Table of Contents

Aelea Commodities IPO presents an exciting opportunity to invest in Aelea Commodities Limited, a dynamic company founded in November 2018 with a focus on trading agricultural products. Initially trading sugar, cashew, pulses, and more, the company expanded into cashew processing with a plant located in Gujarat. Aelea Commodities Limited excels in both B2B and B2C markets, particularly in cashew nuts, while also trading sugar, pulses, soybeans, rice, and wheat flour exclusively through B2B channels. With plans to convert Cashew Nut Shell Liquid (CNSL) into Cardanol and Residol, Aelea Commodities Limited is poised to meet the growing global demand for sustainable fuels. .

Aelea Commodities IPO Details

IPO Open Date | IPO Closed Date | Allotment Date |

12th July 2024 | 16th July 2024 | 18th July 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 19th July 2024 | 19th July 2024 | 22nd July 2024 |

| IPO Issue Size | IPO Issue Price | Market Lot | Total Shares |

| ₹51.00 Cr | ₹ 91.00 – ₹ 95.00 | 1200 Shares | 53,68,800 |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 1200 | ₹ 1,14,000 |

| Retail(Max) | 1 | 1200 | ₹ 1,14,000 |

| Small-HNI (Min) | 2 | 2400 | ₹ 2,28,000 |

| Small-HNI (Max) | 8 | 9600 | ₹ 9,12,000 |

| Big-HNI (Min) | 9 | 10800 | ₹ 10,26,000 |

| RII (Retail) | NII | QIB |

| 35.00% | 15.00% | 50.00% |

| Pre-Promoter | Post Promoter | Listing IN |

| 86.45% | 63.66% | BSE SME |

| No | Objectives |

| 1 | Setting up a new manufacturing unit and installing Plant and machinery thereon |

| 2 | Purchasing Plant and Machinery at an existing manufacturing unit |

| 3 | General Corporate Purposes |

| LEAD | REGISTRAR |

| EKADRISHT CAPITAL PRIVATE LIMITED | MAASHITLA SECURITIES PRIVATE LIMITED |

| Telephone | |

| info@aeleacommodities.com | +91- 22 6634 09891 |

Aelea Commodities IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Financial of Aelea Commodities IPO

