Table of Contents

Welcome to the vibrant world of Baweja Studios Limited, a pioneering entity in the entertainment landscape. Established in 2001, Baweja Studios IPO stands as a beacon of creativity, specializing in the production of top-notch content across diverse formats. With a keen focus on script research, content development, and intellectual property creation, Baweja Studios is committed to setting new benchmarks in production quality and filmmaking excellence. From digital films to web series, animated features to Punjabi cinema, the company’s diverse portfolio reflects its unwavering dedication to delivering quality multi-format content to audiences worldwide.

Baweja Studios Limited IPO Dates

| IPO Open Date | IPO Closed Date | Allotment Date |

| 29th Jan 2024 | 1st Feb 2024 | 2nd Feb 2024 |

| Refunds Date | Credit of Shares | IPO Listing Date |

| 5th Feb 2024 | 5th Feb 2024 | 6th Feb 2024 |

Baweja Studios Limited IPO Allotment Chances Calculator

| Allotment Status | Allotment Chances |

| Click Here | Click Here |

Baweja Studios Limited IPO Issue Details

| IPO Issue Size | IPO Issue Price | Market Lot |

| ₹97.20 Cr | ₹170.00- ₹180.00 | 800 Shares |

Financial of Baweja Studios Limited IPO

| Particulars | Mar-23 | Mar-22 | Mar-21 |

| Assets | 19,197.87 | 17,262.76 | 14,645.06 |

| Revenue | 26,643.84 | 18,846.92 | 10,927.03 |

| Expense | 24,660.37 | 18,694.92 | 10,501.51 |

| PBT | 1,983.47 | 152 | 425.52 |

| PAT | 1400.41 | 110.1 | 309.12 |

| ROE | 27.66% | 3.01% | 8.80% |

| PAT Margin | 5.27 | 0.59 | 2.84 |

