Table of Contents

The Akiko Global Services IPO highlights a company dedicated to financial product distribution in partnership with major banks and NBFCs, offering loans, credit cards, and more. Akiko Global Services Ltd, through its platform The Money Fair, leverages advanced algorithms to collect and analyze customer information, assessing creditworthiness with precision. Utilizing a customized CRM, Akiko Global Services enhances service delivery efficiency, ensuring superior customer engagement and satisfaction. This robust technological backbone positions the Akiko Global Services IPO as a compelling investment opportunity in the financial sector.

Akiko Global Services IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

25th Jun 2024 | 27th Jun 2024 | 01st July 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 01st July 2024 | 01st July 2024 | 2nd July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹ 23.11 Cr | ₹ 73.00 – ₹ 77.00 | 1600 Shares | 30.01,600 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 1600 | ₹ 1,23,200 |

| Retail(Max) | 1 | 1600 | ₹ 1,23,200 |

| Small-HNI (Min) | 2 | 3200 | ₹ 2,46,400 |

| Small-HNI (Max) | 8 | 12800 | ₹ 9,85,600 |

| Big-HNI (Min) | 9 | 14400 | ₹ 11,08,800 |

| RII (Retail) | NII | QIB |

| 35.00% | 15.00% | 50.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 92.77% | 66.91% | NSE SME |

| No | Objectives |

| 1 | Implementation of ERP Solution and TeleCRM |

| 2 | Mobile Application for financial product solution |

| 3 | To meet working capital requirements |

| 4 | Enhancing visibility and awareness of the brands, including but not limited to “Akiko Global” or “Moneyfair |

