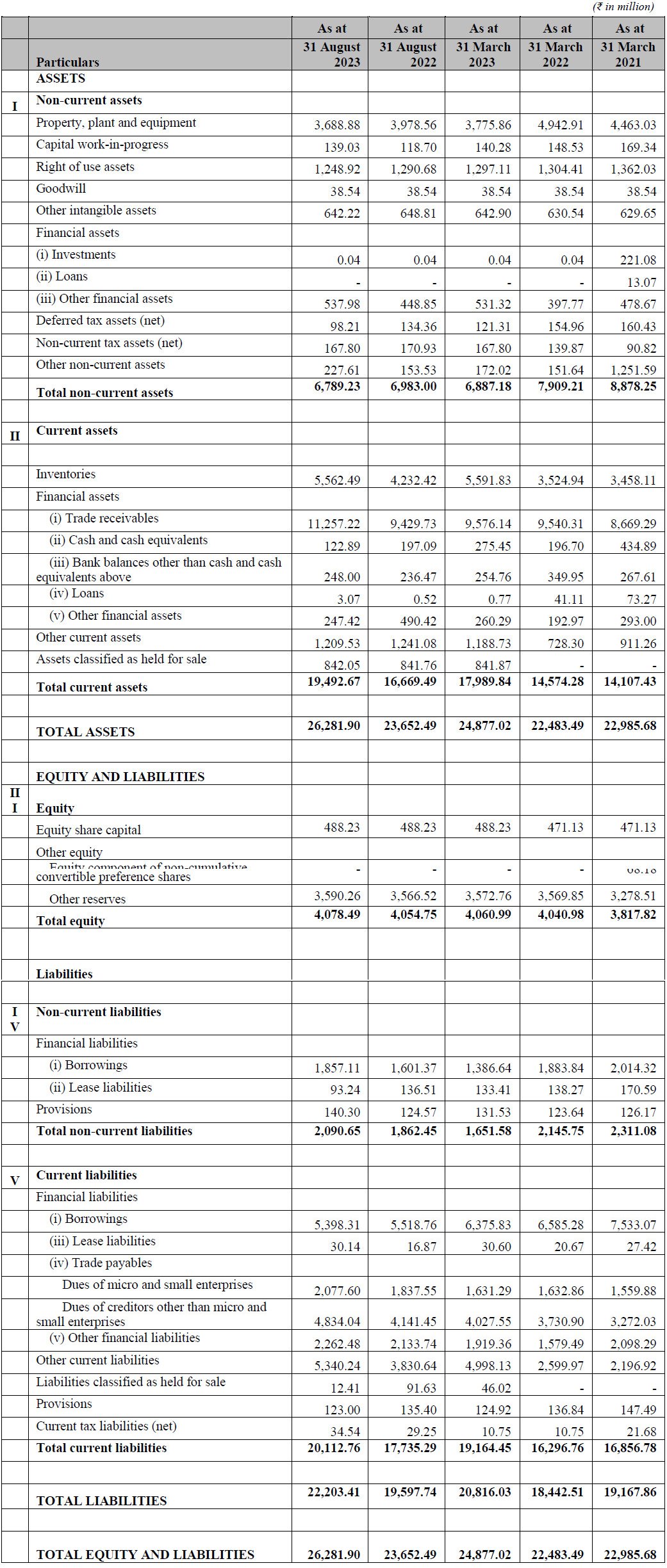

Statement of Balance Sheet

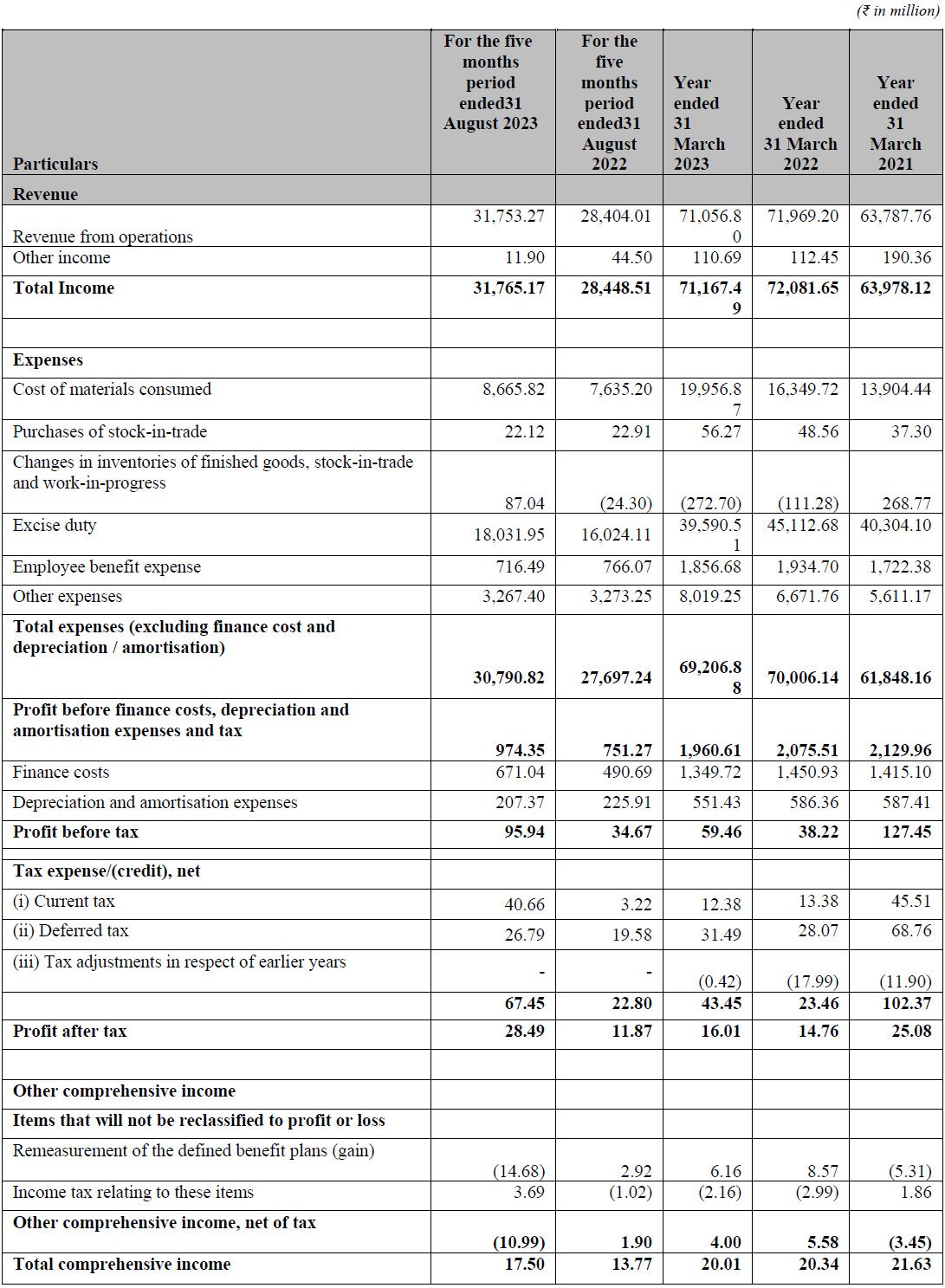

Statement of Profit and Loss

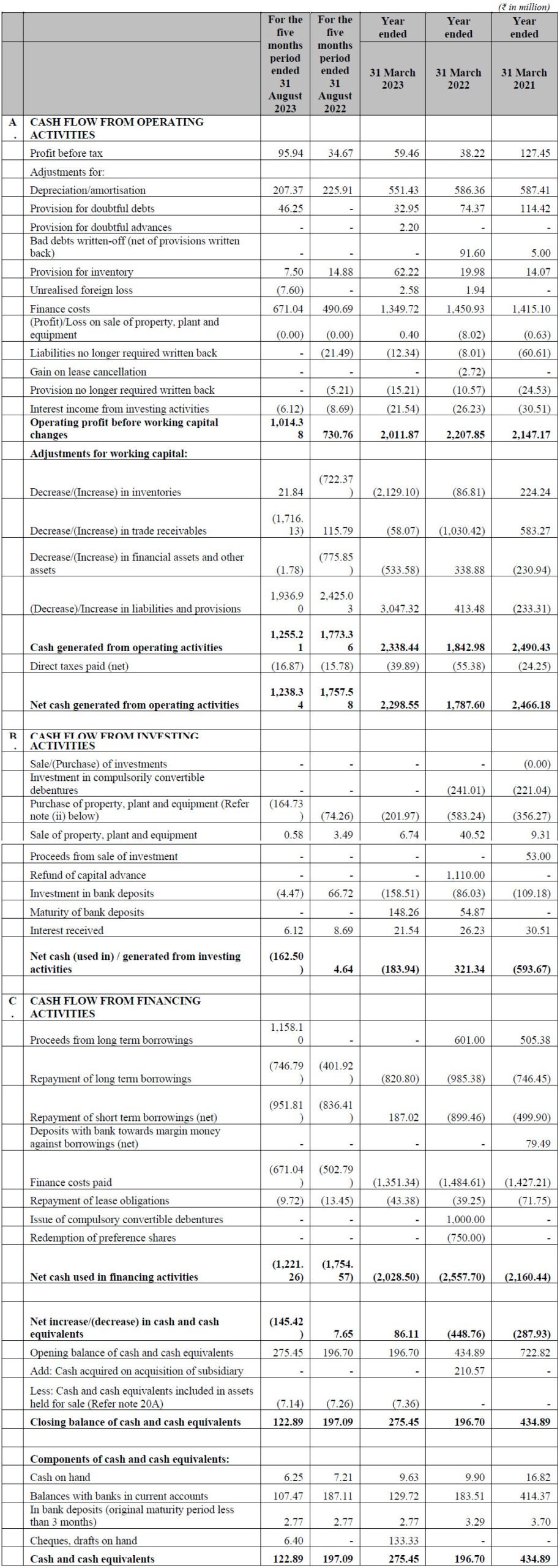

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Allied Blenders and Distillers IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Allied Blenders and Distillers IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Allied Blenders and Distillers IPO and other offerings a more informed and confident endeavor.

1. Allied Blenders and Distillers IPO key dates & Issue Details

The much-anticipated Allied Blenders and Distillers IPO is set to open on June 25, 2024, and will close on June 27, 2024. This IPO offers a unique opportunity for investors, with an issue price ranging from ₹267.00 to ₹281.00 per share. The total issue size for the Allied Blenders and Distillers IPO is ₹1500.00 crore, comprising an offer for sale worth ₹500.00 crore and a fresh issue of ₹1000.00 crore.