| EBITDA | 2,754.40 | 793.58 | 1316.33 |

| EBITDA Margin | 10.36% | 4.22% | 12.08% |

| Fresh Issue | Offer for Sale | Issue Type |

| 40,00,000 | 1400000 | Fresh Issue & OFS |

| RII (Retail) | NII | QIB |

| 47.73% | 47.73% | 4.55% |

| Application | Lots | Shares | Amount |

| Retail(Min) | 1 | 800 | 144000 |

| Retail(Max) | 1 | 800 | 144000 |

| Small-HNI (Min) | 2 | 1600 | 288000 |

| Small-HNI (Max) | 6 | 4800 | 864000 |

| Big-HNI (Min) | 7 | 5600 | 1008000 |

| Pre-Promoter | Post Promoter | Listing IN |

| 99.90% | – | NSE |

| Lead | Register |

| FEDEX SECURITIES PRIVATE LIMITED | SKYLINE FINANCIAL SERVICES PRIVATE LIMITED |

| Established | Website | Industry |

| 2001 | bawejastudios.com | Media & Entertainment |

| Contact Information | |

| Telephone | |

| cs@bawejastudios.com | 91-22-35901403 |

| Objective | |

| No | Objective |

| 1 | To meet the working capital requirements |

| 2 | General corporate purposes |

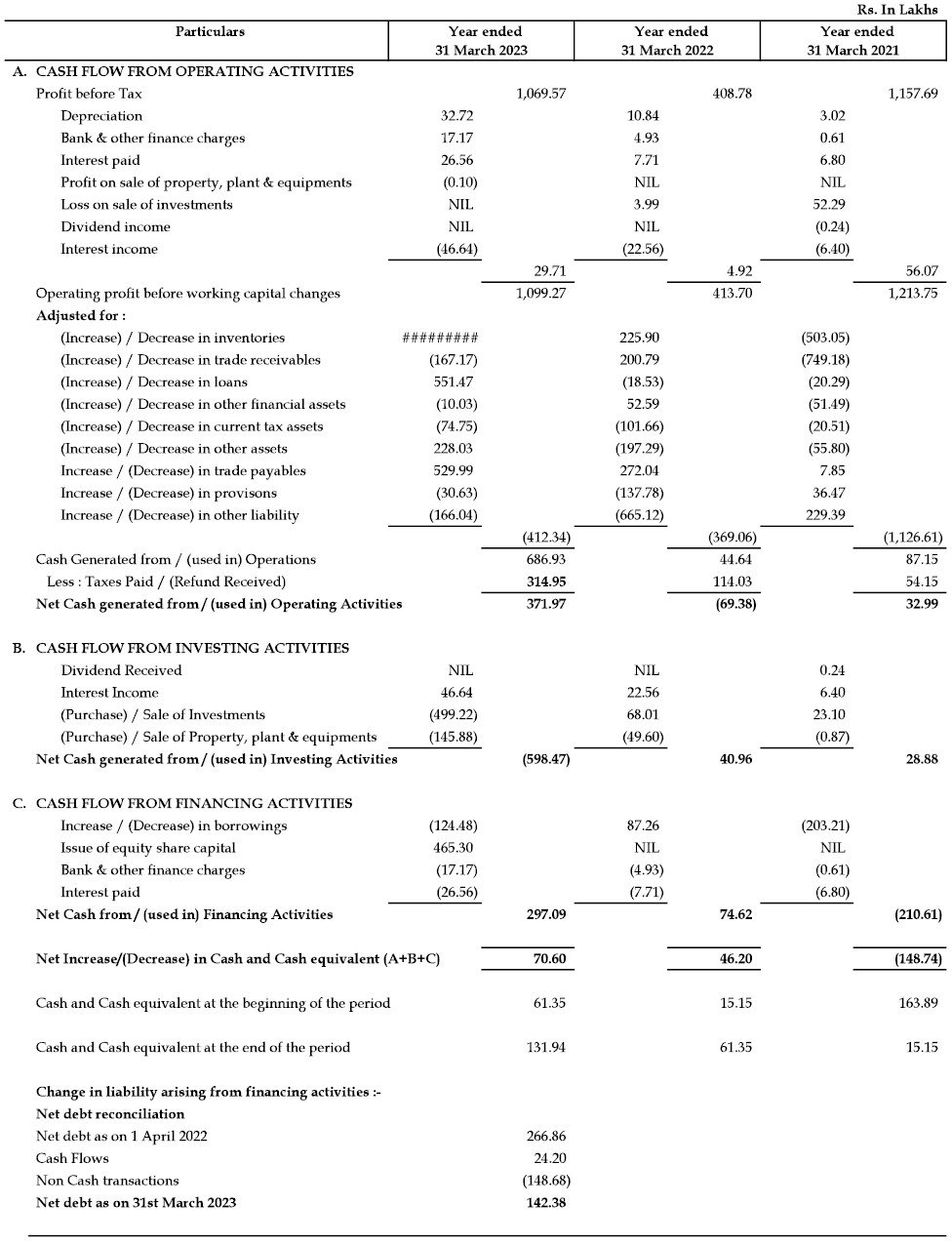

Statement of Cash Flows

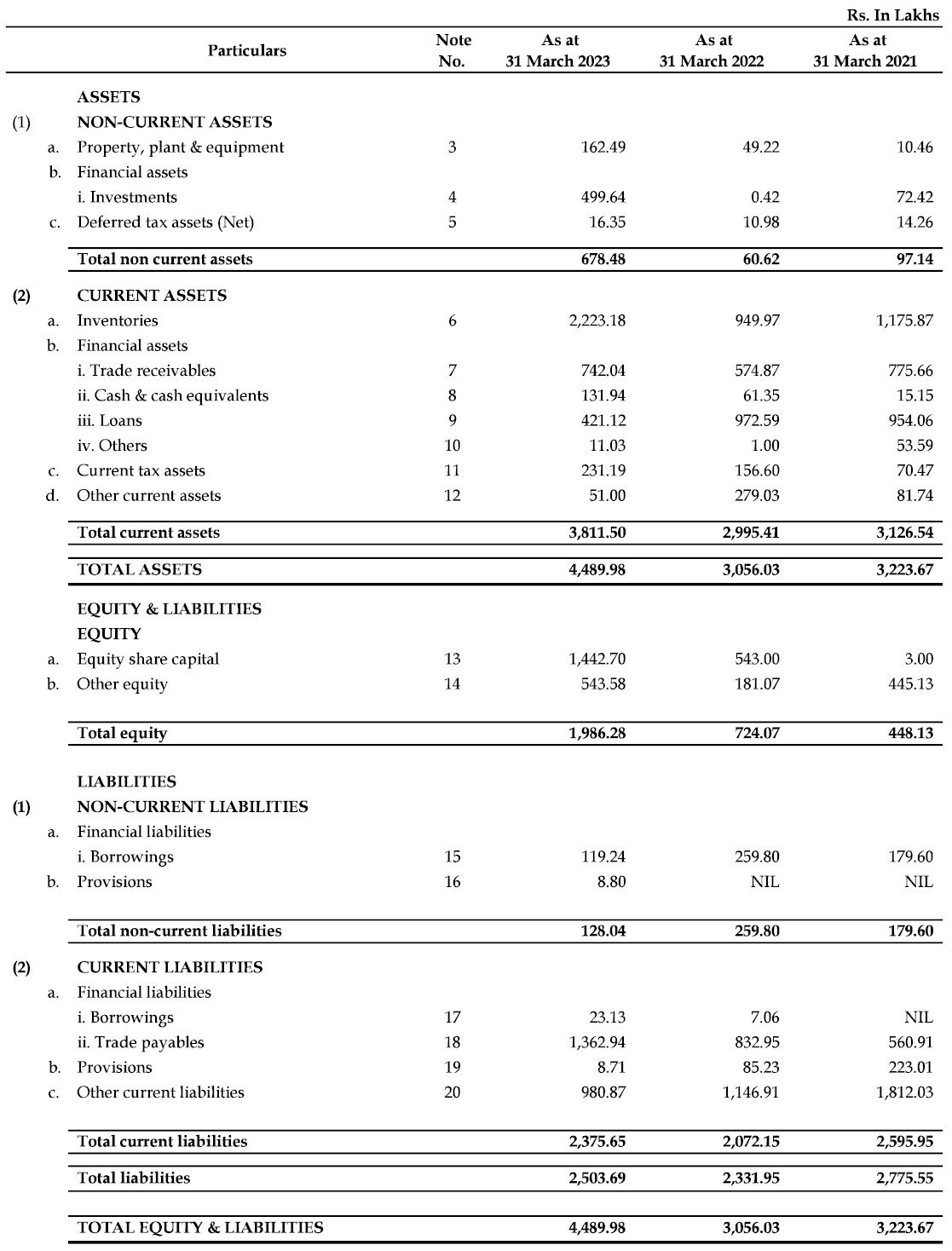

Statement of Assets and Liabilities

Statement of Profit and Loss

A Game-Changer You Definitely Didn't Know About: IPO Allotment Calculator by SwiftTopics.com

Introducing a groundbreaking tool for IPO enthusiasts – India’s first Baweja Studios IPO allotment calculator, brought to you by SwiftTopics.com. This innovative calculator empowers users with a swift and secure way to assess the probability of IPO allotment without the need for any login credentials. Seamlessly designed, it provides accurate insights into the allotment chances for upcoming IPOs, including the highly anticipated offering from Baweja Studios IPO.

SwiftTopics.com’s IPO allotment calculator stands out for its user-friendly interface, offering a quick and hassle-free experience. Investors and IPO enthusiasts can simply input the relevant details, and the calculator generates a precise probability of IPO allotment, aiding in informed decision-making. Whether you’re a seasoned investor or a newcomer to the IPO landscape, this tool ensures accessibility and efficiency.

To explore this game-changing IPO allotment calculator and elevate your IPO investment experience, click here:

Unlock the potential for accurate and timely information, making your IPO journey with Baweja Studios IPO and other offerings a more informed and confident endeavor.

1. Baweja Studios IPO key dates & Issue Details

- Are you looking to invest in the Baweja Studios IPO? Here are the key details you need to know about this exciting opportunity. Baweja Studios is set to launch its SME IPO, with the issue opening on 29th Jan 2024 and closing on 1st Feb 2024. Priced between ₹170.00 to ₹180.00 per share, the IPO offers investors a chance to participate in the company’s growth.

- The IPO is a book build issue with an issue size of ₹97.20 Cr, comprising an offer for sale of ₹25.20 Cr and a fresh issue of ₹72.00 Cr. Notably, the retail quota guarantees at least 42% of the net issue, ensuring ample opportunities for retail investors to participate.