| 5 | General Corporate Purpose |

| 6 | Issue Expenses |

| LEAD | REGISTRAR |

| FAST TRACK FINSEC PRIVATE LIMITED | SKYLINE FINANCIAL SERVICES PVT LTD |

| Telephone | |

| accounting@akiko.co.in | 011-40104241 |

Akiko Global Services IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

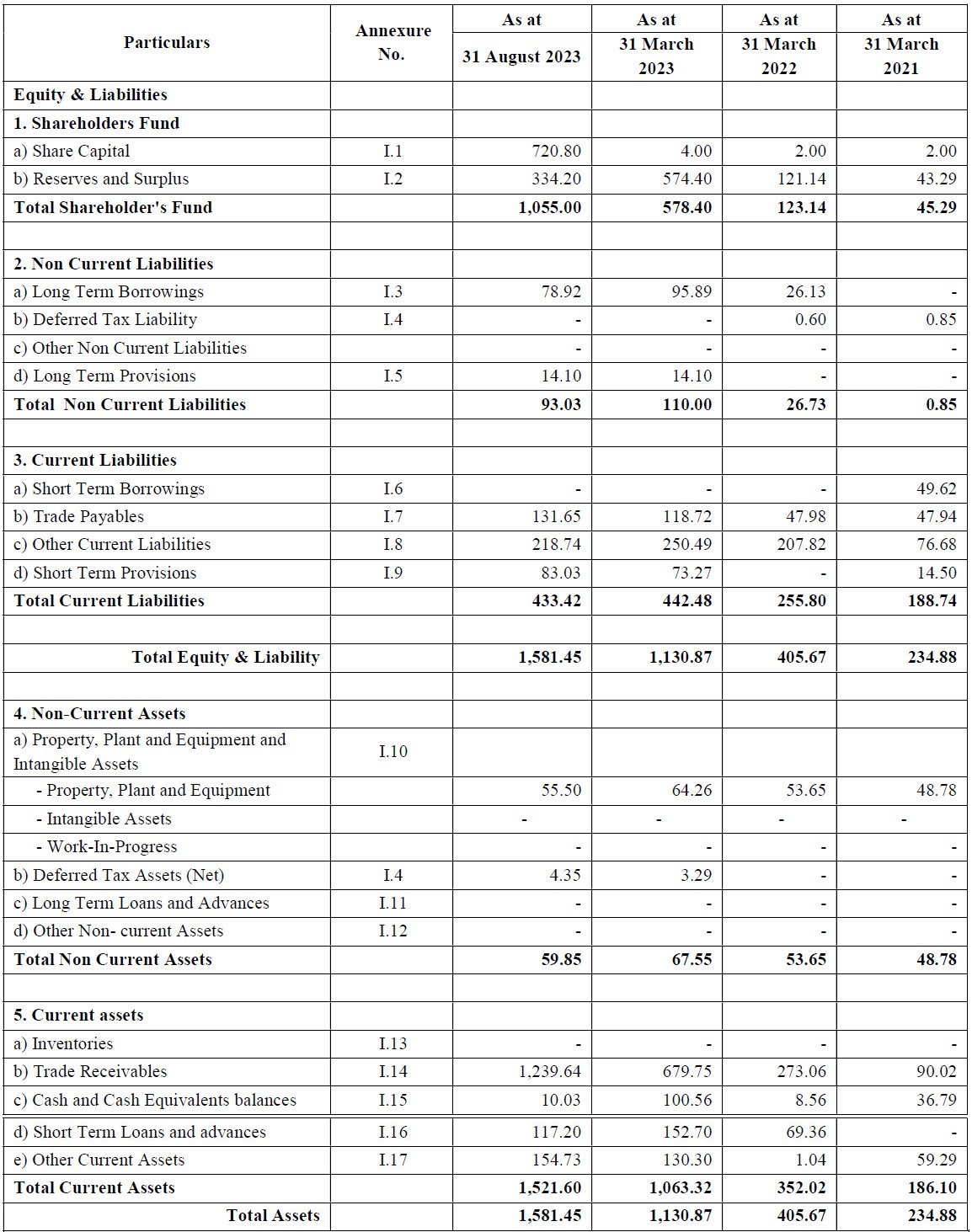

Financial of Akiko Global Services IPO

| Amounts in Lakhs ₹ | |||

| Particulars | FY-2023 | FY-2022 | FY-2021 |

| Assets | 1,131 | 406 | 235 |

| Revenue | 3,959 | 1,353 | 611 |

| Expense | 3,327 | 1,235 | 568 |

| Net Worth | 578 | 123 | 45 |

| Borrowing | 95.89 | 26.13 | 49.62 |

| EBITDA(%) | 15.97 | 8.74 | 6.95 |

| Reserves | 574.40 | 121.14 | 43.29 |

| PAT | 453 | 78 | 23 |

| EPS | 12.62 | 2.86 | 0.84 |

| Debt/Equity | 0.17 | 0.21 | 1.10 |

| Established | Website | Industry |

| 2018 | themoneyfair.com | Finance |

Statement of Assets and Liabilities

Statement of Profit and Loss

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Akiko Global Services IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Akiko Global Services IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Akiko Global Services IPO and other offerings a more informed and confident endeavor.

1. Akiko Global Services IPO key dates & Issue Details

The Akiko Global Services IPO is an exciting opportunity for investors looking to capitalize on a promising small and medium-sized enterprise (SME). This book build issue IPO will be listed on the NSE SME, offering shares at a price range of ₹73.00 to ₹77.00 per share. Investors can participate in this IPO starting from the issue opening date on 25th June 2024, with the closing date set for 27th June 2024.

One of the significant aspects of the Akiko Global Services IPO is the fresh issue size of ₹23.11 Cr. This IPO will feature shares with a face value of ₹10 per equity share. Retail investors will be pleased to know that not less than 35% of the net issue is reserved for them, ensuring ample opportunity to get a piece of this promising venture.

Important Dates for Akiko Global Services IPO

Mark your calendars for the crucial dates related to the Akiko Global Services IPO. The basis of allotment date is tentatively set for 1st July 2024. On the same day, investors can expect the initiation of refunds and the credit of shares to their Demat accounts. The much-anticipated listing date on the NSE SME is scheduled for 2nd July 2024.

Investment Details and Lot Size for Akiko Global Services IPO

Investors interested in the Akiko Global Services IPO should note the market lot size is 1600 shares, amounting to ₹123200 per lot. For High Net Worth Individuals (HNI), the minimum requirement is 3200 shares, which is equivalent to 2 lots. This strategic allocation ensures a fair distribution among different types of investors.

Promoter Holdings in Akiko Global Services IPO

The promoter holding pre-IPO stands at a substantial 92.77%, which will be reduced to 66.91% post-IPO. This reduction is a common occurrence in IPOs and indicates a commitment from the promoters to allow a broader ownership base.

Investing in the Akiko Global Services IPO offers a promising venture for potential investors, with clearly outlined dates and issue details making it a well-structured opportunity in the SME sector. Ensure to keep a close eye on the dates and participate in this exciting IPO to be part of Akiko Global Services’ growth journey.

2. Akiko Global Services IPO Allotment Status

Dive into the excitement surrounding the Akiko Global Services IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Akiko Global Services IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Akiko Global Services IPO journey.

3. Introduction to Akiko Global Services IPO: A Comprehensive Business Overview

Akiko Global Services IPO offers a remarkable investment opportunity in a company that has steadily grown since its incorporation as a Private Limited Company on June 13, 2018. Originally known as “Akiko Global Services Private Limited,” the company underwent a transformation to a Public Limited Company on April 12, 2023, and was renamed “Akiko Global Services Limited.” Operating with Corporate Identification Number U794999DL2018PLC335272, Akiko Global Services IPO is set to make its mark in the financial sector.

Since commencing operations in 2018, Akiko Global Services has established itself as a trusted Channel Partner (DSA) for major banks and NBFCs. The company’s business model integrates tele-calling, corporate activities, and a combination of feet-on-street and digital marketing approaches to acquire customers digitally. Specializing in credit cards and loans, Akiko Global Services provides comprehensive guidance and support to both individuals and businesses. Whether clients seek the best credit card for rewards or the most suitable loan, Akiko’s expertise ensures tailored recommendations and informed decisions.

The Business Model and Approach of Akiko Global Services IPO

Akiko Global Services IPO stands out in the industry due to its commitment to compliance and quality. ISO Certified by QFS Management Systems LLP and accredited by the Standards Council of Canada, Akiko adheres to strict guidelines issued by partnering banks. The company’s proficiency is further amplified by the use of a proprietary Customer Relationship Management (CRM) system, which integrates seamlessly with external CRMs or APIs, ensuring customer data security and efficient operations.

