Table of Contents

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

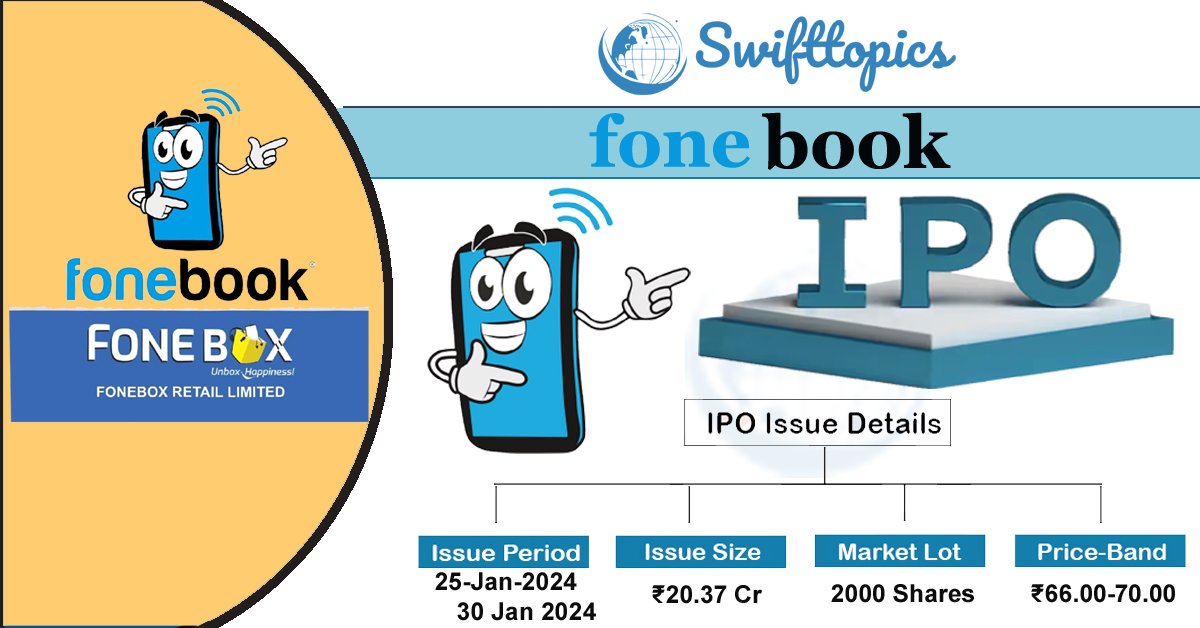

Introducing a ground-breaking tool for IPO enthusiasts – India’s first Fonebox Retail IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Fonebox retails IPO.

SwiftTopics.com’s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Fonebox SME IPO and other offerings a more informed and confident endeavor.

1. Fonebox Retail IPO key dates

Stay informed about the Fonebox Retail IPO with the latest details on key dates. The tentative timeline includes the Basis of Allotment Date scheduled for January 31, 2024, with refunds initiation expected on February 1, 2024. On the same day, the credit of shares to Demat accounts is anticipated. The Fonebox Retail IPO is set to be listed on February 2, 2024, marking a significant milestone for investors.

Additionally, let’s take a closer look at the Fonebox Retail IPO lots. The issue price is within the range of ₹66.00-70.00. A market lot consists of 2000 shares, and the investment for one lot is ₹140,000. High Net Worth Individuals (HNI) are required to invest in a minimum of 4000 shares (2 lots) to participate in this IPO. Keep an eye on these crucial dates and details to make informed decisions as the Fonebox Retail IPO unfolds.

Fonebox Retail IPO Overview:

Fonebox Retail IPO is gearing up for its Initial Public Offering (IPO) with a tentative timeline as follows:

| IPO Open Date | IPO Closed Date | IPO Issue Size | IPO Issue Price | Market Lot |

| 25th Jan 2024 | 30th Jan 2024 | ₹20.37 Cr | ₹66.00-70.00 | 2000 Shares |

| Allotment Finalisation Date | Refunds Initiation | Credit of Shares to Demat Account | IPO Listing Date |

| 31st Jan 2024 | 1st Feb 2024 | 1st Feb 2024 | 2nd Feb 2024 |

| Min Small HNI Lots | 4000 Shares | 2 Lots |

| Min Big HNI Lots | 16000 Shares | 8 Lots |

Investors are advised to stay tuned for updates as these dates are subject to change. Fonebox Retail IPO promises an exciting opportunity in the ever-evolving market.