Investors should note that the face value of each equity share is ₹2. The IPO will be listed on both the BSE and NSE, ensuring broad market access. Retail investors have a quota of not less than 35% of the net issue, making the Allied Blenders and Distillers IPO particularly attractive for this segment. Additionally, there is a special discount for employees, priced at ₹26.00 per share.

Promoter holding pre-IPO stands at 96.21% and will reduce to 80.91% post-IPO, reflecting a significant but controlled dilution. The Allied Blenders and Distillers IPO follows a Book Build Issue process, providing a structured and transparent method for price discovery.

Allied Blenders and Distillers IPO Important Dates

Key dates for the Allied Blenders and Distillers IPO include the basis of allotment date on June 28, 2024, and the initiation of refunds on July 1, 2024. Investors can expect the credit of shares to their Demat accounts also on July 1, 2024. The much-awaited listing of the Allied Blenders and Distillers IPO on the stock exchanges is tentatively scheduled for July 2, 2024.

Allied Blenders and Distillers IPO Lots

The issue price for the Allied Blenders and Distillers IPO ranges from ₹267.00 to ₹281.00 per share. The market lot size is set at 53 shares, with a minimum lot amounting to ₹14,893. Small HNI investors looking to invest between ₹2 lakh and ₹10 lakh can subscribe to a minimum of 742 shares, equivalent to 14 lots. For larger HNI investments exceeding ₹10 lakh, a minimum of 3604 shares, or 68 lots, is required.

These detailed insights into the Allied Blenders and Distillers IPO provide a comprehensive guide for potential investors. The strategic planning around the IPO dates, issue size, pricing, and lot structure ensures that the Allied Blenders and Distillers IPO is positioned as a compelling investment opportunity in the market.

2. Allied Blenders and Distillers IPO Allotment Status

Dive into the excitement surrounding the Allied Blenders and Distillers IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Allied Blenders and Distillers IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Allied Blenders and Distillers IPO journey.