- Investors should take note of the market lot, which consists of 800 shares, translating to an initial investment of ₹144000 for one lot. High net worth individuals (HNIs) are required to bid for a minimum of 1600 shares (2 lots) to participate in the IPO.

- As for the IPO timeline, the basis of allotment is tentatively scheduled for 2nd Feb 2024, with refunds initiation and credit of shares to demat accounts expected on 5th Feb 2024. The listing date for Baweja Studios SME IPO is set for 6th Feb 2024, offering investors the opportunity to trade their shares on the NSE SME platform.

- With the Baweja Studios IPO presenting an exciting investment prospect, investors are encouraged to stay updated on the latest developments and seize the opportunity to be part of the company’s growth trajectory.

2. Baweja Studios IPO allotment Status

Dive into the excitement surrounding the Baweja Studios IPO allotment status with ease! Satisfy your curiosity by quickly checking the IPO allotment status through a streamlined process designed for your convenience. Navigate effortlessly to the IPO allotment status check and ensure a hassle-free experience as you eagerly await the results.

Stay ahead of the curve by clicking on the provided links below to swiftly access the information you’ve been waiting for. Don’t miss out on the latest updates – verify your IPO allotment status effortlessly and stay well-informed about your Baweja Studios IPO investment.

Verify Your IPO Allotment Status

Stay connected with the latest developments and secure your spot in the Baweja Studios IPO journey.

3. Introduction to the Dynamic World of Baweja Studios IPO

- Welcome to the world of Baweja Studios, where creativity meets innovation in the realm of motion picture production and audio-visual content creation. Founded as Baweja Movies Private Limited in 2001, our journey has been one of transformation and growth. Over the years, we’ve evolved into Baweja Studios Limited, a name synonymous with quality entertainment and cutting-edge storytelling.

- At the helm of our operations stands Harjaspal Singh Baweja, affectionately known as Harry Baweja, whose visionary leadership has shaped our trajectory in the Bollywood film industry. With iconic productions like “Dilwale” in 1994, Harry Baweja’s legacy is etched in the annals of Indian cinema. Today, under the guidance of our Chairman and Managing Director, Harman Baweja, we continue to uphold the values of excellence and innovation.

- Our forte lies in the production of Hindi and Punjabi films, backed by an extensive film library that boasts of acclaimed titles such as “Chaar Sahibzaade” and “Love Story 2050”. Beyond traditional filmmaking, we also delve into the trading of movie rights, facilitating the seamless flow of content from producers to exhibitors and streaming platforms.

- With over 22 projects already under our belt and several more in the pipeline, we stand poised to redefine the landscape of entertainment. From digital films to web series, animation to music videos, we embrace diversity in content creation, pushing the boundaries of storytelling with every endeavor.

- Central to our success is a robust business model that emphasizes strategic sourcing, meticulous selection, and efficient execution. Whether through in-house development or strategic acquisitions, every project undergoes a rigorous evaluation process to ensure its viability and market potential.

- In our pursuit of excellence, we adopt a flexible approach to production, employing both independent and co-production models. While the former grants us full creative control and ownership, the latter allows for shared risk and collaborative partnerships, ensuring a balanced portfolio of projects.

- Post-production activities, including dubbing, sound design, and visual effects, are meticulously managed to deliver top-notch content to our clients. Our dedicated sales and marketing team ensures optimal visibility and market positioning for each project, fostering long-term relationships with our stakeholders.

- Based out of Mumbai, the heart of India’s film industry, Baweja Studios operates from state-of-the-art facilities equipped with the latest technology and talent. With a focus on innovation and creativity, we strive to be pioneers in the field of content production, setting new standards of excellence with every venture.

- As we embark on this exciting journey, we invite you to join us in shaping the future of entertainment. With Baweja Studios IPO, the stage is set for a new chapter in our cinematic odyssey, where imagination knows no bounds and creativity reigns supreme.

4. Financial Details of Baweja Studios

- Delving into the financial landscape of Baweja Studios Limited, a promising player in the entertainment industry, reveals a story of remarkable growth and financial resilience. Restated financial information showcases the company’s impressive performance, with significant increases in revenue and profit after tax (PAT) over the past fiscal years.