| Amounts in Lakhs ₹ | |||

| Particulars | FY-2024 | FY-2023 | FY-2022 |

| Assets | 10,653 | 9,877 | 7,028 |

| Revenue | 14,451 | 11,014 | 10,551 |

| Expense | 12,995 | 10,717 | 9,576 |

| Net Worth | 4,593 | 3,383 | 3,061 |

| Borrowing | 4,077 | 3,327 | 2,131 |

| EBITDA(%) | 12.97 | 4.78 | 8.33 |

| Reserves | 3,092.89 | 3,351.00 | 3,029.53 |

| PAT | 1,222.32 | 191.22 | 1,063.11 |

| EPS | 8.15 | 1.27 | 7.09 |

| Debt/Equity | 0.89 | 0.99 | 0.70 |

| Established | Website | Industry |

| 2018 | prizor.in | Food |

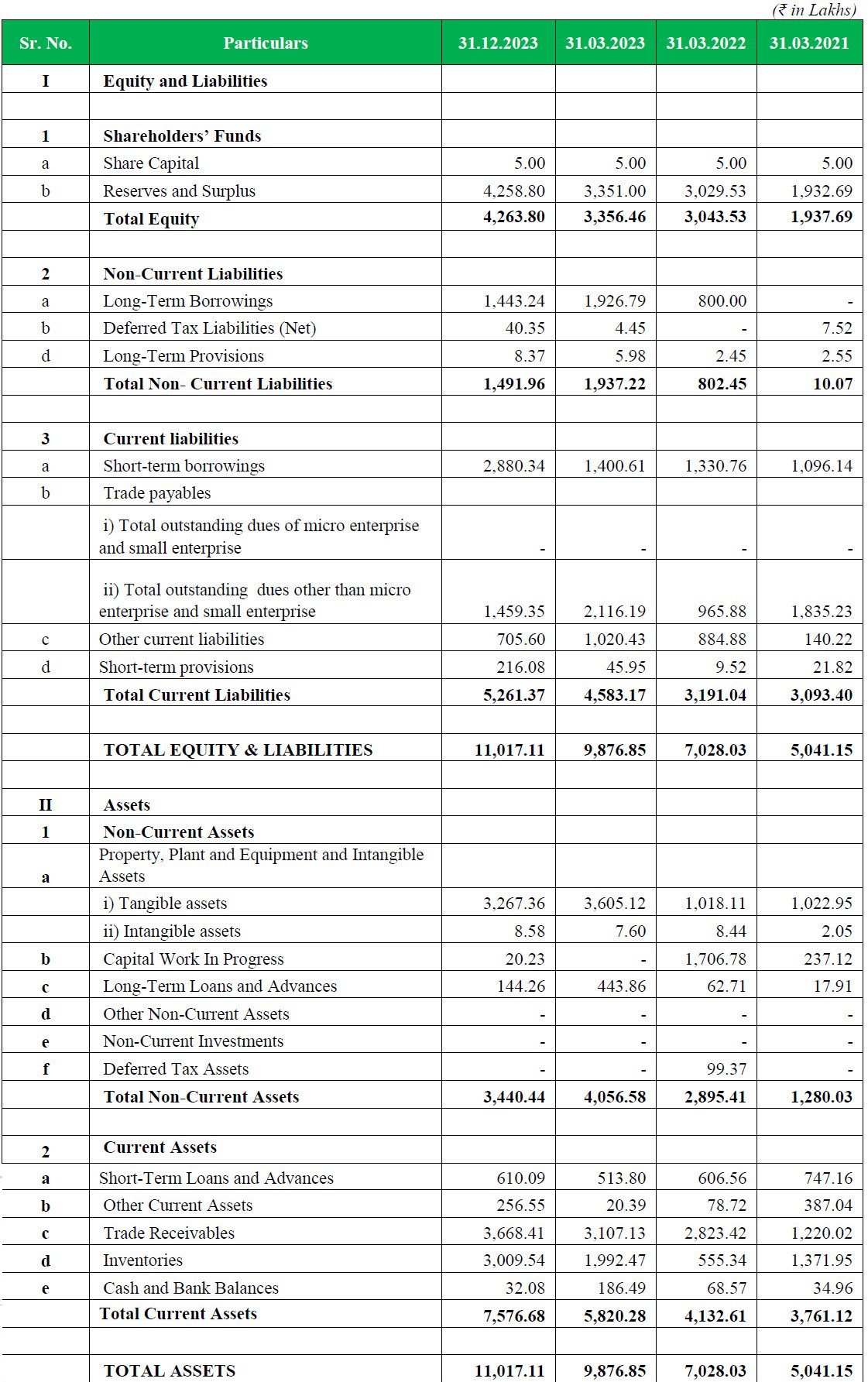

Statement of Assets and Liabilities

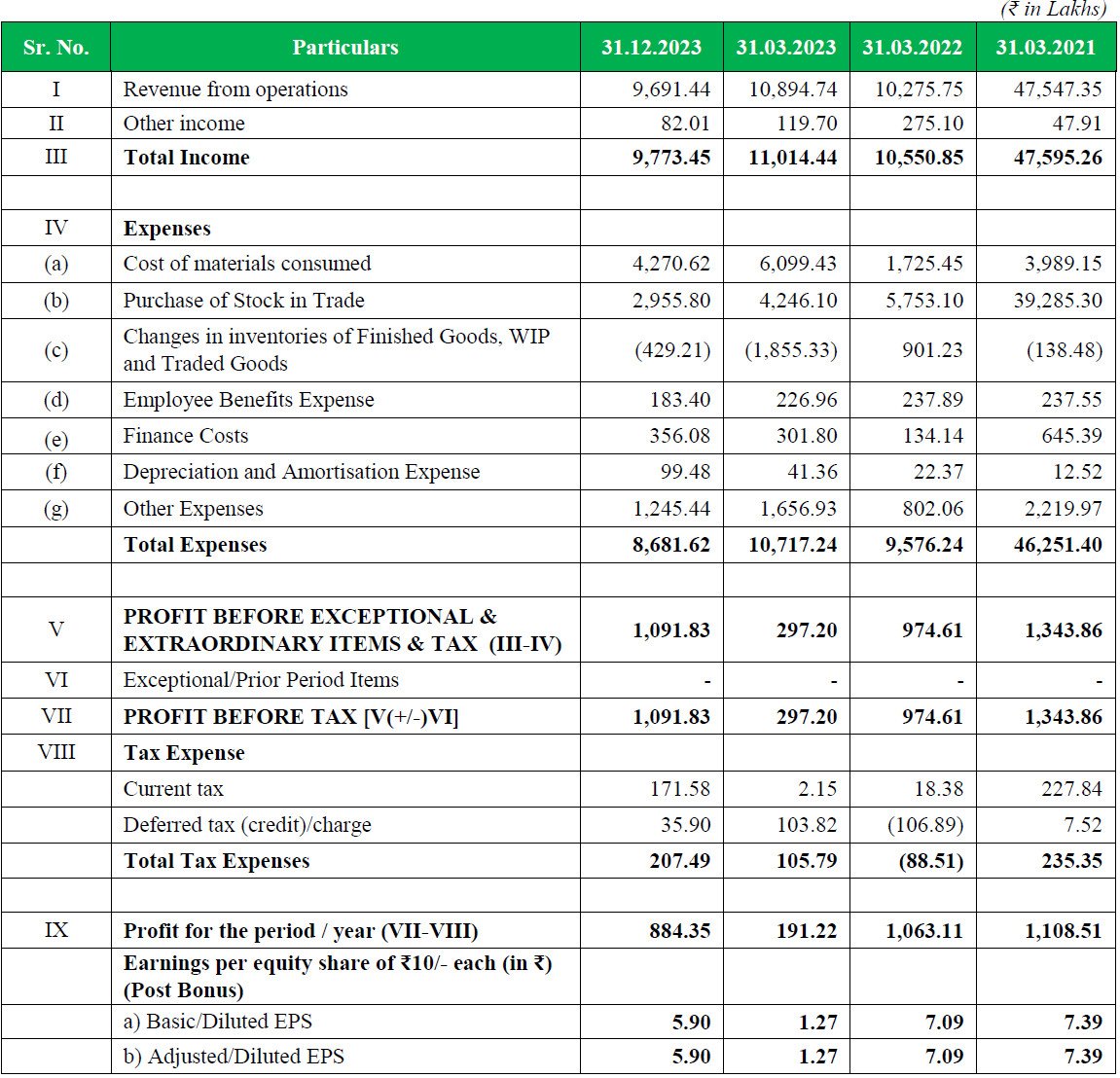

Statement of Profit and Loss

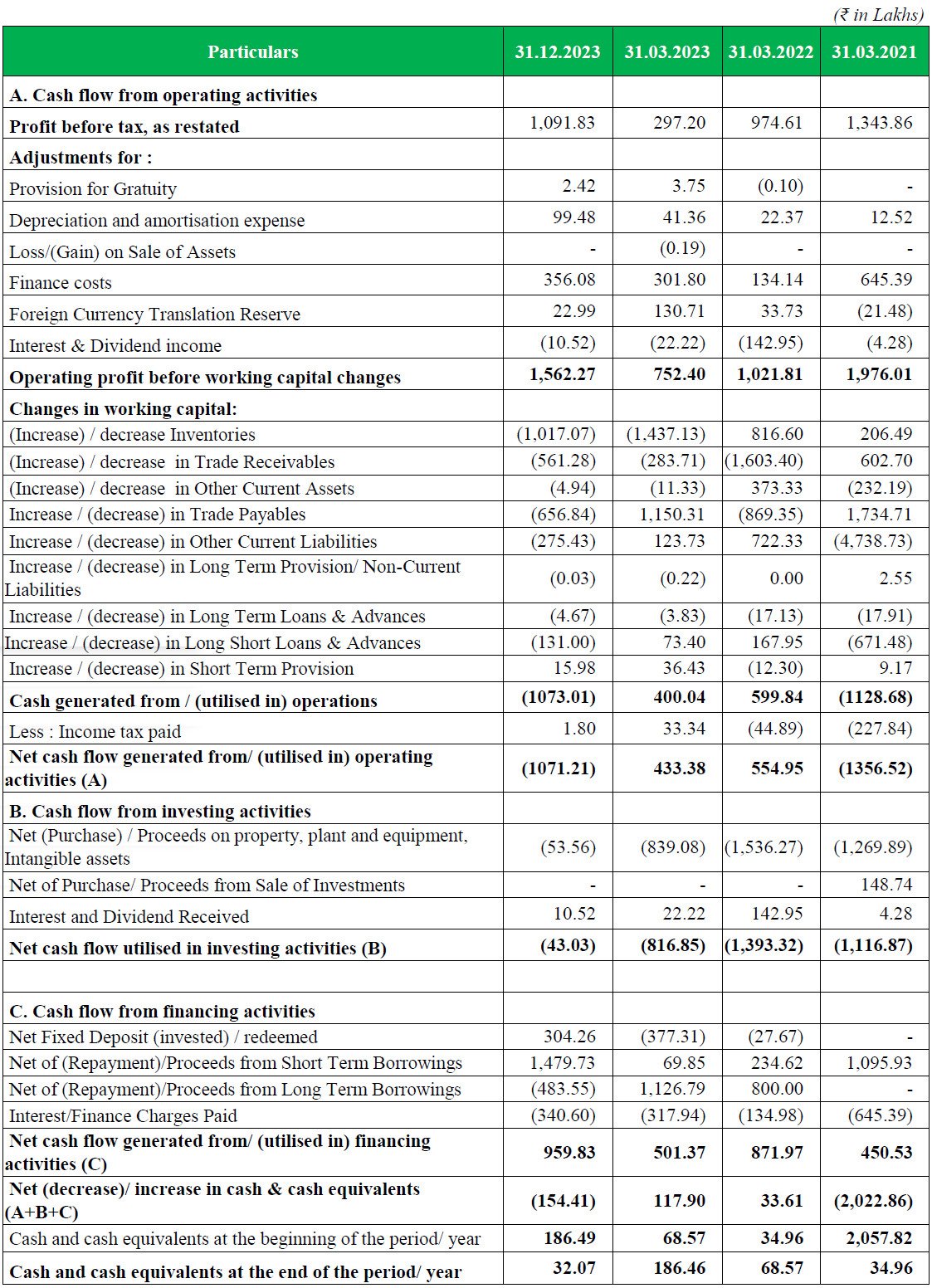

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Aelea Commodities IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Aelea Commodities IPO.

SwiftTopics.com‘s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Aelea Commodities IPO and other offerings a more informed and confident endeavor.