3. Introduction to Allied Blenders and Distillers IPO: A Comprehensive Business Overview

The Allied Blenders and Distillers IPO represents a significant opportunity in the Indian-made foreign liquor (IMFL) market. As the largest Indian-owned IMFL company and the third largest by annual sales volumes between Fiscal 2014 and Fiscal 2022, Allied Blenders and Distillers (ABD) has a well-established presence in India. With a market share of 11.8% in the Indian whisky market for Fiscal 2023, ABD’s flagship brand, Officer’s Choice Whisky, launched in 1988, has consistently ranked among the top-selling whisky brands globally.

ABD’s diversified product portfolio includes 17 major brands across whisky, brandy, rum, and vodka, with notable brands like Sterling Reserve, Officer’s Choice Blue, and ICONiQ Whisky achieving ‘Millionaire Brand’ status by selling over a million 9-litre cases in a year. The company has a robust pan-India distribution network, covering 30 States and Union Territories, supported by 12 sales support offices and extensive route-to-market capabilities.

The company’s market leadership is further evidenced by its 8.2% market share in the IMFL market by sales volumes in Fiscal 2023, with products retailed across 79,329 outlets in India. ABD’s extensive distribution network supports significant business growth and financial performance, enhancing its position as a leading exporter to 14 international markets, including the Middle East, North America, Africa, Asia, and Europe.

ABD has made significant investments in brand awareness and goodwill, with key brands receiving numerous awards at prestigious events such as the Design and Packaging Masters, The Spirits Business London, and the International Taste Institute in Brussels. The company’s marketing strategies include partnerships with prominent sports leagues and celebrity brand ambassadors, focusing on building consumer engagement and product appeal.

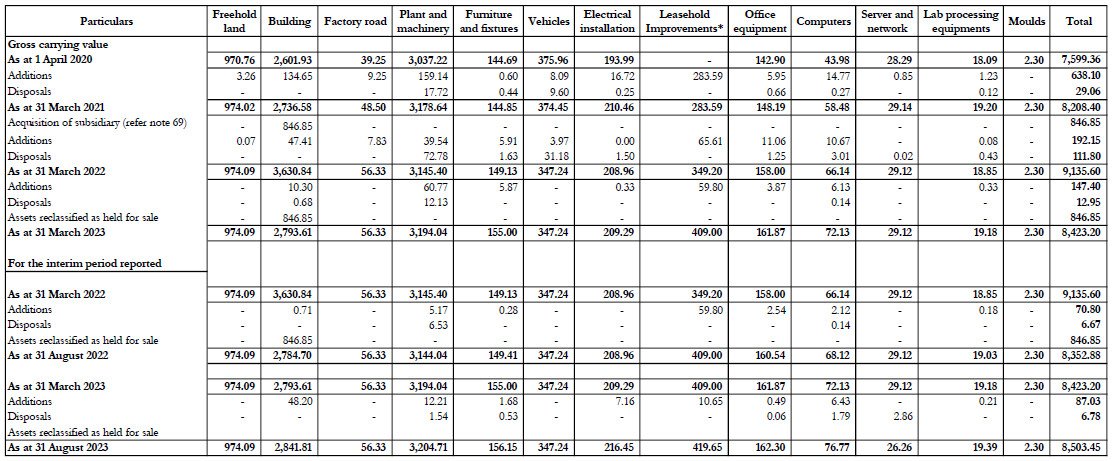

The company’s manufacturing prowess is underscored by its distillery in Rangapur, Telangana, with an annual capacity of 54.75 million litres of extra neutral alcohol (ENA). ABD relies on 32 bottling facilities across India, including nine owned and operated units, and various third-party bottling agreements to maintain flexibility and competitive pricing.

ABD’s experienced and distinguished Board of Directors, led by Whole-Time Director Shekhar Ramamurthy and Managing Director Alok Gupta, provides strategic leadership and guidance. The senior management team’s extensive experience in consumer goods, sales and marketing, manufacturing, and finance has enabled ABD to capitalize on growth opportunities in the Indian alcoholic beverages industry.

Strengths of Allied Blenders and Distillers IPO

The Allied Blenders and Distillers IPO highlights several key strengths. As the largest Indian-owned IMFL company with a diversified and contemporary product portfolio, ABD enjoys strong brand recognition. Its strategically located, large-scale, and advanced manufacturing facilities, coupled with a sophisticated research and development center, bolster its market position. Access to an extensive pan-India distribution network further enhances ABD’s scalability.

