Table of Contents

Embark on a transformative journey with BLS E-Services IPO, a trailblazing technology-enabled digital services provider established in 2016. Our comprehensive offerings span business correspondent services to major banks, assisted e-services, and e-governance solutions, reaching grassroots communities across India. Through our robust network, we facilitate access to critical public utilities, social services, healthcare, education, agriculture, and banking services for governments, businesses, and citizens in diverse urban, semi-urban, rural, and remote areas. Partnering closely with merchants, we act as trusted business correspondents, offering a spectrum of banking products and services on behalf of banks through subsidiaries ZMPL and Starfin.

BLS E-Services IPO

| IPO Open Date | IPO Closed Date | Allotment Date |

| 30th Jan 2024 | 1st Feb 2024 | 2nd Feb 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 5th Feb 2024 | 5th Feb 2024 | 6th Feb 2024 |

BLS E-Services IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

BLS E-Services IPO Issue Details

| IPO Issue Size | IPO Issue Price | Market Lot |

| ₹310.91 Cr | ₹129.00- ₹135.00 | 108 Shares |

Financial of BLS E-Services

| Particulars | Mar-23 | Mar-22 | Mar-21 |

| Assets | 17,946.59 | 5,592.93 | 4,058.73 |

| Revenue | 24,629.27 | 9,839.56 | 6,523.35 |

| Expense | 21,671.33 | 9,161.82 | 6131.13 |

| PBT | 2957.94 | 677.74 | 392.22 |

| PAT | 2033.18 | 537.96 | 314.82 |

| ROE | 33.33% | 43.18% | 38.91% |

| PAT margin | 8.36% | 5.56% | 4.88% |

| EBITDA | 3628.96 | 862.07 | 547.29 |

| EBITDA Margin | 14.73% | 8.76% | 8.39% |

| Fresh Issue | Offer for Sale | Total Issue Size |

| 2,41,30,000 | N/A | 2,41,30,000 |

| RII (Retail) | NII | QIB |

| 10% | 15% | 75% |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 108 | 14580 |

| Retail(Max) | 13 | 1404 | 189540 |

| Small-HNI (Min) | 14 | 1512 | 204120 |

| Small-HNI (Max) | 68 | 7344 | 991440 |

| Big-HNI (Min) | 69 | 7452 | 1006020 |

| Pre-Promoter | Post Promoter | Listing IN |

| 93.80% | – | NSE/BSE |

| Established | Website | Industry |

| 2016 | blseservices.com/ | IT SERVICES |

| Contact Information | |

| Telephone | |

| cs@blseservices.com | 91-11-45795002 |

| Objective | |

| No | Objective |

| 1 | Strengthening the technology infrastructure to develop new capabilities and consolidating the existing platforms; |