1. Aelea Commodities IPO key dates & Issue Details

Aelea Commodities SME IPO is set to launch on 12th July 2024, offering potential investors a chance to participate in the company’s growth. The IPO will close on 16th July 2024, with an issue price range of ₹91.00 to ₹95.00 per share. This book build issue is being listed on the BSE SME platform, making it a notable event for small and medium enterprise investors.

With a fresh issue size of ₹51.00 crore, the face value of each equity share is ₹10. Notably, the retail quota for this IPO is set at not less than 35% of the net issue, ensuring ample opportunities for retail investors. Pre-IPO, the promoters hold 86.45% of the company, which will be reduced to 63.66% post-IPO.

The key dates for Aelea Commodities IPO are crucial for potential investors. The basis of allotment will be finalized on 18th July 2024, followed by the initiation of refunds on 19th July 2024. Investors can expect the credit of shares to their Demat accounts on the same day, 19th July 2024. The much-anticipated listing of Aelea Commodities IPO shares on the BSE SME platform is scheduled for 22nd July 2024. These dates are tentative and will be updated as more information becomes available.

For those considering investing in Aelea Commodities IPO, understanding the lot sizes is essential. The market lot is set at 1200 shares, which amounts to an investment of ₹114000 for one lot. High net-worth individuals (HNIs) must purchase a minimum of 2400 shares (2 lots), totaling ₹228000. This structured lot system ensures that both retail and HNI investors can strategically plan their investments in Aelea Commodities IPO.

With Aelea Commodities IPO, investors have the opportunity to invest in a promising SME with substantial growth potential. Keep an eye on the important dates and ensure you meet the investment requirements to capitalize on this opportunity.