The company is well-positioned to capture the positive trends in the Indian IMFL industry, supported by an experienced Board, senior management team, and a committed employee base.

ABD’s flagship brand, Officer’s Choice Whisky, has consistently ranked among the top-selling whisky brands globally, reinforcing its market leadership. The company’s strategic brand-building initiatives and consumer-centric approach have driven high sales volumes and strong brand loyalty. With a market share of 20.9% in the mass premium whisky segment, Officer’s Choice Whisky leads its category.

The Allied Blenders and Distillers IPO offers a unique investment opportunity in one of India’s largest and most diversified IMFL companies. With a strong market presence, extensive distribution network, advanced manufacturing capabilities, and a highly experienced management team, ABD is poised for continued growth and success in the Indian alcoholic beverages market.

4. Financial Details of Allied Blenders and Distillers

The Allied Blenders and Distillers IPO showcases significant financial metrics that highlight the company’s growth trajectory and stability. For the financial year ending March 31, 2023, the company’s revenue experienced a marginal decrease of 1.27%, dropping from ₹7,208.17 crore in FY 2022 to ₹7,116.75 crore. However, the profit after tax (PAT) demonstrated a notable increase of 8.47%, rising from ₹1.48 crore in FY 2022 to ₹1.60 crore in FY 2023.

Key Financial Metrics

The consolidated financial performance and position of Allied Blenders and Distillers Limited are impressive. As of December 31, 2023, the company’s assets stood at ₹2,741.39 crore, reflecting a steady growth from ₹2,487.70 crore as of March 31, 2023. Revenue for the period ending December 31, 2023, was ₹5,914.98 crore, showing a consistent performance.

The net worth of the company increased slightly to ₹409.26 crore as of December 31, 2023, from ₹406.10 crore as of March 31, 2023. Additionally, the company’s reserves and surplus were ₹360.43 crore, and total borrowings were ₹798.11 crore as of December 31, 2023.