- Between March 31, 2022, and March 31, 2023, Baweja Studios Limited witnessed a substantial 86.2% surge in revenue, accompanied by an impressive 188.8% rise in profit after tax. This surge underscores the company’s robust financial trajectory and its ability to capitalize on emerging opportunities in the entertainment sector.

- Examining the financial highlights for the period ending on September 30, 2023, reveals a pattern of consistent growth and financial stability. Total assets stand at ₹4,202.57 Lakhs, reflecting a steady expansion of the company’s resource base. Revenue for the period amounted to ₹3,890.11 Lakhs, demonstrating the company’s strong revenue generation capabilities.

- Profitability metrics further underscore Baweja Studios Limited’s financial strength. With a profit after tax of ₹435.33 Lakhs for the period ending on September 30, 2023, the company continues to deliver robust financial performance, driven by its strategic initiatives and operational efficiency.

- Key performance indicators provide deeper insights into the company’s financial health and operational efficiency. Revenue from operations surged to ₹7,628.31 Lakhs for the fiscal year ending March 31, 2023, marking a significant 81.26% growth compared to the previous year. EBITDA margins, indicative of operational efficiency, stood at 12.22%, underlining the company’s ability to generate profits from its core operations.

- Moreover, Baweja Studios Limited boasts impressive returns on equity (RoE) and returns on capital employed (RoCE), with RoE reaching 40.12% and RoCE standing at 52.55% for the fiscal year ending March 31, 2022. These metrics underscore the company’s ability to generate substantial returns for its shareholders while effectively utilizing its capital resources.

- In summary, Baweja Studios Limited’s financial performance reflects its resilience, adaptability, and strategic vision in navigating the dynamic landscape of the entertainment industry. With a track record of consistent growth and profitability, the company is well-positioned to capitalize on emerging opportunities and deliver value to its stakeholders in the evolving entertainment landscape.