2. Aelea Commodities IPO Allotment Status

Dive into the excitement surrounding the Aelea Commodities IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Aelea Commodities IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Aelea Commodities IPO journey.

3. Introduction to Aelea Commodities IPO: A Comprehensive Business Overview

Company Background

Aelea Commodities, incorporated on November 05, 2018, began with the objective of trading agricultural products like sugar, cashews, pulses, and other commodities. Over time, the company ventured into cashew processing, establishing a facility in Surat, Gujarat, at Gujarat Agro Infrastructure Mega Food Park. Specializing in high-quality cashew products, Aelea Commodities caters to both B2B and B2C markets across India and internationally. The company has a subsidiary, Supreme Commodities DMCC, located in Dubai.

Business Model

Aelea Commodities operates through two distinct models: Business to Business (B2B) and Business to Customer (B2C). While cashew products are marketed through both B2B and B2C channels, other commodities like sugar, pulses, soybean, rice, and wheat flour are traded exclusively via B2B. This strategic approach optimizes operations, ensuring efficient and quality service for business partners and retail customers alike.

Operational Strategy and Expansion

Aelea Commodities imports raw cashew nuts (RCN) from African nations like Benin, Tanzania, Burkina Faso, Senegal, and Cote d’Ivoire. The company processes these nuts into edible cashew kernels and trades them along with by-products like bagasse from sugar mills. The existing cashew processing plant has a robust capacity of 40 metric tons per day, with plans to increase this to approximately 140 metric tons per day. This expansion includes venturing into the processing of cashew nut shells into Cashew Nut Shell Liquid (CNSL), used in various industries such as automotive, pharmaceuticals, and chemicals.

Products and Market Reach

Aelea Commodities offers a variety of products, including plain and roasted & salted cashews, plain sugar, pulses, soybean, rice, and wheat flour. The company utilizes a comprehensive cashew processing method, from receiving raw cashew nuts to final packaging. While B2C sales through online platforms like Amazon and Flipkart are minimal, B2B transactions dominate the revenue stream.

Competitive Strengths

The company’s promoters possess significant industry knowledge, contributing to consistent growth. Aelea Commodities maintains strong client relationships by meeting customer demands and ensuring timely delivery of high-quality products. The company’s well-established systems and procedures, coupled with experienced promoters, ensure efficient operations and customer satisfaction.

Business Strategy

Aelea Commodities aims to expand its manufacturing capacity to capitalize on industry opportunities and increase operational efficiency. The company plans to enhance its distribution reach, focusing on different regions and establishing long-term relationships with customers. By entering new geographies and building a robust marketing and sales team, Aelea Commodities is poised for sustained growth and success in the market.

In summary, Aelea Commodities IPO offers investors a chance to invest in a company with a strong foundation in agricultural trading and cashew processing. With a strategic expansion plan and a commitment to quality and customer satisfaction, Aelea Commodities is set to solidify its position as a leader in the industry.

4. Financial Details of Aelea Commodities

Aelea Commodities Limited has demonstrated remarkable financial growth, highlighted by a substantial increase in revenue and profit after tax (PAT). Between the financial year ending March 31, 2024, and March 31, 2023, the company’s revenue surged by 31.2%, while PAT experienced an impressive rise of 539.22%. This robust performance underscores Aelea Commodities Limited’s commitment to operational excellence and strategic expansion.

Aelea Commodities IPO: Detailed Financial Data

Consolidated Assets and Revenue

For the period ending May 31, 2024, Aelea Commodities Limited reported assets amounting to ₹11,641.28 lakhs. This marks a steady increase from ₹10,653.47 lakhs as of March 31, 2024, ₹9,876.85 lakhs in 2023, ₹7,028.03 lakhs in 2022, and ₹5,041.15 lakhs in 2021. The company’s revenue also saw significant growth, with figures reaching ₹2,758.47 lakhs for the period ending May 31, 2024. In the preceding years, revenue was recorded at ₹14,450.77 lakhs (2024), ₹11,014.44 lakhs (2023), ₹10,550.85 lakhs (2022), and ₹47,595.26 lakhs (2021).