Financial Performance Indicators

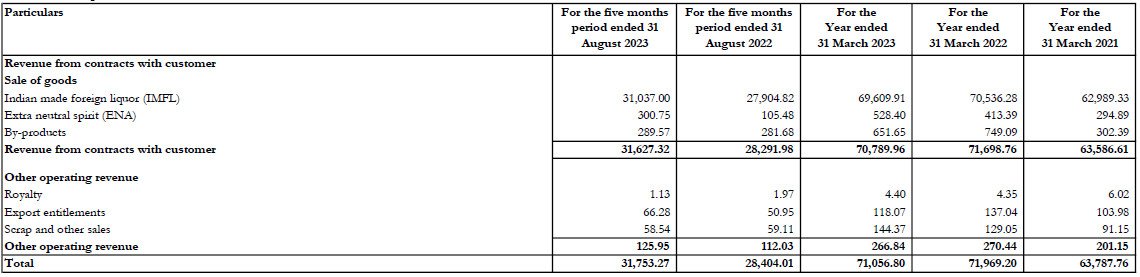

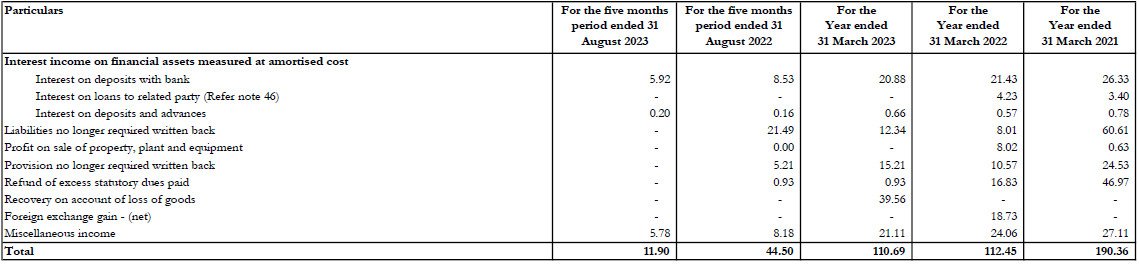

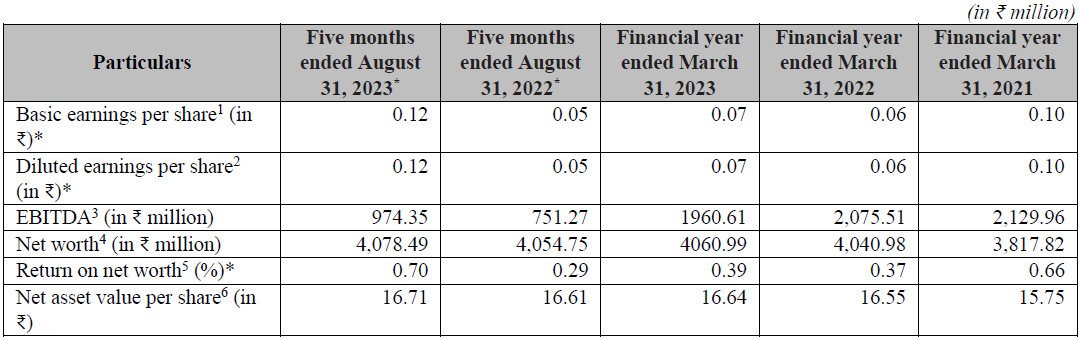

Several key financial indicators provide insight into the company’s performance for the fiscal years ending March 31 and the five-month periods ending August 31. In FY 2021, Allied Blenders and Distillers Limited reported a revenue from operations of ₹63,787.76 million, which grew to ₹71,969.20 million in FY 2022 and slightly decreased to ₹71,056.80 million in FY 2023. The restated profit after tax for the company was ₹25.08 million in FY 2021, ₹14.76 million in FY 2022, and ₹16.01 million in FY 2023.

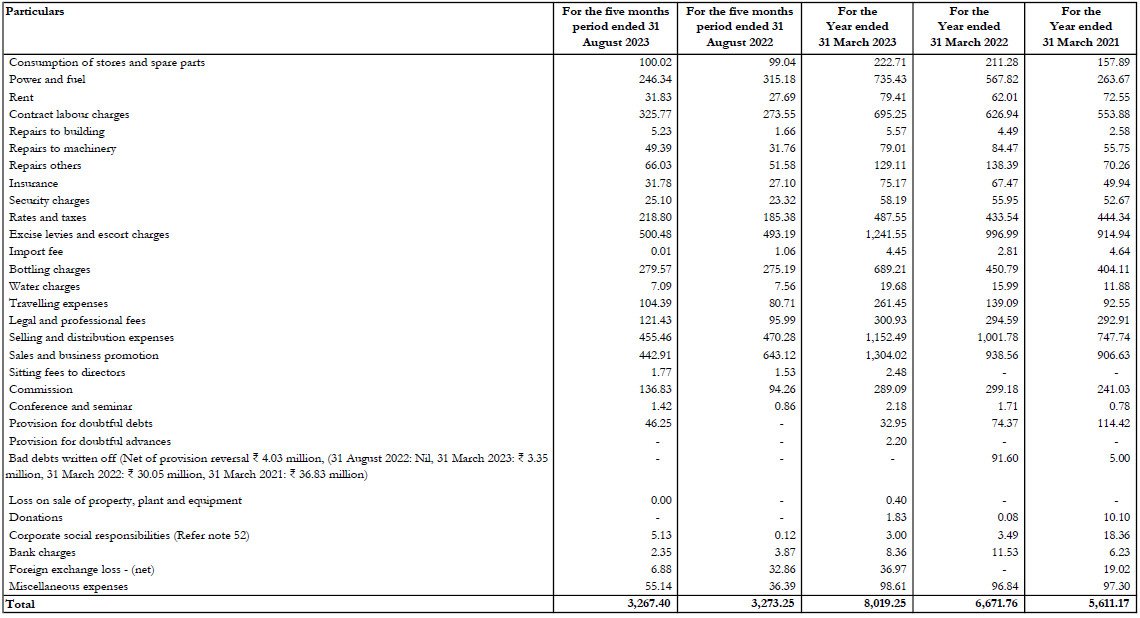

The company’s gross margin was 39.49% in FY 2021, 39.36% in FY 2022, and 37.26% in FY 2023. EBITDA for these years was ₹2,129.96 million, ₹2,075.51 million, and ₹1,960.61 million, respectively, reflecting the company’s strong operational efficiency.