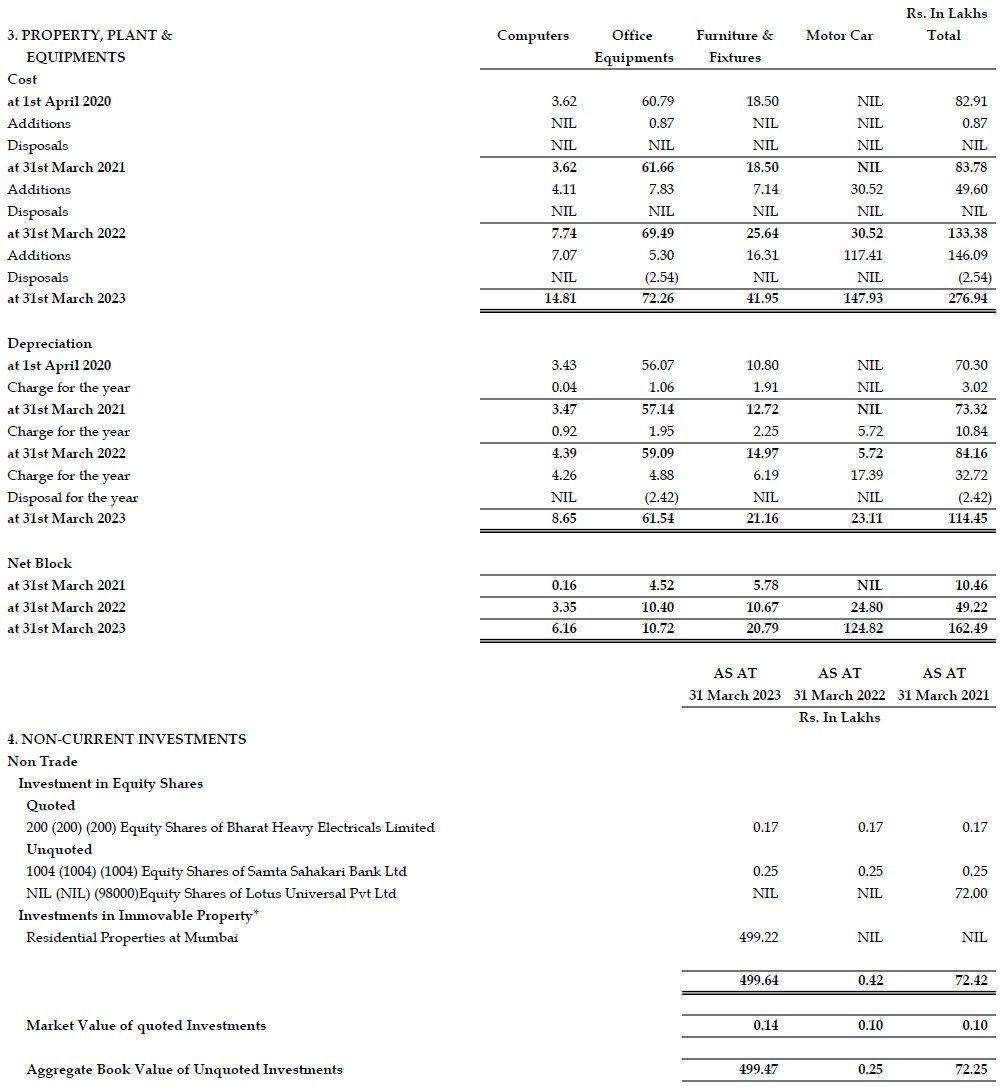

Baweja Studios Statement of Property, plant and Equipment

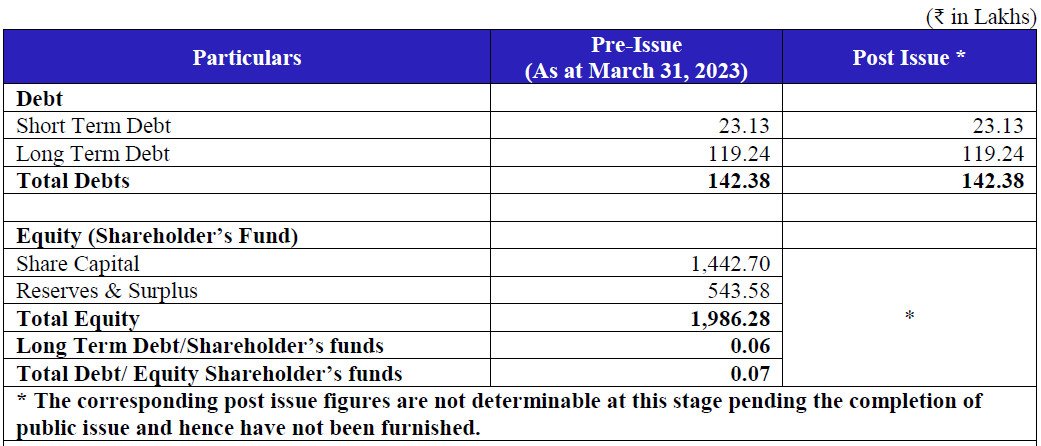

Baweja Studios Statement of Capitalization

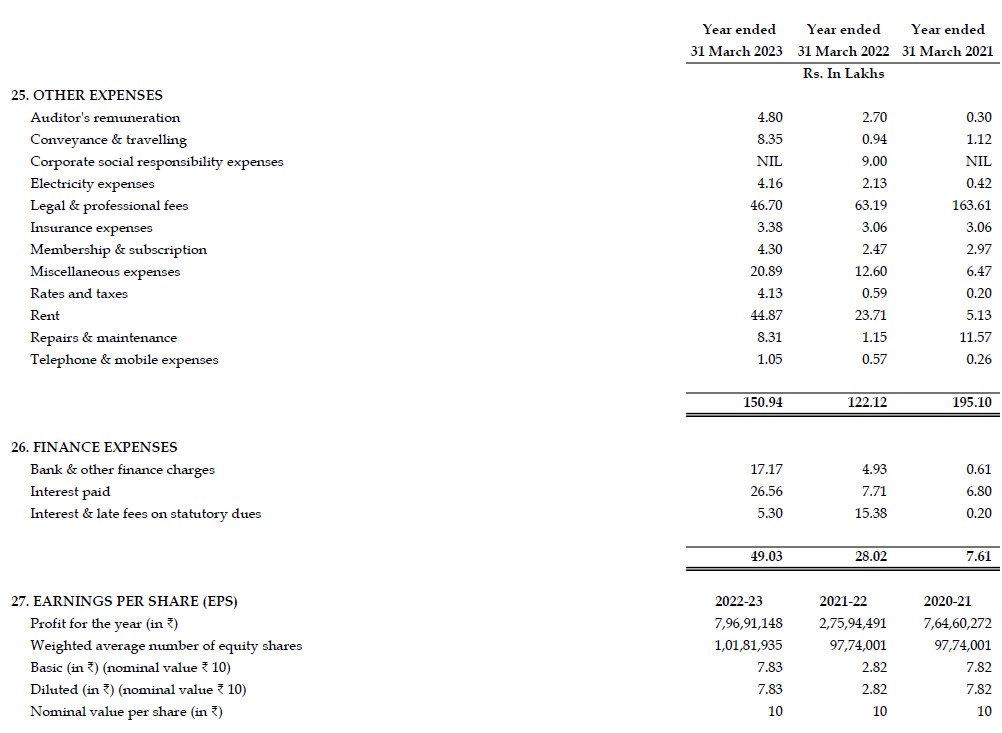

Baweja Studios Statement of Other Expenses

5. Baweja Studios IPO FAQs

Baweja Studios IPO is the initial public offering of shares of Baweja Studios Limited, a prominent player in the entertainment industry.

The Baweja Studios IPO issue opens on 29th Jan 2024 and closes on 1st Feb 2024.

The price range of Baweja Studios IPO shares is ₹170.00 to ₹180.00 per share.

Baweja Studios IPO will be listed on the NSE SME platform.

Baweja Studios IPO is a book build issue.

The Baweja Studios IPO issue size is ₹97.20 Cr, comprising ₹25.20 Cr from offer for sale and ₹72.00 Cr from fresh issue.

The face value of Baweja Studios IPO shares is ₹10 per equity share.

Not less than 42% of the net issue is reserved for the retail quota in Baweja Studios IPO.

– Basis of Allotment Date: 2nd Feb 2024

– Refunds Initiation: 5th Feb 2024

– Credit of Shares to Demat: 5th Feb 2024

– SME IPO Listing Date: 6th Feb 2024

Baweja Studios IPO market lot is 800 shares.

One lot amount for Baweja Studios IPO is ₹144000.

The minimum HNI lots requirement for Baweja Studios IPO is 1600 shares (2 lots).

Baweja Studios is in the business of originating, creating, developing, and producing motion pictures and audio-visual content, followed by marketing, distribution, and exploitation.

Baweja Studios’ revenue increased by 86.2% and PAT rose by 188.8% between the financial years ending March 31, 2023, and March 31, 2022.