Profit After Tax and Net Worth

Aelea Commodities Limited’s PAT for the period ending May 31, 2024, stood at ₹280.36 lakhs, demonstrating strong profitability. For the full financial year ending March 31, 2024, PAT was ₹1,222.32 lakhs, compared to ₹191.22 lakhs in 2023, ₹1,063.11 lakhs in 2022, and ₹1,108.51 lakhs in 2021. The company’s net worth has also seen consistent growth, reaching ₹4,875.32 lakhs as of May 31, 2024, up from ₹4,592.89 lakhs in 2024, ₹3,383.00 lakhs in 2023, ₹3,060.89 lakhs in 2022, and ₹1,940.51 lakhs in 2021.

Reserves, Surplus, and Borrowings

Aelea Commodities Limited reported reserves and surplus of ₹3,375.32 lakhs as of May 31, 2024. This is a continuation of the upward trend from ₹3,092.89 lakhs in 2024, ₹3,351.00 lakhs in 2023, ₹3,029.53 lakhs in 2022, and ₹1,932.69 lakhs in 2021. The company’s total borrowings were noted at ₹4,120.36 lakhs for the period ending May 31, 2024, reflecting a steady increase from ₹4,077.32 lakhs in 2024, ₹3,327.40 lakhs in 2023, ₹2,130.76 lakhs in 2022, and ₹1,096.14 lakhs in 2021.

Aelea Commodities IPO: Valuations and Margins

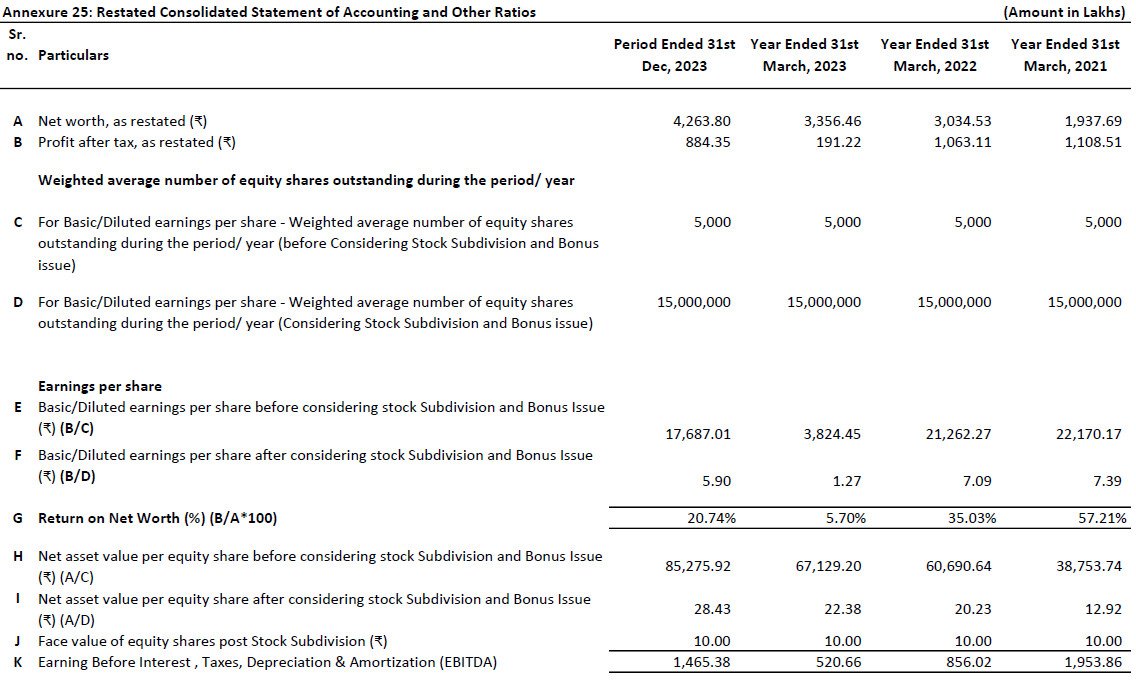

Earnings Per Share (EPS) and Price-to-Earnings (PE) Ratio

Aelea Commodities Limited’s earnings per share (EPS) for FY 2024 stood at 8.15, a significant increase from 1.27 in FY 2023, and 7.09 in FY 2022. The PE ratio for FY 2024 ranged between 11.17 and 11.66, reflecting the company’s market valuation.