Valuations and Margins

The Allied Blenders and Distillers IPO presents crucial valuation metrics and margins for potential investors. For FY 2021, the earnings per share (EPS) was 0.10, which decreased to 0.06 in FY 2022 and slightly increased to 0.07 in FY 2023. The price-to-earnings (PE) ratio for FY 2023 was between 4,073.42 and 4,287.01, indicating the company’s market value relative to its earnings. The return on net worth (RONW) for the company was 0.66% in FY 2021, 0.37% in FY 2022, and 0.39% in FY 2023.

The net asset value (NAV) per share was ₹15.64 in FY 2021, ₹16.55 in FY 2022, and ₹16.64 in FY 2023. The return on capital employed (ROCE) was 26.45% in FY 2021, 25.13% in FY 2022, and 25.87% in FY 2023.The company’s EBITDA margin was 9.07% in FY 2021, 7.73% in FY 2022, and 6.23% in FY 2023. The debt-to-equity ratio decreased from 2.39 in FY 2021 to 2.05 in FY 2022 and further to 1.85 in FY 2023, indicating a reduction in the company’s leverage.

The financial health of Allied Blenders and Distillers Limited reflects steady growth and strategic financial management, making the Allied Blenders and Distillers IPO an attractive prospect for investors. With improved profitability, strong EBITDA margins, and a decreasing debt-to-equity ratio, the company is well-positioned for future expansion and success in the competitive IMFL market. Investors looking for a robust and growing company in the Indian alcoholic beverages industry should consider the Allied Blenders and Distillers IPO as a viable investment opportunity.