2. Fonebox Retail IPO allotment Status

Dive into the excitement surrounding the Fonebox Retail IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Fonebox Retail IPO investment.

Stay connected with the latest developments and secure your spot in the Fonebox Retail IPO journey.

3. Introduction to Fonebox Retail ( Fonebook )

Welcome to the dynamic realm of Fonebox Retail, the ultimate destination for cutting-edge technology and stylish gadgets. Fonebox Retail Limited, headquartered in Ahmedabad, India, proudly stands as a leading multi-brand retail chain specializing in Smart Phones, Smart Watches, TVs, ACs, Laptops, Accessories, and Gadgets.

In March 2021, Fonebox Retail Limited inaugurated its first showroom in Ahmedabad, introducing an innovative concept that seamlessly integrates the look, touch, and feel of mobile outlets. This transformative approach to modern retail, built on the pillars of Choice, Ease, and Elegance, has significantly redefined the way customers experience technology.

Embracing the mantra, “Phone hai lena to Fonebook hai na” (If you’re getting a phone, it has to be from Fonebook), Fonebox Retail Limited has rapidly expanded its footprint. With 120+ showrooms strategically positioned across Gujarat, it has earned the distinction of being the fastest-growing mobile retail chain in the state.

At the core of Fonebox Retail Limited’s success lies a steadfast commitment to teamwork, cooperation, and unity. Boasting a workforce of over 650 knowledgeable and dedicated professionals, the company is renowned for its deep understanding of customer needs. This, coupled with well-trained staff, forms the cornerstone of its operational excellence.

Fonebox Retail Limited’s robust relationships with manufacturers and an unwavering focus on customer satisfaction have consistently garnered accolades in sales. Looking forward, Fonebox Retail Limited envisions setting new benchmarks in world-class mobile retail chain facilities. The goal is to emerge as India’s largest retail chain for Smart Phones, Smart Watches, TVs, ACs, Laptops, Accessories, and Gadgets.

As we delve into the exciting journey of Fonebox Retail Limited, stay tuned for updates on the highly-anticipated Fonebox Retail IPO. Explore the future of technology retail with Fonebox Retail IPO, where innovation meets opportunity. Discover how Fonebox Retail IPO is set to revolutionize the landscape of Smart Phones, Smart Watches, TVs, ACs, Laptops, Accessories, and Gadgets retail in India.

Company’s official website:

http://www.fonebook.in/

4. Financial Details of Fonebox Retail ( Fonebook)

Fonebox Retail Limited’s financial strength is fortified by its innovative business model, deriving revenue from two major verticals. The first, Sale through Owned Stores (COCO Model), involves selling mobile handsets, accessories, and consumer durable home appliances through 40 strategically located owned stores across Gujarat. These outlets serve as hubs for showcasing the latest smartphones, providing hands-on experiences, and delivering top-notch customer service.

The second vertical, Sale through Franchise Branch Stores (FOCO Model), involves selling products through 113 franchise retail outlets operating on the FOCO model. Fonebox Retail Limited earns a percentage of the total turnover achieved by these franchises, enhancing its revenue stream. The FOCO model allows the company to extend its brand name to franchise owners, fostering a network of retail outlets under the “Fonebox,” “Fonebook,” or “My Mobile” brand.

As we explore the financial and business landscape of Fonebox Retail Limited, anticipate the significant impact these factors will have on the narrative of the highly-anticipated Fonebox Retail IPO. Witness the convergence of financial prowess and innovative business models as Fonebox Retail IPO takes center stage in the market.