– Assets: ₹4,202.57 Lakhs

– Revenue: ₹3,890.11 Lakhs

The net worth of Baweja Studios was ₹1,986.28 Lakhs

The EBITDA margin for Baweja Studios stood at 12.22% as of March 31, 2022.

The RoE for Baweja Studios was 40.12% as of March 31, 2022.

Baweja Studios has produced over 22 projects as of the date of the Draft Red Herring Prospectus.

The primary objectives of Baweja Studios IPO are to raise capital for expansion, enhance market visibility, and provide liquidity to existing shareholders.

For Further Inquiries and Information:

Should you have any additional inquiries or require further information regarding Baweja Studios IPO or the DRHP, we welcome you to reach out to us directly via email at swifttopics365@gmail.com. Our team is dedicated to providing comprehensive assistance and addressing any queries you may have.

Exclusive IPO Allotment Calculator:

Furthermore, we highly recommend making use of India’s exclusive IPO allotment calculator to assess the chances of allotment for the Baweja Studios IPO This tool offers valuable insights into the allotment process, allowing you to plan your investments strategically.

Stay Informed with Our Updates:

We sincerely appreciate your continued interest in Baweja Studios IPO. To stay informed and up-to-date with our latest developments, announcements, and industry insights, keep a close eye on our communications. We are committed to keeping you informed about the exciting progress and milestones in the Baweja Studios IPO journey.

Thank you for choosing swifttopics.com/ and we look forward to assisting you with any information you may require.