Return on Net Worth (RONW) and Net Asset Value (NAV)

The return on net worth (RONW) for FY 2024 was 26.61%, demonstrating strong profitability, compared to 5.70% in FY 2023 and 35.03% in FY 2022. The net asset value (NAV) also increased, reaching 30.62 in FY 2024, up from 22.38 in FY 2023, and 20.32 in FY 2022.

Return on Capital Employed (ROCE) and EBITDA Margin

The return on capital employed (ROCE) for FY 2024 was 31.94%, significantly higher than 11.34% in FY 2023 and 28.91% in FY 2022. The EBITDA margin also showed a positive trend, standing at 12.97% in FY 2024, up from 4.78% in FY 2023 and 8.33% in FY 2022.

Debt-to-Equity Ratio

Aelea Commodities Limited maintained a healthy debt-to-equity ratio, recorded at 0.89 for FY 2024, compared to 0.99 in FY 2023 and 0.70 in FY 2022. This indicates the company’s prudent financial management and ability to leverage debt effectively.

Conclusion

The financial performance of Aelea Commodities Limited showcases its solid growth trajectory and strategic financial management. With significant increases in revenue, PAT, and other key financial metrics, Aelea Commodities IPO stands as a promising investment opportunity, underpinned by robust financial health and strategic market positioning.