| 2 | Funding initiatives for organic growth by setting up of BLS Stores; |

| 3 | Achieving inorganic growth through acquisitions; and |

| 4 | General Corporate Purposes |

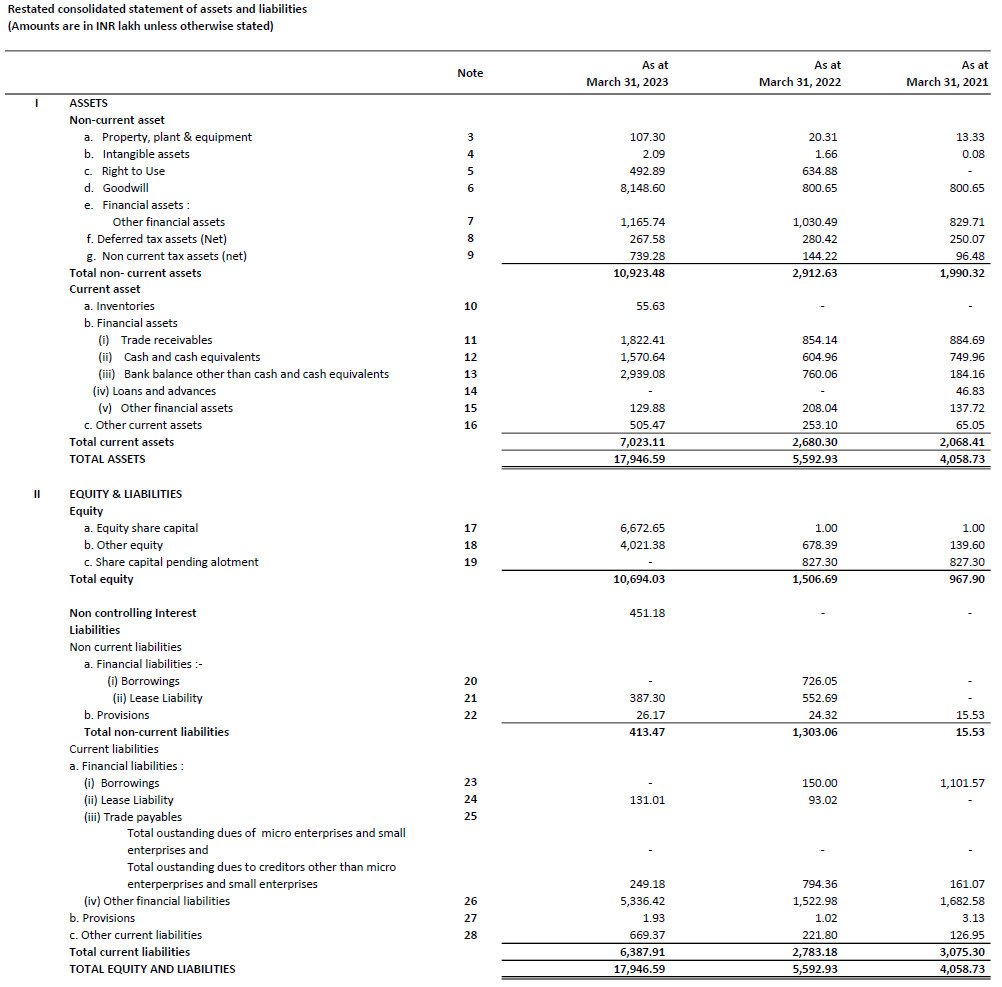

Statement of Assets and Liabilities

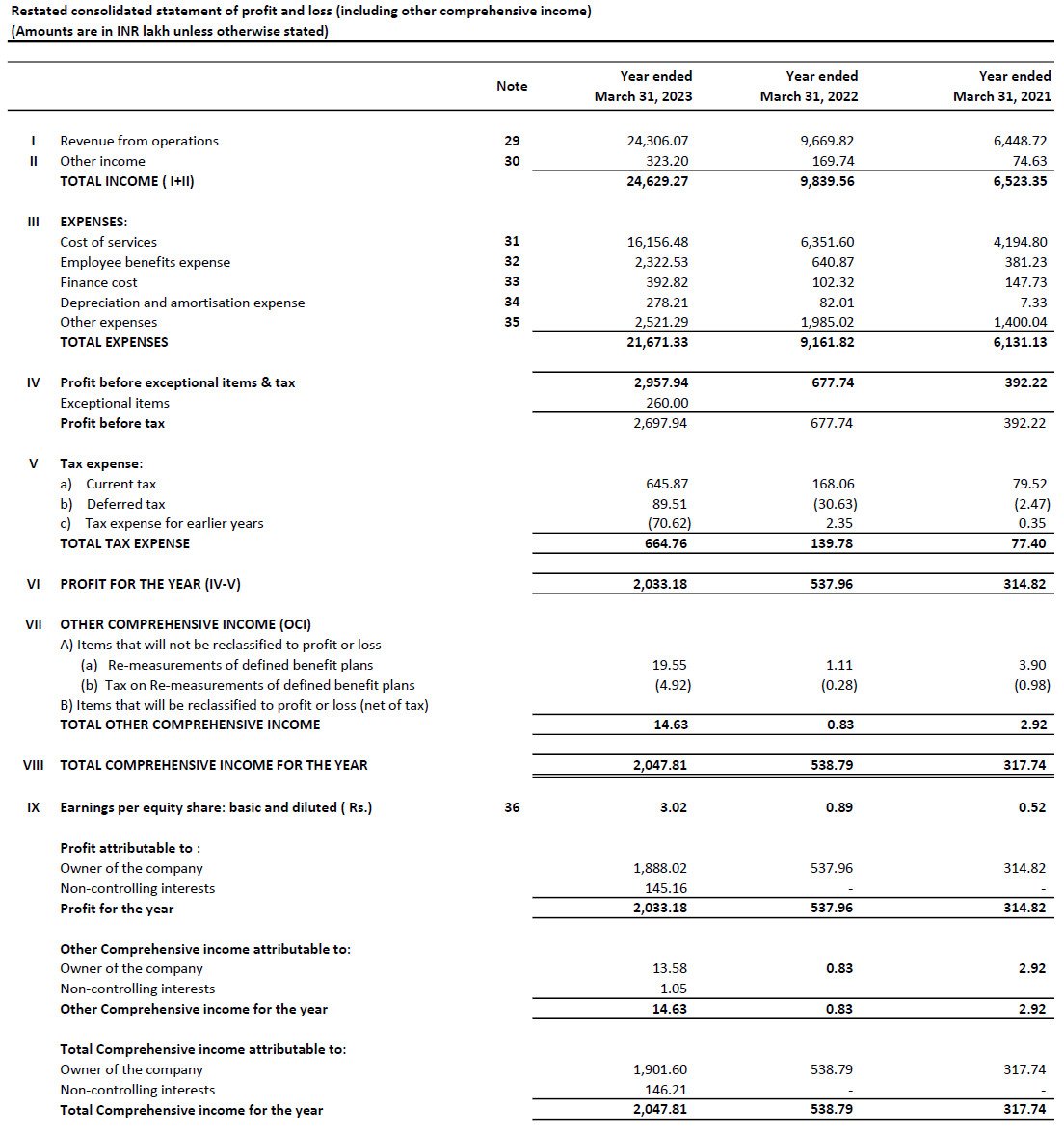

Statement of Profit and Loss

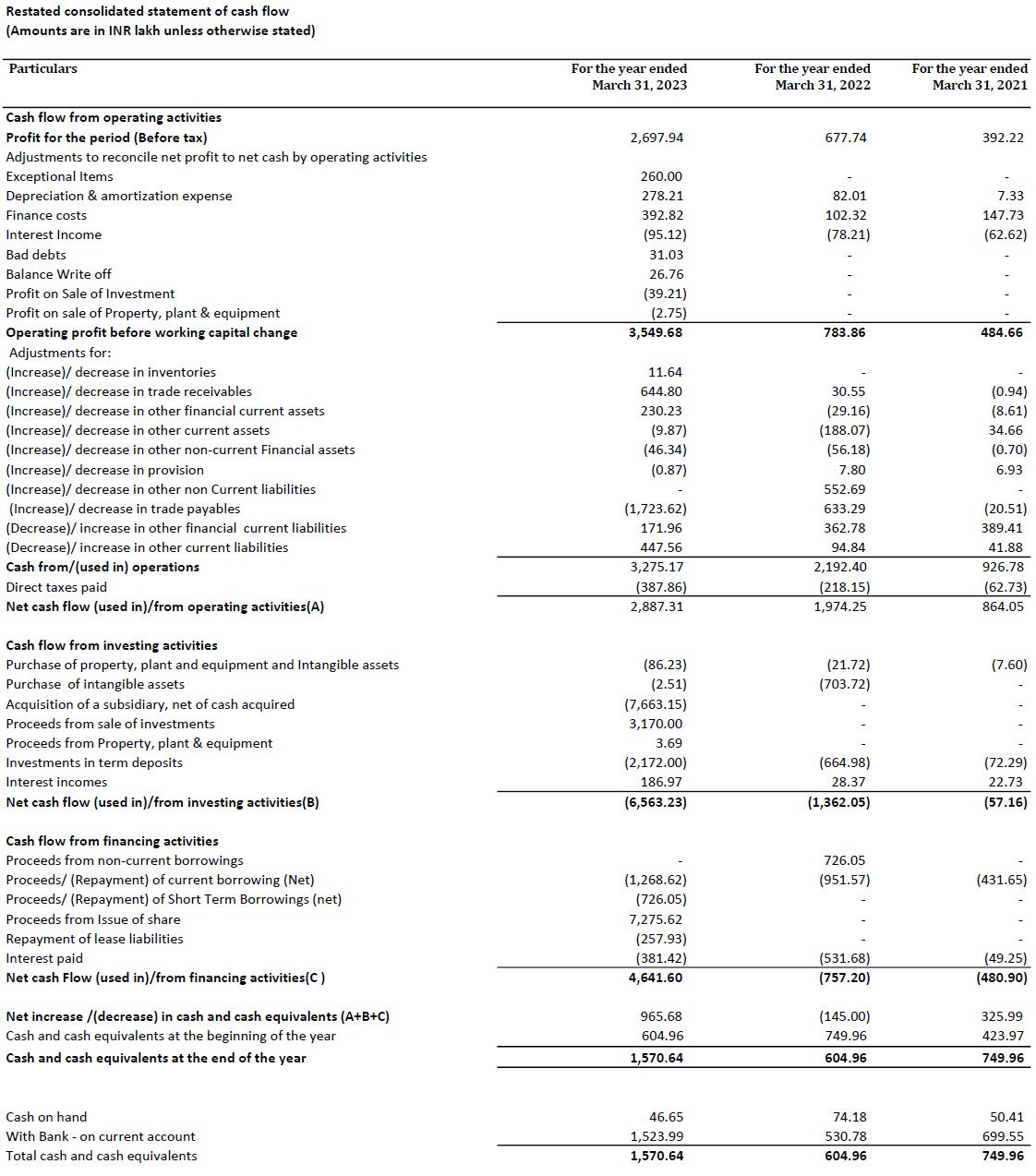

Statement of Cash Flows

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first BLS E-Services IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from BLS E-Services IPO.

SwiftTopics.com’s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with BLS E-Services IPO and other offerings a more informed and confident endeavor.

1. BLS E-Services IPO key dates & Issue Details

- The BLS E-Services IPO is set to hit the market, offering investors an opportunity to partake in this exciting venture. The IPO issue will commence on 30th Jan 2024 and conclude on 1st Feb 2024, presenting a window for potential investors to subscribe. Priced between ₹129.00 to ₹135.00 per share, the IPO is poised to raise ₹310.91 Cr through a book build issue, with a face value of ₹10 per equity share.