Akiko Global Services employs a multi-channel approach to customer acquisition, maximizing reach and engagement. The telemarketing team undergoes regular training to enhance communication and conversion rates. In digital marketing, the company invests in SEO, PPC advertising, social media marketing, WhatsApp, and email campaigns to boost brand visibility. The feet-on-street team targets high foot traffic areas, establishing personalized relationships with potential customers and guiding them through financial decisions.

Strengths, Opportunities, and Strategic Growth of Akiko Global Services IPO

The Akiko Global Services IPO benefits from the company’s extensive experience and diversified business model. Since 2018, Akiko has accumulated a vast database of target segment customers, enabling precise targeting and tailored offerings. The growing demand for credit products in India, driven by an expanding middle-class population and increased digital payment adoption, presents a significant market opportunity. Additionally, the government’s push for financial inclusion and awareness has increased the demand for personal loans.

Akiko Global Services IPO aims to deepen collaborations with banks, providing customers with exclusive products and features. Embracing technology, the company invests in advanced analytics and AI-driven algorithms to optimize marketing efforts and personalize offerings. The development of a user-friendly mobile application ensures real-time access to credit card and loan information, enhancing customer experience.

Akiko Global Services IPO: Market Opportunities and Strategic Alliances

The Indian market’s growing demand for credit cards and personal loans is a key focus for Akiko Global Services IPO. The company’s comprehensive approach to customer acquisition, through telemarketing, digital marketing, feet-on-street engagement, and corporate activities, positions it to capitalize on this lucrative market. As consumer needs evolve, Akiko aims to offer personalized financial solutions that cater to specific preferences, providing tailored benefits and flexible repayment options.

Strategic alliances with corporations present further growth opportunities for Akiko Global Services IPO. By partnering with companies to enhance employee benefits programs or co-branded credit card offerings, Akiko extends its reach and influence. The synergy of India’s economic growth, changing consumer behaviors, and the expansion of financial services creates a substantial market opportunity for Akiko Global Services IPO.

With a strong foundation, innovative approach, and commitment to excellence, Akiko Global Services IPO is poised to make a significant impact in the financial sector. Investing in this IPO offers a chance to be part of a dynamic and evolving company dedicated to delivering unparalleled value in the credit card and personal loan market.