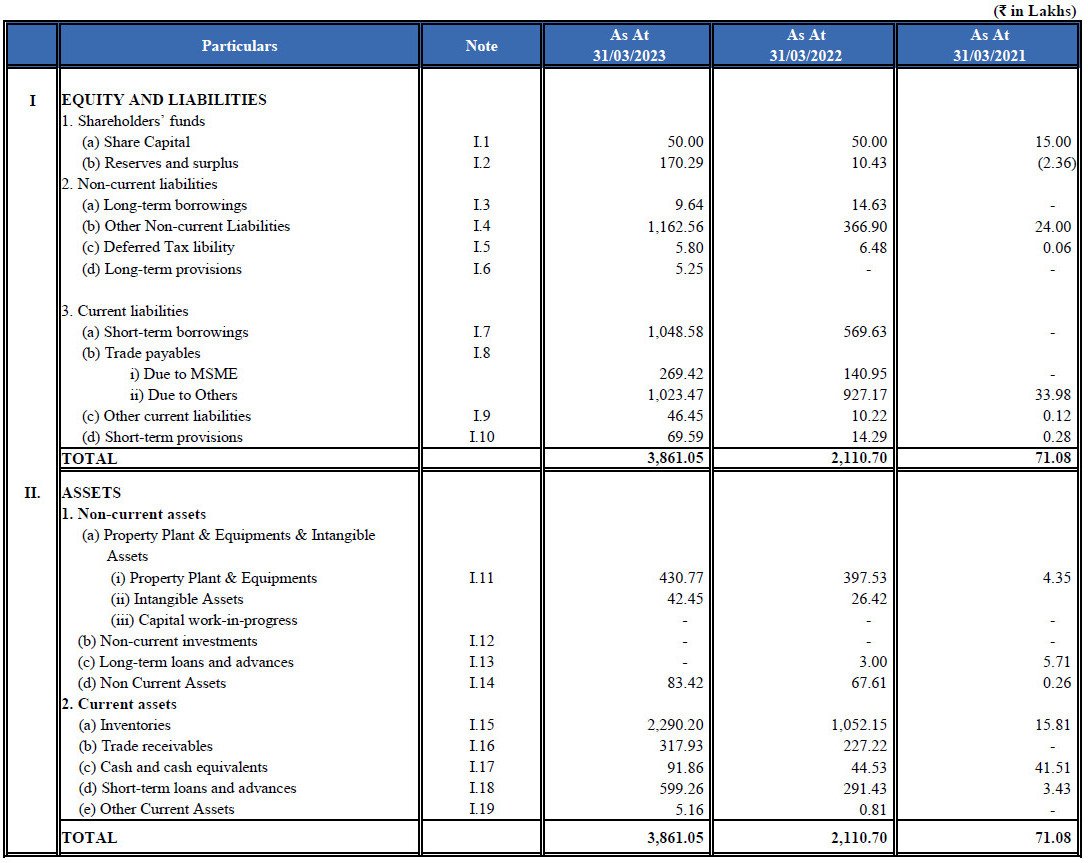

FONEBOX RETAIL IPO: STATEMENT OF ASSETS & LIABILITIES

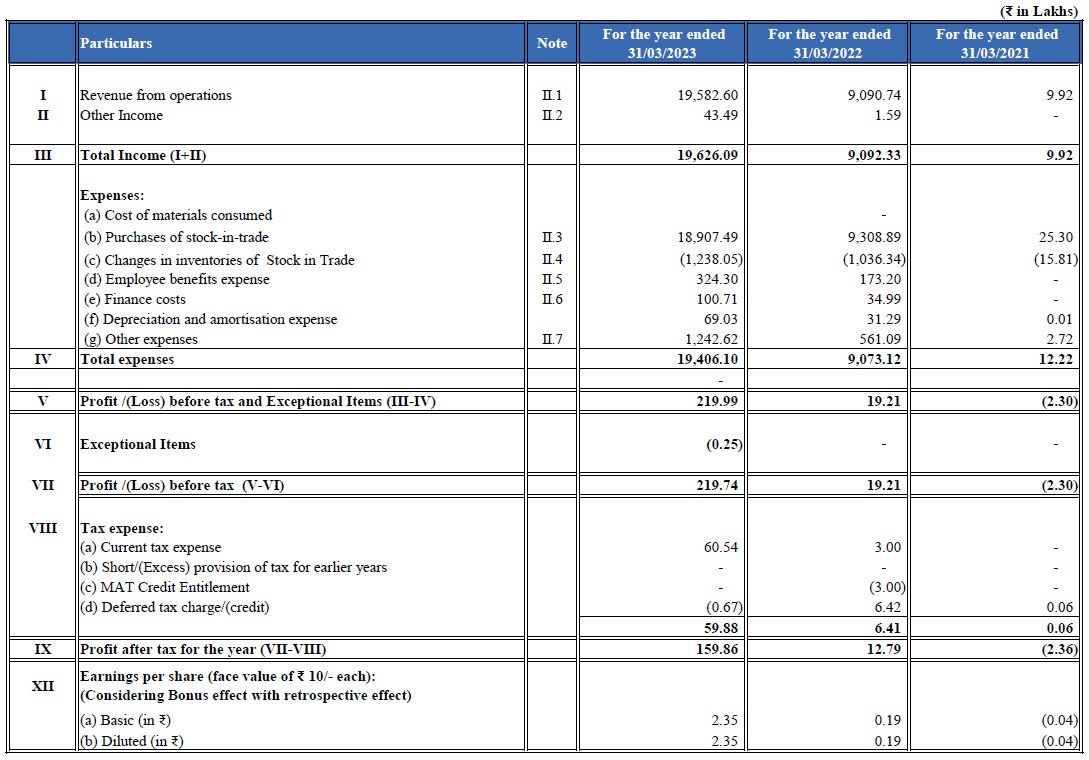

Explore the robust financial performance of Fonebox Retail Limited in the context of its two major business verticals. From the financial year ending on March 31, 2022, to March 31, 2023, the company experienced remarkable growth, with revenue surging by an impressive 115.85%. The profit after tax (PAT) witnessed an extraordinary surge of 1149.88% during the same period, establishing Fonebox Retail Limited as a formidable player in the market.

FONEBOX RETAIL IPO: Statement of Profit & Loss

Delving into the financial snapshot as of September 30, 2023, Fonebox Retail Limited’s assets have surged to ₹4,342.27 Lakhs, showcasing a substantial increase from ₹3,861.05 Lakhs recorded on March 31, 2023. The upward trajectory is evident across various key metrics, reinforcing the company’s financial strength.