Statement Of Revenue From Operations

Statement of Other Income

Statement of Other Expenses

Statement of Property, Plant and Equipment

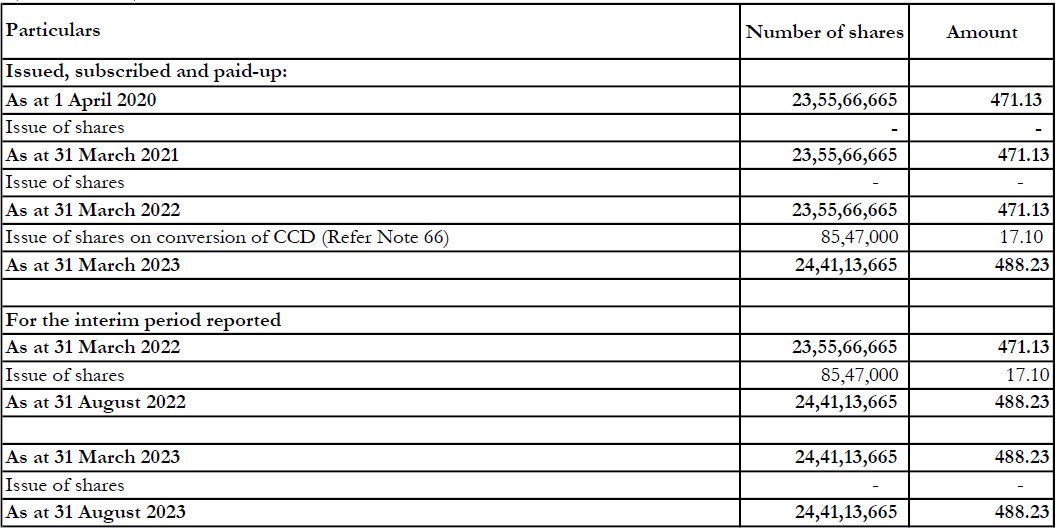

Statement of Equity Share Capital

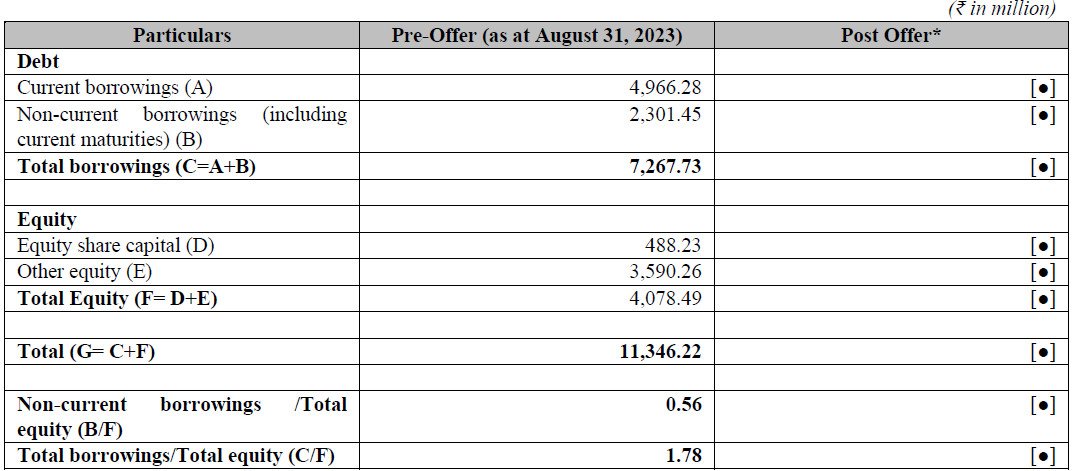

Statement of Capitalisation

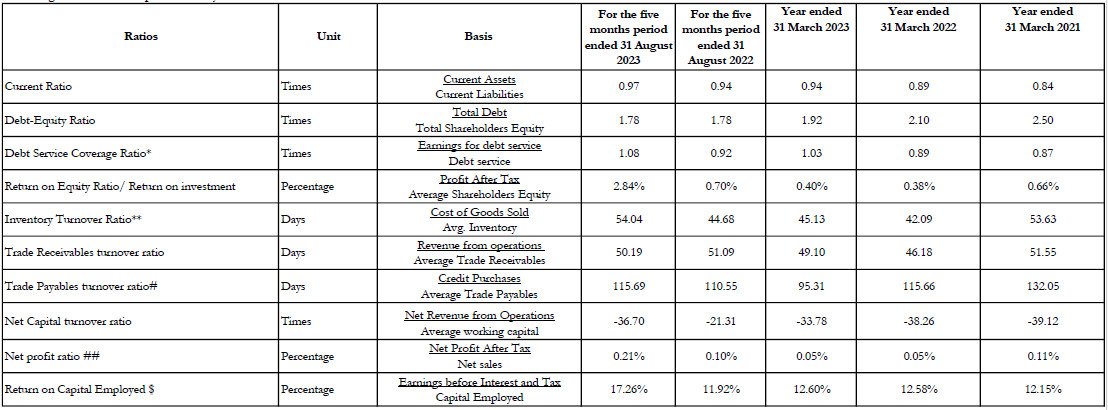

RATIO ANALYSIS

Financial Ratios

5.Allied Blenders and Distillers IPO FAQs

The Allied Blenders and Distillers IPO opening date is June 25, 2024.

The IPO closing date is June 27, 2024.

The IPO issue price is between ₹267.00 and ₹281.00 per share.

The IPO will be listed on BSE and NSE.

The minimum market lot size is 53 shares.

The total IPO issue size is ₹1500.00 crore.

The IPO includes a fresh issue of ₹1000.00 crore and an offer for sale of ₹500.00 crore.

The face value of each share is ₹2.

The promoter holding pre-IPO is 96.21%.

The promoter holding post-IPO will be 80.91%.

The retail quota is not less than 35% of the net issue.

Allied Blenders and Distillers is the largest Indian-owned IMFL company, focusing on a diverse portfolio of alcoholic beverages, including whisky, brandy, rum, and vodka, with a strong distribution network across India and international markets.

The flagship brand is Officer’s Choice Whisky.

In FY 2023, the revenue was ₹7,116.75 crore, a slight decrease from FY 2022, while the profit after tax increased by 8.47% to ₹1.60 crore.

Key financial ratios include an EBITDA margin of 6.23% in FY 2023 and a debt-to-equity ratio of 1.85.

As of August 31, 2023, Allied Blenders and Distillers had 17 major brands in its portfolio.

Products have received various awards, including gold awards at the Monde Selection Brussels and recognition at the International Taste Institute.

The gross margin was 37.26% in FY 2023, compared to 39.36% in FY 2022.

The EBITDA for FY 2023 was ₹1,960.61 million.

As of August 31, 2023, Allied Blenders and Distillers’ products were retailed across 79,329 outlets in India, with exports to 14 international markets.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Allied Blenders and Distillers IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Allied Blenders and Distillers IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Allied Blenders and Distillers IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Allied Blenders and Distillers IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.