4. Financial Details of Akiko Global Services

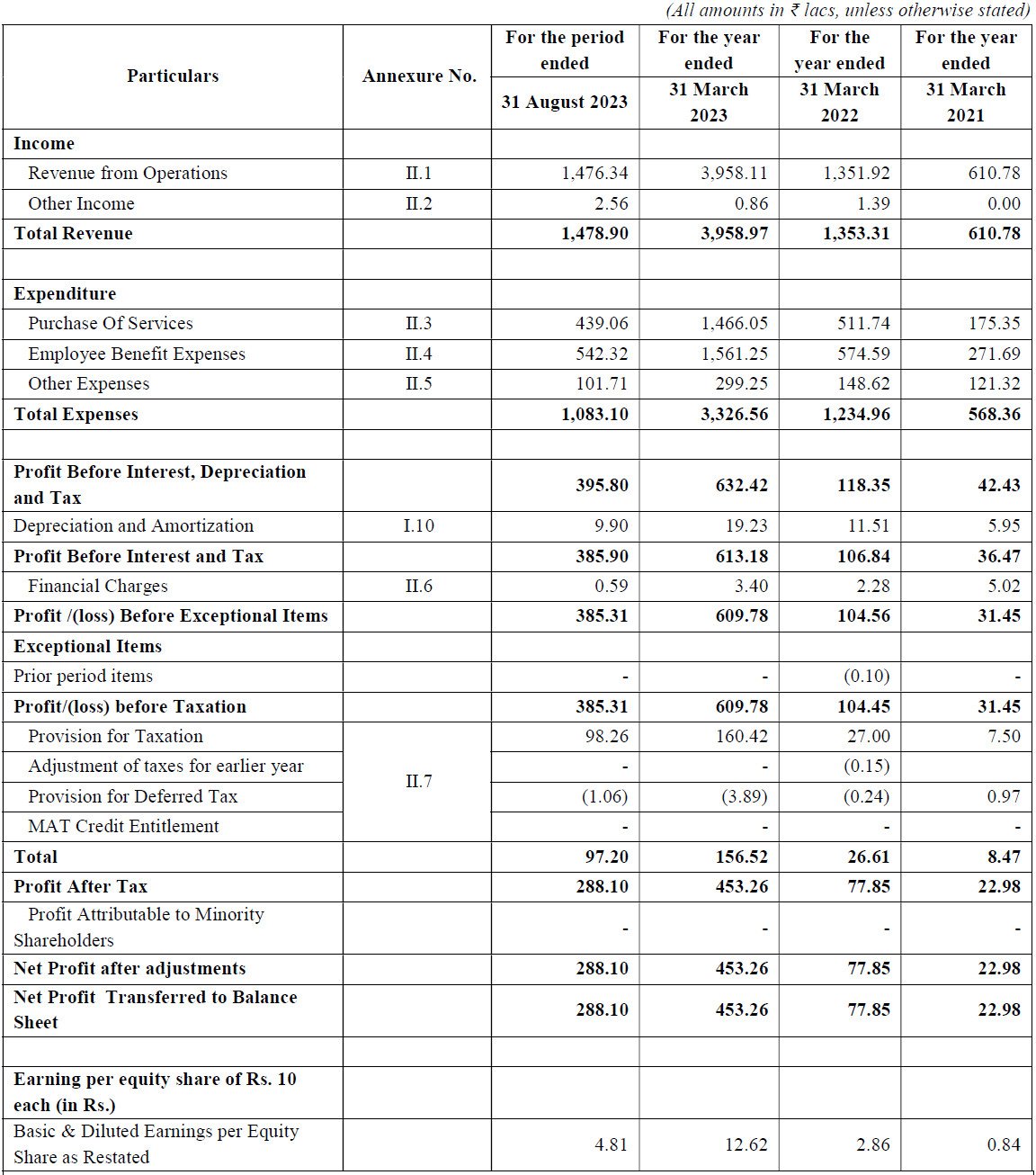

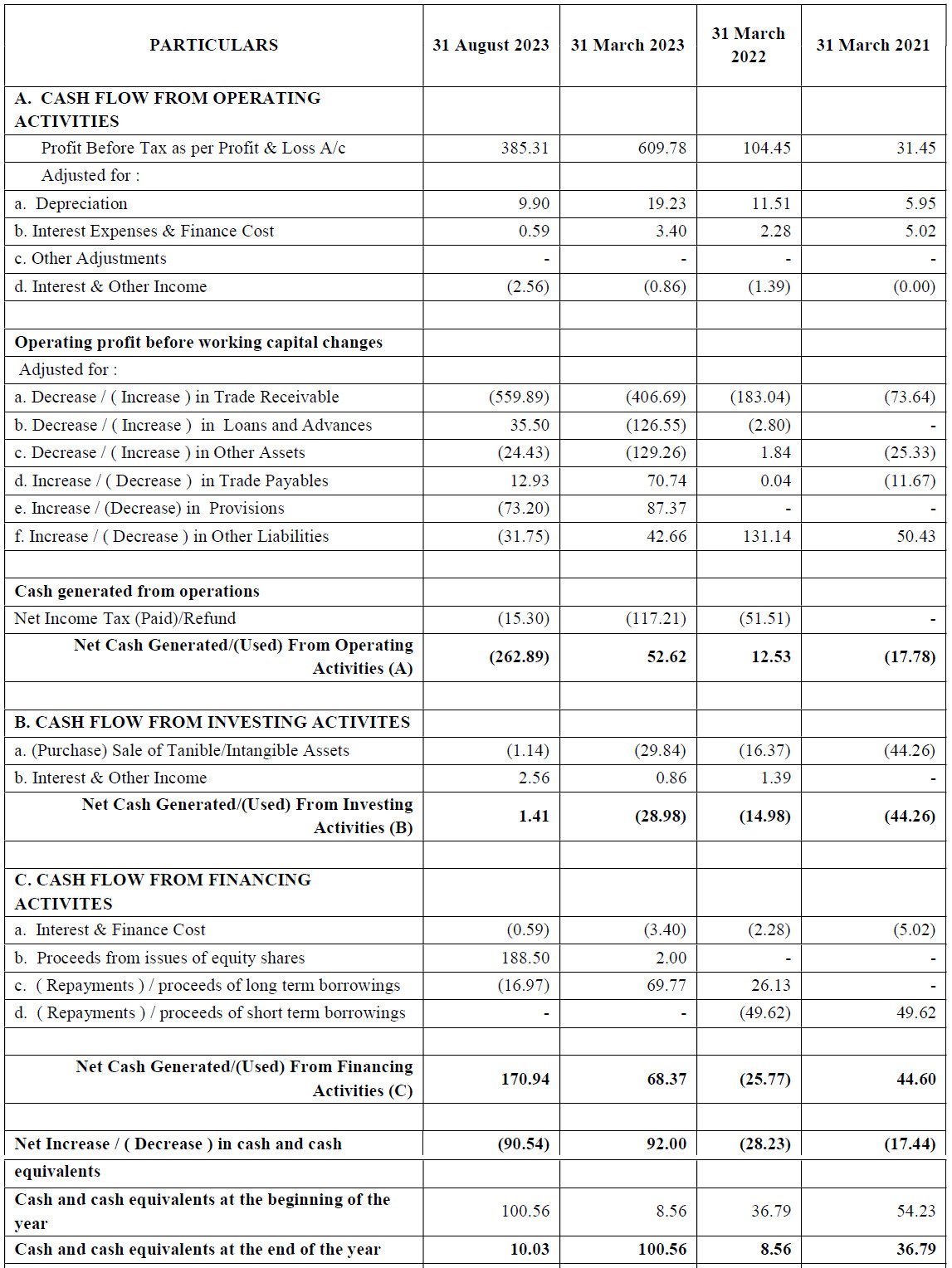

The Akiko Global Services IPO showcases a company with a strong financial foundation and impressive growth trajectory. The financial data for Akiko Global Services Limited, presented in restated form, highlights significant increases in assets, revenue, profit, and net worth over recent years.