Statement Of Revenue From Operations

Statement of Other Income

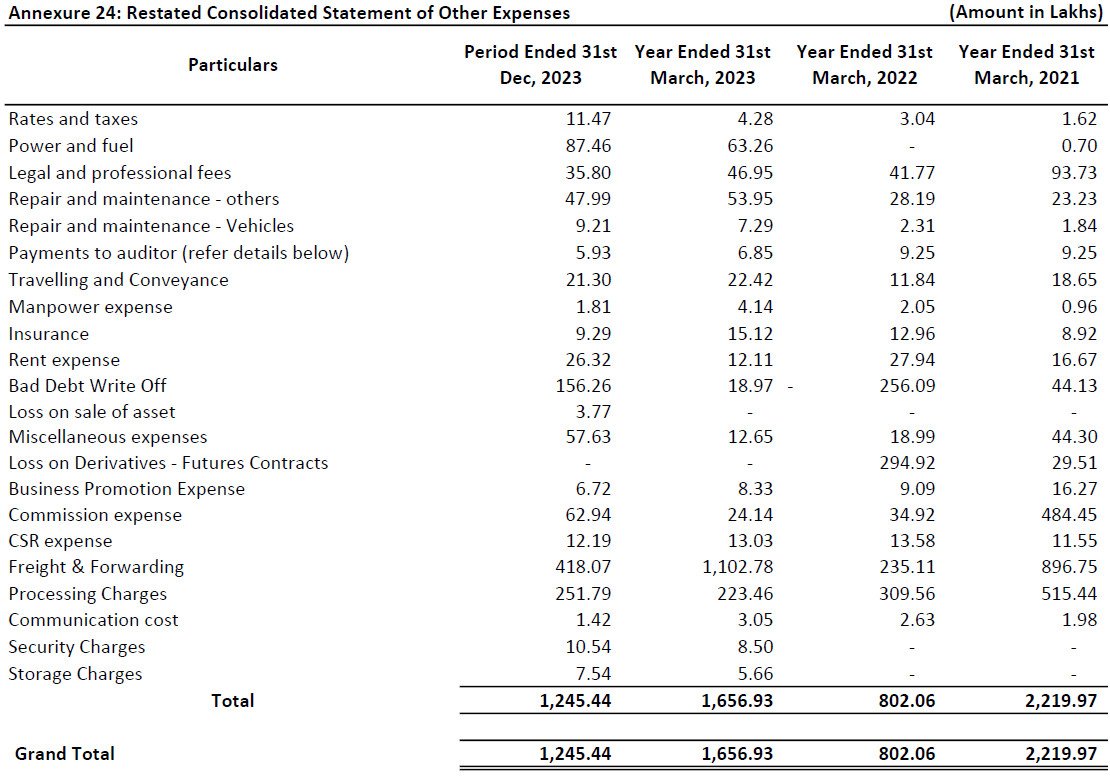

Statement of Other Expenses

Statement of Reserves & Surplus

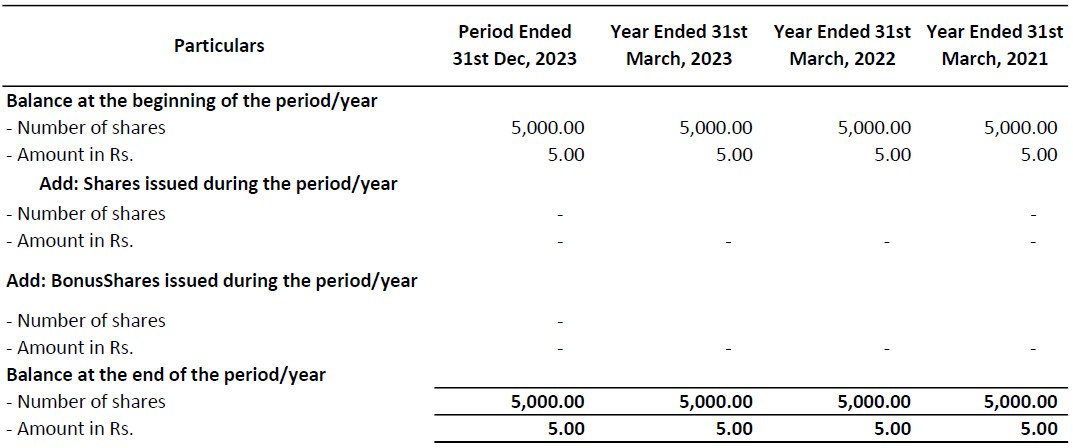

Statement of Equity Share Capital

Statement of Capitalisation

Financial Ratios

5. Aelea Commodities IPO FAQs

General IPO Details

Aelea Commodities IPO refers to the initial public offering of Aelea Commodities Limited, where the company offers its shares to the public for the first time.

The opening date for Aelea Commodities IPO is yet to be officially announced.

The closing date for Aelea Commodities IPO will be announced alongside the opening date. Typically, IPOs remain open for three to five days.

IPO Issue Details

The price band for Aelea Commodities IPO will be specified in the official announcement by the company.

The exact number of shares offered in the Aelea Commodities IPO will be detailed in the company’s official prospectus.

The minimum bid lot, or the smallest number of shares an investor can apply for, will be stated in the IPO’s official documentation.

Company and Business Model

Aelea Commodities Limited is involved in the trading and distribution of various commodities, leveraging its extensive market expertise and strategic partnerships.

Aelea Commodities Limited distinguishes itself through its robust supply chain, diverse product portfolio, and innovative trading strategies.

The company plans to expand its market presence, diversify its commodity portfolio, and invest in technology to enhance operational efficiency.

Financial Data

In FY 2024, Aelea Commodities Limited reported a revenue of ₹14,450.77 lakhs and a profit after tax (PAT) of ₹1,222.32 lakhs.

The revenue grew by 31.2% from FY 2023 to FY 2024.

The PAT increased by 539.22% from FY 2023 to FY 2024.

Financial Metrics and Ratios

The EPS for FY 2024 was 8.15.

The RONW for FY 2024 was 26.61%.

The debt-to-equity ratio decreased from 0.99 in FY 2023 to 0.89 in FY 2024.

Asset and Liabilities

The total assets were ₹11,641.28 lakhs as of May 31, 2024.

The net worth grew to ₹4,875.32 lakhs by May 31, 2024.

The total borrowings were ₹4,120.36 lakhs as of May 31, 2024.

Investment and Market Position

Investors may find Aelea Commodities IPO attractive due to the company’s strong financial performance, significant revenue growth, and strategic market positioning.

Risks may include market volatility, commodity price fluctuations, and potential changes in regulatory environments affecting the commodity trading industry. Investors should review the IPO prospectus for detailed risk factors.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Aelea Commodities IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Aelea Commodities IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Aelea Commodities IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Aelea Commodities IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.