- This IPO marks a significant milestone for BLS E-Services, as it aims to list on both the BSE and NSE exchanges. The retail quota is capped at 10% of the net issue, ensuring fair participation across investor segments. The entire issue consists of fresh shares amounting to ₹310.91 Cr, providing the company with fresh capital for its expansion and growth initiatives.

- Key dates in the IPO timeline include the Basis of Allotment Date scheduled for 2nd Feb 2024, followed by refunds initiation and credit of shares to Demat accounts on 5th Feb 2024. The IPO listing date is tentatively set for 6th Feb 2024, marking the commencement of trading for BLS E-Services shares.

- Investors can participate in the IPO with a market lot of 108 shares, equating to ₹14,580 for one lot. For small HNIs (High Net Worth Individuals) with investments ranging from 2 to 10 lakh, the minimum lot size stands at 1512 shares (14 lots). Conversely, big HNIs with investments exceeding 10 lakhs are required to subscribe to a minimum of 7452 shares (69 lots).

- As the BLS E-Services IPO garners attention from investors, its strategic pricing, coupled with the company’s growth potential, positions it as an attractive investment opportunity in the market. Stay tuned for more updates as the IPO journey unfolds.

2. BLS E-Services IPO allotment Status

Dive into the excitement surrounding the BLS E-Services IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your BLS E-Services IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the BLS E-Services IPO journey.

3. Introduction to BLS E-Services: Empowering Communities Through Digital Solutions

- Introducing BLS E-Services, a pioneering technology-driven digital service provider poised to revolutionize access to essential services across India. Our multifaceted offerings encompass Business Correspondents services to leading banks, Assisted E-services, and E-Governance Services at grassroots levels nationwide. Through a robust network, we serve as vital access points for a spectrum of public utility services, social welfare schemes, healthcare provisions, financial solutions, educational resources, agricultural support, and banking facilities, catering to governments, businesses, and citizens alike.