As of January 31, 2024, Akiko Global Services Limited reported total assets amounting to ₹1,794.91 lakhs, a substantial rise from ₹1,130.87 lakhs on March 31, 2023. This growth trend continues back to ₹405.67 lakhs in 2022 and ₹234.88 lakhs in 2021. Revenue generation also showcases robust growth, with the latest figures at ₹2,609.76 lakhs as of January 2024, compared to ₹3,958.97 lakhs in 2023, ₹1,353.31 lakhs in 2022, and ₹610.78 lakhs in 2021.

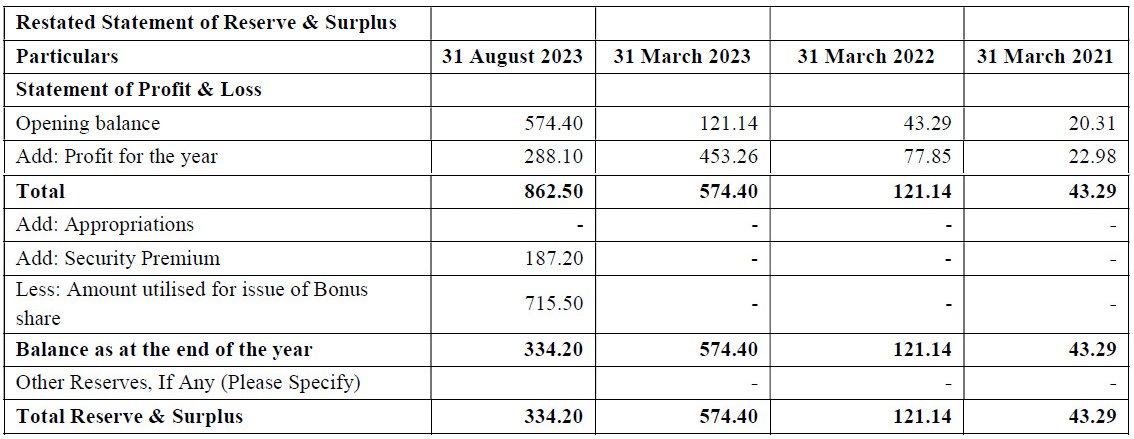

Profit After Tax (PAT) has seen a notable increase, standing at ₹321.48 lakhs as of January 2024. This follows a PAT of ₹453.26 lakhs in 2023, ₹77.85 lakhs in 2022, and ₹22.98 lakhs in 2021. Net worth has grown impressively as well, reaching ₹1,403.37 lakhs by January 2024, up from ₹578.40 lakhs in 2023, ₹123.14 lakhs in 2022, and ₹45.29 lakhs in 2021. The reserves and surplus of the company have also seen significant growth, highlighting a strong financial backbone.