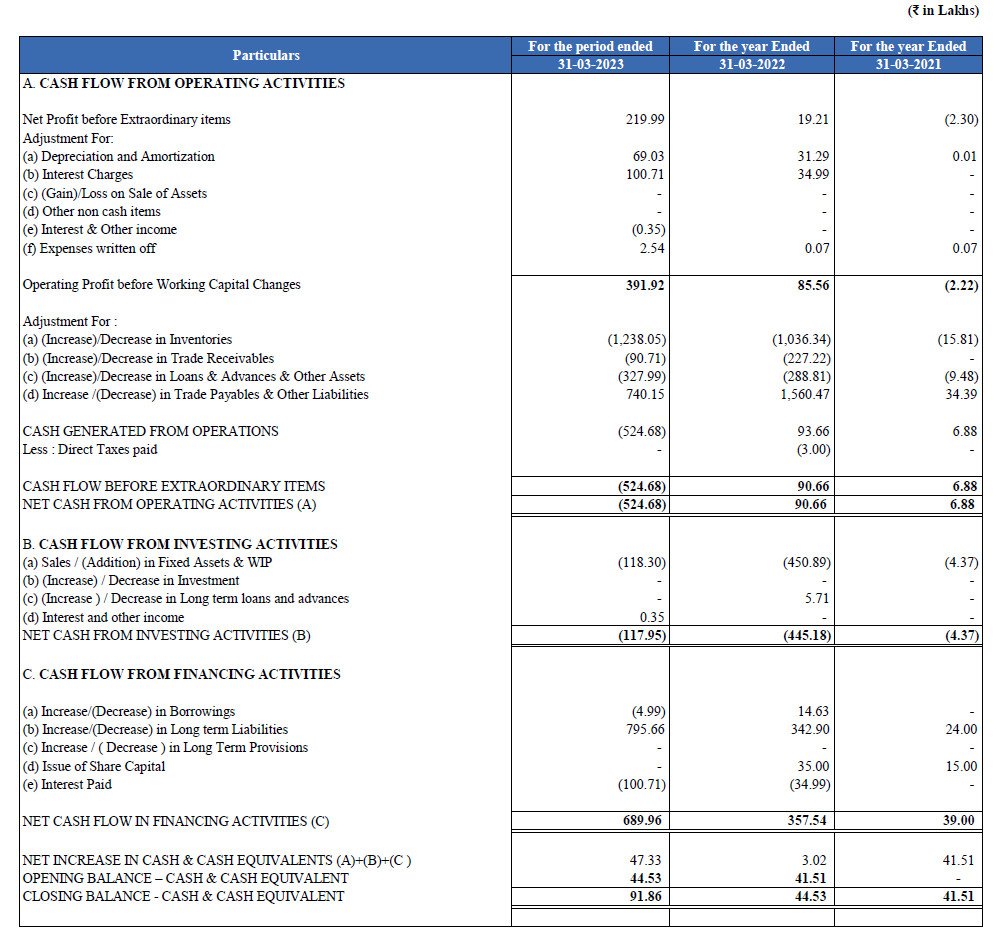

FONEBOX RETAIL IPO: STATEMENT OF CASH FLOW

Revenue for the period ending on September 30, 2023, stands at ₹14,022.98 Lakhs, showcasing a consistent upward trend. This significant increase in revenue from ₹9,092.33 Lakhs on March 31, 2022, underscores Fonebox Retail Limited’s robust performance in the market.