- Operating at the intersection of technology and community empowerment, our integrated business model bridges the digital divide in semi-urban, rural, and remote areas where internet penetration remains low. Across three primary business segments – Business Correspondents Services, Assisted E-services, and E-Governance Services – we collaborate closely with merchants, pivotal stakeholders facilitating seamless delivery of our products and services to citizens.

- As trusted Business Correspondents, we extend comprehensive banking products and services on behalf of banks, including account management, remittances, bill collections, and more, through subsidiaries ZMPL and Starfin. Our Assisted E-services, available through BLS Touchpoints, offer a gamut of solutions such as PoS services, ticketing, and assisted e-commerce.

- Moreover, we play a pivotal role in facilitating state government e-governance initiatives, leveraging Information Communication Technology (ICT) to offer transparent and accountable citizen-centric services. From facilitating birth and death certificates to PAN and Aadhar registrations, our E-Governance Services delivered through BLS Touchpoints ensure convenient access to essential documentation.

- In a landmark partnership, BLS E-Services has inked an MOU with the National e-Governance Division (NeGD) to integrate unified mobile application for new-age Governance (UMANG) services into our digital platform, further enhancing accessibility to E-Governance Services.

- As we embark on our IPO journey, BLS E-Services stands at the forefront of innovation, poised to redefine the landscape of digital service provision in India. Stay tuned for more updates as we continue to empower communities and drive inclusive growth through technology-enabled solutions.

4. Financial Details of BLS E-Services

- Explore the financial prowess of BLS E-Services through key performance indicators showcasing its fiscal strength and growth trajectory. In the fiscal year 2023, the company witnessed a remarkable surge in revenue from operations, soaring to ₹24,306.07 lakhs compared to previous fiscal years, marking a substantial rise from ₹9,669.82 lakhs in fiscal 2022 and ₹6,448.72 lakhs in fiscal 2021.

- Total revenue followed suit, reaching ₹24,629.27 lakhs in fiscal 2023, underscoring the company’s consistent expansion and revenue generation capabilities. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) surged to ₹3,628.96 lakhs in fiscal 2023, reflecting robust operational efficiency and profitability.

- The EBITDA margin witnessed a commendable uptick, climbing to 14.73% in fiscal 2023 from 8.76% and 8.39% in fiscal 2022 and fiscal 2021 respectively. Profits after tax (PAT) also experienced substantial growth, reaching ₹2,033.18 lakhs in fiscal 2023, compared to ₹537.96 lakhs and ₹314.82 lakhs in fiscal 2022 and fiscal 2021 respectively.