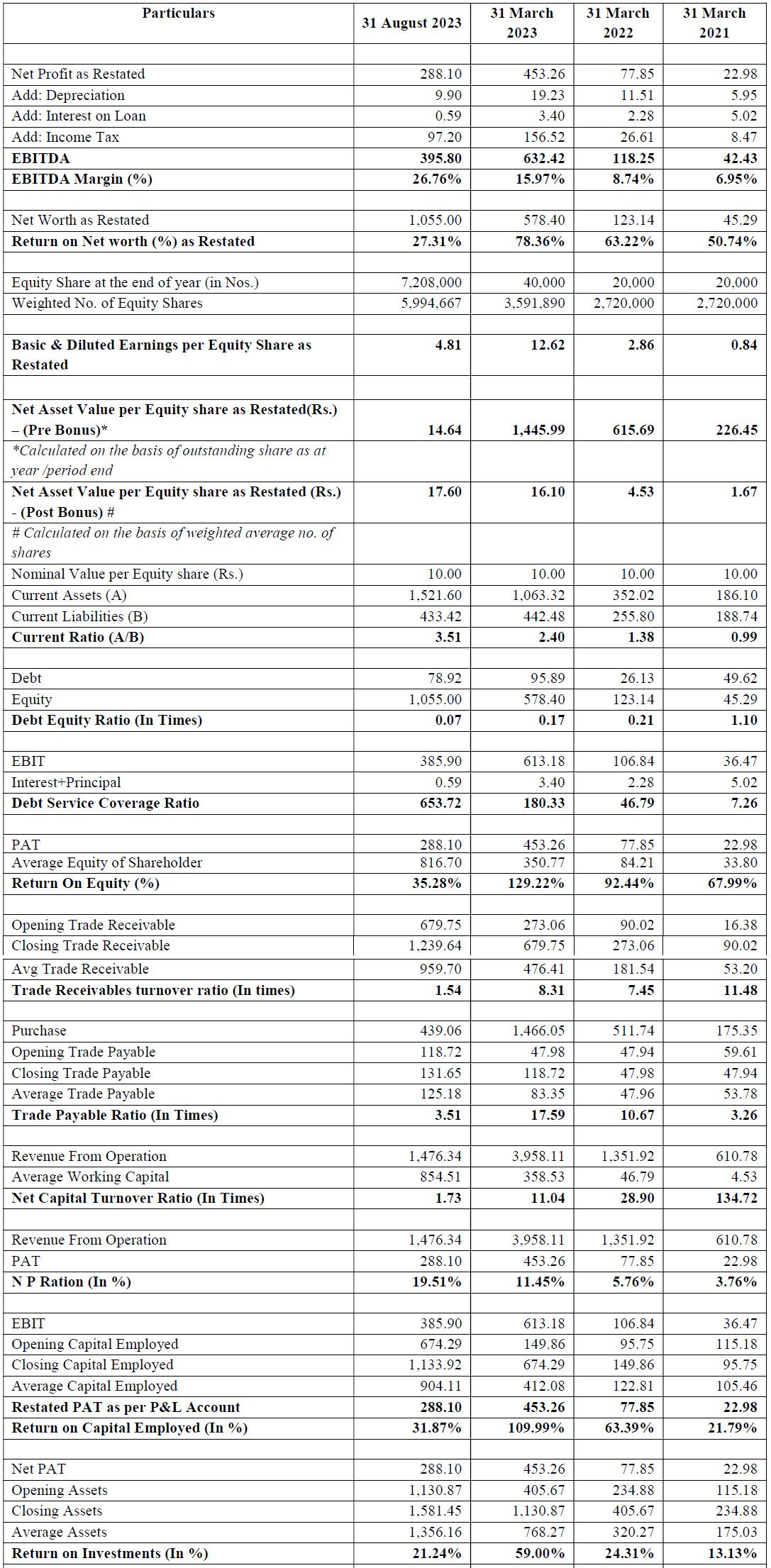

Key Performance Indicators of Akiko Global Services IPO

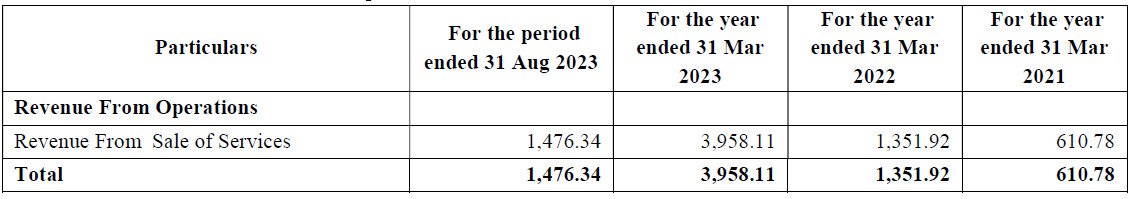

The Akiko Global Services IPO is supported by strong key performance indicators, reflecting the company’s financial health and operational efficiency. For the period ending August 31, 2023, revenue from operations stood at ₹1,476.34 lakhs, following ₹3,958.11 lakhs in March 2023, ₹1,351.92 lakhs in March 2022, and ₹610.78 lakhs in March 2021.

EBITDA has shown remarkable improvement, reaching ₹395.80 lakhs as of August 2023, up from ₹632.42 lakhs in March 2023, ₹118.25 lakhs in March 2022, and ₹42.43 lakhs in March 2021. This is reflected in the EBITDA margin, which has increased to 26.76% as of August 2023 from 15.97% in 2023, 8.74% in 2022, and 6.95% in 2021.

Profit After Tax (PAT) for August 2023 stands at ₹288.10 lakhs, demonstrating consistent growth from ₹453.26 lakhs in March 2023, ₹77.85 lakhs in March 2022, and ₹22.98 lakhs in March 2021. The PAT margin has also seen improvement, reaching 19.51% as of August 2023, compared to 11.45% in 2023, 5.76% in 2022, and 3.76% in 2021.

Net worth has grown to ₹1,055.00 lakhs by August 2023, up from ₹578.40 lakhs in March 2023, ₹123.14 lakhs in 2022, and ₹45.29 lakhs in 2021. Return on Equity (RoE) and Return on Capital Employed (RoCE) have also shown strong performance, with RoE at 35.28% in August 2023, and RoCE at 31.87%, indicating efficient management and profitable growth.

Investors looking into the Akiko Global Services IPO will find a company with a proven track record of financial stability, consistent revenue growth, and strong profitability. The robust financial metrics and performance indicators make Akiko Global Services IPO a compelling investment opportunity in the burgeoning financial sector.