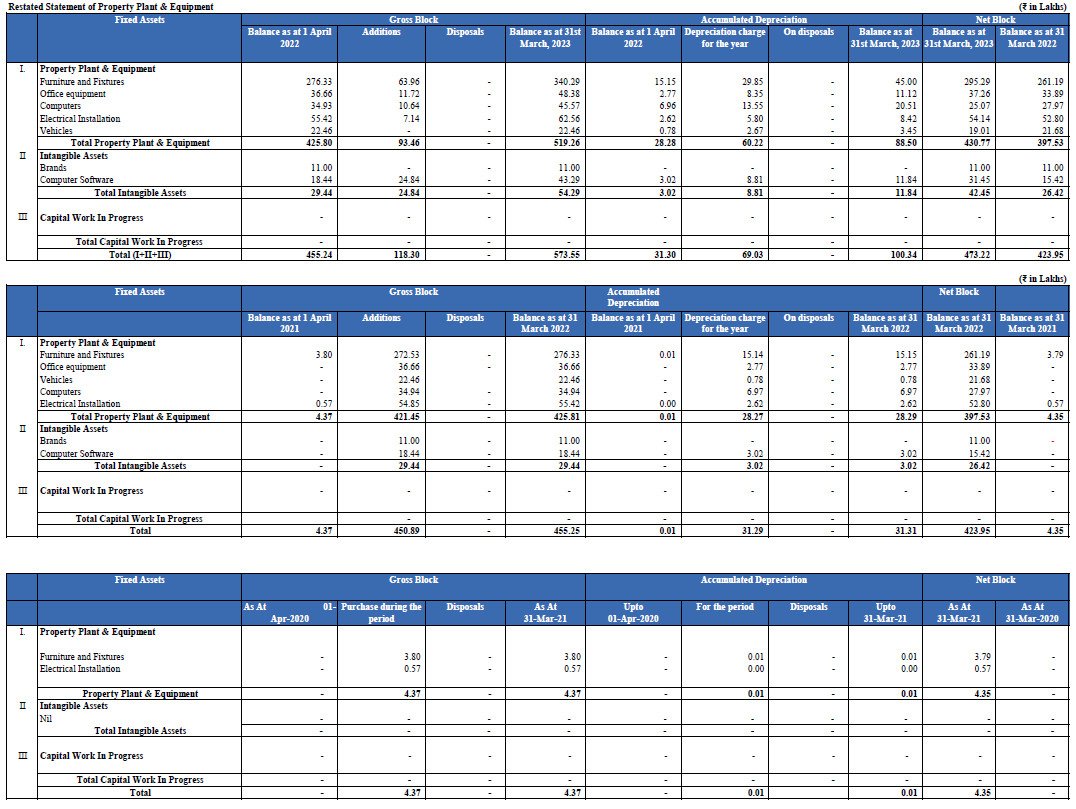

FONEBOX RETAIL IPO: Property Plant & Equipment

Profit After Tax (PAT) reflects an impressive figure of ₹155.19 Lakhs as of September 30, 2023, representing substantial growth compared to ₹12.79 Lakhs on March 31, 2022. This notable increase underscores the company’s ability to generate profits efficiently.

Net Worth, a key indicator of financial health, has surged to ₹916.72 Lakhs, showcasing a significant rise from ₹210.26 Lakhs as of March 31, 2023. The growth in Net Worth reflects positively on Fonebox Retail Limited’s financial stability.

FONEBOX RETAIL IPO: Statement of Other expenses

Reserves and Surplus have seen a noteworthy increase, reaching ₹190.48 Lakhs on September 30, 2023, compared to ₹170.29 Lakhs on March 31, 2022. This demonstrates the company’s commitment to building financial reserves for future growth and stability.

Total Borrowing stands at ₹506.57 Lakhs as of September 30, 2023, reflecting a strategic balance in leveraging capital for growth initiatives.

5. Fonebox Retail IPO FAQs

The Fonebox Retail IPO marks the initial public offering of shares by Fonebox Retail Limited, providing an opportunity for investors to participate in the company’s growth.

Investors can apply for Fonebox Retail IPO lots through their preferred brokerage platforms during the IPO subscription period.

The minimum lot size for Fonebox Retail IPO is 2000 shares.

Fonebox Retail Limited focuses on being a multi-brand retail chain specializing in Smart Phones, Smart Watches, TVs, ACs, Laptops, Accessories, and Gadgets.

As of the latest available information, Fonebox Retail Limited has set up 120+ showrooms strategically located across Gujarat.

Fonebox Retail’s COCO Model involves the sale of mobile handsets and accessories through owned stores, showcasing the latest technology and providing hands-on experiences.

Fonebox Retail’s FOCO Model entails selling products through 113 franchise retail outlets operating on the FOCO model. Fonebox Retail Limited earns a percentage of the total turnover achieved by these franchises, enhancing its revenue stream. The FOCO model allows the company to extend its brand name to franchise owners, fostering a network of retail outlets under the “Fonebox,” “Fonebook,” or “My Mobile” brand.

Fonebox Retail Limited’s financial performance has been robust, with notable increases in revenue, profit after tax, net worth, and reserves, as highlighted in the restated financial information.

Key financial metrics for Fonebox Retail IPO include the issue price, market lot, and other details specified in the IPO prospectus.

Investors can check the Fonebox Retail IPO allotment status from links given above in this blog or other designated platforms.

Fonebox Retail Limited derives revenue from two major business verticals: Sale through Owned Stores (COCO Model) and Sale through Franchise Branch Stores (FOCO Model).

As per the restated financial information, Fonebox Retail Limited’s net worth has surged to ₹916.72 Lakhs.

International investors can often participate in the Fonebox Retail IPO, subject to regulatory requirements. Check with your investment advisor or the IPO prospectus for details.

Fonebox Retail Limited boasts a workforce of over 650 knowledgeable and committed professionals, contributing to its operational excellence.

Fonebox Retail Limited sets itself apart through its commitment to providing choice, ease, and elegance in the mobile retail space, creating a unique customer experience.

Fonebox Retail Limited aims to set new benchmarks in innovative world-class mobile retail chain facilities and emerge as India’s largest retail chain for Smart Phones, Smart Watches, TVs, ACs, Laptops, Accessories, and Gadgets.

Reserves and Surplus play a crucial role in building financial strength and stability for Fonebox Retail Limited, as reflected in the financial reports.

Investors seeking information or clarification can usually find on the company’s official website given above in this blog.