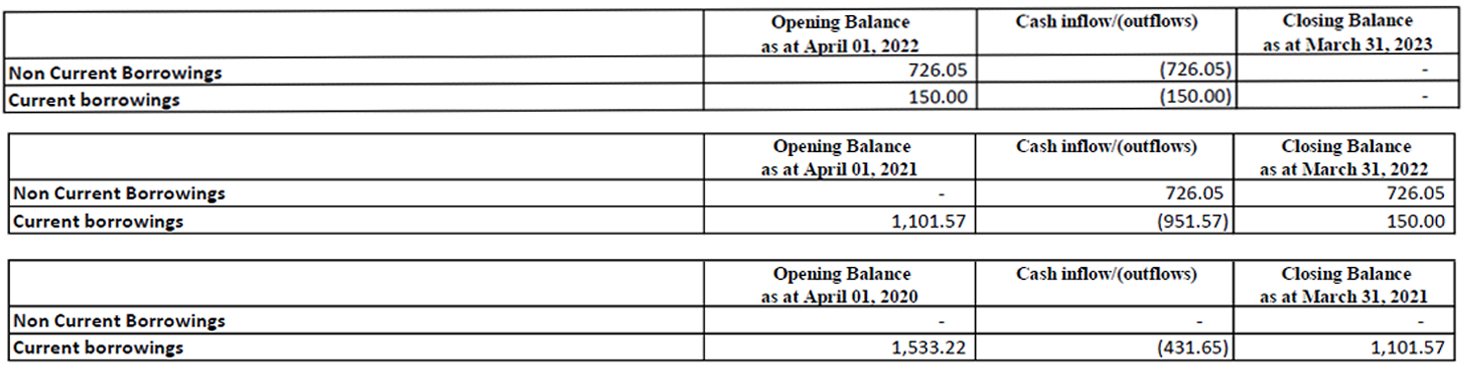

- BLS E-Services demonstrated solid returns on equity (ROE) at 33.33% in fiscal 2023, showcasing efficient utilization of shareholder equity for generating profits. Notably, the company maintained a favorable debt to equity ratio of 0.05, signifying prudent financial management and minimal reliance on debt financing.

- Interest coverage ratio stood robust at 8.53 in fiscal 2023, underlining the company’s capacity to service its debt obligations comfortably. The return on capital employed (ROCE) remained impressive at 30.62%, indicating efficient utilization of capital for generating profits.

- Furthermore, BLS E-Services exhibited a healthy current ratio of 1.10 in fiscal 2023, ensuring ample liquidity to meet short-term obligations. The net capital turnover ratio surged to 91.32%, reflecting enhanced efficiency in capital utilization compared to previous fiscal years.

- As BLS E-Services gears up for its IPO, these robust financial indicators underscore its strong foundation and growth potential, making it an attractive investment opportunity in the market. Stay tuned for more updates as BLS E-Services continues its journey towards greater heights of success in the digital service sector.