Statement Of Revenue From Operations

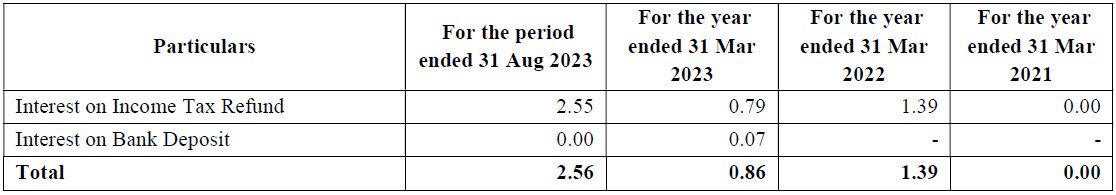

Statement of Other Income

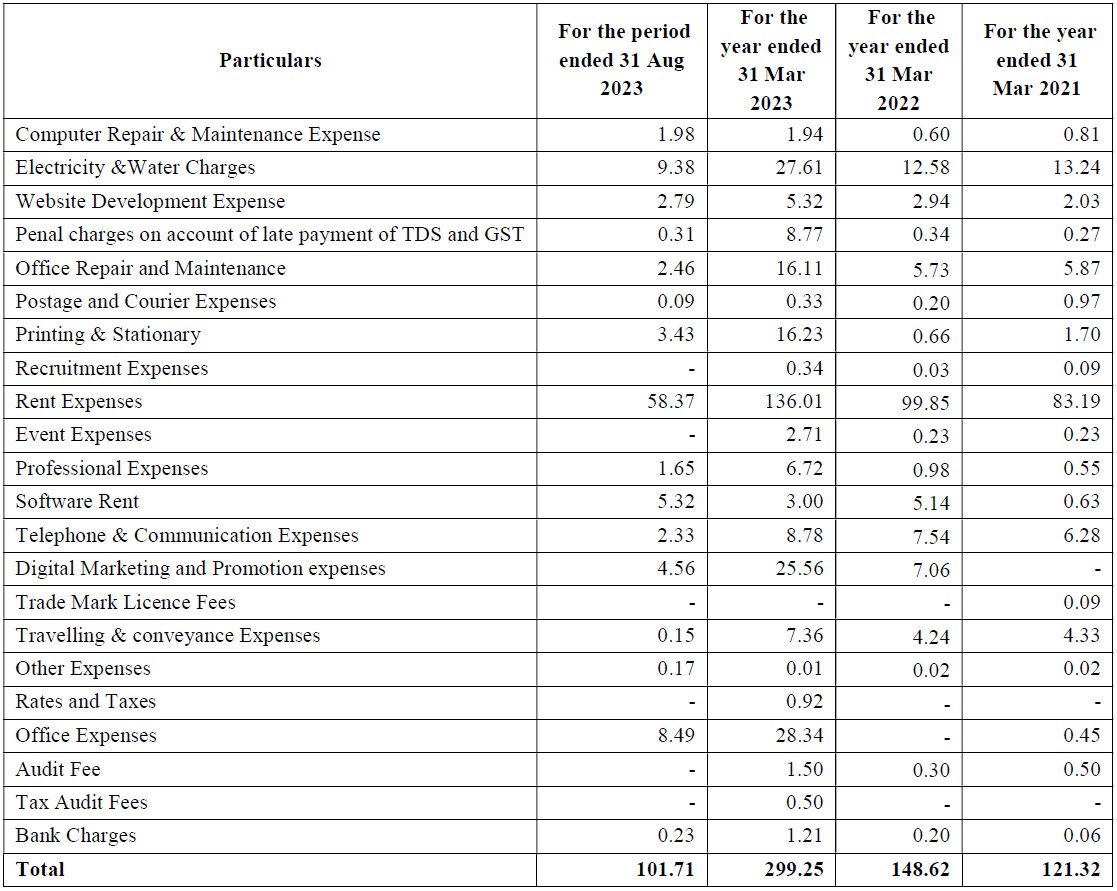

Statement of Other Expenses

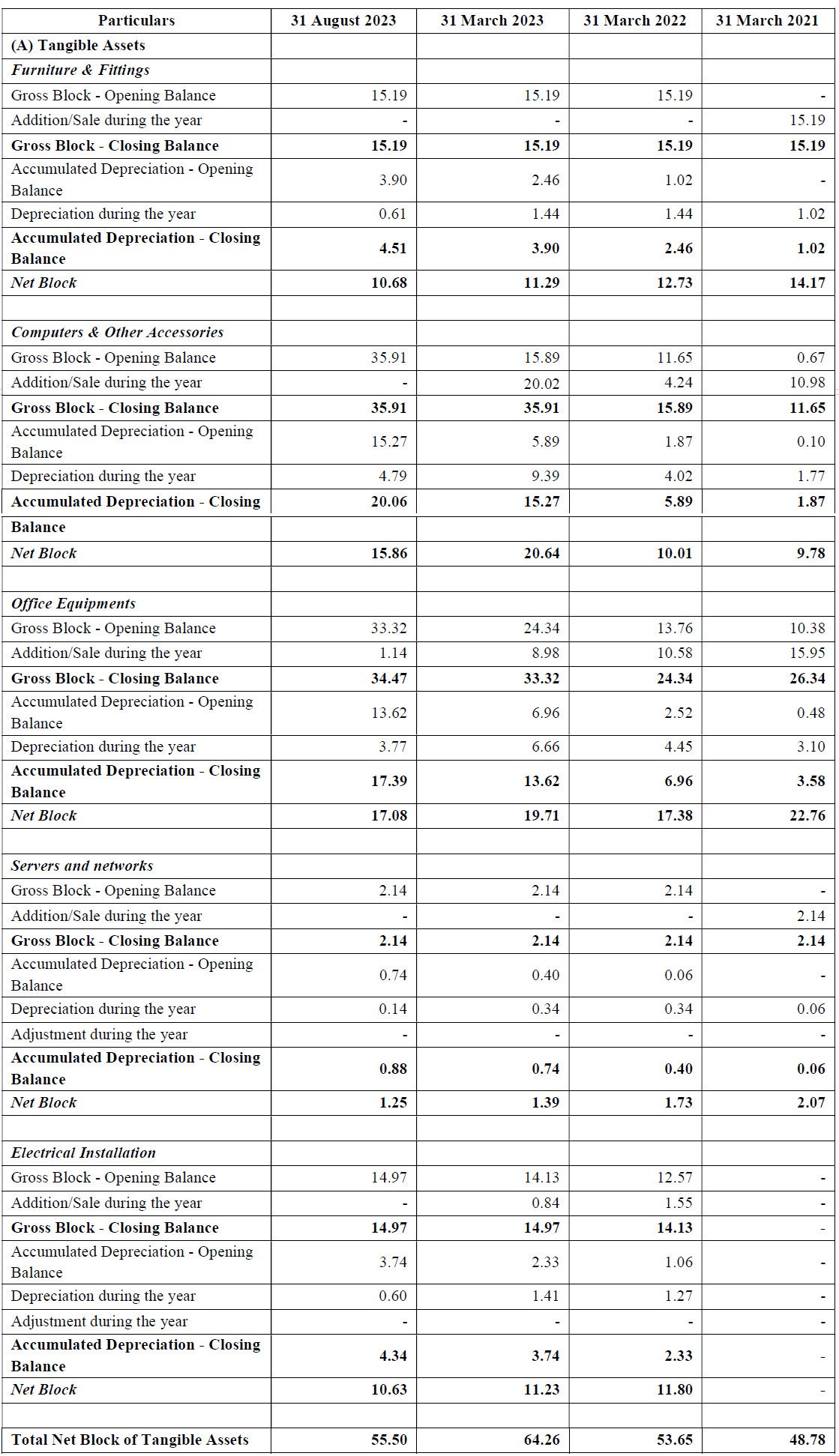

Statement of Property, Plant and Equipment

Statement of Reserves & Surplus

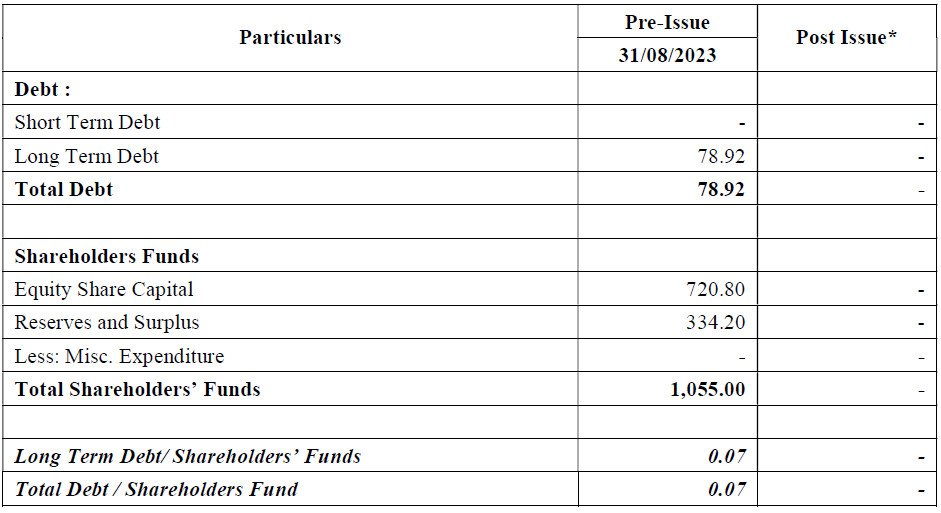

Statement of Capitalisation

Financial Ratios

5. Akiko Global Services IPO FAQs

Akiko Global Services IPO Details

The Akiko Global Services IPO opens on June 25, 2024.

The Akiko Global Services IPO closes on June 27, 2024.

The price range for the Akiko Global Services IPO is ₹73.00 to ₹77.00 per share.

The Akiko Global Services IPO will be listed on the NSE SME.

The Akiko Global Services IPO is a Book Build Issue.

The total issue size of the Akiko Global Services IPO is ₹23.11 crores.

Not less than 35% of the net issue is allocated to retail investors.

Akiko Global Services IPO Key Dates

The basis of allotment date is tentatively set for July 1, 2024.

Refunds will be initiated on July 1, 2024.

Shares will be credited to Demat accounts on July 1, 2024.

The listing date for the Akiko Global Services IPO is July 2, 2024.

Akiko Global Services IPO Issue Details

The face value of shares is ₹10 per equity share.

The market lot size is 1600 shares.

The minimum investment amount for one lot is ₹123,200.

The minimum HNI investment requires 3200 shares (2 lots).

Akiko Global Services Business Model

Akiko Global Services acts as a Channel Partner (DSA) for major banks and NBFCs, specializing in credit cards and loans.

Akiko Global Services uses tele-calling, corporate activities, feet-on-street, and digital marketing to acquire customers.

Akiko Global Services uses a proprietary Customer Relationship Management (CRM) system to manage customer relationships and integrate with external CRMs or APIs.

Akiko Global Services Financial Data

The revenue for the period ended January 31, 2024, was ₹2,609.76 lakhs.

Akiko Global Services’ PAT has increased from ₹22.98 lakhs in 2021 to ₹77.85 lakhs in 2022, ₹453.26 lakhs in 2023, and ₹321.48 lakhs for the period ended January 31, 2024.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Akiko Global Services IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Akiko Global Services IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Akiko Global Services IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Akiko Global Services IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.