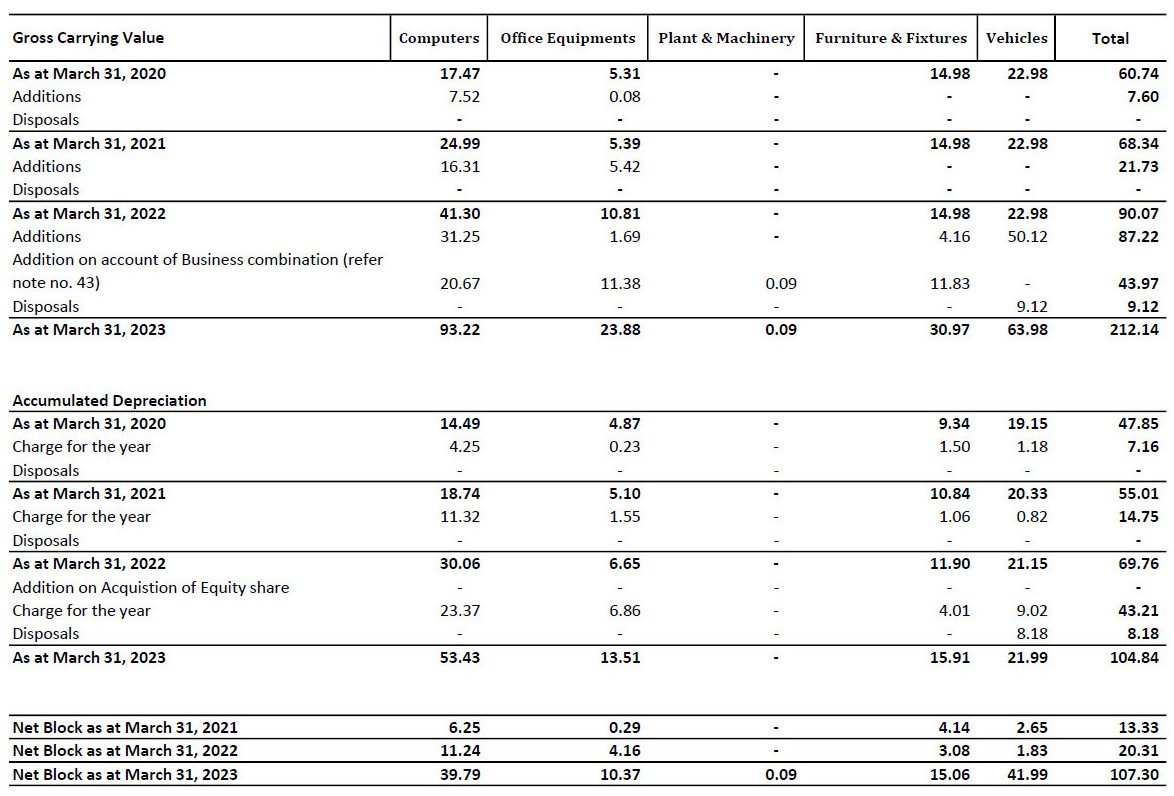

Statement of Property, Plant and Equipment

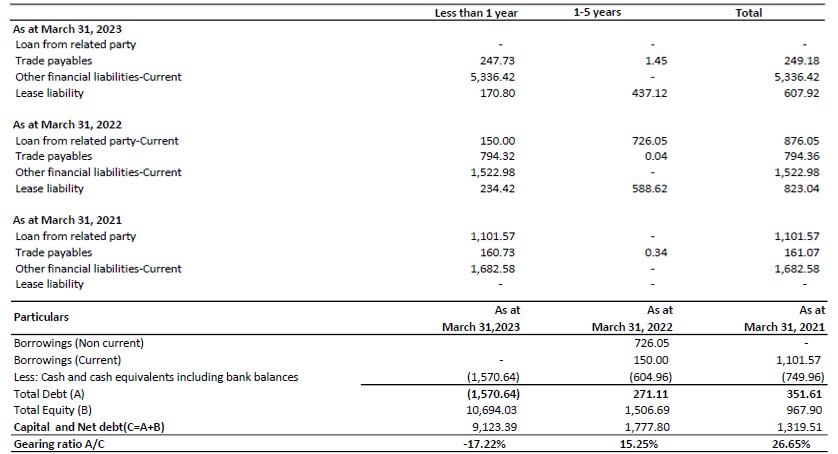

Financial liabilities maturity & Capital Management

Statement of Other Expenses

5. BLS E-Services IPO FAQs

BLS E-Services IPO Details

The opening date for the BLS E-Services IPO is 30th Jan 2024.

The closing date for the BLS E-Services IPO is 1st Feb 2024.

The issue price range for shares in the BLS E-Services IPO is ₹129.00 to ₹135.00 per share.

The BLS E-Services IPO will be listed on the BSE and NSE.

The IPO issue size for BLS E-Services is ₹310.91 Cr.

BLS E-Services IPO Dates:

The basis of allotment date for the BLS E-Services IPO is 2nd Feb 2024.

Refunds for the BLS E-Services IPO will be initiated on 5th Feb 2024.

Shares for the BLS E-Services IPO will be credited to Demat accounts on 5th Feb 2024.

The IPO listing date for BLS E-Services is scheduled for 6th Feb 2024.

BLS E-Services IPO Issue Details:

The face value of shares in the BLS E-Services IPO is ₹10 per equity share.

The IPO discount for BLS E-Services is yet to be determined.

The retail quota for the BLS E-Services IPO is not more than 10% of the net issue.

BLS E-Services Business Model:

The primary business segments of BLS E-Services include Business Correspondents Services, Assisted E-services, and E-Governance Services.

BLS E-Services provides access points for delivery of public utility services, social welfare schemes, healthcare, financial, educational, agricultural, and banking services through its robust network and integrated business model.

BLS E-Services Financial Data:

The revenue from operations for BLS E-Services in fiscal 2023 was ₹24,306.07 lakhs.

The EBITDA margin for BLS E-Services in fiscal 2022 was 8.76%.

The profit after tax for BLS E-Services in fiscal 2021 was ₹314.82 lakhs.

The return on equity (ROE) for BLS E-Services in fiscal 2023 was 33.33%.

The debt to equity ratio for BLS E-Services in fiscal 2021 was 1.14.

The current ratio for BLS E-Services in fiscal 2023 was 1.10.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding BLS E-Services IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Docmode Health Technologies IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in BLS E-Services IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the BLS E-Services IPO journey.

Thank you for choosing Swifttopics.com, and we look forward to assisting you with any information you may require.